This article will focus on the top forex brokers for Moroccan traders that allow local banking, particularly for safe brokers with easy funding options.

Because there is little direct support for Moroccan banks, choosing your international broker carefully is key.

I will point out reliable brokers with good cost, excellent trading platforms, and easy deposit and withdrawal services for Moroccan traders.

Key Poinst & Best Forex Brokers for Moroccan Traders Using Local Banking

| Broker | Key Point |

|---|---|

| Fusion Markets | Low-cost trading with tight spreads and low commissions |

| Pepperstone | Fast execution and strong regulation across multiple jurisdictions |

| Hantec Markets | Trusted broker with long history and solid reputation |

| Global Prime | Transparency in trade execution and liquidity |

| IC Markets | ECN trading with ultra-low spreads and high liquidity |

| Capital.com | AI-powered platform with strong educational tools |

| Vantage FX | User-friendly interface and multiple account types |

| Tickmill | Competitive pricing and strong regulatory oversight |

| XTB | Beginner-friendly with excellent customer support |

| AvaTrade | Wide asset selection and strong educational resources |

10 Best Forex Brokers for Moroccan Traders Using Local Banking

1. Fusion Markets

Fusion markets has become widely popular among Moroccan Forex traders due to its quick execution, low trading/non-trading fees, and minimal spreads.

It has also been ranked as the best Forex broker in Morocco owing to its seamless access to numerous currency pairs and support to Forex trading platforms like MetaTrader 4 and 5.

Although Fusion Markets does not support local MAD deposits, Moroccan traders can still invest on the platform through international bank transfers, e-wallets, and credit cards.

Fusion Markets Features

- Low-cost trading: Fusion Markets is known for low overall trading costs.

- Multiple platforms: You can access your account via MT4, MT5, and cTrader

- No minimum deposit: They do not maintain a minimum deposit threshold.

- Free and fast withdrawals: They perform cashout processing for clients quickly, using a variety of payment solutions.

| Pros | Cons |

|---|---|

| Very low trading and non-trading fees and tight spreads, ideal for cost-conscious traders. | No direct local Moroccan dirham (MAD) bank transfers — funding is via international methods. |

| Fast account opening and free deposits/withdrawals depending on method. | Limited product range (mostly forex/CFDs, fewer stocks/ETFs). |

| Supports major platforms like MetaTrader 4 & 5. | No local support office in Morocco. |

2. Pepperstone

As a forex broker, Pepperstone is one of the best in the game with ultra competitive spreads and high level of order execution quality.

That is perfect for Moroccan traders whether you are a beginner or an expert. They have a large range of payment options like international bank wiring, all types of cards (credit/debit), and of course electronic wallets.

Trading in Morocco is amazing because you can open an acccount in no time and enjoy the exact same prices and fast customer support even though you can’t bank locally in Moroccan dirhams (MAD).

Pepperstone Features

- Ultra-fast execution: The trading speed would make it ideal for scalping and day trading.

- Platform variety: You can choose MT4, MT5, or cTrader for manual or algorithmic trading.

- Tight pricing: You can obtain raw spreads (starting from 0.0 pips) on select accounts.

- Strong support: They offer support via chat, phone, and email, which won them several awards.

- Limited crypto exposure: They offer a smaller crypto portfolio than other brokers.

| Pros | Cons |

|---|---|

| Highly regulated with strong oversight and trust for Moroccan traders | No direct local bank MAD deposits — international transfers/cards/e-wallets required. |

| Tight spreads and low cost ECN trading on MT4/MT5 and cTrader. | Higher minimums/recommendations may apply for some accounts. |

| Good customer support and reliable execution. | Limited crypto options compared to some rivals. |

3. Hantec Markets

Hantec Markets is recognized for a wide range of trading instruments coupled with low fees for trading CFDs and Forex.

Among the brokers used by Moroccan traders, it is noted for low trading costs and free deposit/withdrawal services.

Although direct Moroccan banking is not supported, local traders can deposit funds via international bank transfers and e-wallets.

Hantec Markets Features

- Multi-regulated and established: They are a trusted broker with decades of market presence.

- Diverse assets: Provides services in forex, indices, commodities, metals, and cryptocurrencies.

- Platforms: Supports MT4, MT5, and also offers proprietary mobile and web platforms.

- Quick funding: Rapid processing for both deposits and withdrawals.

- Limited education & research: Basic tools for education and market analysis need improvement.

| Pros | Cons |

|---|---|

| Competitive forex and CFD fees and solid spreads. | Not known for supporting local Moroccan bank transfers (global methods used). |

| No or low deposit/withdrawal fees common with many brokers. | Platform offering is less extensive than bigger brokers. |

| Supports MT4/MT5 with decent charting tools. | Less global presence than some peers. |

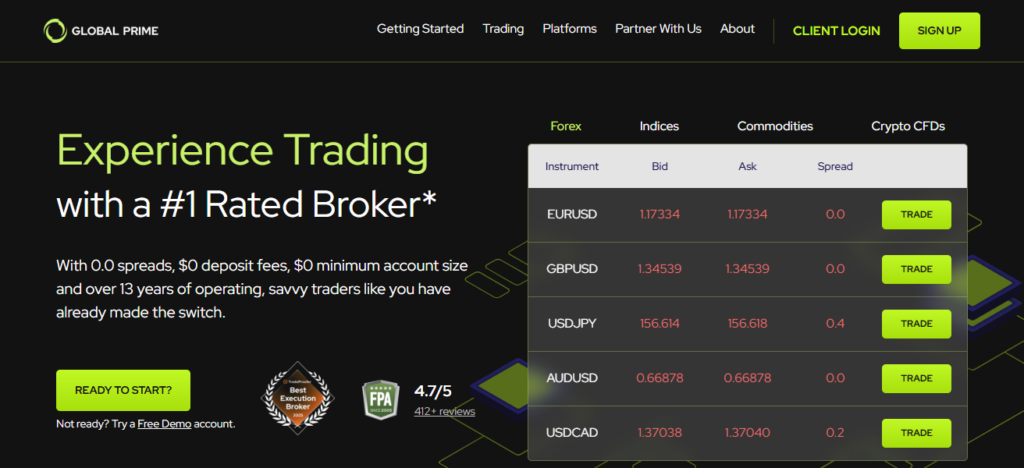

4. Global Prime

Global Prime is yet another broker with good reviews that Moroccan traders appreciate for low forex fees, solid execution, and easy account opening.

They are known for giving customers withdrawals and deposits that are free of charge (based on the payment method used) and supports the most used trading platforms.

With Moroccan customers, they accept transfers from international banks and digital payment methods to pay for their accounts.

Global Prime’s competitive pricing and good service makes it suitable for customers that are mainly into trading forex.

Global Prime Features

- Cost-effective surroundings: Offers spreads beginning from 0.0 pips and no fees for deposits.

- Diverse range of instruments: Offers forex, indices, commodities, and CFD for cryptocurrencies

- Quick Execution: Able to fill orders promptly from low-latency servers.

- Practice accounts: Allows the opportunity to trade without financial risks.

- Limited market tools: Less abundant research materials compared to some of the larger brokerage firms.

| Pros | Cons |

|---|---|

| Low spreads and good forex trading conditions. | Does not provide direct local banking in MAD — funding through global options. |

| Easy and fast account opening with fee-free options. | Fewer additional markets (like wide CFD stocks) than some brokers. |

| Supports major platforms like MT4 & MT5. | No local office/service in Morocco. |

5. IC Markets

IC Markets is ideal for Moroccan traders looking for raw spread trading and institutional-grade liquidity. It provides extremely low spreads and access to cTrader and MetaTrader.

While direct local MAD bank transfers are usually unavailable, IC Markets offers deposits through international bank transfers, cards, and e-wallets

Including some free and low-cost options. Their reputation, execution speed, and variety of funding options are solid reasons to choose IC Markets in Morocco.

IC Markets Features

- Extremely low spreads: Raw spreads starting from 0.0 pips which is perfect for traders looking to save on costs

- Variety of platforms: MT4, MT5, cTrader, and TradingView platforms are offered.

- High liquidity: Enjoy fast execution and access to institutional pricing.

- Variety of assets: Forex, CFDs on indices, commodities, stocks, and cryptocurrencies.

- Additional services: Provides advanced tools such as social/copy trading, VPS, and some of the third-party platforms.

| Pros | Cons |

|---|---|

| Ultra-low spreads and deep liquidity for Moroccan scalpers. | No direct local banking deposits — only global transfers/cards/e-wallets. |

| Free or low-cost deposits/withdrawals are common. | Platform options may overwhelm beginners. |

| Supports MT4, MT5, cTrader plus automation/copy tools. | Risk of high leverage trading for novices. |

6. Capital.com

Moroccan customers are attracted to Capital.com’s user-friendly trading platform and comprehensive offering of CFDs and foreign exchange pairs.

Account funding via global bank wire, credit/debit cards, and e-wallets is accessible to Moroccan clients. Banking in Moroccan dirhams is not supported.

However, with Capital.com’s multiple deposit options, trading internationally can be done with ease. Competitive pricing and trading tools that assist novice and advanced traders alike make Capital.com a great choice.

Capital.com Features

- New user-friendly: Intuitive user interface for traders with embedded charting and trade recommendations.

- Variety of instruments: Provides over thousands of CFDs on all Forex, Stock, Indices, and Cryptocurrencies.

- Supports MT4: Works with popular third party trading platforms

- Less advanced research: Compared to some competitors, research tools are more basic

| Pros | Cons |

|---|---|

| Easy-to-use platform with educational tools. | Limited direct local banking for Moroccan clients. |

| Competitive fees and broad instruments beyond forex | Spread-based pricing may cost active traders more. |

| Quick account opening and multiple funding methods. | Some advanced features may cost extra. |

7. Vantage FX

Vantage (previously Vantage FX) offers multiple account types and competitive execution as a multi-asset broker.

It’s recognized as a top forex broker for trading conditions and offers support for major platforms such as MT4 and MT5.

Since local banks do not process transfers in Moroccan Dirham (MAD), Moroccan traders must use international bank wires and card/e-wallets for funding. Vantage’s banking methods and deposits/withdrawals alleviate concerns for both active and beginner traders in a robust trading environment.

Vantage FX (Vantage Markets) Features

- Multi-asset access: Forex trading plus CFDs on shares, commodities, indices and ETFs

- Low spreads: Major instruments priced competitively

- Learning materials: Research and trade tools for novice traders.

- Wider spreads than ECN competitors: Some accounts have higher costs. (Vantage LATAM) [10

| Pros | Cons |

|---|---|

| Strong execution and flexible account types. | No local MAD bank deposit support. |

| Supports MT4 & MT5 with competitive spreads. | Smaller research tools than larger platforms. |

| Good options for both beginners and pros. | Global regulation only — no local Moroccan regulation. |

8. Tickmill

Tickmill is well regarded in the forex industry for its low commission rates, narrow spreads, and fast execution which is why it is attractive to cost-focused Moroccan traders.

MetaTrader 4 and 5 are compatible. Its simple fee structure is attractive for both scalpers and long-term traders.

Funding options include international bank transfers, cards, and e-wallets, which Moroccan clients use. Tickmill may not offer direct local banking in MAD, but its global and accessible banking options are an advantage.

Tickmill Features

- Affordable: Offering low spreads and commissions.

- Clear account categories: Options include Standard, Pro, and VIP.

- Educational seminars: Online training for traders lives.

- Good execution: Quickly fills orders.

- Fewer features: Platforms have fewer features than many competitors.

| Pros | Cons |

|---|---|

| Very competitive forex fees and tight spreads. | No direct local MAD bank support. |

| Fast account setup and beginner-friendly conditions. | Less range of products beyond FX/CFDs. |

| Good execution quality. | Lower brand recognition compared with giants like Pepperstone. |

9. XTB

XTB is known as a respected broker that is publicly traded, has a good range of regulations and offers a variety of forex and CFD instruments.

For traders of all levels, XTB is known for their trading platforms and educational resources which support Moroccan traders.

Funding for XTB accounts can be done through international bank transfers, cards, and e-wallets which allows for flexibility in payment.

Although XTB may not support local Moroccan banking options, their global payment methods help Moroccan clients with account funding and withdrawals.

XTB Features

- Proprietary platform: Advanced indicators and charting on xStation

- Diverse access: Access equities, FX, CFDs, and ETFs.

- Exceptional education: Tools for market analysis, webinars, and guides.

- Mobile app: Users rate the app highly.

- Fees for inactivity: Fees apply for inactivity.

| Pros | Cons |

|---|---|

| Regulated internationally with strong platform quality. | Local Moroccan banking is not supported for deposits. |

| Wide asset variety (forex, stocks, indices, crypto CFDs). | Spreads may be wider on standard accounts. |

| Good educational content for traders. | May impose inactivity fees depending on region. |

10. AvaTrade

AvaTrade is a well known global broker who is recognized for their compliance with regulations and offers a variety of trading options for their clients.

They offer trading platforms such as MT4, MT5, and their own AvaTradeGO mobile app. Other features include social/ copy trading.

Moroccan customers can fund their trading accounts through international bank transfers, credit cards and some e-wallets.

Although Moroccan clients may not be able to do bank deposits with converted Moroccan dirhams, AvaTrade offers a lot of global deposit and withdrawal options to make it reliable.

AvaTrade Features

- Multi platforms: Use MT4, MT5, and WebTrader, and get options on AvaOptions.

- Wide range of CFDs: Includes forex, stocks, ETFs, commodities, and CFDs.

- Trade copying: Social trading features with ZuluTrade and AvaSocial.

- Pricing model: fixed and floating spreads.

| Pros | Cons |

|---|---|

| Long-standing broker with many regulatory licenses. | Doesn’t support direct local bank transfers in MAD. |

| Multiple platforms (MT4/MT5/AvaTradeGO). | Spreads can be higher than pure ECN rivals. |

| Good for beginners and mobile trading. | Range of advanced tools isn’t as deep as some specialists. |

How We Choose Best Forex Brokers for Moroccan Traders Using Local Banking

- Broker should allow Moroccan clients and have cross-border funding services for Moroccan banks.

- Banking, cards, and e-wallets are available to Moroccan customers.

- Regulated by Tier 1 to ensure safety of trader’s funds and business transparency.

- Low trading margins and commissions for forex activity.

- Withdrawals and deposits are prompt and cost little.

- MT4, MT5, and cTrader are robust and reliable; some have their own.

- Many currency pairs and top CFDs.

- Good slippage and fast execution in turbulent times.

- Customer service is international; they speak Arabic and English, which is helpful.

Cocnsluion

In cocnsluion Choosing forex brokers that Moroccan traders can use with local banking means selecting safe, regulated brokers with flexible funding.

While deposits from Moroccan banks are limited, international top brokers provide sufficient alternatives such as bank transfers, cards, and e-wallets.

These brokers give clear trading conditions, strong trading platforms, and fast withdrawals which makes forex trading easier and safer for Moroccan traders.

FAQ

Can Moroccan traders use local banks for forex trading?

Direct local banking is limited; most traders use international transfer options.

Is forex trading allowed in Morocco?

Forex trading is not locally regulated but allowed through international brokers.

Which brokers accept traders from Morocco?

Many global brokers like IC Markets, Pepperstone, and AvaTrade accept Moroccan clients.

What deposit methods are best for Moroccan traders?

International bank transfers, debit/credit cards, and e-wallets are commonly used.