The Best Forex Brokers With Integrated Trading Psychology Tools will be covered in this post, with an emphasis on brokers that assist traders in controlling their emotions and making better decisions.

By offering features like sentiment indicators, risk management alerts, and behavioral analytics, these systems help traders stay disciplined, restrain impulsive trades, and cultivate an organized trading attitude for improved forex market performance.

What Are Trading Psychology Tools?

Specialized features and resources known as “trading psychology tools” are intended to assist Forex traders in controlling their emotions, making better decisions, and remaining disciplined during trading.

These systems monitor trader behavior, reveal emotional trends, and warn users about risky or impulsive trading behaviors. Sentiment analysis, risk management warnings, trade journaling systems, and behavioral feedback mechanisms are typical examples.

Through the use of these techniques, traders can improve their long-term performance in the Forex market by recognizing errors, managing emotional responses like fear or greed, and making more logical, consistent trading decisions.

Why Use Best Forex Brokers With Built-In Trading Psychology Tools

Better Emotional Balance – Tools help discover emotional triggers and learn to manage them like fear, greed and overconfidence.

Better Choices – Alerts and behavioral insights help traders stick to discipline, as well as make rational and better choices.

Risk Management Assistance – Tools can alert traders to instances where open and currently traded positions are likely to increase the extent of overexposure of the account’s risk, and/or alert them to instances of overtrading.

Journals and Performance Assessment – Integrated journals let traders take a record of their mistakes and learn from their different behaviors in past trades.

Trading Demand – Insights help bolster consistency over time and curb impulsive trading behaviors, as well as promote consistency.

Trainers and Coach – Brokers applying psychology tools also provide trainers and other coaches behavioral techniques to assist in gradual improvement.

| Broker | Key Points |

|---|---|

| Pepperstone | Low spreads, fast execution, strong MT4/MT5 support, regulated in multiple jurisdictions. |

| XM | Offers multiple account types, competitive spreads, strong educational resources. |

| FXTM | Flexible leverage, wide range of account options, fast KYC approval. |

| Exness | High leverage options, low minimum deposits, strong mobile trading platforms. |

| AvaTrade | Good for beginners, multiple platform support (MT4, MT5, AvaTradeGo), strong regulation. |

| IC Markets | Ultra-low spreads, high-speed execution, ECN accounts, strong for scalping and algo trading. |

| FP Markets | Tight spreads, multiple account types, strong MT4/MT5 integration, good research tools. |

| OANDA | Transparent pricing, strong regulatory oversight, reliable for long-term traders. |

| FOREX.com | Good for US traders, solid platform options, educational resources, competitive spreads. |

| FXCM | Strong global presence, good trading platforms, research tools, moderate spreads. |

Key Point & Best Forex Brokers With Built-In Trading Psychology Tools List

1. Pepperstone

Pepperstone is very well regarded in the world of forex brokers. As the only broker with built in features allowing the broker to assist with the trading psychology to help traders become more self aware, and help them with strategies while tracking their trades to avoid the emotional trade traps.

As a broker with the regulatory oversight of the FCA in the UK and ASIC in Australia Pepperstone has good oversight and safety.

The account is as little as $200, and in the account you can trade with 500:1 leverage depending on the account. The broker has MT4, MT5, and cTrader, and in addition has a full featured mobile app to trade on. Pepperstone services all but a few countries in the world, with 24/5 client support with chat, email, or phone.

Pepperstone Key Features

- Integrated emotion trading tools

- Regulated by UK’s FCA and Australia’s ASIC}

- Minimum deposit is just $200

- 500:1 accounts ( depending on the account)

- MetaTrader 4, MetaTrader 5, cTrader + Full mobile app available.

Pros

- Faster execution and lower spreads

- Multi-platform supports ( so you can pick MT4/MT5/cTrader)

- Excellent overall global regulations

- Highly recommend for scalping + high frequency trading

- Multilingual support available 24/5

Cons

- Low educational resources available

- Downtimes can happen in extreme market conditions

- Makes it more difficult for beginners

- Not accepting US clients

- Tools related trading psychology are inferior to competitors

2. XM

XM incorporates various tools due to trading psychology to help traders to master emotions as well as improve discipline through things like journaling and performance reviews. It has regulation from ASIC (Australia) and CySEC (Cyprus) and has a minimum deposit of only $5 and a maximum leverage of up to $888:1.

XM supports MT4 and MT5 and has a mobile app which includes features for tracking trading psychology. XM has clients from over 196 countries and offers multilingual support from their employees through live chat and email. All of these features allow traders to focus on their technical strategy as well as their emotions giving them focus on psychology trading and making XM one of the best Forex brokers for these traders.

XM Key Features

- Ez tools and resources available to encourage trading journaling and performance assessments to help with trading psychology.

- Regulated by Australia’s ASIC and Cyprus’s CySEC.

- Minimum deposit of $5.

- High leverage ratio of 888:1.

- Supports platforms MT4 and MT5 with mobile app that tracks psychology of trading.

Pros

- Very few to no deposit requirements.

- New traders are especially welcomed and targeted.

- Excellent worldwide support of many languages.

- Over 196 countries have clients

- Disciplines and emotions tools that are very easy.

Cons

- Unable to narrow spreads in high volume trading situations.

- Very basic advanced charting is available.

- Not accepting US clients.

- High max leverage does introduce over leverage risk.

- Analysys of Psychological Data

3. FXTM

FXTM focuses on the relevant tools needed to master the trading psychology for the understanding of the emotional biases and risk-taking behaviors to improve the trader. They are regulated by CySEC, FCA, and FSCA (South Africa) which increases their safety and transparency. They start their minimum deposit at $10 and have a maximum leverage of up to 2000:1 on some specific accounts.

They use MT4 and MT5 for their platforms and offer a mobile trading app for tracking psychology in real-time. FXTM has multilingual support for over 150 different countries as well as real-time live chat and phone support. These tools assist the trader in gaining self-awareness as well as emotional control to help enhance their performance in the Forex markets over a lengthy period of time.

FXTM Key Features

- Tools focusing on emotional bias & risk behavior

- Regulation in FCA, CySEC, FSCA (South Africa)

- Minimum deposit: $10

- Maximum leverage is up to 2000:1 (on some accounts)

- Platforms: MT4, MT5 + Mobile app with psychology tracking

Pros

- Beginner-friendly accounts

- Strong educational resources

- Multilingual support across 150+ countries

- Copy trading is offered

- Wide variety of account types are offered

Cons

- Some accounts have very high fees

- Narrowed beyond forex, asset offering is limited

- Strategic high volumes is an area to avoid

- Basic in nature, psychology tools are unrefined

- Accounted varied, spread size is high

4. Exness

Exness has integrated behavioral tools that track trader activity, and warn users of risky behavior. Its regulators are CySEC, FCA, and Seychelles FSA and the minimum deposit requirement is 1$, making it quite affordable, with a maximum leverage of 2000:1.

Their platforms are MT4 and MT5, and their mobile applications feature the psychologic analytics and trading journals. They are presente in nearly every country in the world, with the exception of a few like the USA. Their customer support is 24/7 with trading assistance, both technical and psychological, through live chat, email and phone.

Exness Key Features

- Risky trade alerts in real-time with behavior tracking

- Regulation by FCA, CySEC, Seychelles FSA

- Minimum deposit: $1

- Leverage is up to 2000:1

- Platforms: MT4, MT5 + Mobile apps with psychology & journals

Pros

- Super-low spreads on major pairs

- Ultra-flexible account options

- Rapid transaction: deposit & withdrawal

- Fee structure is transparent

- Global accessibility is wide

Cons

- There are limited research tools

- Customer support is consistent, but regionally varied

- It may lead to an increase in risk exposure to high leverage

- Advanced psychology tools are limited

- Withdrawal verification can be strict

5. AvaTrade

AvaTrade employs tools that help in the tracking of trader activity, in order to assist in the prevention of overtrading, emotional trading, and psychological tools aimed at improving decision making. AvaTrade is regulated by ASIC, The Central Bank of Ireland and FSA (Japan), their compliance is considered quite strong.

The minimum deposit is $100, with a maximum leverage of 400:1. They feature their own app AvaTradeGo, along with MT4 and MT5. They have trade journaling and emotional tracking features. They provide support to over 150 countries and their customer support is multilingual. A balance of technical features and emotional control is offered, which are features ideal for psychology traders.

AvaTrade Key Features

- Tools for overtrading prevention & emotion tracking

- Regulators include ASIC, Central Bank of Ireland, FSA (Japan)

- Minimum deposit: $100

- Leverage of up to 400:1

- Platforms: MT4, MT5, AvaTradeGO + trade journaling

Pros

- Great range of educational materials

- Several platform choices

- Major region regulations

- Suitable for disciplined traders

- Included access to Crypto CFD

Cons

- Majorly, average spreads are higher

- Available ECN accounts are fewer

- Can be slow, customer support

- More advanced psychological tools

- Extra perks are locked behind higher account tiers

6. IC Markets

IC Markets assists users in analyzing their behaviors and in taking steps to avoid rash decisions by offering trading psychology tracking tools. Regulated by ASIC, CySEC, and FSA (Seychelles) with a minimum deposit starting at $200, with maximum leverage reaching up to 500:1 depending on the type of account.

They offer MT4, MT5, and cTrader, and an app that includes trade tracking and emotion analytics. They are international, assisting most countries except those with restrictions such as the US. Support staff internationally are able to assist 24/7 by live chat, phone, and email with trading and tools to enhance trading psychology.

IC Markets Key Features

- Tools for tracking behavior & psychology

- Verified by ASIC, CySEC, Seychelles FSA

- Minimum deposit: $200

- Leverage of Upto 500:1

- Platforms: MT4, MT5, cTrader +psychology focused mobile features

Pros

- ECN execution is true

- High liquidity & reduced spreads

- Great for trading automation

- Professional execution speeds

- Available support globally 24/7

Cons

- Not beginner friendly

- Little educational material

- Some accounts have complex fee structures

- Psychology features are quite basic

- US clients not accepted

7. FP Markets

FP Markets decreases the trading and psychological risk by providing integrated tools such as trade journals, alerts for dangerous trading behavior, and leveraging the discipline and consistency of traders.

FP Markets is also regulated by ASIC and CySEC. The minimum deposit is $100 to start with a leverage of 500:1. You get MT4, MT5, and IRESS and an app that monitors and tracks trading behavior. FP Markets is international, offering and assist customers from all over the world.

The tools that FP Markets provide also helps in recognizing emotional patterns to refine the execution of trading strategy and to assist in maintaining consistent trading over a long period.

FP Markets Key Features

- Psychology integration risk tools (journals, behavioral alerts)

- Licensed with ASIC, CySEC

- Starting deposit: $100

- Up to 500:1 leverage

- Psychology tracking + MT4, MT5, IRESS

Pros

- Low-cost trading

- Competitive spreads

- Robust tools for analysis and research

- Regulation across multiple jurisdictions

- Variety of account configurations

Cons

- Limited options for crypto

- Slower response to support

- No clients from the US

- Moderate depth of tools for psychology

- Fewer added advanced tools for the platform

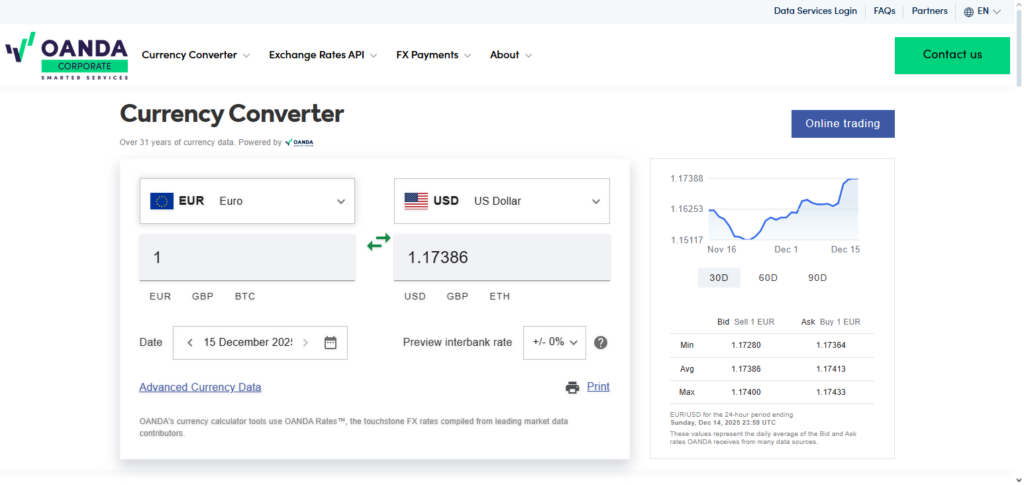

8. OANDA

OANDA provides tools such as trade journals and sentiment analysis to assist with emotional control and psycho-decision making when trading. The company is regulated by the CFTC (US), FCA (UK), and ASIC (Australia). Most accounts have no minimum deposit, and leverage works at approximately a 50:1 rate, region permitting.

Traders can assess their performance and access the psycho-tracking tools offered through their proprietary websites and mobile apps, as well as MT4. The company provides all round support with a fully staffed live chat, phone, and email. These tools are great for novices and seasoned professionals to harvest discipline while trading Forex.

OANDA Key Features

- Journals for trading and tools for sentiment analysis

- Regulation with CFTC (US), FCA (UK), ASIC (Australia)

- No deposit required (depends on region)

- Leverage ~ 50:1 (depends on region)

- Platforms: MT4 + mobile tools for psychology + OANDA proprietary

Pros

- A broker trusted in many parts of the world

- Flexible sizing for trades

- Tools for analytics on a high level

- Outstanding support for beginners

- Extended range of regulations

Cons

- Some accounts have higher spreads

- Fewer options for CFDs

- Tools for psychology are on a lower level

- Some trades have leverage limits

- Not the best for high-frequency scalping

9. FOREX.com

FOREX.com is a highly regulated broker and is also praised for the safety it provides through its various psychological tools, including journaling, alerts to risks, and tracking behavior.

Most accounts require a $50 minimum deposit, and leverage can vary from 50:1 to 200:1, depending on account type. Platforms used are MT4 and a proprietary FOREX.com mobile app and platform. Clients are from all parts of the globe. Impulsive trading is discouraged by the tools to help people create a more disciplined trading plan.

FOREX.com Key Features

- Alerts for risk behavior, tools for journaling

- Strong global regulatory oversight

- Starting deposit: $50

- Leverage~50:1–200:1 depending on the area

- Platforms: MT4 + mobile + proprietary platform

Pros

- Extensive educational materials

- Purpose-built mobile and desktop platforms

- Range of assets

- Worldwide customers

- Trading with incentives based on discipline

Cons

- Larger spreads on standard accounts

- No support for cTrader

- In certain areas, leverage is restricted

- Limited psychology tools

- Less advanced order types

10. FXCM

The company FXCM has introduced some novel features to help improve trader discipline. Their offerings include options for trade journaling, emotional analytics, and risk level alerts. They are licensed and regulated by the FCA in the UK, ASIC in Australia, and the FSCA in South Africa. With trades beginning at $50 and leveraging up to 400:1, you have options on Trading Station, MT4, and MT5.

There are mobile apps that facilitate trading and behavior tracking. FXCM is available worldwide, but there are some limitations for clients based in the USA. You can contact them via chat, phone, and email, and they have customer service 24/7. The provider offers unique emotional control alongside frameworks for traders to make cohesive decisions.

FXCM Key Features

- Risk alerts and emotional analytics

- Regulated by **FCA (UK)**, **ASIC (Australia)**, **FSCA (South Africa)**

- Minimum deposit: 50 dollars

- Leverage is up to 400:1

- Platforms: Trading Station, MT4, MT5 + mobile with behavior analytics

Pros

- Excellent for traders with a lot of activity

- Access to a variety of platforms

- Solid regulatory control

- Favours the development of discipline

- Low spreads for certain instruments

Cons

- Few account types

- Some instruments have higher fees

- Not directed toward beginners

- Basic psychology tools

- The support quality differs depending on the region

Key Features to Look for in Forex Brokers With Psychology Tools

Improved Emotional Control – Assists the players with understanding and controlling the feelings of fear, greed and over confidence.

Better Decision-Making – Guides the user in making more rational trading choices by signalling impulsive and risky actions.

Enhanced Risk Management – Provides warnings for overtrading or going beyond the defined risk parameters to preserve capital.

Increased Consistency – Encourages the formation of disciplined trading and the removal of inconsistency of trading due to emotional driven actions.

Trade Performance Insights – Traders are able to document their trades and, through the tool’s provided analytics, trades to enable the user to learn and rectify their actions.

Educational Support – Trading psychology improvements are offered from brokers through guides, assists and coaching.

Long-Term Profitability – The combination of strategy with psychologically driven actions enables more sustainable outcomes as over.

Benefits of Using Brokers With Built-In Trading Psychology Tools

More Effective Emotional Control – Traders are provided with the means to help identify and manage the key emotions of fear, greed, and overtrading.

Improved Decision Making – Traders are made aware of when they are making rash or dangerous decisions, thus guiding them to make more thoughtful and careful decisions.

Greater Risk Control – Overtrading, and other risk exposure limitations are signaled by the tools so that you will be able to protect your capital.

More Trading Consistency – Emotional discipline and erratic decision making are caused by the tools in order to help you keep the habit of trading in a more consistent and cohesive manner.

Insights on Trade Performance – Past trading mistakes are provided by journals and analytical tools so that you are able to learn to improve from them.

Mentored Learning – Extra educational offerings as tutorials, coaching, and tips on improving your mental trading are a common offering by brokers.

Sustainable Trading – With the integration of psychological elements, a trader is able to achieve more of a sustainable results by using a strategy to achieve more.

Conclusion

By fusing technical technique with emotional control, selecting a Forex broker with integrated trading psychology tools can greatly improve a trader’s success.

Features like trade journaling, emotional analytics, risk alerts, and educational materials are provided by brokers like Pepperstone, XM, FXTM, Exness, AvaTrade, IC Markets, FP Markets, OANDA, FOREX.com, and FXCM to assist traders in controlling fear, greed, and rash actions.

Traders can increase consistency, make wiser choices, and eventually attain long-term profitability by utilizing these tools. Integrating psychology-focused tools into trading routines is no longer optional—it’s essential for success in the competitive Forex market.

FAQ

What are trading psychology tools in Forex brokers?

Trading psychology tools are built‑in features that help traders monitor, analyze, and manage the emotional aspects of their trading. These can include trade journaling, behavior tracking, sentiment analysis, risk alerts, and reminders to prevent overtrading or impulsive decisions.

Why are psychology tools important for Forex traders?

Psychology tools help traders control emotions like fear and greed, increase discipline, and make more rational trading decisions. They reduce emotional errors, improve consistency, and support better long‑term performance in volatile markets.

Do all Forex brokers offer psychology tools?

No—while many brokers offer educational materials and basic analytics, only some provide integrated psychology tools like behavior tracking, emotional alerts, or trade journaling within their platforms.

Are built‑in psychology tools suitable for beginners?

Yes. These tools are especially helpful for beginners, as they guide disciplined trading, help avoid common emotional mistakes, and reinforce good trading habits early on.

Can psychology tools guarantee profits?

No. Psychology tools improve decision‑making and discipline, but profits still depend on trading strategies, market conditions, and risk management.