This article will discuss the best IIROC-registered Forex Brokers accessible to Canadian clients.

Choosing a broker regulated by the Investment Industry Regulatory Organization of Canada (IIROC) is essential in guaranteeing a safe and transparent environment.

A plethora of players populate the intensely competitive forex market; I shall discuss some of the prominent features, advantages, and concerns one needs to consider before making a decision.

Key Point & Best IIROC-Regulated Forex Brokers List

| Broker | Key Point |

|---|---|

| HYCM | Offers a wide range of trading instruments and competitive spreads. |

| OANDA | Known for its advanced trading tools and flexible leverage options. |

| CMC Markets | Provides extensive research resources and a user-friendly platform. |

| Interactive Brokers | Offers low-cost trading and access to global markets. |

| FP Markets | Features low spreads and a strong focus on forex trading. |

| RoboForex | Provides high leverage and a variety of account types. |

| FBS | Offers bonuses and promotions for new traders. |

| Saxo Bank | Renowned for its comprehensive trading platform and market research. |

| City Index | Provides a robust trading platform with a wide range of markets. |

| easyMarkets | Known for its user-friendly platform and fixed spreads. |

10 Best IIROC-Regulated Forex Brokers for 2024

1. HYCM

HYCM is another great IIROC-regulated forex broker. Providing a good set of trading instruments, hycm also has low spreads and good trading conditions.

With the IIROC regulation, the broker follows several strict financial rules that most traders would be relaxed about knowing.

Otherwise, even the existing trading platforms offered by Hycm are more than adequate, while their client service should also be a plus for both novice and professional traders.

HYCM Features

- Regulatory Compliance: Have stringent requirements from IIROC, ensuring that a trader’s interest is protected and that there is transparency.

- Diverse Trading Instruments: Offers a variety of forex pairs, commodities, and indices for trading purposes.

- Competitive Spreads: Presents low spreads, which are advantageous to the traders.

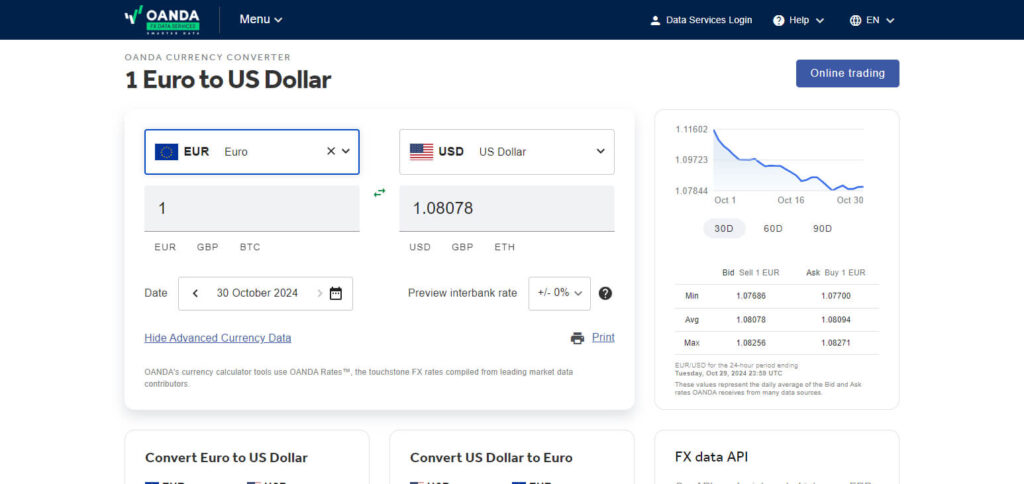

2. OANDA

OANDA is one of the most popular IIROC-regulated forex brokers. A standout with its great trading tools and press, OANDA has good leverage as well.

IIROC regulation with the broker ensures that they conform to preserving minimum financials, which is very healthy from a trader’s perspective.

OANDA focuses on the needs of traders and offers significant market analysis and educational material that caters to both beginner and advanced traders, which is why it is pretty popular in the forex market.

OANDA Features

- Customization of Leverage: Permits traders to alter leverage ratios depending on their risk appetite.

- Depth Analysis Tools Offering: Offers research, analytics, news, and educational materials, allowing the creation of a well-considered trading strategy.

- For All Trading Experience Levels: It has an easy-to-use trading platform, even for those who have just started to engage in trading activities.

3. CMC Markets

CMC Markets is a recommended forex broker. CMC Markets is well-known for the excellent trading platforms they provide to their clients since they have a variety of instruments along with tight spreads.

Traders’ confidence stems from IIROC regulation, which protects investors in terms of financial security and transparency.

With sound educational materials and good charting facilities, CMC Markets is ideal for traders of all experience levels.

CMC Markets Features

- Access to Global Market: It has more than 9,000 trading instruments, including forex, forex, indices, and commodities.

- Professional Charting Tools And Technical Analysis Tools: It has powerful charting capabilities and technical analysis tools to enhance trading strategies.

- Stop-loss Orders: Guaranteed stop-loss orders and various provisions for traders are provided.

4. Interactive Brokers

Interactive Brokers is a regulated forex broker in Canada by IIROC.

It has low-cost and international trading opportunities; Interactive Brokers has a regulated and secured environment with IIROC.

Also, the broker’s sophisticated trading platforms and global scale are ideal for professional investors.

As such, with adequate research tools and great pricing within the platform, it is clear why Interactive Brokers is a dependable option in the Canadian foreign exchange landscape.

Interactive Brokers Features

- Low Trading Costs: As a bonus, its trading services are some of the cheapest in the industry when considering fees and commissions.

- Wide Range of Asset Classes: Such availability allows you to trade stocks, shares, options, futures, and forex for a more diversified portfolio.

- Advanced Trading Technology: It has multiple professional trading systems which offer speedy execution of trades and advanced customization of tools for experienced traders.

5. FP Markets

IIROC supervises FP Markets and is a respectable broker. Low spreads, quick execution speeds, and a wide range of trading instruments are the qualities that FP Markets has become renowned for.

Regulation by IIROC brings extra security and transparency to traders. The firm’s robust platforms and training materials are appropriate for novice and proficient clientele.

Which gives FP Markets an edge in competition for the Canadian forex market.

FP Markets Features

- Ultra-Low Spreads: A minimum spread of 0.0 pips makes trading on FP Markets easy and cost-effective.

- Multiple Account Types: Several accounts are offered to the clients, encompassing different trading styles and expertise levels.

- Plenty of Market Analysis Provided: FP Markets provides trading and financial tools encompassing extensive market education pieces and strategies.

6.RoboForex

RoboForex appears to be a rising star amongst forex brokers as it comes with value-added propositions.

While high leverage and a wide range of accounts are solid factors for RoboForex, it’s not yet IIROC-regulated in Canada.

Nonetheless, other global bodies authorize it, which allows traders to employ innovative tools and have market access in multiple ways.

For Canadian clients looking for IIROC regulation, perhaps it is better to look for alternative brokers to feel more secure and legally protected.

RoboForex Features

- High Leverage Options: Offers flexible leverage of up to 1:2000 according to various risk levels.

- Diverse Trading Platforms: Offers many trading platforms, such as the MetaTrader 4 and 5 technology, for more options in trading.

- Wide Range of Instruments: Provides many instruments to trade, including foreign exchange, stock, and digital currency, which gives more opportunities for trading.

7. FBS

FBS is a forex broker with a variety of bonuses and account types. Under IIROC in Canada, however, there is no current regulation.

It has some educational materials and competitive spreads under different countries’ rules, but Canadian traders looking for IIROC-regulated brokers may want to consider other alternatives.

FBS is still a good option for traders looking for more features other than those offered under IIROC rules.

FBS Features

- Bonus Offers: FBS Many new and existing clients are welcomed with bonuses and promotions to reinforce trading capital.

- Convenient Mobile Application: A mobile app designed so that trading can be done quickly regardless of the location.

- Customized Learning Aids: FBS provides a range of learning options, such as webinars, online seminars, and tutorials on various topics.

8. Saxo Bank

Saxo Bank is a reputable forex broker with excellent capabilities; its trading platform is well-equipped with research and trading tools.

However, while Saxo Bank is regulated in several jurisdictions, it is not IIROC-regulated in Canada.

Canadian brokers prioritising IROc supervision must look for other choices for locally supervised brokers.

Saxo Bank is well respected around the world.

Saxo Bank Features

- Vital Research and Analysis: Provides a good amount of market research, which helps make better trading decisions.

- Top Notch Trading Platforms: Features highly complex trading systems with professionally styled interfaces and advanced capabilities for experienced traders.

- Multiple Investments: Allows trade of more than just currencies, including various assets like stocks, bonds and commodities.

9. City Index

As a broker with a well-known trading platform and geographical business diversity, City Index holds a strong position.

They’re regulated in various regions, but IIROC Canada is not one of them.

The broker features slightly wider spreads, educational materials, and various traders’ level-appropriate tools.

Nevertheless, Canadian traders looking for trade options that are IIROC-regulated may want to look further for local compliance with regulatory requirements.

City Index Features

- Variety of Markets Available: Offers a selection of more than 12,000 markets, including forex, indices, commodities, and digital currencies.

- Intelligent Tools for Trading: Advanced tools such as risk management and trading signals have been incorporated to improve trading strategies.

- Competitive Pricing: This has minimal spreads and no extra charges, so the lower rates are transparent during trading.

10.easyMarkets

A leading broker famous for its easy-to-navigate system and fixed spreads is easyMarkets.

Even though easyMarkets provides excellent options, such as tools for managing risk exposure and reasonable fees, it does not qualify for IIROC regulation in Canada.

The Canadian traders looking forward to executing their trades through an IIROC-regulated broker may want to look elsewhere for better-localised protection.

Even so, customers worldwide appreciate EasyMarkets since it is easy to use and provides a lot of help to people new to trading.

easyMarkets Features

- Fixed Spreads: The company lists its fixed spreads on various currency pairs, making the trading costs more predictable.

- Risk Management Tools: The firm offers unique features, including deal cancellation and a guaranteed stop loss that assists in controlling risk.

- User-Friendly Interface: Created with a simple platform that is easy and friendly for novice and expert traders.

How we Choose the Best IIROC-Regulated Forex Brokers

Regulatory Compliance With IIROC: This guarantees that brokers cope with client respect concerning their financial security and regulatory compliance.

Low Transaction Costs: Deals with the evaluation of quotes, commissions and other costs related to trading.

Trading Platform’s Efficiency: Attempts to analyze the efficiency of the given trading platform in terms of simplicity and the components which could be present.

Basket of Markets: Assesses the number of instruments that can be traded, including currency pairs, commodities, etc.

Range of Accounts: Considers and assesses the types of accounts and the number of ways of funding the accounts.

Quality of Customer Service: Tests the timeliness of the responses from the client support department and the quality of services provided to clients.

Tutorial Material or Additional Resources: Evaluate the tutorials, webinars, and other market analysis tools the broker offers.

Additional Features: Indicators,, chating, and risk management techniques, will be explored.

Conclusion

In a nutshell, it can be said that the selection of a suitable IIROC-regulated forex broker guarantees Canadian traders security, transparency, and a toolkit for a reasonably successful trading experience.

It does not matter the trader’s location, as Canadian forex traders have the option because focusing on some of the listed aspects like platform quality, trading costs, and the client’s support makes it possible to find a broker that suits them.

IIROC-approved brokers are more trusted with traders and are reputable sources for people looking for a regulated trading space in Canada.