In this post, I will talk about the Best German Stocks to Buy & Invest in 2026. Germany has some of the world’s most innovative and financially strong companies in technology, automotive, healthcare, and finance.

The prominent German stocks provide excellent growth opportunities, consistent dividends, and increase in long-term value, making them an appealing option for investors who want to shift into Europe’s strongest economy.

Key Investment Point & German Stocks to Buy

| Company Name | Key Investment Point (2025) |

|---|---|

| SAP SE | Strong cloud and AI growth; part of Germany’s “Magnificent Seven” outperforming the DAX. |

| Siemens AG | Diversified industrial giant leading in automation and smart infrastructure globally. |

| Deutsche Telekom AG | Stable telecom with strong U.S. growth (T-Mobile); attractive dividends and 5G leadership. |

| Allianz SE | Global insurance and asset management powerhouse with consistent earnings and yield. |

| Rheinmetall AG | Defense sector leader benefiting from rising European military budgets and global demand. |

| Merck KGaA | Innovator in healthcare, life sciences, and electronics; solid growth in biotech and semis. |

| Siemens Healthineers AG | Medical technology leader, gaining from global diagnostic and imaging demand. |

| Munich Re (Münchener Rück) | World’s top reinsurer with strong capital reserves, stable profits, and rising premiums. |

| Volkswagen AG | Accelerating in EV and software mobility solutions; global brand with transformation upside. |

| BMW AG | Premium EV and luxury vehicle maker with expanding electrified product lineup and global reach. |

1. SAP SE (Founded 1972)

A prominent player in global enterprise software, SAP SE specializes in cloud-based solutions and has over 400,000 businesses as clients across the globe.

Founded in 1972 and based in Walldorf, Germany, the company is a forerunner in supporting the digital transformation of businesses.

SAP’s revenue streams are increasingly driven by its cloud services, particularly its SAP S/4HANA platform and AI-integrated tools.

Its strategic shift to cloud-first architecture and strong performance in software-as-a-service (SaaS) markets position it well for long-term growth.

SAP is considered one of the Best German Stocks to Buy in 2025 due to its innovation in AI, growing subscription revenue, and recurring income streams.

SAP SE

Pros:

- Has a strong global presence in enterprise software.

- Cloud, and AI revenue streams are evolving.

- High customer retention and revenue, compliments recurring income.

Cons:

- Rising competition in the SaaS market.

- Margin pressures in the short run due to cloud transition.

- Cuts in global IT spending heavily impact SAP.

2. Siemens AG (Founded 1847)

Siemens AG, an international conglomerate, was established in 1847. The company specializes in several fields, including automation, digital technologies, energy, and mobility.

Its Munich headquarters is one of over 190 offices located in different parts of the world. Siemens is at the forefront of the new smart infrastructure and electrification initiatives in Germany.

Its digital industries and smart mobility units are highly profitable, supported by strong software competitiveness. Siemens is one of the Best German Stocks to Buy in 2025, owing to sustained innovation and resilient expansion.

The company is strongly positioned on digital twins, industrial IoT, and sustainability, aligning with the megatrends of climate tech and urbanization.

The company’s broad diversification offers good growth with defensive characteristics making it suitable for balanced portfolios.

Siemens AG

Pros:

- Broader industrial coverage like energy, mobility, and automation.

- Smart infrastructure, and digital industries.

- Global footprint and strong order backlog.

Cons:

- Global capital expenditure cycles impacts business heavily.

- Global supply chain risks.

- Complex corporate structure.

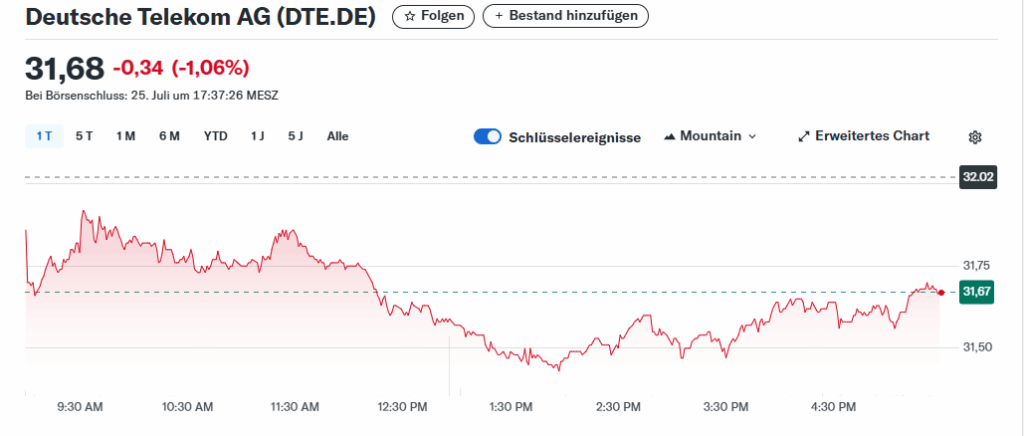

3. Deutsche Telekom AG (Established in 1995)

Deutsche Telekom AG is now the largest Telecom company in Europe and operates a global subsidiary, T-Mobile US, making it a global player in the industry.

It is headquartered in Bonn and serves 240 million mobile users and is rapidly advancing in the deployment of 5G technology across Europe and North America.

Earnings in the telecommunication sectors in U.S. have significantly improved and the company is also known for its reliable dividends. For 2025, it is forecasted to be one of the Best German Stocks to Buy.

With the investments in cloud infrastructure, fiber optics, and the steadfast focus on network leadership and digital services, the company is poised for growth.

For conservative and aggressive investors, the company is appealing due to its strategic scale, consistent income, and reliable cash flows.

Deutsche Telekom AG

Pros:

- Strength in Europe and U.S. through T-Mobile.

- Consistent cash flow and a dependable dividend.

- Growth potential from 5G and fiber-optic expansion.

Cons:

- Network investments lead to significant accumulated debt.

- Risks from regulation in telecom.

- Region dominated by a single competitor market.

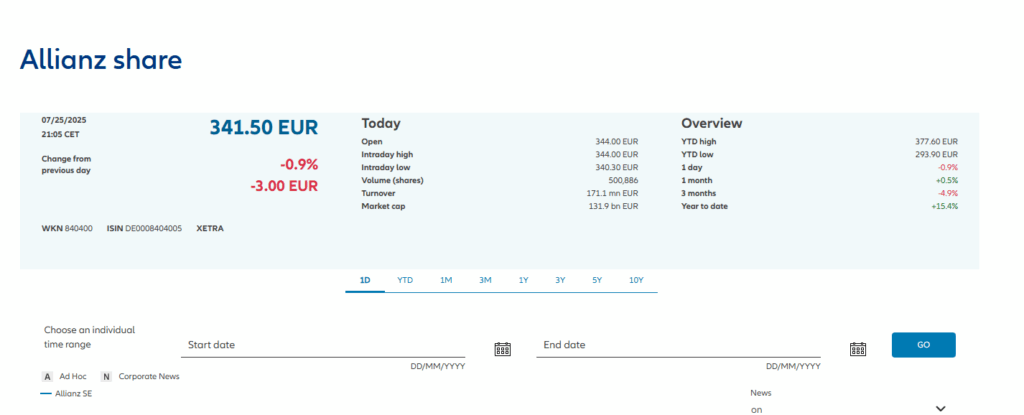

4. Allianz SE (Founded 1890)

Allianz SE is one of the biggest insurance and asset management companies globally, and it was established in 1890, with its headquarters in Munich.

The company manages assets in excess of €2 trillion, and it operates in property, life, health, and reinsurance. In volatile markets, Allianz is regarded as a defensive play due to its diversified income and consistent financial performance.

The company is ranked as one of the Best German Stocks to Buy in 2025 due to its reliable dividend payments, international presence.

Allianz is also noted for its strong solvency ratios. For portfolio managers, the company has adopted ESG factors, making it appealing to sustainability-focused investors.

In the financial sector, Allianz’s disciplined capital allocation, growing presence in Asia and European market leadership position the company as a dependable long-term investment.

Allianz SE

Pros:

- Global leader in insurance and asset management.

- Resilient earnings and strong capital reserve.

- Good dividend returns along with diversification of investment risks

Cons:

- Risk of natural catastrophes and excessive spikes in claims

- Vulnerability to changes in interest rates

- A lot of compliance and restrictions with this industry

5. Rheinmetall AG (Founded 1889)

Founded in 1889 and based in Düsseldorf, Rheinmetall AG is one of the leading defense and automotive technology companies in Germany.

Due to the growing European defense spending and NATO rearmament activities, the company has experienced spike in demand.

Rheinmetall manufactures and supplies not only armor-plated vehicles and ammunition but also advanced military systems which makes them a crucial component of the defense supply chain in Europe.

With the increasing geopolitical tensions in the world, Rinmetall is emerging as one of the Best German Stocks to Buy in 2025. The company is benefitting from sustained government contracts and rising demand from NATO countries.

At the same, the company is focusing on hydrogen storage systems, autonomous vehicles, and other civilian applications, thus improving its profile as an innovator.

The company’s presence in two different sectors ensures a reliable multi-channel revenue stream and strategic importance.

Rheinmetall AG

Pros:

- Prominent contractor of defense industry with increasing needs

- Supportive contracts from governments of NATO members

- Diverse expansion in technologies applicable to civil life e.g. hydrogens storage

Cons:

- The defense industry is sensitive to politics

- Increased demand of 2025 leads to overvaluation in 2024

- Investors with an ESG focus may shun this company

6. Merck KGaA (Founded 1668)

Merck KGaA, which started operating in 1668 in Darmstadt, is one of the oldest and most diversified virologists and science and technology companies in the world.

It specializes in the manufacture of specialty chemicals, biotech products, and pharmaceutical therapies, remaining active in healthcare, life sciences, and electronics sectors.

The life science division of Merck supports global research and development through lab solutions and focuses on oncology and immunology in its healthcare pipeline.

Merck is one of the Best German Stocks to Buy in 2025 because of its strong research base and predictable earnings. The company is also well positioned from an enduring structural demand in biotech and semiconductors in the wake of post-COVID research boom.

Through cross-sector collaboration, Merck is able to sharpen its competitive edge in innovation and sustainability which also enhances long-term resilience and returns on investment for shareholders.

Merck KGaA

Pros:

- A blended portfolio in pharmaceuticals and life sciencies along with electronic industry

- A more than average global presence with competent STEM personnel which leads to better innovation

- Steady earnings coming from both technologically and health oriented industries

Cons:

- A global presense along with STEM personnel leads to high indirect expenses as well as delay in return on investment

- Loss of patents and rules to abide to for gaining earnings may hold off profits

- Effects of global economies on currency may alter

7. Siemens Healthineers AG (Founded 2017)

Siemens Healthineers AG became independent from Siemans AG in 2017, and has rapidly established itself as a worldwide leader in imaging, diagnostics, and therapeutic technologies.

The company is located in Erlangen, Germany, which allows it to help transform the worldwide delivery of healthcare. The company is a global leader in MRI and CT imaging as well as in laboratory diagnostics.

Siemens Healthineers is ranked as one of the Best German Stocks to Buy in 2025. This is attributed to their strong performance driven by the growing elderly population, increased chronic illness cases, and the digitization of healthcare services.

The company continues to diversify into AI-powered diagnostics and is also pursuing the development of less intrusive surgical techniques.

Their strong earnings performance and focus on R&D make Siemens Healthineers a strong investment for any portfolio in the healthcare and technology sectors.

Siemens Healthineers AG

Pros:

- Strong reputation in image-based diagnostics and analytical medicine

- Greater demand from elderly citizens

- Emphasis on digital and AI augmented health care

Cons:

- hi-tech health care is capital intensive

- Dependent on budgets of health facilities and policy changes

- Sensitive to disruptions in health public policies.

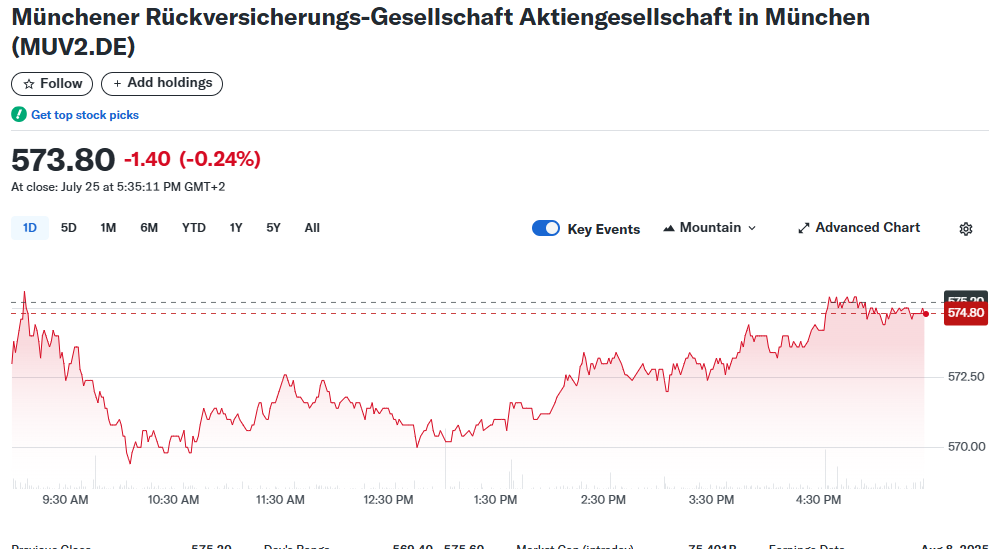

8. Munich Re (Münchener Rück) (Founded 1880)

Munich Re, founded in 1880, is the largest reinsurer in the world, and is essential for the stability of insurance across the world. They are located in Munich and offer services in reinsurance, primary insurance, as well as risk management.

It is very famous for its disciplined underwriting as well as its strong financial reserves. It is adavantageous during an economic downturn and natural disasters.

Due to its extensive coverage, expertise in risk pricing, and strong track record of dividend payments, it is listed among the Best German Stocks to Buy in 2025.

It is also benefitting from an increase in demand for coverage concerning climate change and cyber risks.

With Munich Re’s AI risk modeling, green investing, and other forward-looking strategies, they are well-positioned for the future in the ever-changing insurance field.

Munich Re (Münchener Rück)

Pros:

- On both the global and domestic scale, the company is a leading provider of reinsurace alongside other businesses with control on pricing.

- Diverse portfolio in insurable risks like climate, cyber, and life risks

- Solid dividends and reliable firm balance sheet

Cons:

- Exposure to climate disasters and other high-loss events

- Global reinsurance market is intensely competitive

- Regulatory pressures and solvency concerns

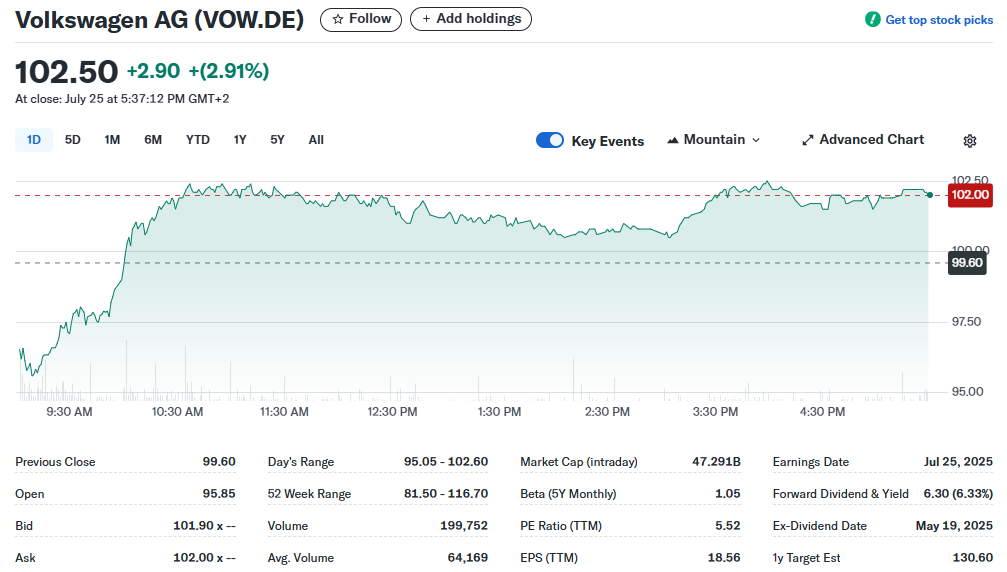

9. Volkswagen AG (Founded 1937)

Volkswagen AG is one of the largest car manufacturers in the world with its headquarters situated in Wolfsburg.

They own brands like Audi, Porsche, and Lamborghini. They are currently and aggressively shifting to electric car production with the ID series and investment in battery giga factories.

They are expected to shift from LimitedBest German Stocks to Buy in 2025 as Volkswagen moves from traditional vehicles to autonomous electric vehicles.

They hope to dominate the electric vehicle market while investing in software and mobility platforms.

Even with regulatory challenges, its innovation, scale, and diverse portfolio support headwinds sustainable growth and leadership across vehicle classes.

Volkswagen AG

Pros:

- Wide-ranging brand portfolio spanning economy to luxury

- Major investments in EVs and software in addition to battery technology

- Leads in global production and market

Cons:

- Still dealing with the legacy of diesel and Internal Combustion Engine (ICE) vehicles

- Recalls and other regulatory uncertainties

- Competition from Tesla and Chinese firms in the EV space

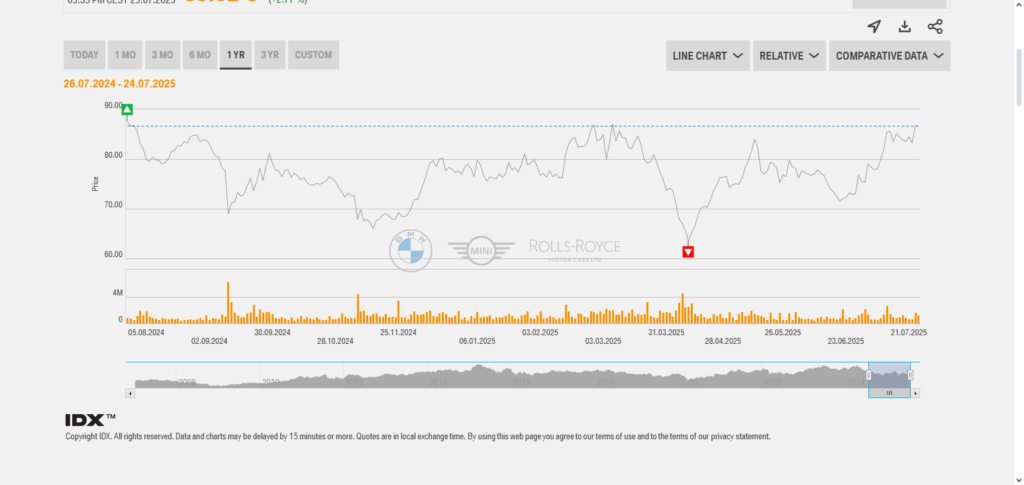

10. BMW AG (Bayerische Motoren Werke) (Founded 1916)

Best known for its luxury vehicles, BMW AG was founded in 1916 and is headquartered in Munich. It is the parent company of BMW, MINI, and Rolls-Royce.

In conjunction with its considerable global production footprint, BMW is the world’s largest manufacturer of motorcycles and has significant and growing investments in electric vehicles, autonomous technologies, as well as digital mobility and driving services.

In 2025, BMW is expected to be one of the Best German Stocks to Buy, especially after the company’s i4 and iX launch.

In addition to emerging markets for high-performance EVs, BMW’s operational efficiency, innovation and brand loyalty, and sustainability commitments make the company resilient to global emission targets.

BMW AG (Bayerische Motoren Werke)

Pros:

- Leading luxury brand with strong market share and customer loyalty

- Fast ramp-up of EV models (i4, iX, etc.)

- Excellent manufacturing quality and efficient operations

Cons:

- Vulnerability to worldwide demand and prices of materials

- Elevated spending on R&D and transformation

- Competition from newer automakers focused on EVs

Conclusion

The top companies in Germany provide investment prospects in technology, industrials, healthcare, finance, automotive, and defense. SAP SE and Siemens AG are leaders in innovation in cloud computing and smart infrastructure.

Also providing stability and consistent dividends are other important companies, Deutsche Telekom and Allianz SE. High growth stocks like Rheinmetall AG that are reaping the benefits from increased defense spending, include Merck KGaA and Siemens Healthineers AG, leaders in science and med tech.

Also, Munich Re, Volkswagen and BMW combine global presence and rethinking strategies in electric mobility and reinsurance. German stocks that provide growth, resilience, and long term potential in Germany’s economy best the other stocks to buy in 2025.