In this article, I will discuss the Best Forex Brokers With Micro Accounts, perfect for beginners and traders who prefer low risk.

Micro accounts let you deal with tiny lot sizes, so you can keep risk low and still get hands-on practice in real markets. Well review each top broker, noting key features, regulations, trading platforms, and the reasons they shine in todays crowded forex scene.

Key Point & Best Forex Brokers With Micro Accounts

| Broker | Key Point |

|---|---|

| RoboForex | Offers Cent accounts and CopyFX copy trading platform for beginners. |

| FP Markets | ECN pricing with ultra-low spreads and fast execution via MetaTrader & cTrader. |

| Eightcap | Provides integrated TradingView charts and strong crypto CFD offerings. |

| IC Markets | Raw spreads from 0.0 pips with high liquidity for scalpers and day traders. |

| XM Group | Flexible micro, standard, and ultra-low accounts with multilingual support. |

| XTB | User-friendly xStation 5 platform and strong educational tools for traders. |

| BlackBull Markets | Institutional-grade ECN trading with VPS and FIX API support. |

| Global Prime | Offers transparency with trade receipts and no dealing desk interference. |

| Pepperstone | Advanced trading tools and fast execution speed ideal for algorithmic traders. |

| IFC Markets | Unique synthetic instruments creation via the GeWorko Method. |

1. RoboForex

Founded in 2009, RoboForex operates under an IFSC Belize license. The broker provides Cent accounts, perfect for beginners who want to test the waters with very small money. Clients can choose between MetaTrader 4, MetaTrader 5, cTrader, or the in-house R Trader.

With leverage reaching 1:2000, you can manage bigger trades even with tiny deposits. RoboForex features fast order fills, a low entry price of just $10, and numerous funding options like credit cards, Skrill, Neteller, and standard bank wires.

It also runs CopyFX, a straightforward copy-trading tool that lets rookies follow more experienced investors. Overall, the brokers asset variety and educational content, paired with its Cent account, make it an appealing pick for micro account users.

RoboForex – Features

- Cent accounts let you trade 0.01 lots, so beginners risk very little.

- Choose from MetaTrader 4/5, cTrader or R Trader.

- CopyFX and RAMM let you follow other traders with one click.

2. FP Markets

Established in 2005, FP Markets works under ASIC and CySEC rules, giving traders peace of mind. It offers micro accounts via Raw and Standard options. New or seasoned users can choose between MetaTrader 4, MetaTrader 5, or the IRESS platform. Retail leverage reaches 1:500, while fast order fills keep costs low.

Spreads start at 0.0 pips, and the ECN setup pulls liquidity from many major banks. Funding is simple through bank wires, PayPal, Neteller, Skrill, or standard credit and debit cards. Add in free lessons and 24/5 support in several languages, and the broker stays beginner-friendly.

FP Markets – Features

- Raw ECN spreads start at 0.0 pips.

- Trade on MetaTrader 4/5 or the IRESS app.

- Leverage goes to 1:500 and orders fill in a flash.

3. Eightcap

Eightcap launched in 2009 and holds ASIC plus SCB licenses, marking it safe for micro traders. The broker backs both MetaTrader 4 and 5, letting clients scale to 1:500 leverage.

Tidy spreads from 0.0 pips pair with two micro-ready accounts Standard and Raw. Deposits and withdrawals flow via bank transfer, Visa/Mastercard, Skrill, Neteller, or even crypto.

Traders can also access over 200 crypto derivatives and more than 1000 CFDs, giving plenty of room to explore. Light minimums, quick support, and TradingView show the broker watches every detail.

Eightcap – Features

- Over 1,000 CFDs, including plenty of cryptocurrencies.

- TradingView charts are built right into the account.

- MetaTrader 4/5, low minimums and quick withdrawals.

4. IC Markets

Founded in 2007 and overseen by ASIC, CySEC, and the FSA of Seychelles, IC Markets calls itself a genuine ECN broker. Traders can pick between Raw Spread and Standard accounts, using either MetaTrader 4, MetaTrader 5, or cTrader.

Those on the micro plan start with just \$200 and can leverage their capital up to 1:500. The broker records lightning-fast trade execution thanks to deep pools of liquidity. Money in and out can be done by bank transfer, PayPal, Skrill, Neteller, UnionPay, or credit/debit cards.

Because of the low lag and infrastructure that matches what big institutions have, scalpers and robot traders feel right at home. Micro customers can fine-tune strategies in real live markets while risking only a small amount.

IC Markets – Features

- Pure ECN pricing fed by banks and dark pools.

- Trades typically land in under 40 milliseconds.

- MetaTrader 4/5 and cTrader support scalpers and EAs.

5. XM Group

XM Group opened its doors in 2009 and works under the rules of ASIC, CySEC, and IFSC. It quickly became a go-to place for micro accounts, where 1 lot equals 1,000 currency units.

The broker backs both MetaTrader 4 and 5, lets clients use up to 1:1,000 leverage, and processes deposits through bank wires, cards, Skrill, Neteller, and other options.

With a tiny \$5 minimum deposit, zero re-quotes, and a full library of lessons and live webinars, XM is very welcoming for beginners. Its clear fees and friendly service make learning to trade much less stressful.

XM Group – Features

- Micro accounts mean 1 lot equals just 1,000 units.

- Leverage up to 1:1,000 and an entry minimum of only $5.

- Live webinars and clear tutorials help you learn fast.

6. XTB

XTB started in 2002 and is covered by FCA, KNF, and CySEC, giving it solid global trust. Its accounts may not say micro, yet traders can open orders from 0.01 lots, so small positions work.

Clients pick the in-house xStation 5 app or MetaTrader 4 where xStation is not offered. Depending on where you live, leverage can reach 1:500. Funding options cover credit cards, PayPal, bank wires, and Skrill.

Thanks to a clear interface, quick fills, and useful learning guides, XTB suits beginners who wish to risk only modest capital.

XTB – Features

- The xStation 5 platform is simple and packed with analysis.

- Start trades at 0.01 lots to manage risk closely.

- Live sessions and video courses guide every step.

7. BlackBull Markets

Launched in 2014 and overseen by FMA in New Zealand plus FSA in Seychelles, BlackBull is another solid micro broker. It lets clients trade on MetaTrader 4, 5, or TradingView and opens accounts that accept 0.01 lots. Leverage also climbs to 1:500.

Orders pass through ECN hardware and spreads may drop to 0.0 pips. Money can move via credit card, bank transfer, Skrill, Neteller, or UnionPay. With VPS plans, FIX API access, and fast servers, BlackBull attracts automated systems, yet micro lot sizes give newcomers a low-cost doorway to Forex.

BlackBull Markets – Features

- Fast ECN fills, even for micro-lot orders.

- VPS hosting and FIX API for serious coders.

- Works smoothly on MetaTrader 4, 5, and TradingView.

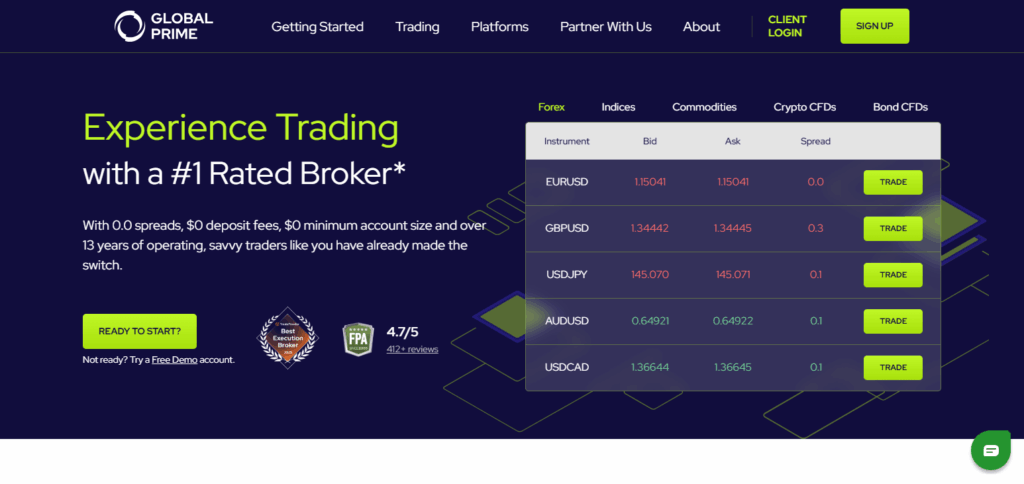

8. Global Prime

Global Prime began in 2010 and now sits under the watchful eyes of ASIC and the VFSC. The broker lets clients trade tiny micro lots and boasts a clean reputation for clear pricing.

You can work on trades using MetaTrader 4 or TradingView, and leverage reaches 1:200. Payments roll in through cards, Skrill, Neteller, or a simple wire. What really sets the firm apart is that it e-mails a slip for every order, naming the liquidity provider who filled it.

Those solid ECN rules and fair-execution habits suit new traders testing small accounts while insisting on honesty.

Global Prime – Features

- See trade slips showing which liquidity firm filled you.

- Uses MetaTrader 4 and TradingView.

- Micro lots, plus no desk dealing.

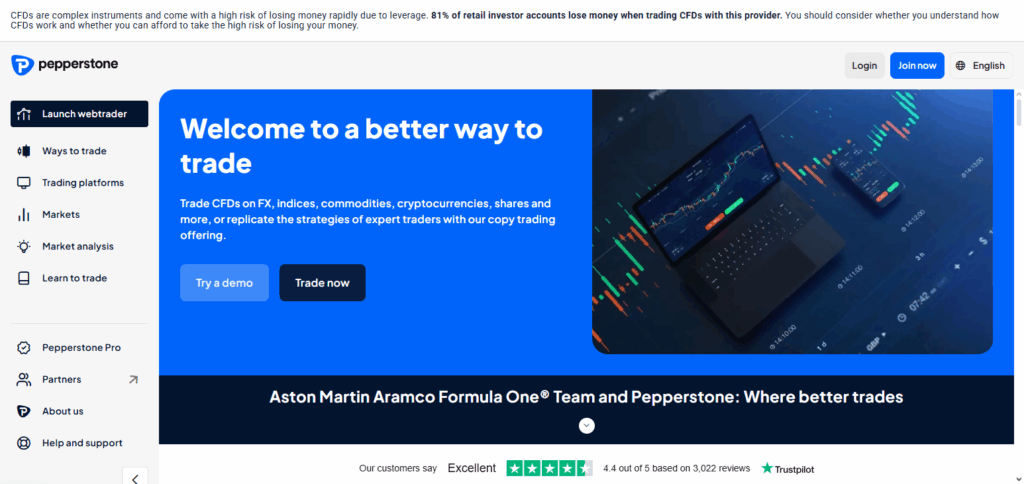

9. Pepperstone

Pepperstone also opened its doors in 2010 and now ticks all the compliance boxes with ASIC, FCA, CySEC, BaFin, and DFSA. It offers micro-lot trades (0.01 lots) through Razor or Standard accounts on MetaTrader 4/5, cTrader, and even TradingView.

Maximum leverage soars to 1:500. Funding is easy via bank wire, PayPal, credit cards, Skrill, or Neteller. The broker is famous for lightning-fast fills, razor-thin spreads that start at 0.0 pips, and almost no slippage.

Copy-trading options through Myfxbook and DupliTrade let beginners sit back while more seasoned users still pick up fresh ideas.

Pepperstone – Features

- Choice of MetaTrader, cTrader, or TradingView.

- Plug in social tools like Myfxbook or DupliTrade.

- Razor account with spreads starting at 0.0 pips.

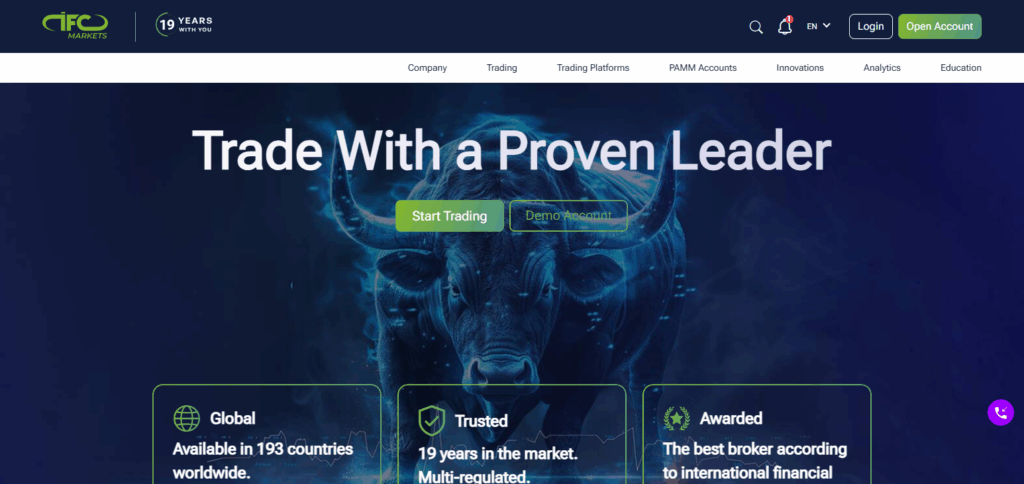

10. IFC Markets

IFC Markets started in 2006 and works under rules from BVI FSC and CySEC. Traders can open micro accounts through NetTradeX, MT4, or MT5. Leverage reaches an eye-catching 1:400. The broker also offers its GeWorko Method, letting people build one-off instruments.

With a micro account, you can trade 0.01 lots after putting down only $1. Payments get processed via bank transfer, credit cards, Skrill, Neteller, or crypto. Overall, IFC is a strong pick for micro traders who want tiny orders, fast deposits, and creative portfolio tools.

IFC Markets – Features

- Build custom pairs with the GeWorko method.

- Cent and Micro accounts on MT4, MT5, or NetTradeX.

- Trades crypto, stocks, forex, and synthetic assets.

Conclusion

For new traders and anyone who prefers to play it safe, picking a trustworthy forex broker that offers micro accounts is a must. Brokers such as RoboForex, XM Group, and IC Markets let you trade real micro lots, letting you set your own lot size and still use big leverage.

FP Markets, Eightcap, and Pepperstone, on the other hand, mix their powerful trading tools with the same tiny position sizes. Because each platform has its own strengths, you can match one with your goals and how long you have been trading.

FAQ

What is a micro account in forex trading?

A micro account allows traders to trade small lot sizes, typically 1,000 units of the base currency (0.01 standard lots). It’s ideal for beginners or low-capital traders to practice and manage risk.

Which forex brokers offer true micro accounts?

Brokers like RoboForex, XM Group, and IC Markets offer true micro accounts with flexible lot sizes starting from 0.01 lots and low minimum deposits.

Can I use leverage with a micro account?

Yes, most brokers offer high leverage with micro accounts—often up to 1:500 or more—allowing traders to control larger positions with minimal capital.

Are micro accounts good for beginners?

Yes, micro accounts are perfect for beginners as they allow risk-controlled trading and strategy testing without needing large deposits.