Traders that care about going into detail, automation, and risk management should look for forex brokers offering advanced order types like OCO (One Cancels the Other) and OTO (One Triggers the Other).

These brokers, because of their excellent platforms, quick execution, and strong regulations, allow for smarter forex trading. Depending on the broker, you can set-and-forget orders that help stabilze the emotional trading that a lot of people are a victim of.

These brokers allow traders to pre-plan their entries and exits, stabilizing the emotional trading that a lot of people are a victim of, and help keep a steady response to the markets.

What is Forex Brokers?

A forex broker is a company or business that facilitates a buyer or a seller in the the foreign exchange market.. Forex brokes offer trading platforms and pricing quotes and sell these services to the market place Forex traders and investors participate in the buying and selling of different currencies and Forex brokers offer access to different currencies with the help of leverage.

Forex brokers provide services of risk management and different trading strategies to Forex traders. Forex traders and retail investors must use Forex broker. Forex brokers keep the security of the traders funds.

Trading currencies is an online business and Forex brokers provide contrracts with regulated trading. Forex Brokers are important to anyone who wishes to trade currencies online.

Key Point

| Broker Name | Key Point |

|---|---|

| IC Markets | Offers seamless OCO order integration across its platforms, making advanced trade management accessible for both beginner and professional traders. |

| RoboForex | Provides OCO orders that help traders efficiently execute strategies while controlling risk in fast-moving market conditions. |

| XTB | Uses OCO orders to enhance precise position management, allowing traders to automate exits and protect capital effectively. |

| XM | Integrates OCO orders within its platform, supporting multiple instruments alongside advanced tools for flexible trading strategies. |

| OANDA | Known for robust proprietary platforms that include OCO orders and powerful analytical tools for disciplined trading. |

| JustMarkets | Focuses on low spreads and high leverage, making it attractive for traders seeking aggressive trading opportunities. |

| Octa Forex | Offers a broad range of instruments combined with competitive trading conditions for diversified trading strategies. |

| MultiBank Group | Accepts Indian traders and provides access to a wide selection of forex and CFD instruments globally. |

| BlackBull Markets | Supports MT4, MT5, cTrader, and TradingView, giving traders flexibility across multiple professional platforms. |

| Pepperstone | Delivers fast execution and platform-based OCO functionality, ideal for scalpers and strategy-driven traders. |

1. IC Markets

IC Markets is one of the biggest Forex and CFD brokers which is globally recognized and partnered with ASIC and CySEC. Since its inception in 2007, It has had numerous accolades due to its wide ranging forex market.

It has a min of 200 dollars to open a forex account and provides services of bank wire transfer, credit and debit card services, and other online transfer services such as Skrill, Neteller, and PayPal. The company provides its customers with MT4 and MT5.

The company is also known for its customer services as they provide a range of customer services from live chat to customer service email and cognitive line and they also provide their customers with 24/7 services. The company is suitable for new and experienced customers alike.

IC Markets – Quick Facts

| Key Point | Details |

|---|---|

| Established | 2007 |

| Regulation | ASIC, CySEC, FSA |

| Minimum Deposit | $200 |

| Order Types | Market, Limit, Stop, OCO |

| Platforms | MT4, MT5, cTrader |

| Funding Methods | Bank Transfer, Cards, PayPal, Skrill, Neteller |

| Instruments | Forex, Indices, Commodities, Crypto, Shares |

| Customer Support | 24/7 Live Chat, Email, Phone |

IC Markets Pros & Cons

Pros

- Excellent for scalping and high frequency trading with very low and fast execution spreads.

- Facilitates advanced order types such as OCO for better trade management.

- 24/7 customer support in various languages.

- Well regulated by ASIC and Cy SEC.

Cons

- Must deposit 200 dollars to open an account which is more than in other firms.

- More advanced platforms may overwhelm those who are just starting out.

2. RoboForex

RoboForex started working in 2009 and has international regulatory licenses and is reputed for providing the best in class trading options and trading features. With RoboForex, traders can employ OCO orders and implement complex trading strategies and mitigate the risk of loss.

The broker has a minimum deposit requirement of about $10 which is ideal for beginner traders and continues to be the trading platform of choice. Deposit options available are bank wire and card and a variety of popular e-wallets.

RoboForex is integrated in various trading platforms including MT4, MT5, cTrader and its own created exclusive platform. The broker responds to any customer and technical queries on its platforms and via its app 24/7.

RoboForex – Quick Facts

| Key Point | Details |

|---|---|

| Established | 2009 |

| Regulation | IFSC |

| Minimum Deposit | From $10 |

| Order Types | Market, Limit, Stop, OCO |

| Platforms | MT4, MT5, cTrader, Proprietary |

| Funding Methods | Bank Transfer, Cards, E-wallets |

| Instruments | Forex, CFDs, Stocks, Crypto |

| Customer Support | 24/7 Live Chat & Email |

RoboForex Pros & Cons

Pros

- Good for beginners because of a low starting deposit of approximately $10.

- Has a range of platforms such as MT4, MT5, cTrader and their own platform.

- Good order flexibility such as OCO.

- 24/7 support for different time zones.

Cons

- In some areas, they are not governed by top tier ultra regulations (no FCA/ ASIC for all accounts).

- Some reviews have mentioned missing execution speeds based on the account type.

3. XTB

XTB is a reputed broker providing services since October 2002. It is regulated by FCA and CySEC and many other authorities. XTB ‘s strengths is in offer OCO order which traders used to finely tune their order execution.

XTB does nevot et telecom a minumum deposit to open a live trading account which is a benefit in account opening flexibiltiy.

Your can fund your trading account by bank transfer, credit card, and e-wallets. XTB offers xStation and MT4 trading platform. XTB client services are operate in weekdays. Clients can contact company agents throught telephone, email, or live chat.

XTB – Quick Facts

| Key Point | Details |

|---|---|

| Established | 2002 |

| Regulation | FCA, CySEC, KNF |

| Minimum Deposit | No minimum |

| Order Types | Market, Limit, Stop, OCO |

| Platforms | xStation, MT4 (limited regions) |

| Funding Methods | Bank Transfer, Cards, E-wallets |

| Instruments | Forex, Stocks, Indices, ETFs |

| Customer Support | 24/5 Live Chat, Email, Phone |

XTB Pros & Cons

Pros

- No minimum deposit is required in a variety of areas.

- Platform xStation is outstanding with advanced features.

- Supports complex order types such as OCO.

- Strong regulation (FCA, CySEC, KNF).

- Fast customer service and great educational support.

Cons

- In some regions, support for MetaTrader is limited.

- OCO and some other advanced features may not be as customizable as with MT broker platforms.

4. XM

XM started operating in 2009 and has earned the trust of many users and gained regulations from ASIC and CySEC. XM offers access to forex, commodities, indices and cryptocurrencies as well as OCO manipulation orders.

XM is one of the most beginner-friendly brokers as they only require a $5 deposit to get started. To fund your account, you can use one of several methods, including local bank transfers, credit and debit cards and e-wallets.

XM provides their traders access to MT4 or MT5, and you can use them on your desktop or mobile. XM’s customer support stands out as they can be contacted in several languages and they are available 5 days a week.

XM – Quick Facts

| Key Point | Details |

|---|---|

| Established | 2009 |

| Regulation | ASIC, CySEC |

| Minimum Deposit | From $5 |

| Order Types | Market, Limit, Stop, OCO |

| Platforms | MT4, MT5 |

| Funding Methods | Bank Transfer, Cards, E-wallets |

| Instruments | Forex, Commodities, Indices, Crypto |

| Customer Support | 24/5 Multilingual Support |

XM Pros & Cons

Pros

- Very low minimum deposit (from $5).

- Has advanced features for order execution including OCO.

- Regulated in multiple regions (ASIC, CySEC).

- Has education and research support for clients.

Cons

- Compared to ECN style brokers, some accounts can have higher spreads.

- Only MT4 and MT5 with no support for cTrader.

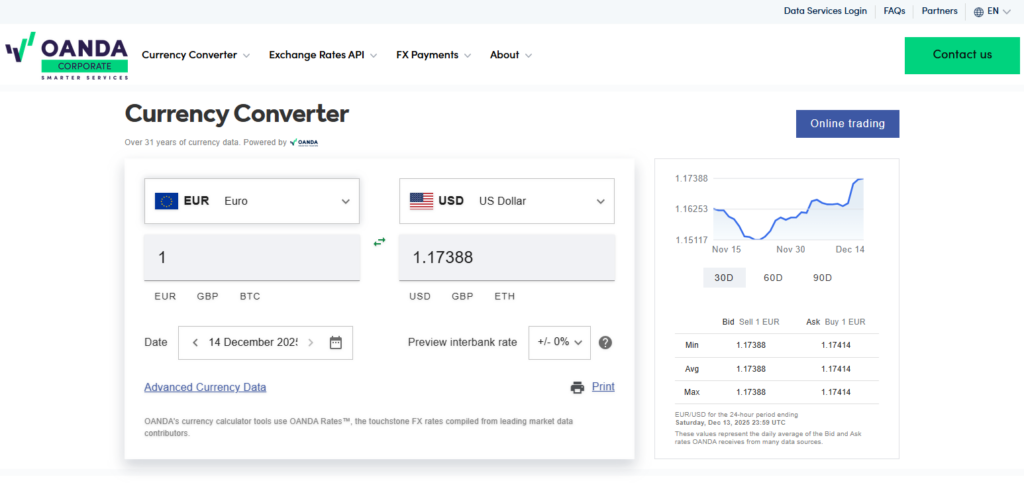

5. OANDA

Established in 1996, OANDA is considered one of the most respected Experts brokers in the industry, incurring regulation from CFTC, FCA, and ASIC. OANDA is known for their transparency, as they offer OCO, and also have no minimum deposit requirements for trading.

Due to this, they have good flexibility for traders when starting. Depending on the area, funding is available through bank transfer and cards.

OANDA supports MT4 and also their own proprietary trading platform with advanced analytics. Their customer support is good and can be reached via chat, email, and phone.

OANDA – Quick Facts

| Key Point | Details |

|---|---|

| Established | 1996 |

| Regulation | FCA, ASIC, CFTC |

| Minimum Deposit | No minimum |

| Order Types | Market, Limit, Stop, OCO |

| Platforms | OANDA Trade, MT4 |

| Funding Methods | Bank Transfer, Cards |

| Instruments | Forex, Indices, Commodities |

| Customer Support | Live Chat, Email, Phone |

OANDA Pros & Cons

Pros

- Very established history as a broker for decades.

- Zero deposit requirement to open an account.

- Supports OCO and other advanced order types.

- Strong international regulation (FCA, ASIC, CFTC).

- Good transparency and robust platforms.

Cons

- Fewer products available compared to some competitors (e.g. exotic CFD markets).

- By region, available funding options can be limited and vary a lot.

6. JustMarkets

JustMarkets has been operational since 2012 and is one of the most quickly progressing brokers that are working in flexible conditions. JustMarkets has a positive reputation for quick order execution and has low spread for orders.

This company also has a high leverage that is preferred by many for higher volume trading strategies and brokers. Additionally, JustMarkets has a low initial deposit of 10 usd, also allows bank transfer, cards, and e-wallets as funding.

The company also makes it possible for MT4 and MT5 platform users to trade, whether manually or in an automated system. JustMarkets has 24/7 customer support to accommodate users in different geographical locations.

JustMarkets – Quick Facts

| Key Point | Details |

|---|---|

| Established | 2012 |

| Regulation | FSA |

| Minimum Deposit | From $10 |

| Order Types | Market, Limit, Stop, OCO |

| Platforms | MT4, MT5 |

| Funding Methods | Bank Transfer, Cards, E-wallets |

| Instruments | Forex, Indices, Crypto, CFDs |

| Customer Support | 24/7 Live Support |

JustMarkets Pros & Cons

Pros

- Very low cost of entry with a minimum deposit of $10.

- Supports OCO and other advanced order types.

- MT4 and MT5 supported.

- 24/7 customer support is a plus for traders needing support around the clock.

Cons

- Compared to some others, such as the FCA or the ASIC, regulation is weaker.

- How competitive the spread and commission is can depend on the instrument.

7. Octa Forex

Established in 2011, Octa Forex is one of the most popular Forex Brokers Octa Forex is multi regulated for the most competitive trading environment. Octa Forex allows and supports advanced trading strategies with flexible order execution.

This is good for swing and intraday trading. The broker normally requires a min deposit of 25$, funding methods are bank transfer, card and in some regions, crypto.

Traders can use MT4, MT5 and proprietary platforms. The company provides 24h support, with assistance in several languages.

Octa Forex – Quick Facts

| Key Point | Details |

|---|---|

| Established | 2011 |

| Regulation | CySEC, SVGFSA |

| Minimum Deposit | From $25 |

| Order Types | Market, Limit, Stop |

| Platforms | MT4, MT5, Proprietary |

| Funding Methods | Bank Transfer, Cards, Crypto |

| Instruments | Forex, Indices, Commodities |

| Customer Support | 24/7 Customer Assistance |

Octa Forex Pros & Cons

Pros

- There are a number of different assets that the company offers.

- Experienced traders are able to make use of the flexible order execution.

- Lower minimum deposit is required to open an account (~$25).

- Platform is supported on MT4, MT5, as well as other proprietary ones.

Cons

- Compared to other top global brokers, their regulation may be on the lighter side.

- In times of high volatility, the liquidity in the market and the execution of the order may be delayed.

8. MultiBank Group

MultiBank Group is a broker with worldwide regulation that has been serving traders from India and other locations since 2005. Traders with MultiBank Group have access to a variety of advanced order types and can trade numerous forex and CFD instruments.

Depending on the type of account an opened, the broker’s minimum deposit is $50. Funding can be done via bank transfer, credit or debit cards, and e-wallets.

There is MT4 and MT5 available as well as 24/7 customer support that is professional and caters to the needs of traders from all over the world.

MultiBank Group – Quick Facts

| Key Point | Details |

|---|---|

| Established | 2005 |

| Regulation | ASIC, CySEC, BaFin |

| Minimum Deposit | From $50 |

| Order Types | Market, Limit, Stop, OCO |

| Platforms | MT4, MT5 |

| Funding Methods | Bank Transfer, Cards, E-wallets |

| Instruments | Forex, CFDs, Metals |

| Customer Support | 24/7 Global Support |

MultiBank Group Pros & Cons

Pros

- Can accept traders from India and many other parts of the world.

- Offers OCO and other advanced types of trading.

- Has a large variety of instruments (forex, CFDs, metals).

- Good customer support and they have a lot of educational resources.

Cons

- There is still a minimum deposit of ~$50 to open an account, which may be high for a lot of ultra-beginner traders.

- Some reviews mention an inconsistency on the execution of spreads when demand is high.

9. BlackBull Markets

Established in 2014 and regulated in New Zealand, BlackBull Markets offers professional trading conditions with institutional grade capabilities. BlackBull Markets Advanced order types and unrestricted access to extensive multi-asset liquidity.

The firm generally has a minimum deposit of 200, and includes multiple funding methods such as banks, card, and e-wallets. Users of the MT4, MT5, cTrader and TradingView platforms is very accommodating for technical traders. The firm has a 24/7 Customer Support.

BlackBull Markets – Quick Facts

| Key Point | Details |

|---|---|

| Established | 2014 |

| Regulation | FMA (New Zealand) |

| Minimum Deposit | From $200 |

| Order Types | Market, Limit, Stop, OCO |

| Platforms | MT4, MT5, cTrader, TradingView |

| Funding Methods | Bank Transfer, Cards, E-wallets |

| Instruments | Forex, CFDs, Crypto |

| Customer Support | 24/7 Customer Service |

BlackBull Markets Pros & Cons

Pros

- Good execution of orders at a high speed and they have a nice support team.

- Offers support on many advanced platforms, including MT4, MT5, cTrader, and TradingView.

- There is a lot of liquidity in the market at their prices, which are at an institutional level.

- OCO order support is nice feature to have for more advanced automated trading system.

Cons

- There is a minimum deposit of ~$200 and that is higher than a lot of other beginner brokers.

- There is strong yet limited scope of issuance in the case of some traders (e.g., FMA NZ).

10. Pepperstone

Pepperstone is a broker that has been around since 2010 and is considered trustworthy with regulations from ASIC and FCA. As a full-service broker, they offer OCOs, quick execution, and tight spreads. Although there is no minimum deposit, a common recommended amount is 200.

They offer a variety of acceptances that include bank transfers, credit, PayPal, and instant money transfers like Skrill and Neteller.

They offer 24/5 support, further making them stand out as reliable traders. They support quite a number of platforms including MT4, MT5, cTrader, and TradingView.

Pepperstone – Quick Facts

| Key Point | Details |

|---|---|

| Established | 2010 |

| Regulation | ASIC, FCA |

| Minimum Deposit | No minimum (Recommended $200) |

| Order Types | Market, Limit, Stop, OCO |

| Platforms | MT4, MT5, cTrader, TradingView |

| Funding Methods | Bank Transfer, Cards, PayPal, Skrill |

| Instruments | Forex, CFDs, Crypto |

| Customer Support | 24/5 Professional Support |

Pepperstone Pros & Cons

Pros

- Great execution speeds and very low average spreads.

- Advanced order types such as OCO.

- Multiple platform support: MT4, MT5, cTrader, TradingView.

- Good support and educational offerings.

- Great FCA, ASIC, regulation.

Cons

- While there is no required minimum deposit, the recommended deposit funding of ($200) is expected.

- No support 24/7 most of the time (24/5).

Factors to Consider when Choosing Best Forex Brokers With Advanced Order Types (OCO, OTO)

Support for Advanced Order Types

It is critical that the broker states competitor OCO and OTO order support across their platforms. This is critical for the automation of the market entries and exits, as well as the automated stop-loss of the order, in times of fast market movement.

Support and Stability of the Technology

Complex order automation is at its best with the use of effective systems such as MT4, MT5, cTrader, TradingView, or proprietary systems. The less volatile and the quicker the system is, the less likely there is to be a slippage and automated order placements.

Speed of Execution and Accuracy of Orders

Execution of an order in OCO and OTO strategy has to be instant. ECN or STP execution is preferable for the traders. The lower the latency and the greater the liquidity available, the less likely that a trigger is missed.

Regulations of the Broker and its Stability

It is best to choose brokers that are under the oversight of FCA, ASIC, CySEC, or CFTC. This level of regulation guarantees that the broker will respect the execution of the orders, that there is a safety of the funds, and that there will be no opaque practices around the complex order types.

Spreads, Commissions, and Trading Costs

Advanced orders are often executed on a more ongoing basis. In order to keep overall trading costs on a more controllable basis, one needs to keep in mind tight spreads, low commissions, and transparent pricing.

Risk Management Tools

In fast and volatile markets, a trader’s risk can best be handled by a combination of OCO and OTO orders, along with guaranteed stop-losses, trailing stop-losses, and margin alerts.

Instrument and Market Coverage

Make sure you can access increases order types for a range of instruments, including forex pairs, indices, commodities, and cryptocurrencies, Completing a broader coverage allows active trading with a focused strategy.

Minimum Deposit and Account Flexibility

It is easier to test out OCO and OTO strategies with low or no minimum deposit. Flexibility is also added for different trading styles with varied account types.

Funding and Withdrawal Options

Smooth execution of strategy-based trades is dependent on reliable brokers, which is also ensured by fast deposits and withdrawals. They offer fast deposits and withdrawals via bank transfer, cards, and e-wallets.

Customer Support and Education

Look for 24/5 or 24/7 customer support, so you can gain the clarity needed to use the advanced order types effectively. Detailed guides and instructional resources in OCO and OTO are also helpful.

Mobile Trading Capabilities

Traders must have the ability to stream and manage advanced order types to help sustain the flexibility to manage strategies and mitigate mobile platform trading limitations.

Transparency and User Reviews

To verify the success OCO and OTO orders and their ability to trigger during extreme volatility and news events, you must consult the broker documentation and the trader community.

Conclusion

Positioning yourself with one of the best OCO and OTO brokers is essential for traders placing a premium on accuracy and the automation of risk management. Such order types give traders the capacity to plan the entry and exit of a trade ahead of time to lessen the impact of emotions and respond in a timely manner to rapid changes in the market.\

All of the best brokers are the ones that also boast of reliable and fast execution, balanced with good platforms, solid regulation, and good pricing. It is also crucial to have good account flexibility, tight spreads, and good support, allowing the trader to have the confidence to use the more sophisticated trade management strategies.\

In the end, the best broker is a function of the trader’s style, expertise, and risk appetite. No more than a solid regulated broker with good execution and platforms in the market along with the flexibility to deploy advanced order types associated with improved trading execution. Now a trader can better protect their trading capital and trade forex with more confidence.

FAQ

What are OCO and OTO orders in forex trading?

OCO (One-Cancels-the-Other) places two linked orders where executing one automatically cancels the other. OTO (One-Triggers-the-Other) activates a secondary order after the first is executed.

Why are advanced order types important for forex traders?

Advanced orders help traders automate strategies, manage risk effectively, and remove emotional decision-making, especially during high volatility or news-driven market movements.

Do all forex brokers offer OCO and OTO orders?

No, not all brokers support these order types. Availability depends on the trading platform and broker infrastructure, so it’s important to confirm support before opening an account.

Which trading platforms support OCO and OTO orders?

Platforms such as MT4, MT5, cTrader, TradingView, and proprietary platforms commonly support OCO and OTO orders, though functionality may vary by broker.

Are OCO and OTO orders suitable for beginners?

Yes, beginners can use them, but understanding how they work is essential. Many brokers provide tutorials and demo accounts to practice using advanced orders safely.