Choosing the Best PayPad Crypto Alternatives has become vital for businesses and individuals seeking safe, low‑fee, and globally accessible payment solutions.

Platforms like Cash App, Coinbase Commerce, Binance Pay, NOWPayments, and others offer special advantages including multi-currency compatibility and privacy-focused gateways as the use of cryptocurrencies grows.

This guide examines the leading options to help you determine which one best suits your requirements for flexibility, compliance, and smooth cross-border transactions.

What is PayPad Wallet?

PayPad Wallet was created by PayPad Online Ltd to be a modern, all-in-one, digital wallet where users can manage their entire finances in one place. PayPad Wallet allows users to receive and send payments, make purchases, save, and invest, all in one place.

Customers can manage their money with flexible, hassle-free, seamless transactions on their smartphones. PayPad Wallet partners with various other payment systems and facilitates quick and easy money transfers and payments.

The platform streamlines daily payment activities for businesses and users alike. For users with more complex money managing needs, PayPad Wallet allows direct cash withdrawals and offers multiple payment options. The platform was built with financial data security to protect customers with flexible money managing needs in 2026.

Key Point

| Platform Name | Description |

|---|---|

| Cash App | U.S. digital wallet offering peer-to-peer transfers, Bitcoin buying and selling, plus integrated debit card access for everyday payments. |

| Coinbase Commerce | Merchant-focused crypto payment solution supporting multiple cryptocurrencies with easy integration for e-commerce platforms. |

| Krak (by Kraken) | Global peer-to-peer payments app enabling both crypto and fiat transfers across more than 100 countries worldwide. |

| Binance Pay | Contactless, borderless crypto payment system supporting many tokens with zero transaction fees for users. |

| NOWPayments | Crypto payment gateway featuring low fees and simple integration for online stores accepting digital assets. |

| CoinGate | Crypto payment processor allowing merchants to accept payments and convert crypto into fiat currencies easily. |

| Samsung Wallet | All-in-one mobile wallet combining digital payments with built-in crypto asset support and security features. |

| Blockonomics | Non-custodial crypto payment processor enabling direct wallet-to-wallet Bitcoin payments for merchants. |

| BTCPay | Open-source, decentralized crypto payment platform offering full transaction control without third-party involvement. |

| SpicePay | Versatile crypto processor providing invoicing, real-time currency conversion, and global payout support for businesses. |

1. Cash App

Founded in 2013 and based in the United States, Cash App was created by Block, Inc, and is a mobile wallet service where users can perform peer-to-peer transactions, trade in Bitcoin, and use a debit card.

Cash App has instanst transfer fees that equal 1.5 % of the transfer, they also have Bitcoin transfer fees that vary. Cash App only supports USD and Bitcoin, and primarily serves the United States market.

Customer support through the app and email, however, it has been noted that response times can vary and take a while.

Cash is considered to be on of the most advisable PayPad crypto alternatives as it is best suited for individuals and smaller size businesses that reside in the United States that need to easily and efficiently Bitcoin integrated into their banking.

Cash App Features

- Founded: 2013, Block Inc.

- Key Features: Peer-to-peer transfer, buy and sell Bitcoin, Debit cards.

- Currencies Accepted: USD and Bitcoin.

- Region: USA, and the UK.

- Customer Service: In-app chat, email, and help center.

- Highlight: Facilitates Bitcoin payment acceptance for small entities.

Cash App Pros & Cons

Pros

- Peer-to-peer Bitcoin trading for starters.

- Spending your Bitcoin using Cash App’s Debit Card is easy.

- Cash App’s fees are great. For people and small businesses budgets.

Cons

- Cash App is a Bitcoin-only platform. No alternative coins.

- Cash App is a US-UK App only.

- Cash App is a Bitcoin-only platform. Slow response to support requests.

2. Coinbase commerce

Alongside the creation of Coinbase in 2012, Coinbase commerce was created. Coinbase commerce became functional in 2018 and allows crypto payments to be accepted by merchants worldwide.

Transaction fees for coinbase commerce are 1%, however they automatically convert to USDC to control for adversity.

For the most part, Coinbase commerce has approximately 100 countries where it can operate. Convenient, timely customer services are available through a help search, queue system, and for enterprise users, live chat.

Coinbase Commerce stands as the top competitor for PayPad as it provides the services needed for global merchants such as the ability to convert payment options to fiat, an ecommerce integrations, and having a compliance ready infrastructure.

Coinbase Commerce Features

- Founded: 2018, 2012 for parent company Coinbase.

- Key Features: Crypto sales merchant checkouts, automatic USDC conversion, and API.

- Currencies Accepted: USDC, Bitcoin, Ethereum, and the major coins.

- Region: 100+ countries.

- Customer Service: Help center with ticketing, live chat for enterprises.

- Highlight: Excellent for global merchants needing fiat conversion.

Coinbase Commerce Pros & Cons

Pros

- Coinbase Commerce Trading platform supports Bitcoin, Ethereum, and USD Coin.

- Automatic switch of crypto to stable coin and USD Coin to is available.

- Coinbase Commerce customer support is the best.

Cons

- Exchanges are charged a Coinbase Commerce fee. 1%.

- All countries don’t have merchant services.

- Only ticket support is available, and they don’t have responsive customer support that I’m happy with.

3. Krak (by Kraken)

In 2025, Krak was launched and it Krakens first mobile application. The Krak app enables users to send and receive funds, whether it be in crypto or fiat. Krak users can send and receive money without most of the typical fees, as the app has almost zero transaction fees.

The platform is usable in a multitude of countries, over 160, allowing the platform a large reach. For the Krak platform, customer assistance is built into the mobile application chat and is also available through Kraken’s traditional support system.

As a PayPad alternative, Krak is one of the most compliant mobile money transfer applications in the market.

Krak Features

- Founded: 2025, Kraken started in 2011.

- Key Features: Global money transferring app, incredibly low fees, crypto and fiat transfers.

- Currencies Accepted: 300+ crypto assets, stablecoins, and other fiat currencies.

- Region: 160+ countries.

- Customer Service: Kraken help desk and integrated chat.

- Highlight: Best for instant, low fee cross-border payment.

Krak (by Kraken) Pros & Cons

Pros

- Because there are virtually no transfers, this is a great feature.

- More than 300 assets are featured (crypto + fiat) on this platform.

- Support for 160+ countries.

Cons

- This product copy is new. Launched in 2025. Still a work in progress.

- For the full feature set, you do need a Kraken account.

- Older payment gateways have more integration and customer support.

4. Binance Pay

Binance Pay functions got started in 2021. It is one of the most popular functions in the Binance ecosystem, especially as it is one of the few platforms to offer users free crypto transactions.

The platform has an extensive crypto list as it supports 200+ cryptocurrencies, making it usable for sends and payments. Binance Pay is also one of the most marketable platforms, available in almost every country in the world, with a few restrictions on certain countries.

For customer service, the platform also has a live chat support system, ready to assist with any challenges, 24/7. Binance is one of the most popular PayPad alternatives for merchants as it integrates with Binance’s broader services allowing for a seamless transaction experience with other platforms in the ecosystem.

Binance Pay Features

- Founded: 2021

- Key Features: Free crypto payments, payment integration with Binance, and a QR checkout.

- Currencies Supported: 200+ cryptocurrencies.

- Regions: Global except restricted jurisdictions.

- Customer Support: 24/7 live chat and email.

- Highlight: Best for traders and merchants leveraging Binance’s reach.

Binance Pay Pros & Cons

Pros

- SDK payment integration only with Binance Pay.

- Access to all 200+ cryptocurrencies.

- Enjoy payment-free crypto transactions.

- Binance470 ecosystem has been incorporated into services for crypto payments.

Cons

- Several Binance Pay features are available to a limited number of users.

- Binance Pay integration is required.

- Support for customers is overworked, and we are sorry for that.

5. NOWPayments

NOWPayments was established in 2019 by ChangeNOW, is a crypto payment gateway and is also uncustodial. There is a 0.5% fee for single currency transactions and 1% fee for multi currency transactions.

The platform is best for businesses needing a variety of different cryptos, automatic transactions, and providing users with a non-custodial merchants \ transactions. It supports 200+ different cryptocurrencies and operates internationally, with great retention of customers in Europe.

Customer support involves live chats, emails and aclarative API documentation. As a best PayPad crypto alternative NOWPayments best fits businesses requiring different forms of cryptos, automatic transactions and providing merchants with non-custodial transactions.

NOWPayments Features

- Founded: 2019 by ChangeNOW.

- Key Features: Non‑custodial gateway, automatic conversions, recurring billing.

- Currencies Supported: 200+ cryptocurrencies.

- Regions: Global, strong in Europe.

- Customer Support: Live chat, email, API docs.

- Highlight: Flexible crypto support with low fees (0.5–1%).

NOWPayments Pros & Cons

Pros

- NOWPayments is a popular payment gateway.

- An easy-to-use interface 200+ cryptocurrencies.

- Simple billing and auto billing.

Cons:

- Higher fees than some competitors (0.5-1%).

- More focus on Europe than Asia and the Middle East.

- Technical setup required to integrate APIs.

6. CoinGate

CoinGate was established in 2014 in Lithuania, with over 70 cryptocurrencies including Bitcoin, stablecoins, and Ethereum. It features a 1% transaction fee with fiat conversion of EUR. It is available in 150+ countries, but there are no merchant services in the USA.

Customer support spans emails, ticket support, as well as account managers for enterprise customers. For European merchants and SaaS, providing a subscription with crypto payments, and for those needing consistent billing, best PayPad crypto alternative has suitable options.

CoinGate Features

- Founded: 2014 in Lithuania.

- Key Features: Merchant tools, API, recurring billing, gift cards.

- Currencies Supported: 70+ cryptocurrencies.

- Regions: 150+ countries (not U.S. merchants).

- Customer Support: Email, ticketing, account managers.

- Highlight: Strong for European SaaS and subscription businesses.

CoinGate Pros & Cons

Pros:

- More than 70 supported coins.

- Includes recurring billing and gift cards.

- Has a strong presence in the European market.

Cons:

- Merchant services are unavailable in the U.S.

- 1% fee per transaction.

- Underwhelming customer service outside Europe.

7. Samsung Wallet

Samsung Wallet was released in 2022 and in 2025 incorporated crypto sub custody. The support for Europe, India, the U.S. and other regions is a great add as transfers are generally free.

User support is provided through Samsung Participatory framework. Crypto and payments are merged with virtual id.

For Galaxy users, Samsung Wallet is integrated in the mobile ecosystem and offers the most secure option for crypto and fiat payment transactions, making it the the best PayPad crypto alternative.

Samsung Wallet Features

- Founded: 2022 (expanded 2025).

- Key Features: Mobile wallet integrating payments, IDs, crypto storage.

- Currencies Supported: Bitcoin, Ethereum, ERC‑20 tokens.

- Regions: U.S., Europe, India, and more.

- Customer Support: Samsung Members app, online chat.

- Highlight: Secure, device‑integrated solution for Galaxy users.

Samsung Wallet Pros & Cons

Pros:

- Built directly into Samsung devices.

- Secure storage for crypto and IDs.

- Compatible with Bitcoin, Ethereum, and most ERC-20 tokens.

Cons:

- Only available to Samsung users.

- Varies by region.

- Customer service available only through the Samsung Members app.

8. Blockonomics

As a decentralized Bitcoin payment gateway, Blockonomics has a 1% fee with direct wallet-to-wallet payments and is based in India. Blockonomics is Bitcoin only.

There is strong merchant adoption in Asia, most of the world, and there is decreased direct support via tickets and forums.

As a best PayPad crypto alternative Blockonomics is the go to payment system for businesses who want Bitcoin payments directly to their wallets without the intermediatary KYC, privacy or decentralization.

Blockonomics Features

- Founded: 2015 in India.

- Key Features: Decentralized Bitcoin gateway, direct wallet‑to‑wallet payments.

- Currencies Supported: Bitcoin only.

- Regions: Global, strong adoption in Asia.

- Customer Support: Support through ticketing, forums, and community help.

- Highlight: Supports Bitcoin payment without permission and with extreme focus on privacy.

Blockonomics Pros & Cons

Pros:

- Decentralized, direct wallet-to-wallet payments.

- Has a global reach and is widely used in Asia.

- Easy for merchants to set up.

Cons:

- Only supports Bitcoin.

- 1% fee per transaction.

- Less formal community-driven support.

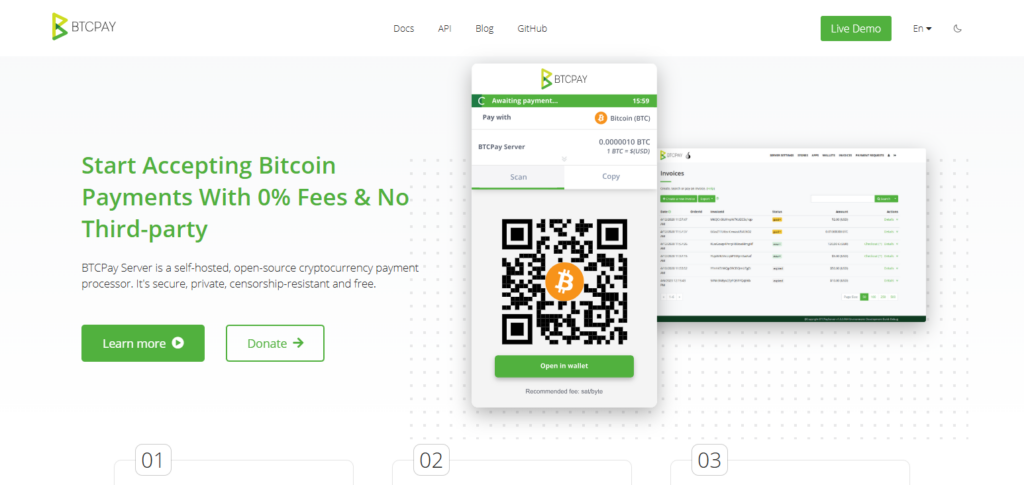

9. BTCPay Server

As a self-hosted open-source payment processor, BTCPay Server has been around since 2017. There are zero fees aside from the usual blockchain network costs, and it has support for Bitcoin (on-chain and Lightning) as well as several altcoins.

Merchants are empowered to launch and manage their own servers. Support is community based via GitHub, Mattermost, and Telegram for all best PayPad crypto alternative BTCPay focuses on privacy and offers merchants the ability to control their crypto payment system without third party payment gateways.

BTCPay Server Features

- Founded: 2017. It is an open-source project.

- Key Features: Offers self-hosting, open-source, and supports the Lightning Network.

- Currencies Supported: Bitcoin and a few select altcoins.

- Regions: No restrictions worldwide; self-hosted.

- Customer Support: Assistance through a community on GitHub, Mattermost, and Telegram.

- Highlight: No fees are involved, and merchants have complete control, with a privacy-first focus.

BTCPay Server Pros & Cons

Pros:

- Open-source, self-hosted, with complete control.

- Only fees are blockchain transaction fees.

- Supports the Lightning Network for fast BTC payments.

Cons:

- Some technical skills needed to set it up.

- Little support for other coins.

- No support team, only the community can help.

10. SpicePay

SpicePay provides Bitcoin exchange and merchant services. SpicePay is based in New York and has been around since 2009.

The cost would be 1% for each transaction. Withdrawal methods include BTC, USD, PayPal, WebMoney, and bank transfers. It interfaces with Bitcoin and some altcoins. It is aimed at customers and clients around the world.

Help is available via emails and tickets. As the best PayPad crypto alternative, SpicePay is strong for businesses needing flexible withdrawal options, long-standing crypto expertise, and integration with traditional payment rails.

SpicePay Features

- Founded: 2009 and located in New York City.

- Key Features: Offers integration of Bitcoin exchange, merchant services, and flexible options for withdrawals.

- Currencies Supported: Bitcoin and a few select altcoins.

- Regions: Supports users globally.

- Customer Support: Contact support through email or ticketing system.

- Highlight: One of the oldest crypto processors; offers fiat withdrawals through PayPal, WebMoney, or a bank transfer.

SpicePay Pros & Cons

Pros:

- crypto processor active since 2009.

- Various withdrawal methods available (BTC, USD, PayPal, WebMoney, bank).

- Offers services to merchants in all countries.

Cons:

- Mostly supports Bitcoin (and only limited altcoins).

- Each transaction incurs about 1% fees.

- Customer service only provided via email/tickets.

Why Users Seek Alternatives?

Excessive Fees

Users find alternatives because of high transaction costs, and even small payments over time become very expensive because of hidden fees and transaction costs.

Lack of Support

Such wallets draw criticism from users because of the absence of functionality, as a large number of wallets support only a limited number of coins and networks, and also tokens that are very important from the perspective of flexibility and efficiency when managing payments and diversified portfolio offerings.

Missing Custom Experience

Because of the absence of control over daily online transactions, withdrawal of funds, and even the private keys that users themselves do not have.

Lack of Helpful User Experience

Users also experienced the absence of such important factors in the adoption of the platform as the absence of constructive user experience, slowdown of technological complex processes, and frictionless payments.

Lack of Support in some Geographic Regions

Users are forced to switch because of the absence of support in specific countries. Some wallets simply do not support specific countries, and this absence forms a lack of control over the associated banking.

Conclusion

Your focus, area of operation, business model, and payment preferences will assist in determining the best PayPad crypto alternative for your business. For merchants that need payment in multiple currencies and are operating globally, Binance Pay, NOWPayments, and Coinbase Commerce are ideal. Individuals looking for convenience will prefer Cash App and Samsung Wallet.

Also, for Blockonomics and BTCPay Server, privacy is the focus. Enterprises with a need for scalable solutions, manage compliance and can use SpicePay or Krak (by Kraken). With this, people and companies can pay and receive crypto in a cost-effective manner and manage their payments with the convenience and flexibility that comes with the tools.

FAQ

What are PayPad crypto alternatives?

PayPad crypto alternatives are platforms like Cash App, Coinbase Commerce, Binance Pay, NOWPayments, CoinGate, Samsung Wallet, Blockonomics, BTCPay Server, SpicePay, and Krak (by Kraken) that allow businesses and individuals to send, receive, and manage cryptocurrency payments securely.

Which PayPad alternatives are best for merchants?

Coinbase Commerce, Binance Pay, NOWPayments, and CoinGate are best for merchants because they support multiple cryptocurrencies, offer fiat conversion, and integrate easily with e‑commerce platforms.

Which alternatives are best for individuals?

Cash App and Samsung Wallet are ideal for individuals since they provide simple interfaces, mobile integration, and easy access to Bitcoin and other tokens.

Are there privacy‑focused PayPad alternatives?

Yes. Blockonomics and BTCPay Server are privacy‑focused solutions. They allow direct wallet‑to‑wallet payments or self‑hosting, ensuring merchants retain full control without intermediaries.

Which alternatives have the widest global coverage?

Krak (by Kraken), Binance Pay, and NOWPayments offer the widest reach, supporting 150+ countries and hundreds of currencies.

Can I withdraw crypto into fiat with these alternatives?

Yes. Platforms like Coinbase Commerce, Cash App, and SpicePay allow conversion to fiat currencies or withdrawal via bank transfer, PayPal, or cards.