For someone looking for Best Ogvio Alternatives , it would be platforms that charge less, transfer money quicker, and have a larger coverage in the world.

Digital payments have grown and so have digital services like Wise, Revolut, PayPal/Xoom, and Remitly that compete for the lowest fees and have the most modern features.

People and businesses can send and receive international payments and use these top services to manage their payments. Cross-border transfers have never been easier.

Key Point

| Service | Key Point |

|---|---|

| Wise (formerly TransferWise) | Offers low-cost international transfers using real mid-market exchange rates. |

| Revolut | Provides multi-currency accounts with fast transfers and powerful mobile banking features. |

| PayPal / Xoom | Allows quick global transfers with wide availability and strong buyer protection. |

| Remitly | Focuses on fast remittances with express and economy delivery options. |

| WorldRemit | Supports transfers to bank accounts, mobile wallets, and cash pickup worldwide. |

| OFX | Provides fee-free large international transfers with competitive exchange rates. |

| CurrencyFair | Peer-to-peer exchange marketplace offering cheaper rates for cross-border transfers. |

| Skrill | Digital wallet enabling online payments and international money transfers at low fees. |

| Western Union Digital | Global transfer leader offering digital transfers to cash pickup locations worldwide. |

| Payoneer | Ideal for freelancers and businesses requiring global payments and multi-currency accounts. |

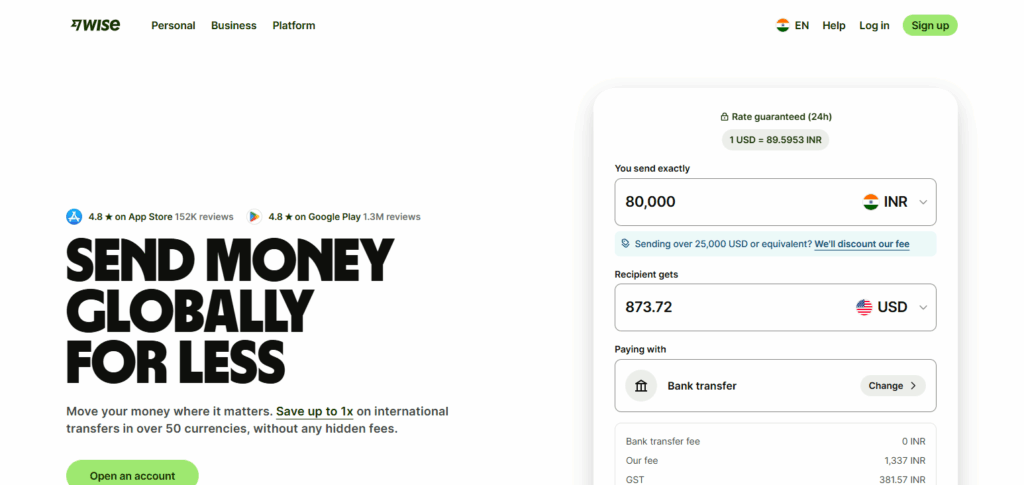

1. Wise

Wise is also a reputable platform that is globally recognized for its transparency and real mid-market exchange rates, making it perfect for low-cost international money transfers.

Clients love the multi-currency account that allows them to spend, receive and convert money in over 40 different currencies. Thus is one of the best OGVIO alternatives. This is ideal for freelancers, remote workers and frequent travelers.

There is also instant transfer for a lot of locations. There are no hidden markups making it a leading platform in the world for less complicated cross-border financial management.

Wise (formerly TransferWise)

Pros:

- There are no hidden markups and the company’s charges are plain and simple.

- There are multi-currency accounts that accept and hold funds in more than 40 currencies.

- Transfer speed is generally instant in some countries.

Cons:

- No cash pick-up option.

- Not the best option if business transfers are in a large amounts.

- In some areas, debit cards are obtainable. In some cases, its availability is delayed.

2. Revolut

Revolut is a digital bank with global transfer options and a global spendable bank account. Revolut allows users to open multi-currency accounts with virtual cards for global spendable accounts. They have automated savings tools and instant overseas money transfers.

Revolut is a finance versatility global ogvio alternative due to travel insurance and crypto, stock, and travel perks. Unsurpassed and easy to mobile bank and exchange money on Revolut. Travelling, money managing, global money sending, and global expense management is easy with Revolut.

Revolut Pros & Cons

Pros:

- There are multi-currency accounts that provide the best rates in the market.

- There is a modern application that is equipped with a cash arranging feature, virtual cards, analytics, and more.

- Currency exchanges in foreign countries either in turkey or instanbul is a target.

- There are advanced options such as crypto and stock trading.

Cons:

- If there are alters to the accounts or there are high amounts of cash in the account, there are fees that apply.

- Customers that are strategic and level 1 to the system may complain if there is no optimized prompt.

- Some privileges are limited by geopolitical situation and fragmentation.

3. PayPal / Xoom

PayPal with Xoom remittance gives global money send at fast. From an appreciated payment partner, it gives ease and reliable global transfer. PayPal Xoom gives instant transfer support and is recognized from best ogvio alternative.

Cash pickup for users, and business account support allows payments on bills for other countries. PayPal Xoom is remittance that allows global money transfer at fast and instant to users.

PayPal / Xoom Pros & Cons

Pros:

- If you are in a hurry to send money to people from over the world, this is the cash system you should be using.

- If you are a trusted internet merchant whose relationship with buyers is straightforward, you should be in a hurry.

- There is Xoom which is a system that allows bank deposit, cash pick up and walmart wallets.

- Online trading platforms and crypto trading are advanced.

Cons:

- If there are advanced options such as crypto and stock trading, there are extra fees.

- There are advanced options such as crypto and online stock trading.

- There are some bank holidays where accounts may be frozen.

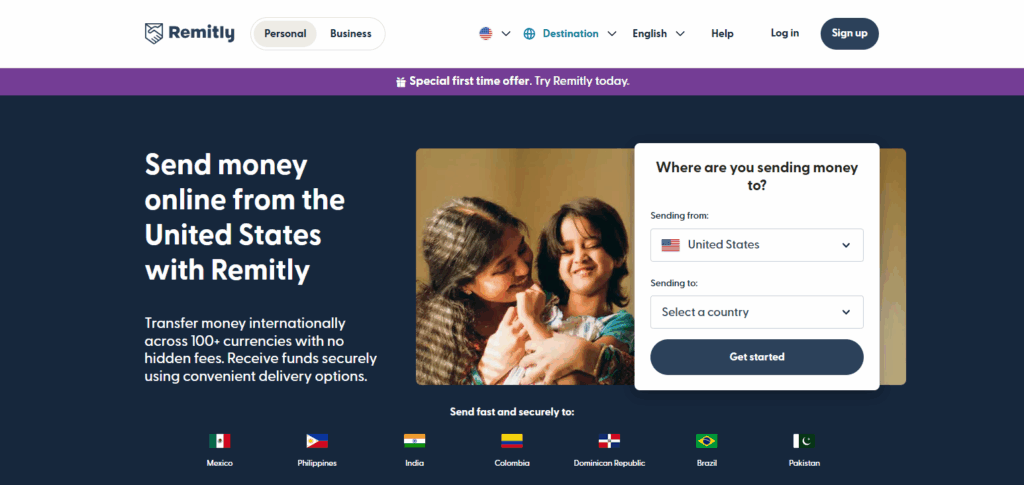

4. Remitly

Remitly specializes in fast and low-cost transfers, with options for Express and Economy. Remitly covers more than 100 countries and offers transfers to bank accounts, mobile wallets, and cash to pickup points.

Remitly has the simplest and fastest on-boarding process in the industry and migrants and their families find it easy to send money to families with the real-time tracking system. Remitly, one of the Best Ogvio Alternatives, is well ahead of competition for speed and reliability in the online remittance industry.

Customers rave about the on-time delivery and customer support which has made Remitly the dominant and preferred service for fast and safe money transfers to their home country.

Remitly Pros & Cons

Pros:

- There are two options of transfers. If you target speed, the Express Economy transfer is the cheaper feature.

- Very good for sending money to lesser developed nations

- Ability to track sending money in real time

- Various ways of receiving payment (money in bank account, cash, cashless payment on phone)

Cons:

- Pricing on fast sending money is very high

- To unlock higher sending money limitations, sending money has to be verified

- Cannot be used to send money to a business

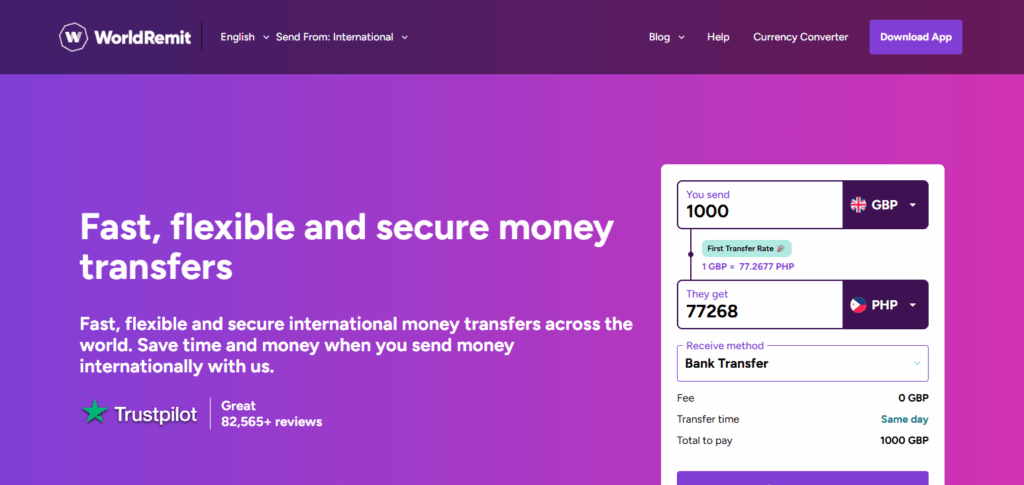

5. WorldRemit

WorldRemit facilitates international money transfers through bank accounts, cash pickup, and mobile deposits, plus offers mobile top-ups and transfers for many established money transfer kiosks.

These services plus popularity, low fees, and speed, make WorldRemit one of the more popular services for personal remittances. WorldRemit operates in more than 130 countries and provides customers the ability to transfer money quickly through their mobile phones and receive notifications.

WorldRemit is known for its security features plus service reliability, and is one of the Best Ogvio Alternatives, because global users, particularly families, travelers, and migrants, prefer their transfer services in more than 130 countries.

WorldRemit Pros & Cons

Pros:

- Large-scale international transactions covering more than 130 countries

- Can send money to a bank account, cash, or cashless payment account

- Can send very small amounts of money

- Very good at sending money fast

Cons:

- Pricing for sending money differs a lot by airport

- No account that can hold multiple currencies

- Very little money can be sent in one transfer

6. OFX

Offering zero transfer fees and competitive exchange rates, OFX specializes in big international funds transfers. This is quite beneficial for both companies and individuals who need to transfer large sums of money across borders.

OFX is one of the Best Ogvio Alternatives for expensive transfers. Safeguarded transactions, tailored services for corporate customers, and OFX’s global network give the users safe and compliant transfers.

Excellent Rate locks and tools for managing currency risks make OFX reliable for all users whether they are personal or business customers.

OFX Pros & Cons

Pros:

- No cost for sending money

- Best option to transfer large amounts of money

- Support available always

- Strong controlling of money sent and money exchanged at a different value

Cons:

- No immediate small money transfers (there is a minimum money transfer that applies)

- No option available to get cash immediately

- To see how many different value of money can be exchanged, an account must be made

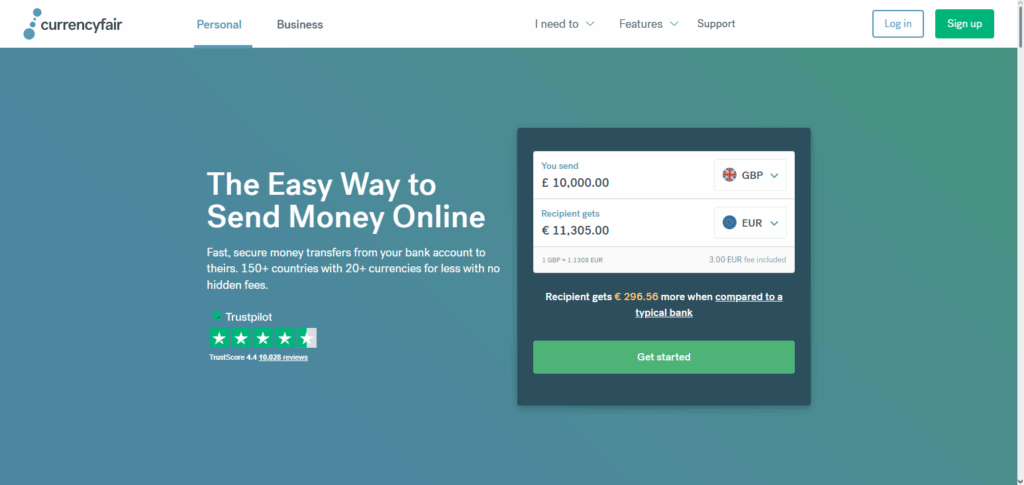

7. CurrencyFair

CurrencyFair is one of the Best Ogvio Alternatives for individuals who want low cost international money transfers within all its other beneficial services. This peer-to-peer exchange marketplace is a platform that lets users choose an exchange rate they want, and for a much lower cost than a bank.

It is multi-currency accounts, and has competitive rates, fast settlements, and low costs, which is particularly advantageous to expatriates, freelancers, and international property owners. Still, for long-term and global transactions, this continues to be a good alternative because of secured operations, clear-cut pricing, and exchange matching.

CurrencyFair Pros & Cons

Pros:

- Marketplace that allows individual people to send money to one another for very little cost

- Pricing on sending money and cost of different money is very competitive

- Can pick how much value the money can be exchanged for

- Can hold multiple currencies at once.

Cons:

- Cannot send money to all people in all countries

- Transferring of money can take a long time because people have to agree on how much value money can be exchanged for.

- Currency availability is limited in comparison to Wise or Revolut.

8. Skrill

Skrill provides a digital wallet which allows international transfers, online purchases, and the ability to buy cryptocurrency. It is also widely used in eCommerce, gambling, and quick cross-border expenditures.

Skrill also has a prepaid card and cheaper transfer rates which enable flexibility for those wanting to move their money. Out of the Best Ogvio Alternatives, Skrill is the most flexible option as it is simple to use, has a secure wallet, and is accepted all over the world.

Users are able to transfer money internally without fees which gives Skrill an incredible versatility to meet everyday needs.

Skrill Pros & Cons

Pros:

- Instant transfers available to most destinations.

- Good for online payments and gaming services.

- Includes prepaid Mastercard for consumer spending.

- Digital wallet is fast and easy to navigate.

Cons:

- Transferring and withdrawing money will incur significant fees.

- There is a lack of transparency in how the fees were created.

- New account holders may be subject to restrictions on their account.

9. Western Union Digital

Western Union Digital gives you the online version of the biggest money transfer. It enables quick cross-border transfers to bank accounts, mobile wallets, and cash pickup locations in over 200 countries.

It is also the most trusted and reliable option. Digital convenience has never been easier. It is also one of the Best Ogvio Alternatives for those needing versatile transfer methods.

Funds can be sent instantly and WU has a pretty good trust rating. It is one of the most popular remittance services in the world which gives it a good rating.

Western Union Digital Pros & Cons

Pros:

- More than 200 countries for international transactions.

- Offers various options for receiving money, including cash.

- Instant transfers available for some countries.

- Well-known and respected company for international payments.

Cons:

- More expensive than the modern competitors for digital transfers.

- You can lose money through the exchange, as the U.S. dollar is worth more than most.

- There are restrictions on how much money can be transferred each day.

10. Payoneer

International companies, eCommerce sellers, and freelancers utilize Payoneer, an effective worldwide payment system, as an optimal payment systems. It enables low-cost international withdrawals, and provides access to multi-currency accounts and worldwide mass payouts.

Payoneer is especially effective as a payment processor, and simplifies payment collection from abroad due to its partnerships with Upwork, Fiverr, and Amazon. In addition to business-oriented resources, Payoneer is one of the most effective Best Ogvio Alternatives.

Clients can manage and convert their money, and execute compliant and secure financial transactions while easily moving their funds. Payoneer is efficient for international financial management, payouts, and earnings.

Payoneer Pros & Cons

Pros:

- Good option for freelancers, businesses, and international transfers.

- Customers can open an account in multiple currencies and receive a digital account number.

- Links to international sites, such as Amazon, Fiverr, and Upwork.

- Low-cost withdrawals to banks in any country.

Cons:

- Personal money transfers are discouraged.

- A fee is charged every year to keep the card active.

- Not as good as Wise for currency exchange.

Conclusion

What Ogvio alternatives are the best is determined by what kind of transfers you need, but the suggested options are strong and inexpensive to execute global payments.

For example, Wise and Revolut offer cheap global transfers with relatively new multi-currency accounts, PayPal/Xoom, Remitly, and WorldRemit are slightly better with fast remittances and overall global coverage. For larger sized payments, OFX and CurrencyFair are great on value.

On the other hand, Skrill, Western Union Digital, and Payoneer focus on providing business accounts and versatile digital wallets. For any global payments, you now have convenient, inexpensive, and safe Ogvio alternatives.

FAQ

What are the best Ogvio alternatives for low fees?

Wise and CurrencyFair are among the best for low-cost transfers because they use transparent fees and competitive exchange rates with no hidden markups.

Which Ogvio alternative is fastest for international transfers?

PayPal/Xoom, Remitly (Express), and WorldRemit often deliver money within minutes, making them the fastest options.

Which platform is best for large international transfers?

OFX is ideal for high-value transfers thanks to its zero-fee model, strong exchange rates, and 24/7 expert support.

What is the best Ogvio alternative for businesses or freelancers?

Payoneer is the top choice for freelancers, eCommerce sellers, and global businesses due to its multi-currency accounts and mass payout options.

Which service offers the most global reach?

Western Union Digital covers over 200 countries and offers cash pickup, bank transfers, and mobile wallet delivery.