Forex trading has developed into a cloud-powered ecosystem in 2026, where flawless cross-device access is now essential rather than optional.

The Best Forex Brokers Supporting Cross-Platform Cloud Sync Trading enable traders to move between web browsers, mobile apps, and desktop terminals with ease without losing open positions, watchlists, or data.

This innovation guarantees speed, flexibility, and consistency, providing a uniform, safe, and effective global trading experience for both novices and experts.

What “Cross-Platform Cloud Sync”

Cross-Platform Cloud Sync in forex trading involves the automatic synchronization of a trader’s broker account’s data, platform settings, lists of watched securities, indicators, and active positions across devices and systems in real time.

This synchronization occurs in the cloud, providing seamless continuity. If a trader uses a desktop terminal, a web browser, and a mobile app, their cloud synced account is up to date with all platform activity.

Cloud Sync in Forex trading allows for instant switching across devices while preserving the same trading environment. This provides unmatched flexibility, reduced error, and a seamless experience to geolocation diverse & travelling traders.

10 Best Forex Brokers with Cloud Sync Trading (2026)

| Broker | Cloud Sync Features |

|---|---|

| Exness | Real-time sync across MT4/MT5, web terminals, and mobile apps |

| IC Markets | Cloud-linked MT4/MT5 + cTrader sync |

| Pepperstone | Cloud sync watchlists, indicators, and settings |

| FP Markets | Integrated cloud sync for MT4/MT5 + IRESS |

| AvaTrade | AvaTradeGO + WebTrader cloud sync |

| XM | MT4/MT5 cloud sync with mobile/web |

| OANDA | Proprietary platform + MT4 sync |

| FOREX.com | Cloud sync across proprietary + MT4 |

| Saxo Bank | SaxoTraderGO cloud sync across devices |

| eToro | Cloud-based social trading sync |

1. Exness

Exness has a strong reputation globally. Brokers like CySEC, FCA, and FSCA regulate Exness ensuring strong compliance. This broker provides MT4, MT5, and WebTrader and has an excellent cloud sync that works across desktop, mobile, and web interfaces.

Traders are able to enjoy seamless sync across watch lists, favorite indicators, and open positions. Payment options like local bank transfers, cards, and e-wallets withdrawals, and deposits are available and transfers are fast across the world.

Exness also operates multilingual customer service channels that are open 24 hours a day. Exness is a reliable and fast broker and is Best Forex Brokers Supporting Cross-Platform Cloud Sync Trading and is well suited for very active traders.

Exness Features

- Regulations: CySEC, FCA, FSCA

- Platforms Used: MT4, MT5, WebTrader

- Cloud Synchronization: Sync across desktop, mobile, and browser terminals in real-time.

- Payment Options: Cards, bank transfers, e-wallets (Skrill, Neteller).

- Geographical Presence: Cyprus Headquarters, significant presence in Asia and Africa.

- Customer Assistance: Multilingual, live chat, and email, available 24/7.

Exness Pros & Cons

| Pros | Cons |

|---|---|

| Ultra-fast execution with real-time cloud sync | Limited educational resources compared to competitors |

| Strong regulation (CySEC, FCA, FSCA) | Higher leverage may increase risk for beginners |

| Wide payment options including local transfers | Some regions face restrictions |

| 24/7 multilingual support | Advanced tools mainly for experienced traders |

2. IC Markets

IC Markets is one of the leading forex brokers in the world. Regulated by ASIC, CySEC, and FSA Seychelles, the broker is known for its transparency and ultra-low spreads. The company is headquartered in Australia and services Europe, Asia, and Africa.

Payment methods include bank transfer, PayPal, Skrill, Neteller, cards and many more, which increases the geographical reach of the broker. The broker has cloud-based solutions with MT4, MT5 and cTrader.

Customer service is available 24/5 and can be reached via email, chat and telephone, providing full forex brokers services. IC markets is particularly suited for algorithmic traders, scalpers, and forex traders in need of cross cloud platform cloud synchronization.

IC Markets Features

- Regulations: ASIC, CySEC, FSA Seychelles

- Platforms Used: MT4, MT5, cTrader

- Cloud Synchronization: Synchronization for watch lists, indicators, and positions.

- Payment Options: PayPal, Skrill, Neteller, cards, bank transfers.

- Geographical Presence: Headquartered in Australia with a substantial presence in the EU and Asia.

- Customer Assistance: 24/7 live chat, phone, and email.

IC Markets Pros & Cons

| Pros | Cons |

|---|---|

| Regulated by ASIC, CySEC, FSA Seychelles | No proprietary platform, relies on MT4/MT5/cTrader |

| Ultra-low spreads, ideal for scalpers | Customer support limited to 24/5 |

| Cloud sync across MT4/MT5/cTrader | Complex setup for new traders |

| Multiple payment methods (PayPal, Skrill, Neteller) | High minimum deposit in some regions |

3. Pepperstone

Regulatory agencies like the FCA, DFSA, and ASIC supervise Pepperstone and grant it primary investor protection. Pepperstone offers MT4, MT5, cTrader, and TradingView, and all allow cloud syncing for watchlists, indicators, and other settings.

Pepperstone’s payment options include cards, bank transfers, PayPal, Skrill, and UnionPay, which serve a worldwide customer base. Pepperstone Australia is situated and has offices in London and Dubai.

Pepperstone has multilingual customer support available 24/5. Best Forex Brokers Supporting Cross-Platform Cloud Sync Trading. Pepperstone is a great choice for multi-platform traders in need of rapid trade execution and account sync across platforms, as it offers great flexibility.

Pepperstone Features

- Regulations: FCA, ASIC, DFSA

- Platforms Used: MT4, MT5, cTrader, TradingView

- Cloud Synchronization: Sync across devices and several platforms.

- Payment Options: Cards, PayPal, Skrill, UnionPay, bank transfers.

- Geographical Presence: Headquartered in Australia with offices in the United Kingdom, and Dubai.

- Customer Assistance: 24/5 multilingual customer service.

Pepperstone Pros & Cons

| Pros | Cons |

|---|---|

| Strong regulation (FCA, ASIC, DFSA) | No guaranteed stop-loss orders |

| Supports MT4, MT5, cTrader, TradingView | Customer support not 24/7 |

| Cloud sync across multiple platforms | Limited proprietary research tools |

| Fast execution and multi-platform flexibility | Withdrawal fees may apply in some regions |

4. FP Markets

With ASIC and CySEC regulations, FP Markets is compliant and transparent. The company operates on MT4, MT5, and IRESS platforms, with desktop, web, and mobile access. There is also cloud-based.

Payments are accepted from credit cards, bank accounts, and e-wallets like Skrill and Neteller. FP Markets has its main office in Sydney, Australia, with substancial operations in Europe and Asia. The support team is multilingual and operates Monday to Friday.

FP Markets ranked among the best for Cross-Platform Cloud Sync Trading. It is more likely to suit advanced traders who want uninterrupted access to professional analytics to trade forex, equities, and CFDs.

FP Markets Features

- Regulations: ASIC, CySEC

- Platforms Used: MT4, MT5, IRESS

- Cloud Sync: Access data anytime across desktop application, website, and mobile app

- Payments: Cards, bank transfers, and services such as Skrill and Neteller

- Region: Australia HQ, strong presence in the European Union and Asia

- Support: Multilingual customer support available 24/5

FP Markets Pros & Cons

| Pros | Cons |

|---|---|

| Regulated by ASIC and CySEC | Customer support limited to 24/5 |

| Supports MT4, MT5, and IRESS | IRESS platform has higher fees |

| Cloud sync across web, desktop, mobile | Limited social trading features |

| Wide payment options including e-wallets | Less marketing presence globally |

5. AvaTrade

AvaTrade maintains global credibility thanks to its multiple regulations with the Central Bank of Ireland, ASIC, FSCA as well as Japan’s FSA. AvaTrade’s cloud-synced services include MT4, MT5, AvaTradeGO, and WebTrader, allowing for device-agnostic access to your positions, watchlists, and settings.

Payments via card, bank transfer, as well as e-wallets like Paypal and Skrill are also accepted. Dublin is AvaTrade’s headquarters, and the company also has a big presence in Europe, Asia, and Africa.

There is a multilingual, replicated 24/5 customer support service. AvaTrade is also one of the best Forex Brokers Supporting Cross-Platform Cloud Sync Trading, which is a reason some copy traders prefer the broker.

AvaTrade Features

- Regulation: The Central Bank of Ireland, ASIC, FSCA, and JFSA

- Platforms: MT4, MT5, AvaTradeGO, and WebTrader

- Cloud Sync: Sync portfolios and watchlists on the AvaTradeGO app

- Payments: Cards, bank transfers, and services including PayPal and Skrill

- Region: Ireland HQ, operations globally in the European Union, Asia, and Africa

- Support: Multilingual customer support available 24/5

AvaTrade Pros & Cons

| Pros | Cons |

|---|---|

| Regulated by Central Bank of Ireland, ASIC, FSCA | Inactivity fees apply |

| Supports MT4, MT5, AvaTradeGO, WebTrader | Spreads higher than ECN brokers |

| Cloud-native sync via AvaTradeGO | Customer support limited to 24/5 |

| Multiple payment options including PayPal | Limited advanced charting tools |

6. XM

XM’s compliance is solid since they have regulations from IFSC Belize, ASIC and CySEC. MT4 and MT5 trading platforms are available and they sync across web, desktop and mobile apps. Payments via card, bank transfer, e-wallets such as Skrill and Neteller and some local e-wallets are supported.

XM has offices all over the globe, although their headquarter is in Cyprus. Customer support is multilingual and available from Monday to Friday.

According to the Best Forex Brokers Supporting Cloud Sync Cross-Platform Trading, XM is well known among retail clients for their synchronized accounts, competitive spreads and ease of access.

XM Features

- Regulation: CySEC, ASIC, and IFSC Belize

- Platforms: MT4 and MT5

- Cloud Sync: Sync available across web, desktop, and mobile applications

- Payments: Cards, bank transfers, and services including Skrill and Neteller

- Region: Cyprus HQ, strong presence in Asia and Africa

- Support: Multilingual customer support available 24/5

XM Pros & Cons

| Pros | Cons |

|---|---|

| Regulated by CySEC, ASIC, IFSC Belize | Customer support limited to 24/5 |

| Supports MT4 and MT5 with cloud sync | Limited proprietary platform |

| Wide payment options including local transfers | Higher spreads on micro accounts |

| Strong global presence in Asia & Africa | Limited advanced trading tools |

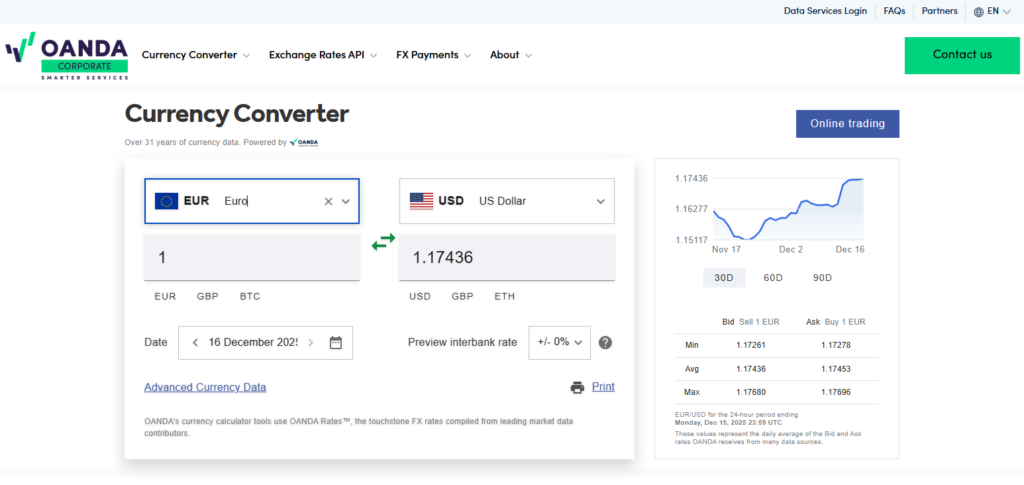

7. OANDA

Probably, one of the safest brokers is OANDA because of the clients’ funds’ safety, as it is regulated by the CFTC (US), FCA (UK), and IIROC (Canada). OANDA also offers OANDA Trade, MT4, and mobile trading apps which allow for seamless trading and are integrated and synchronized across various devices.

Payments made by customers are easy as they accept multiple forms like credit and debit cards, PayPal, and bank wire transfers, facilitating ease of transactions. OANDA services clients from all across the globe, including Europe and parts of Asia.

OANDA’s customer service can be contacted anytime from Monday to Friday. OANDA is one of the best brokers for those customers from the United States and the European Union because of the quality and reliable service.

OANDA Features

- Regulation: The CFTC in the US, the FCA in UK, and IIROC in Canada

- Platforms: OANDA Trade, MT4, and mobile applications

- Cloud Sync: Proprietary platform that allows you to sync across devices

- Payments: Cards, bank transfers, and PayPal

- Region: US HQ, strong presence in North America, Europe, and Asia

- Support: Live support available 24/7 via chat, phone, and email

OANDA Pros & Cons

| Pros | Cons |

|---|---|

| Regulated by CFTC, FCA, IIROC | Limited product range compared to multi-asset brokers |

| Proprietary platform + MT4 with cloud sync | Customer support limited to 24/5 |

| Strong presence in US, EU, Canada | No guaranteed stop-loss orders |

| Payment options include PayPal, cards, bank transfers | Higher spreads than ECN brokers |

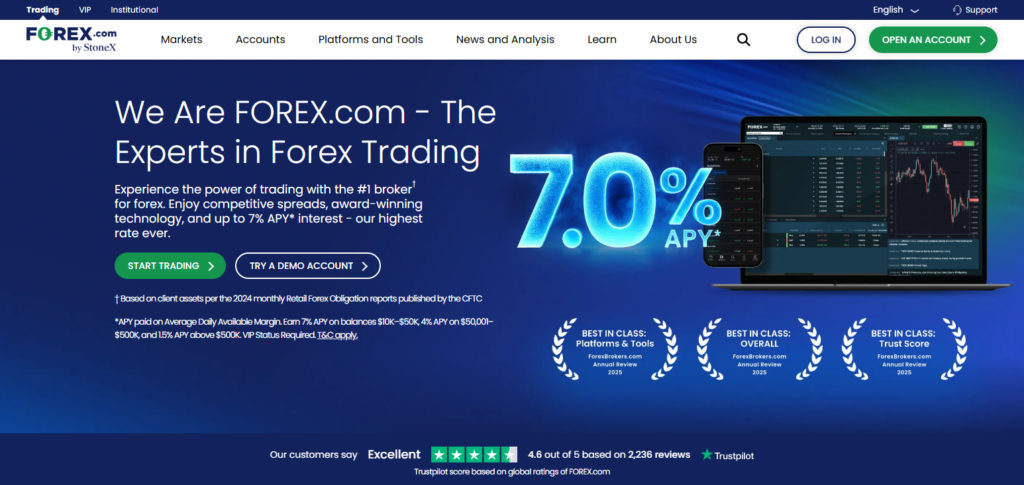

8. FOREX.com

With compliance to the CFTC, FCA, and IIROC, FOREX.com is the most compliant US broker and one of the biggest in the US. The platforms used by FOREX as well as the proprietary one are MT4 and MT5, all synced to the cloud for trading on any device.

Payment methods such as cards, bank transfers, and PayPal are all acceptable for international transactions. With its headquarters in the US, FOREX.com has big operations in Europe and Asia.

Customer service speaks many languages and is available during business days. For US clients needing regulated access, synchronized accounts, and advanced features cross-platform trading and analytics, is best served by the best in the world, FOREX.com.

FOREX.com Features

- Regulation: CFTC, FCA, IIROC

- Platforms: FOREX.com, MT4, MT5 (All Proprietary)

- Cloud Sync: Proprietary and MT4/5 sync

- Payments: Credit cards/bank transfers, PayPal

- Region: USA Headquarters, Offices around EU, Asia

- Support: 24/5 Bilingual Support

FOREX.com Pros & Cons

| Pros | Cons |

|---|---|

| Regulated by CFTC, FCA, IIROC | Customer support limited to 24/5 |

| Proprietary platform + MT4/MT5 with cloud sync | Spreads higher than pure ECN brokers |

| Strong US presence with global reach | Limited social trading features |

| Multiple payment options including PayPal | Withdrawal fees may apply |

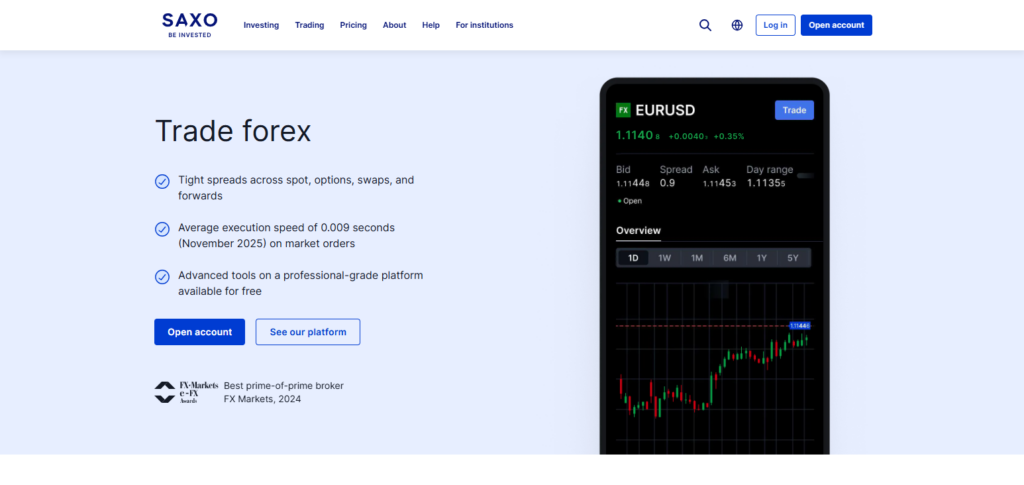

9. Saxo Bank

Saxo Bank is one of the most highly rated and secure brokers around, due in large part to the Danish FSA and the bank’s instant Ether and Bitcoin availability. In addition to the bank’s Ether and Bitcoin availability, the bank is secure because of the merchant accounts, institutional banking options, and the bank is still in Denmark.

Saxo Bank also has other institutional clients in Europe, the Middle East, and in Asia, but they all visit Denmark due to the bank’s support. Saxo Bank and other brokers also offer support in 24 hour blocks during 5 days.

In regard to Saxo Bank, one of the best brokers regarding cross-platform support cloud trading, Saxo Bank is one of the best options for advanced for professionals.

Saxo Bank Features

- Regulation: FSA of Denmark

- Platforms: SaxoTraderGO and SaxotraderPRO

- Cloud Sync: All three (Web, Desktop and Mobile) sync in the cloud.

- Payments: Credit cards/bank transfers, Institutional payment methods

- Region: Headquartered in Denmark, considerable presence in the European Union, Asia, and the Middle East

- Support: 24/5 Account Managers, Dedicated Service and Multilingual

Saxo Bank Pros & Cons

| Pros | Cons |

|---|---|

| Regulated by Danish FSA | High minimum deposit requirement |

| Proprietary SaxoTraderGO & PRO with cloud sync | Not ideal for small retail traders |

| Strong multi-asset offering | Customer support limited to 24/5 |

| Dedicated account managers | Complex fee structure |

10. eToro

CySEC, FCA, and ASIC watch over eToro assuring solid compliance. eToro WebTrader and mobile applications are custom-built with cloud synchronization for social trading, portfolio management, and watch lists.

Payment methods are card, bank transfer, PayPal, Skrill, or Neteller, making deposits simple from anywhere in the world. With head office in Israel and branches in London and Cyprus, eToro has global reach.

eToro has 24/5 multilingual live chat and ticketing system. eToro is excellent for copy trading and social investing due to the cloud-native infrastructure.

eToro Featurers

- Regulation: Regulatory authorities (FCA, CySEC, ASIC)

- Platforms: eToro Mobile Applications, WebTrader

- Cloud Sync: Cloud Synced Social Portfolios and Social Trading Watchlists

- Payments: Credit cards/bank transfers, PayPal, Skrill, Neteller

- Region: Headquarters in Israel, Offices in Cyprus and the United Kingdom, Global

- Support: 24/5 Multilingual Support via Live Chat, Ticketing

eToro Pros & Cons

| Pros | Cons |

|---|---|

| Regulated by CySEC, FCA, ASIC | Higher spreads compared to ECN brokers |

| Cloud-native sync for social trading | Limited advanced charting tools |

| Strong global presence with social investing | Customer support limited to 24/5 |

| Multiple payment options (PayPal, Skrill, Neteller) | Copy trading risk if following poor performers |

Why Cross-Platform Cloud Sync Matters?

Speed and Execution

Having orders placed in the cloud gives the trader instant market execution and also helps with maintaining syncs of their indicators in real time across their desktop, mobile, and web applications.

Keeping the cloud execution service quick to high frequency under 10 milliseconds allows for no missed opportunities and instant execution.

Mobile devices allow for total flexibility in actions taken so global traders can continue their flow.

Security and Reliability

Synchronized cloud setups can use TLS 1.3 encryption with two-factor authentication and a VPN so their system events remain secure.

Above all, it eliminates the fraud and breach data vulnerabilities synchronization can create.

Accessibility and Scalability

Never losing sight of their data, traders now have the capacity to manage any number of accounts at any place with instant cloud executions.

Banks and brokers have access to low costs with high performance, offering the cloud based solution for resilient partnerships.

Risk Management and Consistency

Having fewer devices in the same environment will help the trader manage their risk further.

Keeping the chart depth the same and synchronizing across devices with an order book helps remove the friction of data errors across devices.

Key Criteria for Best Forex Brokers Supporting Cross-Platform Cloud Sync Trading

Regulation Tier Strength Tier-1 regulations (FCA, CySEC, ASIC, CFTC) is a sign of a broker’s reliability and is essential to cross-platform cloud sync trading so global clients can invest with ease.

Payment Options Secure payment methods like bank transfers, cards, Paypal, Skrill, and Neteller give traders access to hassle-free and secure transactions, ensuring quick withdrawals and deposits from any location.

Global Presence Localized services, accessible brokers, and compliance within the regulated zone can be guaranteed to clients within Europe, Asia, North Africa, North America, which can diversify an international broker.

Execution Speed Infrastructural latency is a cloud based environment that is essential for the situation of synchronized platforms to be maintained. This is important for scalpers, algo traders, high investors.

Risk Management Tools Unified dashboards let traders avoid hefty losses thanks to synced stop-losses, take profit, margin-alarms and risk management tools across several devices. Traders can change devices and avoid costly mistakes.

Multi-Asset Access With support for forex, indices, commodities and crypto CFDs traders can have diverse opportunities thanks to synchronized portfolios available across multiple platforms. Traders have access to all of their opportunities in one.

User Experience With cloud-native apps and interfaces users are able to navigate and use features like charting and settings in a synchronized manner with great effici3ency and ease.

Conclusion

Cross-Platform Cloud Sync has become a defining feature of modern forex trading, allowing for seamless switching between desktop terminals, web browsers, and mobile apps, maintaining the same data, watchlists, and open positions.

Tier 1 regulated top forex brokers of 2026, Exness, IC Markets, Pepperstone, FP Markets, AvaTrade, XM, OANDA, FOREX.com, Saxo Bank, and eToro, combine Multi-Platform Excell ence, Dependable Cloud Sync, Broad Payment Options, Global Presence with Good Customer Care.

This means speed, flexibility, and security in volatile markets, in for all traders with synchronized risk management tools and cohesive dashboards. Be it a scalper, algo trader, retail investor, or professional portfolio manager, these brokers offer a seamless cloud trading experience, increasing efficiency and decreasing trading mistakes.

Cross platform cloud sync trading brokers are the forex brokerage bestowing customer care and technology allowing freedom for traders to operate through any means with full flexibility.

FAQ

What is Cross-Platform Cloud Sync in forex trading?

Cross-Platform Cloud Sync allows traders to access the same account data, watchlists, indicators, and open positions seamlessly across desktop, web, and mobile platforms in real time.

Why is cloud sync important for forex traders?

It ensures continuity, speed, and consistency, allowing traders to switch devices instantly, manage risk smarter, and avoid errors caused by mismatched data during volatile market conditions.

Which brokers offer the best cloud sync trading in 2026?

The top brokers are Exness, IC Markets, Pepperstone, FP Markets, AvaTrade, XM, OANDA, FOREX.com, Saxo Bank, and eToro, all offering synchronized platforms and strong regulation.

How do I know if a broker’s cloud sync is reliable?

Look for brokers regulated by Tier-1 authorities (FCA, ASIC, CySEC, CFTC) and platforms with proven cloud-native infrastructure like AvaTradeGO, SaxoTraderGO, and eToro WebTrader.

Do all brokers support MT4/MT5 cloud sync?

Most leading brokers integrate MT4/MT5 with broker-side servers for cloud sync, but some (like eToro and Saxo Bank) use proprietary cloud-native platforms for enhanced synchronization.