Choosing a trustworthy broker with minimal spreads is essential to increasing trading effectiveness. Although IC Markets is well-known for its quick execution and narrow spreads, traders frequently look for alternatives that provide competitive pricing, strong regulation, and cutting-edge platforms.

This article examines the top IC Markets substitutes for low-spread trading, emphasizing brokers who enable traders maximize profits and performance by combining raw spreads, cheap commissions, and dependable execution.

Key Point

| Broker | Why It’s a Top IC Markets Alternative (Key Point) |

|---|---|

| Pepperstone | Offers very low spreads (often from 0.0 pips) and fast execution, strong regulation and advanced tools. |

| Tickmill | Tight spreads starting at 0.0 pips on Pro/VIP accounts with relatively low commissions. |

| FP Markets | Raw ECN pricing with consistently tight spreads and multiple platform options. |

| Fusion Markets | Very low spreads and low commissions, widely touted for cost-efficient trading. |

| Global Prime | Transparent low-spread execution and strong liquidity for forex traders. |

| CMC Markets | Competitive spreads with a comprehensive research platform and many currency pairs. |

| BlackBull Markets | ECN pricing & competitive spreads from around 0.0 pips, no deposit fees. |

| XTB | Low forex costs and competitive spreads with powerful proprietary platform (xStation). |

| IG | Tight forex spreads plus access to advanced research and 17,000+ instruments. |

| LMFX | Forex & CFD broker with low commissions and tight spreads for various currency pairs. |

1. Pepperstone

Pepperstone has ECN accounts and has regulation with the FCA (UK), ASIC (Australia), CySEC (EU), BaFIN (Germany), DFSA (Dubai), SCB (Mauritius), and CMA (Kenya) which gives them strong regulation and client fund protection.

They offer no minimum deposits (however, they recommend around $200) and also offer accounts called Razor, which offer tight spreads of around 0.0 – 0.1 pips on EUR/USD along with $3.50 round trip commission per standard lot.

They also offer client fund protection. They offer trade execution and trading conditions that are perfect for scalpers and algo traders on 4 and 5 of Metatrader, cTrader, and Tradingview, and also on other proprietary platforms.

Pepperstone Key Point

- Established: 2010

- Headquarters: Melbourne, Australia

- Regulation: ASIC, FCA, CySEC, BaFin, DFSA, CMA, SCB

- Leverage: 1:500 | 1:30 (FCA & ASIC retail)

- Trading Platforms: MT4, MT5, cTrader, TradingView

Pepperstone Pros & Cons

Pros:

• Very tight raw spreads (often ~0.0 pips) with ECN execution

• Low commissions and fast order execution

• Excellent platform range (MT4, MT5, cTrader)

• Regulated by top authorities (ASIC, FCA, CySEC)

Cons:

• Higher leverage limited in many jurisdictions

• Inactivity fee after long dormant periods

• Research tools less comprehensive than some rivals

2. Tickmill

Tickmill has also been another strong competitor with the FCA, CySEC, DFSA Dubai, FSA Seychelles, and DFSA Dubai, being one of the most transparent and safe environments.

Traders may establish accounts with an initial deposit of approximately $100. With Pro and VIP accounts offering spreads of about 0.0–0.1 pips on EUR/USD accompanied by low commission, total trading costs are appealing to day traders and professionals.

Tickmill offers MetaTrader 4 and 5, and a WebTrader platform, offering ease of flexibility in execution, charting, and automation. With over 725 instruments, Tickmill increases trading volume and maintains lowered costs.

Tickmill Key Point

- Established: 2014

- Headquarters: London, United Kingdom

- Regulation: FCA, CySEC, FSCA, FSA DFSA (Dubai)

- Leverage: 1:500 | 1:30 (EU/UK retail)

- Trading Platforms: MT4, MT5, WebTrader

Tickmill Pros & Cons

Pros:

• Competitive spreads from ~0.0 pips

• Low commission cost on Pro/VIP accounts

• Strong execution speed & reliability

• Simple pricing and transparent fees

Cons:

• Fewer educational resources than some brokers

• Limited product range outside forex/indices

• Customer support can be slow at peak times

3) FP Markets

FP Markets is overseen by ASIC (Australia), CySEC (EU), FSCA (South Africa), and SVG FSA (St Vincent), offering consistent regulation across all major jurisdictions. The minimum deposit is usually about $100 AUD or equivalent.

RAW Pricing accounts feature ultra-competitive EUR/USD spreads that are sometimes as low as 0.0–0.1 pips, as well as low commission, making it suitable for traders who are very sensitive to costs.

FP Markets offers various trading setups, including MetaTrader 4, 5, cTrader, and IRESS, making it attractive for both automated and manual trading. The large selection of 10,000+ trading instruments and excellent customer service solidifies FP Markets as an excellent alternative to IC Markets.

FP Markets Key Point

- Established: 2005

- Headquarters: Sydney, Australia

- Regulation: ASIC, CySEC, FSCA

- Leverage: Up to 1:500

- Trading Platforms: MT4, MT5, cTrader, IRESS

FP Markets Pros & Cons

Pros:

• Extremely tight raw spreads

• Multiple platforms (MT4/MT5/cTrader/IRESS)

• Broad asset range (10,000+ markets)

• Strong global regulation

Cons:

• Commission structure can be higher for some accounts

• Higher minimum deposit for certain regions

• IRESS platform isn’t ideal for beginners

4) Fusion Markets

Fusion Markets holds a license from the ASIC in Australia and the VFSC in Vanuatu and FSA in Seychelles, and offers low-cost raw forex trading. No minimum deposit requirement stands out, as traders can sidestep deposit restrictions and fund accounts with any amount.

With Fusion Markets, founders can enjoy the flexibility offered by MetaTrader 4, MetaTrader 5, cTrader and TradingView as it offers a reasonable total trading cost, especially Zero account holders, as Forex spreads can go as low as ~0.0 pips on majors with a low commission per side (e.g. ~$2.25). With 90+ currency pairs, trading with Fusion Markets is a better option when it comes to trading with lesser spreads.

Fusion Markets Key Point

- Established: 2017

- Headquarters: Melbourne, Australia

- Regulation: ASIC, FSA (Seychelles), VFSC

- Leverage: Up to 1:500

- Trading Platforms: MT4, MT5, cTrader

Fusion Markets Pros & Cons

Pros:• Spreads and commissions are undercut by competitors

• Flat-rate pricing simplifies things

• MT4, MT5, and cTrader are included

• Offers good pricing and spread for scalping traders

Cons:

• Less established than other major brokers

• Less analysis and research tools

• Limited support availability

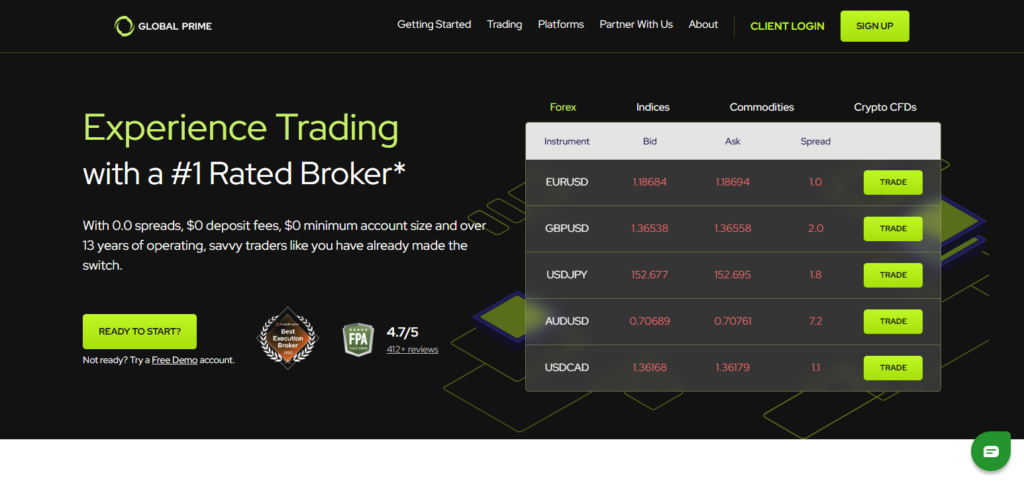

5) Global Prime

Global Prime has coverage from ASIC (Australia) and VFSC (Vanuatu), ensuring a high level of protection. With no official minimum account size, anyone can start trading (although it is usually a good idea to have a bit more than the minimum for margin requirements).

Their ECN and no-fee spreads & low liquidity are complemented by Laurentum Bank, Low Tariff Spreads (which are +~0.0 pips on the Euro/USD).

Even for low volume and barrel boiling, high volume & rapid volume strategies, trading via MetaTrader 4 and MetaTrader 5 on both mobile & desktop is suitable.

Global Prime Key Point

- Established: 2010

- Headquarters: Sydney, Australia

- Regulation: VFSC, ASIC

- Leverage: Up to 1:500

- Trading Platforms: MT4, MT5

Global Prime Pros & Cons

Pros:

• Deep liquidity and ECN spread are tight

• Order execution is fast

• Leverage can be more flexible

• Focus on institutional clientele is strong

Cons:

• Less educational material

• Some platforms are less intuitive than proprietary ones

• Outside of CFDs and forex, range is limited

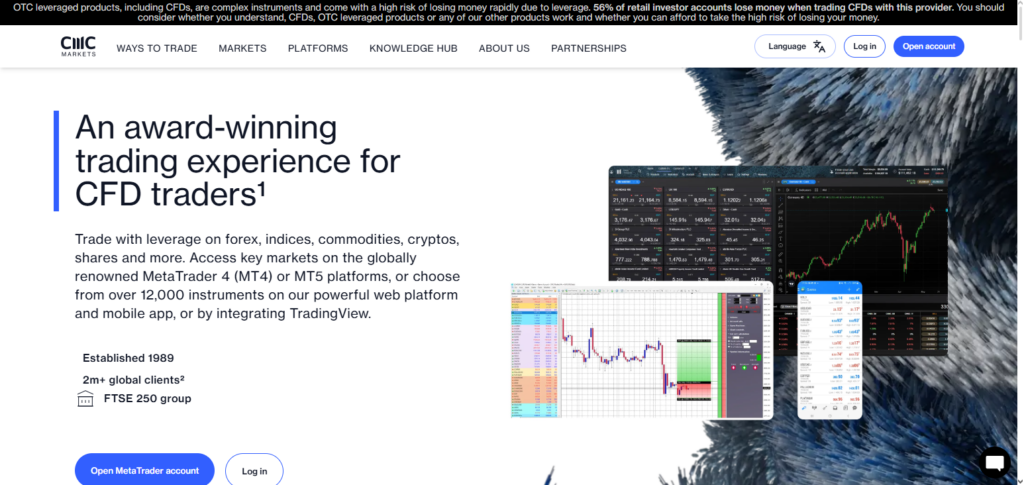

6) CMC Markets

CMC Markets has the regulation of FCA (UK), ASIC (Australia), DFSA (Dubai), and countless other agencies which allows for a wide range of compliance and monitoring globally.

Standard accounts usually have no minimum deposit requirement in most locations, which accommodates varying capital levels across traders.

CMC has no commission on many FX trades, average forex spreads are competitive, and they are usually about 0.7 pips on EUR/USD. Execution quality and platform features are beyond just spreads.

CMC also MetaTrader and Next-Gen web and mobile platforms which have advanced research and charting tools. Execution quality and platform features are beyond just spreads and CMC isn’t always as low as pure ECN brokers.

FXCM Key Point

- Regulators: Financial Conduct Authority (FCA) in the UK,

- Established in: 1989

- Platforms: Next Generation (Proprietary), MetaTrader 4

- Leverage: 1:500 (Professional accounts) / 1:30 (Retail EU/UK)

- Head office: London, United Kingdom

CMC Markets Pros & Cons

Pros:

• Many instruments have good spreads

• MT4 and powerful proprietary platform

• Tools for research and charting are excellent

• Across the board regulation is tight

Cons:

• For retail traders, risk-adjusted leverage could be lower

• For small accounts, several fees may be higher

• For beginners, the platform can be complex

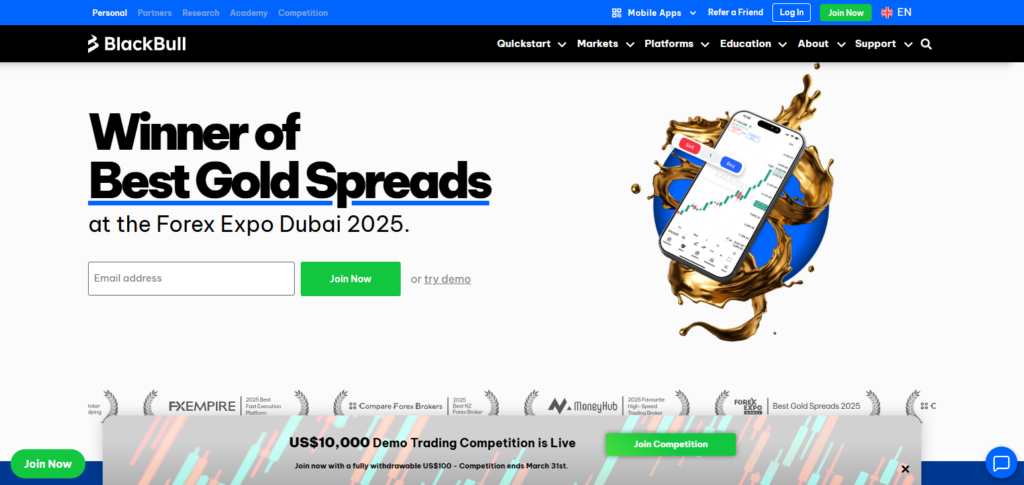

7) BlackBull Markets

BlackBull Markets provides ECN-style executing along with reasonable spread and commission requirements. They have FMA (New Zealand) and FSA (Samoa) regulation, giving them reasonable zones with ideal trading conditions.

Most minimum deposit requirements are $0, making them simple for traders with low capital. However, recommended deposits vary depending on what your targets are.

BlackBull provides MetaTrader 4 and 5, TradingView, copy trading, and more, making them flexible for retail, scalping, and automated traders.

BlackBull Markets Key Point

- Regulators: FMA (New Zealand), FSA (Seychelles)

- Established in: 2014

- Platforms: MetaTrader 4, MetaTrader 5, cTrader, and TradingView

- Leverage: 1:500

- Head office: Auckland, New Zealand

BlackBull Markets Pros & Cons

Pros:

• ECN style spreads are tight

• TradingView, cTrader, MT4, and MT5 are supported

• No minimum deposit or low minimum deposit is required

• Good for scalping/automated trading

Cons:

• Regulation is weaker than ASIC/FCA brokers

• Less educational material

• Compared to other tier brokers, account types are fewer

8) XTB

FCA (UK), CySEC (Cyprus), KNF (Poland), and FSC (other jurisdictions) XTB regulations offer great coverage and safety.

XTB’s minimum initial deposit requirement borders between $0 and $250, varying by region and account type, while average spreads on the EUR/USD pair are approximately 0.7 pips with no commission.

They have also opted for their own proprietary trading platform, xStation 5, which is very well regarded for its user-friendly design, educational tools and resources, trading execution time, and charting capabilities.

This makes XTB an excellent option for traders who are looking for a consolidated trading platform and a trading ecosystem with attractive forex pricing.

XTB Key Point

- Regulators: FCA (UK), CySEC (Cyprus), KNF (Poland)

- **Established in **: 2002

- Platforms: xStation 5 (Proprietary), and MetaTrader 4 (limited regions)

- Leverage: 1:500 (International) / 1:30 (EU/UK retail)

- Head office: Warsaw, Poland

XTB Pros & Cons

Pros:

- Forex prices are competitive.

- The proprietary platform xStation 5 is very good.

- Great tools for building market and research analysis.

- The company is regulated by the CySEC, FCA and KNF.

Cons:

- Compared to pure ECN brokers, the spreads are wider.

- MetaTrader access is limited by region.

- Some jurisdictions have tighter restrictions on leverage.

9. IG

IG is the most established and one of the most heavily regulated brokers, with their brokers being monitored by FCA (UK) , ASIC (Australia) , CySEC (EU) and other tier 1 regulators. Established brokers tend to have minimum deposits of $0 – $250 +, depending on region and account type.

They average about 0.6 – 0.8 pip spreads on EUR/USD and have no commission on standard FX trades. They have both Meta Trader and their own IG platform (available on the web and mobile) which have decent charting tools and research with level 2 pricing.

IG has a regulated environment and offers low spreads which is ideal for traders looking to diversify as they have a big range of instruments offered (over 17,000).

IG

- Regulators: FCA (UK), ASIC (Australia), CySEC (Cyprus), MAS (Singapore), CFTC/NFA (USA)

- Established in: 1974

- Platforms: IG Trading Platform, MetaTrader 4, and ProRealTime

- Leverage: 1:200 (varies by region) / 1:30 (Retail UK/EU)

- Head office: London, United Kingdom

IG Pros & Cons

Pros:

- Pricing on forex and broad markets is tight.

- Platforms and tools are excellent.

- The broker has strong oversight and is long-established.

- There is a huge range of instruments available to trade.

Cons:

- Some brokers have a higher non-trading fee.

- New accounts take longer to approve in some regions.

- Beginner traders may feel overwhelmed by the range of products.

10. LMFX

LMFX allows traders to enjoy increased thinner brokerage spreads by lowering commissions on multiple trades.

Offering high accessibility revised enabling level of trade and high leverage of up to 1:1000 and ultra low spreads reported around 0.2 pips on EUR/USD, LMFX offers trade on almost free of charge basis, However, LMFX is not regulated.

LMFX has no protection from major global authorities such as the FSA, ASIC, or CYSEC, and the minimum deposit is promotional and is offered on MetaTrader 4 as its only platform on mobile and desktop versions.

The appeal of LMFX is cost and high leverage, although low protections from global authorities les trading experience without strong defense regulatory cost.

LMFX Key Point

- Regulators: Not regulated by major financial authorities

- Established in: 2011

- Platforms: MetaTrader 4

- Leverage: 1:1000

- Head office: Offshore entity

LMFX Pros & Cons

Pros:

- There is the possibility to have a balance of 1:1000 due to a very high leverage.

- There is a simple execution on MT4.

- There are options for a low or zero minimum deposit.

- Bonuses and promotions are attractive.

Cons:

- One of the higher risks of slipping in volatile markets.

- There are limited features to research, educate and platforms.

- There are no major authorities to regulate the company.

What Makes a Good Low-Spread Broker?

Tight Raw Spreads

Good low-spread brokers offer tight raw spreads; traders pay the smallest difference between bid and ask prices on the most traded pairs like EUR/USD in normal market conditions.

Low Commission Structure

Competitive commissions per lot are crucial as the total trading cost comprises both. Traders can determine profitability with brokers providing unambiguous, fixed commissions and pre-trade calculable commissions.

Fast Execution Speed

Scalpers and day traders depend on even split execution points and no slippage hence the need for quick execution for critical entry and exit during high market volatility.

Strong Liquidity Providers

Wider spreads from high volatility are less risky when liquidity pools are accessed even during critical news releases hence tight and controllable spreads and stable price.

Reliable Regulation

Trusted authorities like FCA or ASIC, offer regulatory fund protections, transparent regulatory commissions, segregated accounts and fair trading practices eliminating the possibility of manipulation or trading practice misconduct.

Platform Stability & Tools

Good brokers won’t disappoint with the use of MT4 or MT5 as they provide good trading charting, automated trading options and a strong stable trading.

No Hidden Fees

Low-spread brokers don’t use hidden fees to charge their clients more. Fees for account inactivity, withdrawals, and increased fees for overnight swaps are some of the ways brokers can take advantage of their clients.

How to Choose the Best Alternative

Raw Spreads

Low spread brokers offer traders the least possible raw spread, meaning they offer the lowest possible bid and ask price difference on the most traded pairs, like EUR/USD.

Commission Structure

Competitive commission rates per lot are important since total trading costs are made up of commission costs. Traders can determine profitability with clear, fixed commission brokers.

Execution Speed

Day traders and scalpers rely on speed for critical market entry and exit points and even, no slippage on execution.

Good Liquidity Providers

During critical news releases, wider, high volatility spreads come with less risk where addressed tight liquidity pools. Tight and controllable spreads. Stable price.

Trustworthy Regulation

Reliable institutions, such as FCA or ASIC, offer regulatory fund protection, transparent regulatory commissions, segregated accounts, and fair trading practices, so the risk of trade manipulation and trading practice misconduct is eliminated.

Tools and Stability of the Platform

Reliable brokers will not disappoint you with the presence of MT4 or MT5, as they offer decent trading charting, automated trading, and stable trading.

Transparency

Low-spread brokers are upfront about their pricing; they don’t hide their fees. Account inactivity, withdrawal, and elevated overnight swap fees are examples of how brokers might exploit their clients.

Conclusion

Multiple factors such as regulation strength, availability of trading platforms, flexibility of leverage, and overall trading conditions, show that Pepperstone, Tickmill, and FP Markets stand out as solid alternatives to IC Markets for low-spread trading.

All these brokers support multi-platforms and provide raw spread with low start values (around 0.0 pips) and other very low values for commissions.

Other brokers such as CMC Markets, XTB, and IG have their own proprietary trading platforms and provide good coverage when it comes to regulation, though their spreads are not as tight as some available ECN models.

Although LMFX and other offshore brokers may offer higher leverage (up to 1:1000), they provide lower regulatory protections.

In the end, it all comes down to individual trading costs (spreads plus commission), execution speed, trading platform, and regulatory protections, not just the spread. Always remember to test conditions with demo accounts before risking actual capital.

FAQ

Which broker offers the lowest spreads compared to IC Markets?

Brokers like Pepperstone, Tickmill, and FP Markets offer raw spreads starting from 0.0 pips on EUR/USD with commissions. Total cost typically ranges between 0.6–0.8 pips per round lot.

Are these IC Markets alternatives regulated?

Yes, most are regulated by top-tier authorities such as FCA, ASIC, and CySEC. For example, IG and CMC Markets have strong global regulatory oversight. However, LMFX operates without major-tier regulation.

What is the average trading cost on EUR/USD?

Raw account brokers typically offer spreads from 0.0 pips plus commissions of $5–$7 per lot round turn. Standard accounts often average 0.6–1.0 pips with no commission.

Which broker is best for scalping?

Brokers offering ECN-style execution, fast order processing, and tight spreads — such as Pepperstone and Tickmill — are considered suitable for scalping strategies.

What platforms do these brokers support?

Most support MetaTrader 4 and MetaTrader 5. Some brokers like XTB provide proprietary platforms (xStation), while others offer cTrader and TradingView integrations.