This article focuses on Best Nexo Card Alternatives for crypto enthusiasts for the year 2026. Be it higher cashback, support for more cryptocurrencies, self-custody, or low-fees for spending worldwide, there is a card for every requirement.

There are reward cards like the Crypto.com Visa, the Wirex, Fold’s credit card, which is Bitcoin-oriented, and more. These are alternatives to spend and manage your cryptocurrencies at any time and from anywhere in a flexible and safe way.

What is Nexo Card?

The Nexo Card allows you to spend cryptocurrency without selling it. It’s a MasterCard that links to your Nexo wallet, lets you make fiat payments, and keeps your crypto collateral. You also get 2% cash back on all purchases, with the reward being paid out in Bitcoin or NEXO tokens.

You can get the Nexo card for free and don’t have to pay monthly or yearly fees. The card has various cryptocurrencies, works with Apple Pay and Google Pay, and is free to use anywhere in Europe. It’s the perfect card for everyday crypto use.

10 Best Nexo Card Alternatives in 2026

| Card / Provider | Primary Regions |

|---|---|

| Crypto.com Visa Card | Global (many countries) |

| Coinbase Card | US, EU, UK |

| Bybit Card (Mastercard) | EEA, Australia, APAC regions |

| Wirex Card | 130+ countries |

| Gnosis Pay Card | EU & UK (expanding) |

| KAST Solana Card | Global (150+ countries) |

| BitPay Card | Mainly US |

| Venmo Card | US only |

| Fold Credit Card | US (primarily) |

| UUpay Debit Card (UPay) | Global / Worldwide |

1. Crypto.com Visa Card — Best All‑Round Crypto Debit Card

Currently, one of the most reknowned and readily accessible cards in the market is the Crypto.com Visa Card because users are able to spend their coins wherever Visa is valid. Card Type: Crypto linked Prepaid Visa debit card, where the merchant receives the payment in crypto.

Rewards/Cashback: 8% back in their in-house crypto(CRO tokens) at their highest level. Rewards are subject to your staked tokens. Perks include Spotify and Netflix reimbursements at certain tiers, and rewards are at base tiers.

Fees/Notes: No annual fees at base tiers, but you must stake CRO tokens to earn the highest rewards. Foreign transaction fees and top-up fees apply at base levels. Supported Cryptocurrencies: card supports over 20 crypto coins; spends and converts coins like BTC, ETH crypto, CRO coins, stable coins, and other alt coins..

Primary Regions: These cards are operational in the US, EU/EEA, UK, Asia, Australia, and other Markets. Only top-tier users have the ability to earn the highest rewards.

Crypto.com Visa Card Features

- Card Type: Visa prepaid crypto-to-fiat debit card

- Rewards / Cash Back: Up to 8% (Tiered by CRO stake) cashback in CRO tokens

- Fees / Notes: No yearly fees for basic cards; Higher tiers are gated by staking; FX and ATM fees are possible

- Supported Cryptocurrencies: BTC, ETH, LTC, CRO, BNB, ADA, DOT, and other top coins

- Primary Regions: Australia, US, UK, EU/EEA, and APAC

- Additional Features: Airport lounges for premium tiers. Spotify and Netflix reimbursement.

Crypto.com Visa Card Pros & Cons

Pros

- High tiered cashback up to ~8% back in CRO rewards.

- Global availability.

- Extra perks like lounge access and subscription rebates on higher tiers.

- No annual fees on base cards.

Cons

- You need to stake CRO tokens to access the best rewards.

- Benefits are region specific.

- ATM and FX fees may apply.

- You earn rewards in CRO (which may not be your preferred crypto).

2. Coinbase Card — Earning Rewards on Spending Crypto Made Easy.

The Coinbase Card is a Visa debit card, allowing you to make purchases directly from your Coinbase account balance without worrying about fiat currency. Rewards/Cashback: You can get an estimated 4% back on every qualifying purchase and you get to decide the cryptocurrency you want to earn rewards in, including Bitcoin and others.

Fees/Notes: No yearly fees, but you can get charged conversion fees when your cryptocurrency is switched to fiat currency at the sale (unless you pay with specific stablecoins), and is dependent on your location.

Coinbase offers crypto in the wallet including BTC, ETH, USDC, and a whole lot more. Primary Regions: Operating in the USA, UK, and EU/EEA with different country support. The card is good especially for the Coinbase users wanting seamless spending and rewards with no maintenance.

Coinbase Card Features

- Card Type: Visa debit card with a Coinbase wallet connection

- Rewards / Cash Back: Up to 4% in crypto when user specifies which coins to reward

- Fees / Notes: No annual fees; when converting crypto to fiat, there may be a conversion fee

- Supported Cryptocurrencies: BTC, ETH, USDC; other assets that Coinbase supports as well

- Primary Regions: US (it is expected to become available in additional markets in the future)

- Additional Features: Cards are available virtually and physically

Coinbase Card Pros & Cons

Pros

- Simple and easy to use with direct access to your Coinbase balance.

- You have the option of 4% back in crypto rewards, and you can select the crypto.

- No annual fees.

Cons

- When you spend crypto, you are charged conversion fees.

- It’s primarily available in the US.

- Reward caps apply compared to competitors.

- You have to use crypto on Coinbase to use the card.

3. Bybit Card (Mastercard) — High Cashback for Exchange Users

The Bybit Card is a crypto-linked debit card from Mastercard that is a card for users of the Bybit exchange and app. Rewards/Cashback: Around 10% of cashback, which is tiered for Bybit VIP levels, with additional promotional activities.

Fees/Notes: There is no card maintenance fees, but there is an annual fee to pay. User Requirement: Verified Bybit account is a must. Higher user activity is for top promotions.

Supported Cryptocurrencies: Main tokens like BTC, ETH, USDT, USDC, XRP, BNB and more Bybit tokens. Primary Regions: Primarily in the EU/EEA, UK, parts of APAC, and LATAM. Best Nexo Card Alternative: For Bybit users, this card offers better possible cashback than Nexo’s ~2%.

Bybit Card (Mastercard) Features

- Card Type: Bybit account-linked crypto debit card (Mastercard)

- Rewards / Cashback: Up to 10% Cashback depending on monthly promotions and current status as a VIP.

- Fees / Notes: Free annual fees; KYC verification must be done; fees while using ATMs and Foreign Exchange may apply.

- Supported Cryptocurrencies: Bitcoin, Ethereum, USD Coin, Circle USD, Tether USD, XRP, and other supported Bybit tokens.

- Primary Regions: Europe, Switzerland, Australia, Latin America, Asia-Pasific.

- Other Features: Temporary Digital Virtual Card; Apple and Google pay supported.

Bybit Card (Mastercard) Pros & Cons

Pros

- Up to high cashback (around ~10% with VIP/promotional conditions).

- Utilies most major cryptos on Bybit

- Fast availability of virtual cards.

- Can use Apple & Google Pay.

Cons

- High rewards associated with trading activity/account tier.

- Not all countries can access.

- ATM/FX fees can still happen.

- Rewards are complex/variable in structure.

4. Wirex Card — Multi-Asset Card with High Cryptoback

The Wirex Card is an international crypto debit card – Visa/Mastercard (varies by region) that promotes attractive cardholder benefits and crypto flexibility. Rewards/Cashback: Approximately 8% Cryptoback™ rewards in the WXT token of Wirex for card transactions (the reward % is holding/staking dependent).

Fees/Notes: Basic cards have no annual fees; crypto to fiat conversion and cross-border fees apply; rewards are in the WXT token. Supported Cryptocurrencies: 30+ cryptocurrencies and various fiat currencies are accepted, allowing you to spend from different accounts.

Primary Regions: Service is available throughout Europe, the UK, Australia, and the US (some states may have restrictions). If you are looking for multiple cryptocurrencies and high rewards, Wirex is an attractive option.

Wirex Card Features

- Card Type: Crypto Debit Card for either Visa or Mastercard.

- Rewards / Cashback: Receiving up to 8% Cryptoback in WXT tokens.

- Fees / Notes: No annual fees; Foreign exchange transaction fees may apply. Crypto to fiat conversion is required to do any spending.

- Supported Cryptocurrencies: Bitcoin, Ethereum, Litecoin, XRP, Dogecoin, Cardano, Solana, and many more.

- Primary Regions: Europe, the United Kingdom, Asia Pacific and some areas of the United States.

- Other Features: More rewards as WXT tokens are held or staked.

Wirex Card Pros & Cons

Pros

- Up to ~8% Cryptoback™ rewards.

- No annual fee.

- Flexible card that’s widely accepted.

- Large number of cryptocurrencies supported.

Cons

- Rewards are received in WXT token, which can be volatile.

- Limited availability in the US.

- Rewards are based on the amount of token holdings/staking.

- FX spreads and converted costs apply.

5. Gnosis Pay Card — Self-Custodial DeFi Cryptocurrency Card

The Gnosis Pay Card is a self custody Visa debit card self-custodial that is quite different from others as it links directly to your DeFi wallet giving you full control over your funds.

Rewards/Cashback: Up to ~5% GNO token cashback with GNO and NFT tier perks at the higher tiers. Fees/Notes: Card issued at a one-time price of $35; no transaction and no FX fees; your crypto stays in your wallet.

Supported Cryptocurrencies: Primarily used with EURe and GBPe stablecoin; cashback is in GNO tokens. Primary Regions: Card available in EEA and UK (32+ countries). Best Nexo Card Alternative: Ideal for DeFi and self-custody enthusiasts in Europe who want high cashback with no ongoing fees.

Gnosis Pay Card Features

- Card Type: Self Custodial Visa Debit Card (cryptocurrency stays in the wallet).

- Rewards / Cashback: Up to 5% back in GNO tokens.

- Fees / Notes: one time charge for issuance of the card of approximately $35 USD; no transaction, no gas, and no foreign exchange fees.

- Supported Cryptocurrencies: Stablecoins in the Gnosis Safe wallet of EURe and GBPe.

- Primary Regions: The United Kingdom and Europe, including the EEA.

- Other Features: funds will remain in the user’s wallet and no one else can access them.

Gnosis Pay Card Pros & Cons

Pros

- Self-custodial: your crypto remains in your wallet (without third-party custody).

- Up to ~5% cashback in GNO.

- No ongoing FX/transaction fees.

- Excellent for those who appreciate custody control.

Cons

- A one-time fee for card issuance.

- Limited understanding of self-custody wallets needed.

- Less spendable tokens (mostly stablecoins).

- Limited to the EU/UK.

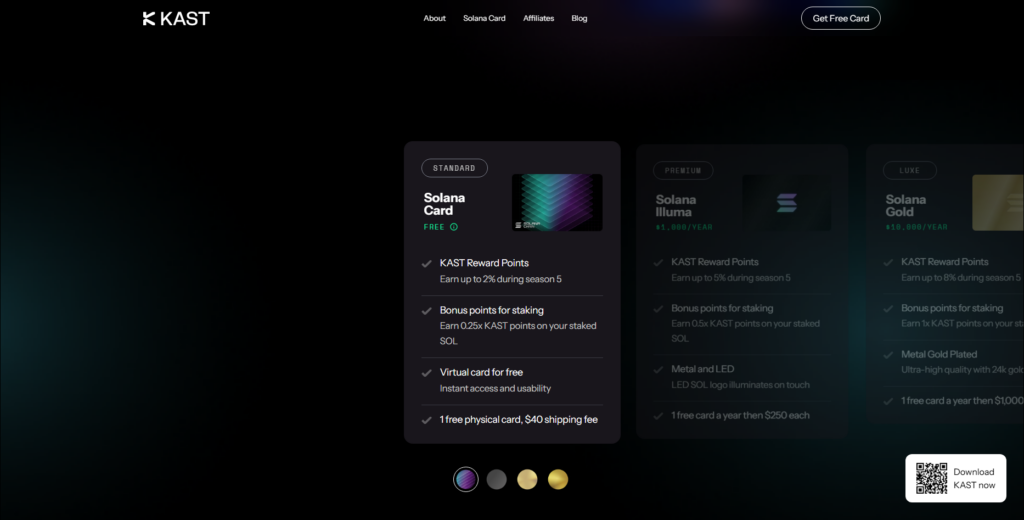

6. KAST Solana Card — Solana Ecosystem Rewards Card

The KAST Solana Card is a Solana ecosystem Visa debit card designed for stablecoin spenders. Rewards/Cashback: Starting at 2% cashback which can grow to ~ 18% (or more) with bonuses for SOL staking and cashback tiers.

Fees/Notes: Annual fees $20 and up depending on tier (more for premium plans). Supported Cryptocurrencies: Spend and 0% instant conversion for USDC, USDT, and PYUSD with bonuses for staked SOL.

Primary Regions: 150+ countries. Best Nexo Card Alternative: Great for those who want to maximize both staked rewards and spend rewards in the Solana ecosystem.

KAST Solana Card Features

- Card Type: Visa debit cards for users on the Solana ecosystem

- Rewards / Cashback: Cardholders may receive 2 to 18 percent cash back depending on the staking tier.

- Fees / Notes: Card fee/annual fee ranges from $20 to premium tier levels.

- Supported Cryptocurrencies: Increased rewards can be earned from staking SOL. Endorsed coins are USDC, USDT, PYUSD.

- Primary Regions: World (over 150 countries)

- Other Features: rewards for staking and additional incentive for SOL holders.

KAST Solana Card Pros & Cons

Pros

- Potentially very high cashback (up to 18%+ with staking combo).

- Global availability (150+ countries).

- Rewards get amplified through participation in Solana ecosystem.

Cons

- Annual fees on higher tier cards.

- Reward tied to staking may cause confusion.

- Best perks entail holding/staking SOL.

- More specialized audience (Solana ecosystem).

7. BitPay Card – Easy Crypto Cards With Flexible Options

With a BitPay Card, you can load crypto and spend with ease. It’s a prepaid Mastercard debit card. Rewards/Cashback: Rewards and cash back are issued through partners so it’s a promotional offer (there are no fixed rewards), with varying rewards based on the merchant.

Fees/Notes: Card issuance fees ($10), ATM fees, and international transaction fees (around 3%). You won’t see an annual fee on your statement. Supported Cryptocurrencies: A lot. You can convert 100+ cryptocurrencies into spendable crypto.

Primary Regions: Currently only available in the US. Best Nexo Card Alternative: It’s a decent alternative if you want widespread crypto access with spending options, even if it means you won’t get a fixed rewards structure.

BitPay Card Features

- Card Type: Prepaid Mastercard debit cards

- Rewards / Cashback: No universal cash back. Only rewards based on the merchant, with no guarantee.

- Fees / Notes: Issuance fee of $10, and foreign transaction and ATM fees. No annual fee.

- Supported Cryptocurrencies: Numerous coins can be converted into spendable balances.

- Primary Regions: Only US

- Other Features: Simple spend cards with a wide range of cryptocurrencies.

BitPay Card Pros & Cons

Pros

- Easy to use prepaid card which is compatible with numerous cryptos.

- No yearly fees.

- Nice response with crypto for deposits.

Cons

- No set high cashback; Instead, it is more merchant/offer‑based rewards.

- There are fees for issuance and ATM.

- Annual fees on foreign transactions (~3%) take away from the value while traveling.

- Only accessible to users in the United States.

8. Venmo Credit Card — Crypto via Venmo with Tiered Cash Back

You can get the Venmo Credit Card for tiered cash back rewards. They offer a credit card with Venmo, and you can spend crypto through the Venmo platform. Rewards/Cashback: You get 3% back on your most spent categories, 2% on the next one, and 1% on the others.

Fees/Notes: No annual fee. Then you also get rewards issued as cash back that are integrated into the app where you can automatically convert it to your selected crypto (BTC, ETH, LTC, BCH, etc.)

Supported Cryptocurrencies: May not be a direct crypto card but cashback rewards can be turned into a major cryptocurrency which Venmo supports. Primary Regions: Us only. Best Nexo Card Alternative: The users who prefer card benefits along with crypto conversion (instead of spending crypto directly) will like this one best.

Venmo Card Features

- Card Type: Regular credit card with a crypto rewards feature.

- Rewards / Cashback: 3 percent, 2 percent, and 1 percent tiers for cash back. Rewards are convertible to Bitcoin, Ethereum, Litecoin, and Bitcoin Cash.

- Fees / Notes: No annual fees

- Supported Cryptocurrencies: Venmo app supports Bitcoin, Ethereum, Litecoin, and Bitcoin Cash.

- Primary Regions: Only US

- Other Features: Normal credit cards with cash back that can be converted into cryptocurrencies.

Venmo Card Pros & Cons

Pros

- Tiered cashback: good rates (3% / 2% / 1%).

- No yearly fees.

- Cashback can be turned into crypto on the app.

- Usual perks of a credit card apply.

Cons

- Not a genuine crypto spending card — it earns cash back that you can convert.

- Only accessible to users in the United States.

- Until converted, rewards are cash back.

- There can be fees to convert to crypto.

9. Fold Credit Card — Bitcoin Rewards Card

The Fold Credit Card (expected launch in 2025‑26) is a Visa Credit Card that gives users one more reason to spend – to earn Bitcoin. Rewards/Cashback: Up to ~3.5% back in Bitcoin on each spend (promotions with certain merchants can even offer more!).

Fees/Notes: Annual fees don’t exist! The only catch is that rewards will go directly to you in Bitcoin; Fold cards will be issued in partnership with Stripe and Visa. Supported Cryptocurrencies: Only Bitcoin is accepted and awarded (spending is on fiat and rewards are in BTC).

Primary Regions: Primarily in the US for the first launch. Best Nexo Card Alternative: Amazing option for people who love Bitcoin and want credit spending with crypto rewards instead of crypto debit.

Fold Credit Card Features

- Card Type: Visa credit card

- Rewards / Cashback: up to 3.5% back in Bitcoin; promo rates may apply

- Fees / Notes: No annual fees; paid in BTC

- Supported Cryptocurrencies: Bitcoin only

- Primary Regions: USA only

- Other: Only US credit card with Bitcoin rewards; Fold knows how to cater to Bitcoin fans

Fold Credit Card Pros & Cons

Pros

- Get rewarded with Bitcoin (3–3.5%+).

- No yearly fees.

- People with a passion for Bitcoin find it appealing since it offers direct crypto rewards.

- Usual perks of a credit card apply.

Cons

- Rewards are only available in Bitcoin (no other tokens).

- Mainly available in the United States.

- You have to pass credit approval.

- Spending is in dollars — crypto is only rewarded.

10. UUpay Debit Card (UPay) — Global Crypto Card with No Fees

The UUpay (UPay) Debit Card is a crypto debit card that has built a reputation for low fees and global accessibility. Rewards/Cashback:** benefits like up to 4% APR rewards features** which is along the lines of rewards than a cashback and of course there are more!

Fees/Notes: No fees for inactivity, international transactions, or every month; Universal acceptance with Visa/MC vendors. Supported Cryptocurrencies: The UPay wallet has BTC, ETH, USDC which are convertible.

The card supports spendable USDT, and other cryptocurrencies that are convertible to USDT. Primary Regions: Global (worldwide availability). Best Nexo Card Alternative: Great for individuals who prefer straightforward and minimal expense speding crypto with additional yields (lower than tiered rewards) instead of higher tiered rewards.

UUpay Debit Card (UPay) Features

- Card Type: Visa crypto debit card

- Rewards / Cashback: No cashback; up to 4% APR with bonus rewards

- Fees / Notes: No monthly fees, inactivity fees, or foreign transaction fees

- Supported Cryptocurrencies: USDT, BTC, ETH, USDC (convertible to USDT for spending)

- Primary Regions: Worldwide

- Other: Apple and Google Pay compatible, low ATM withdrawal fees

UUpay Debit Card (UPay) Pros & Cons

Pros

- No monthly fees, inactivity fees, or foreign transaction fees.

- Accepted globally.

- Earning rewards of ~4% APR and additional bonuses.

- Apple/Google Pay and ATM access.

Cons

- Rewards are not traditional cashback, considering earnings are rewards APR/bonuses.

- spendable crypto support is USDT (with others convertible) and crypto support is spendable.

- Bonuses are more unpredictable than traditional cashback cards.

- Benefits differ based on market and offer structure.

Why Consider Nexo Card Alternatives?

Nexo Offers 8% Cash Back. Alternatives like Wirex and Crypto.com have a higher cash back rate, with their maximum being 2% compared to Nexo.

Fewer Cryptos Availability. Nexo provides fewer tokens than its counterparts, like Bybit and Coinbase, which have dozens of cryptocurrencies available instead.

High Spending Costs. On a day to day basis, Nexo Card costs more to use than BitPay and Venmo, which have lower fees.

Localized. Nexo Cards holds restrictions to only users in Europe. Crypto.com and Wirex are not continent-restricted, offering access to more users.

Fiat Integration. Nexo Card is outdated in comparison to Venmo and UUpay, which have a more modern, integrated transition system between crypto and fiat.

Nexo Is Boring. With Nexo Card, if someone spends money, they will only get cash back. With the Fold, there is a gamification to the spending.

Self-Custodial Wallets. With Nexo and Gnosis Pay, there is less system control and more user control with spendable assets.

Lack Of. Nexo Card lacks partnerships with large companies. Alternative companies like Coinbase Card and Crypto.com Visa do not have this restriction.

Instant Settlements. As a result of blockchain’s rapid processing, the Solana Card provides near-instant settlements, which is a clear advantage over Nexo cards’ slower processing.

Regional Fit. Unlike Nexo, which only operates within Europe, UUpay Debit Card serves the Indian domestic market, offering local benefits, including transit integration.

Conclusion

In 2026, Nexo Card alternatives offer tailored options for crypto users with varying needs. For high-tier cashback and extensive crypto rewards, the Crypto.com Visa and Wirex Cards are perfect.

Bybit and KAST Solana Cards are suited for active traders and stakers. Self-custody advocates are attracted to Gnosis Pay, while everyday crypto users enjoy the Coinbase and BitPay Cards.

Fold and Venmo Cards are credit-focused options that offer cashback conversion to crypto rewards. For low-fee, worldwide convenience, UUpay Debit Card is best. Depending on location, crypto, and rewards, users can choose a specific card.

FAQ

Which card offers the highest crypto rewards?

Crypto.com Visa, Wirex, Bybit, and KAST Solana provide the highest cashback, up to 8–18%, often requiring staking or VIP tiers.

Are these cards available globally?

Most are global (Crypto.com, KAST, UUpay), but some are region-specific (Coinbase, BitPay, Venmo, Fold).

Do they charge annual or foreign transaction fees?

Many cards like UUpay and Wirex have no annual fees; some premium tiers or US-based cards may have FX or ATM fees.

Can I use rewards in crypto?

Yes, most cards offer rewards in crypto, including BTC, ETH, CRO, WXT, or GNO.

Which card is best for self-custody?

Gnosis Pay Card is ideal for self-custodial control.