The Top Forex Brokers for Prop Desk White-Labeling that provide deep liquidity, sophisticated institutional solutions, and adaptable platforms will be covered in this post.

Prop desks may function effectively while retaining complete control over branding, client accounts, and trading methods because to these brokers’ white-label account features, multi-asset access, low-latency execution, and strong risk management tools.

Why Use Forex Brokers for Prop Desk White-Labeling

Custom Branding – Prop desks can brand trading accounts as their own. This elevates their standing and recognition in the industry while using the broker’s backend.

Advanced Trading Platforms – Brokers offer access to institutional-level platforms such as MT4, MT5, or other proprietary solutions to help prop desks trade complex strategies.

Low-Latency Execution – White label broker solutions offer access to optimal liquidity and trade execution which is important for all forms of trading including HFT and algo trading.

Risk & Account Management Tools – Embedded tools for trade management and exposure control help prop desks in client money protection, trade management and overs exposure.

Regulatory Compliance & Security – When prop desks use a regulated broker, they comply with the globe’s best practice standards for funds and operational integrity in prop trading.

Why It Is Forex Brokers for Prop Desk White-Labeling Matter?

Operational Efficiency – They offer the infrastructure that allows prop desks to devote their resources to trading strategies and not platform-building.

Scalability – As the desk grows, White-label solutions for prop trading firms become capable of seamlessly adding multiple accounts, clients, and strategies.

Access to Institutional Liquidity – Competitive trading is the outcome of the prop desks receiving low-latency execution along with the deep liquidity necessary for their trading performance.

Compliance & Security – Working with regulated brokers is a better way to make sure that the legal, financial, and operational standards are met while also maintaining a better reputation.

Brand Autonomy – Firms improve their credibility in the market and the trust of their clients by being able to keep their brand while using the technology and support of a broker.

Key Point & Best Forex Brokers for Prop Desk White-Labeling List

| Broker / Platform | Key Points |

|---|---|

| Saxo Bank | Offers advanced trading platforms, multi-asset access, dedicated account managers, strong regulatory oversight, and institutional-grade execution. |

| Pepperstone Pro | Low-latency execution, access to multi-asset markets, ECN pricing, advanced trading tools, and strong liquidity providers. |

| IC Markets Institutional | Ultra-low spreads, direct market access, multiple liquidity providers, customizable platforms, and strong institutional support. |

| FxPro Institutional | Flexible account types, high-speed execution, multi-asset trading, strong risk management tools, and reliable liquidity sources. |

| CMC Markets Connect | Access to deep liquidity pools, institutional-grade trading tools, advanced charting, customizable platforms, and robust risk management. |

| Dukascopy Bank | ECN execution, Swiss banking regulation, competitive spreads, multi-asset offerings, and strong platform technology. |

| Swissquote | Strong regulatory framework, multi-asset trading, institutional-grade tools, dedicated support, and reliable liquidity access. |

| Interactive Brokers (IBKR) | Global market access, multi-asset trading, low commissions, advanced trading tools, and robust institutional infrastructure. |

| AvaTrade Institutional | Flexible account solutions, multi-asset support, strong risk management, competitive spreads, and dedicated institutional support. |

| FOREX.com Institutional | Direct market access, low-latency execution, advanced trading platforms, strong liquidity, and comprehensive institutional services. |

1. Saxo Bank

Saxo Bank is another well-regarded Forex broker that operates in nearly every corner of the world. Forex broker Saxo Bank offers fully regulated institutional-grade solutions. Their platforms SaxoTraderGO and SaxoTraderPRO offer the latest charting and risk management tools.

If you like trading professionally, you’ll be pleased with their low latency trading execution. Their transparent trading conditions and pricing are also favorable to professionals and institutions. Saxo Bank is one of the Best Forex Brokers for Prop Desk White-Labeling. They provide flexible and customizable multi-account solutions that proprietary trading companies can use to manage accounts.

Saxo Bank Features, Pros & Cons

Features

- Multi-asset trading (FX, stocks, CFDs, bonds).

- Institutional platforms (SaxoTraderGO/PRO).

- Deep liquidity & competitive pricing.

- Robust risk management tools.

- Comprehensive reporting & compliance support.

Pros

- Strong regulatory oversight (high institutional trust).

- Excellent technology and analytics.

- Customizable for prop desk workflows.

- Multi-asset access under one provider.

- Dedicated institutional support.

Cons

- Higher minimum requirements vs smaller brokers.

- Pricing may be less competitive for ultra-high-frequency traders.

- Platform complexity for new teams.

- Limited crypto exposure compared to some peers.

- Potentially higher costs for smaller offices.

2. Pepperstone Pro

Pepperstone Pro gives you the ability to trade with lightning fast execution on all asset classes with ECN-style pricing on forex, indices, commodities, and cryptocurrencies. Institutional clients can access deep liquidity support at low spreads on MetaTrader 4, MetaTrader 5, and cTrader.

Mid-paragraph: For two years running, Pepperstone has been recognized as offering one of the Best Forex Brokers for Prop Desk White-Labeling. Pepperstone Pro gives firms the ability to provide branded trading accounts as well as multi-asset structural support for proprietary trading. With competitive pricing and low-cost, dedicated support, Pepperstone Pro gives trading firms a flexible white-label solution with optimal scalability, reliability, and risk management.

Pepperstone Pro Features, Pros & Cons

Features

- ECN-style pricing & tight spreads.

- Multi-platform support (MT4/5, cTrader).

- Deep institutional liquidity.

- Advanced API connectivity.

- Risk & execution tools.

Pros

- Low trading costs and tight pricing.

- Fast execution speeds.

- Flexible platform choices for prop strategies.

- Strong liquidity partners.

- Responsive institutional support.

Cons

- Brand less recognized than bigger global brokers.

- Limited non-FX asset depth.

- Fewer proprietary tools vs large banks.

- Advanced API integrations necessitate a higher level of technical resource engagement.

- There is a decreased number of fixed-income and crypto offerings.

3. IC Markets Institutional

IC Markets Institutional offers one of the most competitive, low-latency spreads industry-wide and offers direct market access. IC market’s proprietary multi-latency global liquidity solution is built specifically for high-frequency and algorithmic trading. Mid-paragraph: For two years running, IC Markets has been recognized as offering one of the Best Forex Brokers for Prop Desk White-Labeling.

IC Markets Institutional gives proprietary desks the ability to manage branded accounts with risk and liquidity customized to their needs. Because of its impressive scalability, robust APIs, and ultra-rapid execution, IC Markets has become the favored option for hedge funds, prop firms, and institutions needing high-frequency trading.

IC Markets Institutional Features, Pros & Cons

Features

- True ECN infrastructure.

- Ultra-low spreads.

- Multiple liquidity feeds.

- Powerful API access.

- Scalability for high-volume trading.

Pros

- High-frequency prop desks incur low costs.

- Numerous execution alternatives.

- Outstanding technical reliability.

- MT4/5 support is strong.

- Pricing is clear.

Cons

- Onboarding for institutional clients can be extensive.

- Proprietary analytics are sparse.

- Compared to large banks, less global branding authority.

- Primarily FX/CFDs tools.

- Support is inconsistent by region.

4. FxPro Institutional

FxPro Institutional provides professional traders with meta trader 4, meta trader 5, and c trader, coupled with deep liquidity ECN execution. Clients can trade on forex coupled with numerous other commodities, such as indices, metals, and energy. Mid-paragraph: FxPro is awarded among the Best Forex Brokers for Prop Desk White-Labeling.

They offer tailored multi-account models and exceptional institutional assistance. Designed for proprietary trading firms, FxPro’s flexible account types, sophisticated risk management features, and other tools are ideally suited to white label frameworks across multiple asset classes.

FxPro Institutional Features, Pros & Cons

Features

- Access to MT4, MT5, and cTrader.

- Liquidity pools via ECN.

- Institutional desk.

- Risk exposure tools.

- Reporting on portfolios.

Pros

- Execution models are flexible.

- Support on various platforms is available.

- Nice features for managing risk.

- Spreads are competitive.

- Service for institutional consumers.

Cons

- Compared to top tier banks, the depth of market data available is moderate.

- Presence in the global market is less than some of the competition.

- Advanced reports may need additional tools from outside.

- Offering in crypto is not as extensive.

- Compared to their peers, less developed API tools.

5. CMC Markets Connect

CMC Markets Connect provides institutional trading, deep liquidity, and low latency execution. The next-generation platform incorporates sophisticated charting tools, and all trade management features across multiple asset classes. Mid paragraph; CMC Markets Connect is recognized as one of the **Best Forex Brokers for Prop of Desk White-Labeling.

CMC Markets Connect enables firms to set up white label accounts for prop desks with customized spreads and flexible trade management. With regulatory alignment, transparent routs, and reliable trade streams, this infrastructure is tailored for proprietary trading teams, ensuring a professional white label solution.

CMC Markets Connect Features, Pros & Cons

Features

- Access to deep liquidity.

- Tools on the platform are advanced.

- Risk analytics + charting.

- Adjustable spreads.

- Global regulatory framework.

Pros

- Multi-asset desks with high liquidity.

- Advanced analytical tools.

- Risk management controls.

- Recognized regulated brand.

- Flexible architecture.

Cons

- Excessive Knowledge is necessary for brand.

- Variation of spread markups.

- Not enough dedicated automation APIs.

- Excessive payments for premium research.

- Inadequate exposure to Crypto.

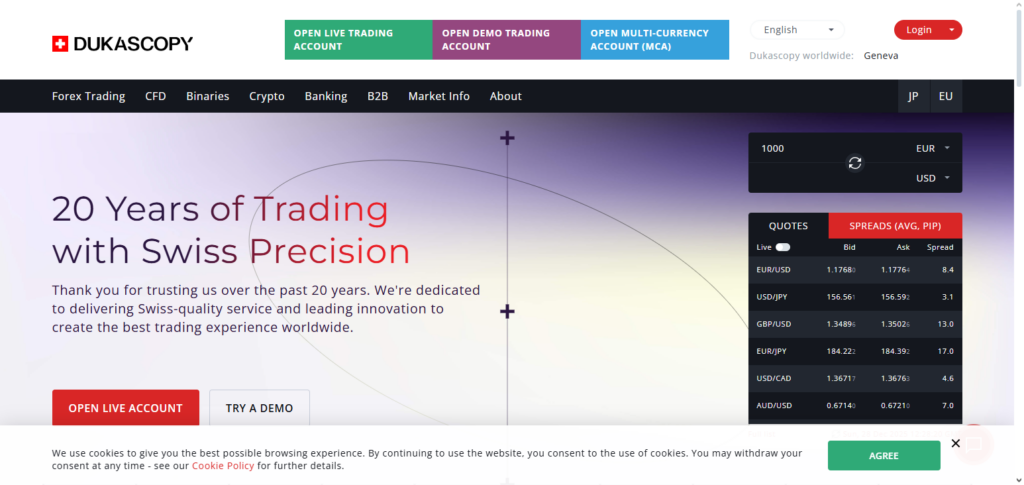

6. Dukascopy Bank

Dukascopy Bank provides multi asset trading including Forex, CFDs, and cryptocurrencies. Dukascopy Bank has received great recognition and reputation for being one of the most reliable Swiss regulated brokers, providing ECN execution , and tight spread trading across multiple assets. Bank offers algorithmic and high-frequency trading on its JForex platform.

Mid-paragraph: Dukascopy Bank has become one of the most recognized companies in the category of the Best Forex Brokers for Prop Desk White-Labeling. Using deep liquidity, strong technology, and Swiss regulation, Dukascopy has positioned itself to offer safe and efficient trading to its customers for institutional white-label trading.

Dukascopy Bank Features, Pros & Cons

Features

- Swiss ECN execution.

- JForex platform with algo support.

- Competitive pricing.

- Multi-asset exposure.

- Risk and back-testing tools.

Pros

- Strong banking regulation (Swiss).

- Excellent algo features.

- Deep liquidity for major FX.

- Transparent pricing.

- Multi-account support.

Cons

- Platforms problem for beginners.

- Lower brand presence compared to big brokers.

- Limited derivatives breadth.

- Support responsiveness isn’t uniform.

- Smaller global footprint.

7. Swissquote

For fully regulated institutional trading services including Forex, Equities, Commodities and Cryptocurrency trading, Swissquote is one of the companies in the industry that offers the most advanced services. Their trading platform has the most advanced features including multi account management, custom solutions, and risk management tools.

Mid-paragraph: One of the industry’s best in providing Prop Desk White-Labeling is Swissquote. For account customization, Swissquote provides proprietary trading desks white label solutions. The technology, regulation and liquidity Swissquote offers makes it one of the best options for institutional and prop trading firms.

Swissquote Features, Pros & Cons

Features

- Regulated multi-asset platform.

- Institutional liquidity access.

- Customizable risk tools.

- Multi-account support.

- Strong compliance.

Pros

- Bank-level security.

- Extensive assets.

- Great reputation.

- Customizable reporting.

- Strong tech.

Cons

- Desktop costs can be high.

- Less personalized tech vs competitors.

- Poor crypto selection.

- Complicated onboarding.

- Increased spreads on some instruments.

8. Interactive Brokers (IBKR)

With respect to prop trading firms and their White-labeling solutions, Interactive Brokers is one of the best-rated Forex brokers. Interactive Brokers is one of the world’s largest brokers, with the highest number of clients.

It offers limitless access to global markets, advanced and fully customizable trading systems and APIs, and the lowest execution costs. Proprietary trading firms are most attracted to their global reach, competitive pricing, and fully scalable solutions.

Interactive brokers also holds the largest number of prop trading firms as clients. Interactive Brokers also offers the most comprehensive global market coverage. Mid-paragraph: Proprietary trading firms are especially attracted to Interactive Brokers because they offer scalable solutions and competitive prices. In addition to these, they also hold the most comprehensive global market coverage.

Interactive Brokers (IBKR) Features, Pros & Cons

Features

- Global multi ‑ asset execution.

- Low commission.

- Strong API.

- Tools for risk/account management.

- Advanced research/account tools.

Pros

- Markets access is extremely broad.

- Market prices are very competitive.

- Tech is of institutional grade.

- Analytics and reporting is deep.

- Support tooling is automated and easy to use.

Cons

- The platform is very complex.

- The learning curve is quite steep.

- Data feeds come with additional costs.

- Customer service is perceived as lacking personalization.

- Integrating white ‑ label branding is more technical.

9. AvaTrade Institutional

With respect to prop trading firms and their White-labeling solutions, AvaTrade is also one of the best-rated Forex brokers. AvaTrade Institutional is also one of the largest brokers in the world, offering the most advanced customized accounts and the most flexible execution speeds.

Flexible account management is one of the most significant features that assist AvaTrade in maintaining their position in the market. Mid-paragraph: AvaTrade’s advanced and reliable technologies, and consistent adherence to regulatory principles, enhance AvaTrade’s position as one of the most reputable brokers.

AvaTrade Institutional Features, Pros & Cons

Features

- Multi ‑ platform (MT4/5, AvaOptions)

- White ‑ label multi ‑ account capabilities

- Risk and exposure management tools

- Multi ‑ asset offering

- Across regions regulatory oversight

Pros

- Flexible white ‑ label options.

- Good suites for risk management.

- Coverage on assets is broad.

- Reasonable pricing.

- Solutions are easy to deploy.

Cons

- Compared to the larger players, liquidity depth is thin.

- The ecosystem of the platform is limited.

- Advanced APIs are less effective.

- There are regions with execution speed disparities.

- Some regions have limited branding.

10. FOREX.com Institutional

FOREX.com Institutional offers direct market access, low-latency execution, and specialized trading tools for premium clients. They provide multi-asset solutions in Forex, commodities, and indices, along with varied account management options.

Mid-paragraph: Forexf.com is considered one of the Best Forex Brokers for Prop Desk White-Labeling, as it provides prop trading companies with the flexibility to offer their branded accounts with customized liquidity, risk, and execution to their clients.

The dependable proprietary trading partner for white-label solutions is Forex.com’s institutional-grade infrastructure, deep liquidity, and dedicated support, which allows proprietary trading firms to customize their solutions.

FOREX.com Institutional Features, Pros & Cons

Features

- Direct access to the market

- Tight spreads and competitive execution

- Support for multiple platforms

- Advanced risk management tools

- Desk for institutional clients

Pros

- FOREX liquidity is strong.

- Support from institutions.

- Price points.

- Established platform reliability.

- Clear reporting.

Cons

- Compared to global brokers, asset variety is less.

- Fewer crypto options.

- API features are more limited.

- Some costs can accumulate for frequent traders.

- Onboarding compliance can be thorough.

Conclusion

In conclusion, the effectiveness, dependability, and scalability of proprietary trading white-label solutions depend heavily on the choice of broker. The top Forex brokers providing prop desk white-labeling include Saxo Bank, Pepperstone Pro, IC Markets Institutional, FxPro Institutional, CMC Markets Connect, Dukascopy Bank, Swissquote, Interactive Brokers (IBKR), AvaTrade Institutional, and FOREX.com Institutional.

Prop desks can function well while retaining complete control over branding and risk thanks to their sophisticated trading platforms, strong liquidity, low-latency execution, and customisable account management. Proprietary trading enterprises can attain professional-grade performance and smooth operations by selecting any of these brokers.

FAQ

What is Prop Desk White-Labeling in Forex?

Prop Desk White-Labeling allows proprietary trading firms to offer branded trading accounts using a broker’s infrastructure. It enables firms to manage client accounts, trading conditions, and risk while leveraging the broker’s technology, liquidity, and regulatory compliance.

Why choose a white-label broker for a prop desk?

White-label brokers provide ready-made trading infrastructure, multi-account management, low-latency execution, and risk tools, allowing prop desks to focus on trading strategies and client growth without building platforms from scratch.

Which brokers are best for prop desk white-labeling?

Brokers like Saxo Bank, Pepperstone Pro, IC Markets Institutional, FxPro Institutional, CMC Markets Connect, Dukascopy Bank, Swissquote, Interactive Brokers (IBKR), AvaTrade Institutional, and FOREX.com Institutional are considered top choices due to their advanced platforms, liquidity, and customizable account solutions.

What features should prop desks look for in a white-label broker?

Key features include multi-account management, customizable spreads and leverage, deep liquidity access, low-latency execution, advanced trading platforms, strong regulatory oversight, and dedicated institutional support.