Businesses and individuals are increasingly using cryptocurrency payments in today’s rapidly changing digital economy due to their speed, security, and worldwide reach. Although Best PayPal Crypto Checkout Alternatives checkout, many people are looking for better choices due to its restrictions in terms of coin support, fees, and flexibility.

The top PayPal cryptocurrency checkout options, such as Coinbase Commerce and Binance Pay, provide cheaper prices, more extensive integrations, and cutting-edge capabilities, enabling retailers to embrace international transactions and future-ready payment options confidently.

What is PayPal?

PayPal, a digital payment platform, was created in 1998, and is present in almost all the countries in the world. PayPal’s headquaters is in San Jose California, and is a digital payment system that lets you shop, pay and receive payments online, without disclosing any sensitive financial information.

PayPal lets buyers link their credit and debit cards and bank accounts, and alerts sellers of payments in real time. PayPal processes over 8 billion transactions per year.

PayPal’s fraud protection, ease of use, and security have made the platform one of the first and most recognized digital payment systems and therefore a leader in online transactions.

Best PayPal Crypto Checkout Alternatives

| Platform | Key Features |

|---|---|

| Coinbase Commerce | Accepts multiple cryptos, easy integration, non-custodial |

| BitPay | Supports Bitcoin & stablecoins, prepaid cards, invoicing |

| NOWPayments | 250+ coins, auto-conversion, recurring payments |

| CoinGate | Accepts BTC, ETH, LTC, stablecoins, gift cards |

| Crypto.com Pay | Cashback rewards, instant settlement, app ecosystem |

| Binance Pay | Zero fees, global reach, wallet-to-wallet |

| BTCPay Server | Fully open-source, self-hosted, no fees |

| Strike | Lightning Network payments, USD conversion |

| OpenNode | Lightning + on-chain BTC, fiat settlement |

| TripleA | Licensed in Singapore, instant settlement, global reach |

1. Coinbase Commerce

With 1% transaction costs, Coinbase Commerce provides businesses with an easy option to accept cryptocurrency worldwide. With quick settlement and volatility-free conversions to USDC, it supports Bitcoin, Ethereum, USDC, and other currencies.

It is perfect for e-commerce since merchants can quickly link with WooCommerce, Shopify, and custom APIs. Coinbase Commerce is reputable for its dependability and compliance and is accessible in more than 100 countries.

It offers a safe, non-custodial payment gateway, eliminates chargebacks, and lowers operating expenses, making it one of the greatest PayPal crypto checkout options.

Coinbase Commerce Features

- Pricing: 1% of each sale

- Supported Cryptos: Bitcoin, Ethereum, and USD Coin.

- Collaborations: Available with Shopify, WooCommerce, and custom API’s

- International Presence: Global coverage

- Differentiating Element: Merchants easily withdraw funds, Coinbase remains the brand merchant can trust.

Coinbase Commerce Pros & Cons

| Pros | Cons |

|---|---|

| Trusted brand backed by Coinbase | 1% transaction fee (higher than some competitors) |

| Non-custodial, merchants control funds | Limited fiat settlement options |

| Easy integrations with Shopify, WooCommerce, APIs | Fewer supported coins compared to NOWPayments |

| Global availability in 100+ countries | Requires Coinbase account for some |

2. BitPay

BitPay offers a payment solution with daily payouts with a transaction fee of 1-2% and $0.25 per transaction. They accept Bitcoin (BTC), Ethereum (ETH), and some altcoins (e.g. Litecoin (LTC), Dogecoin (DOGE)) and stablecoins (e.g. USDC). They support $USD, $GBP, and $EUR payments with daily liquidation.

BitPay offers invoices, donation options, and QuickBooks synchronization, which streamlines processes for both retail businesses and nonprofits. BitPay has a prepaid MasterCard that merchants can use to spend cryptocurrency for points of sale.

They are most suited for crypto merchants in need of fraud protection and a crypto to fiat conversion, and who value the prepaid card spending option. BitPay is a crypto alternative to PayPal at points of sale. They are best suited for merchants who need to accept crypto as payment.

BitPay Features

- Pricing: Approximately 1% plus $0.25 to process each sale

- Supported Cryptos: All forms of USD pegged, and Ethereum.

- Collaborations: Integration with QuickBooks, Magento, WooCommerce, and donation tools

- International Presence: Primarily worldwide with USD, Euro, and GBP

- Differentiating Element: Crypto to fiat, and also fraud protection and prepaid mastercard.

BitPay Pros & Cons

| Pros | Cons |

|---|---|

| Supports BTC, ETH, LTC, DOGE, stablecoins | Fees ~1% + $0.25 per transaction |

| Strong fiat settlement in USD, EUR, GBP | Custodial model (BitPay controls funds until settlement) |

| Integrations with QuickBooks, Magento, WooCommerce | Limited coin support compared to NOWPayments |

| Prepaid Mastercard for spending crypto | KYC requirements may deter small merchants |

3. NOWPayments

With fees as low as 0.5–1%, NOWPayments is a non-custodial gateway that supports more than 300 coins. With automatic translation to stablecoins, regular billing, and instantaneous transfers, it facilitates international payments.

Shopify, WooCommerce, and API plugins are examples of integrations that make it simple for small and medium-sized enterprises. There are no monthly fees or chargebacks, and country assistance is available everywhere.

NOWPayments, one of the top PayPal crypto checkout options, is perfect for businesses looking for affordable, international payments and flexibility in accepting a variety of digital assets while keeping complete control over the money.

NOWPayments Features

- Pricing: 0.5-1%

- Supported Cryptos: Support for 300+ crypto currencies

- Collaborations: Available with Shopify, WooCommerce, and API plugins

- International Presence: Global, with no custody

- Differentiating Element: Automatic stablecoin, with the merchant funds that are recurring and full control.

NOWPayments Pros & Cons

| Pros | Cons |

|---|---|

| Supports 300+ cryptocurrencies | No direct fiat settlement (crypto-only payouts) |

| Low fees (0.5–1%) | Merchants must manage volatility themselves |

| Non-custodial, full merchant control | Less brand recognition than Coinbase or Binance |

| Integrations with Shopify, WooCommerce, APIs | Requires technical setup for advanced features |

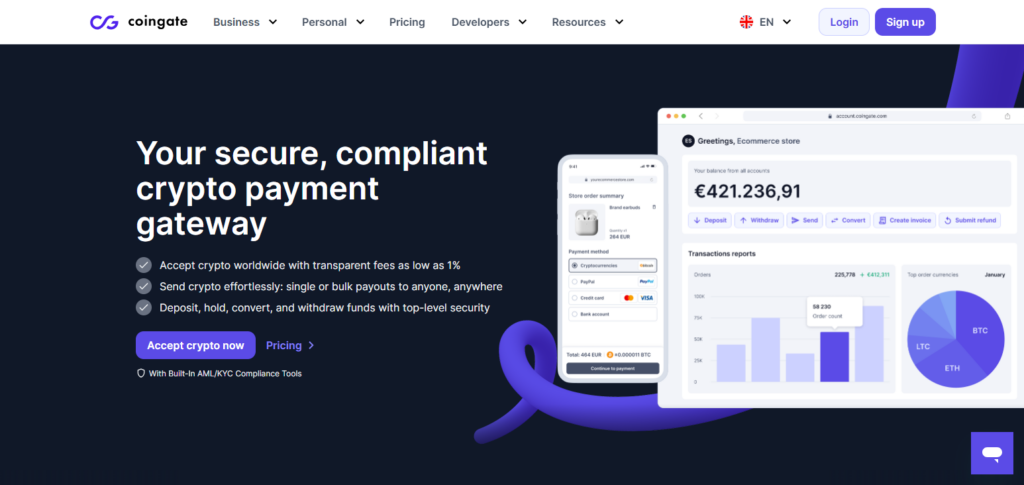

4. CoinGate

CoinGate charges a 1% processing fee. This fee covers both Bitcoin, Ethereum, and Litecoin and all stablecoins. Merchants can settle through a crypto or fiat through SEPA and international bank transfers, which is common in Europe.

Integrations comprise of Magento, WooCommerce, and personal APIs and have straightforward, automated checkout conversions. Operating in 100 countries, CoinGate is a decent PayPal crypto checkout alternative for digital products, gift cards and e-commerce.

It stands out in transparent pricing, easy compliance and ease of work among other competitors looking to accept crypto and settle seamlessly and in fiat.

CoinGate Features

- Pricing: 1%

- Supported Cryptos: Bitcoin, Ethereum, Litecoin, and stablecoins

- Collaborations: Available integration with Magento, WooCommerce, and API to implement checkout

- Global Reach: Large presence in Europe, allows for SEPA transfers

- Unique Strength: Gift card marketplace and fiat settlement via bank transfer

CoinGate Pros & Cons

| Pros | Cons |

|---|---|

| Flat 1% fee | Primarily focused on Europe |

| Supports BTC, ETH, LTC, stablecoins | Smaller coin selection than NOWPayments |

| SEPA and bank transfer fiat settlement | Limited integrations compared to BitPay |

| Gift card marketplace adds utility | Less global adoption outside EU |

5. Crypto.com Pay

Crypto.com Pay offers 0% merchant fees and cashback in the form of CRO tokens. It has 300+ cryptocurrencies loaded and synced with the Crypto.com App for quick settlement. Merchants can use Pay Checkout, pay via link, or scan QR codes, suitable for websites and in-person stores.

Available worldwide, it has the strongest presence in Asia and Europe. As an alternative to PayPal Crypto Checkout, Crypto.com Pay is perfect for retail merchants with crypto spending customers who appreciate cashback offers, loyalty program rewards, and effortless onboarding to a vast cryptocurrency ecosystem.

Crypto.com Pay Features

- Fees: 0% fees paid by merchants

- Supported Assets: Over 300 coins in the cryptocurrency space

- Integrations: Crypto.com App, QR Code Payments, Pay-by-link

- Global Reach: Gained traction in Asia and Europe, now growing in other parts of the world

- Unique Strength: Ecosystem of loyalty with CRO tokens and cashback rewards

Crypto.com Pay Pros & Cons

| Pros | Cons |

|---|---|

| 0% merchant fees | Rewards tied to CRO token (volatile) |

| Cashback incentives for users | Requires Crypto.com ecosystem adoption |

| Supports 300+ cryptocurrencies | Limited fiat settlement options |

| Easy QR code and pay-by-link checkout | Stronger in Asia/Europe, less in US |

6. Binance Pay

Binance Pay supports hundreds of cryptocurrencies and allows wallet-to-wallet payments at no cost. With rapid settlement and integrations through UniPayment and APIs, merchants may reach over 40 million Binance users.

Although it is governed by regional laws, country support is worldwide. P2P transfers, online checkout, and QR codes are among the payment options.

Binance Pay is the ideal option for companies seeking access to Binance’s ecosystem and worldwide reach as a cryptocurrency checkout substitute for PayPal.

It is a potent option for retailers looking for affordable cryptocurrency acceptance across the globe because of its scalability, zero fees, and well-known brand.

Binance Pay Features

- Fees: No fees

- Supported Assets: Hundreds of various cryptocurrency options

- Integrations: UniPayment, various APIs, wallet-to-wallet instant checkout

- Global Reach: Over 40 million Binance customers globally

- Unique Strength: QR payments, instant settlement, and a big customer base

Binance Pay Pros & Cons

| Pros | Cons |

|---|---|

| Zero fees | Subject to regional restrictions (not available everywhere) |

| Access to 40M+ Binance users | Custodial model tied to Binance wallet |

| Supports hundreds of coins | Regulatory uncertainty in some countries |

| Instant settlement, QR code payments | Requires Binance account for both parties |

7. BTCPay Server

BTCPay Server is an open-source processor with no fees best for self-hosting for full control of crypto payments. Because payments go directly into merchants’ wallets.

It supports over 100 coins including Bitcoin and Ethereum and works with WooCommerce and Shopify as well as other APIs. Its decentralized nature makes it censorship resistant and is applicable to all country support globally.

There are several payment options including POS apps, invoices, and crowdfunding utilities. For privacy-centric merchants, BTCPay Server is simply the best for freedom and no third party involvement as well as full control over your crypto payments all while avoiding the hidden costs.

BTCPay Server Features

- Fees: 0% (Open-source and self-hosted)

- Supported Assets: BTC, ETH and 100+ different types of coins

- Integrations: WooCommerce, Shopify, and various custom APIs

- Global Reach: Fully decentralized and can be used anywhere

- Unique Strength: Total control to merchants, censorship resistant, and privacy-first

BTCPay Server Pros & Cons

| Pros | Cons |

|---|---|

| 0% fees, open-source | Requires technical setup and hosting |

| Merchants retain full control | No fiat settlement (crypto-only) |

| Supports BTC, ETH, 100+ coins | Less user-friendly for non-technical merchants |

| Privacy-first, censorship-resistant | No customer support (community-driven) |

8. Strike

Strike enables businesses to support rapid Bitcoin payments instantly with no transaction fees using the Lightning Network. Businesses can access payroll, treasury, and bill payment services. It allows borderless payments in 65+ countries and instant fiats to/from USD and other currencies.

Users can pay using QR Codes or direct wallet transfers. Businesses wanting to optimize payment processing with fast, cheap Bitcoin payments will find Strike to be the best Paypal crypto alternative. Businesses prioritizing Bitcoin in their payment services will find Strike to be the best optimized for Lightning Network fees.

Strike Features

- Fees: 0%

- Supported Assets: Bitcoin using the lightning network

- Integrations: Payroll, treasury and merchant checkout have available APIs

- Global Reach: Has a presence in 65 countries

- Unique Strength: Payments made with Bitcoin are low-cost and very fast, with the option to convert to fiat

Strike Pros & Cons

| Pros | Cons |

|---|---|

| Zero fees | Focused mainly on Bitcoin (Lightning Network) |

| Ultra-fast payments via Lightning | Limited coin support (BTC only) |

| Global reach in 65+ countries | Fiat conversion limited to select currencies |

| API for payroll, treasury, checkout | Still growing merchant adoption |

9. OpenNode

OpenNode provides Lightning transactions for free and charges 1% for on-chain transactions. OpenNode can convert bitcoin transactions and payments abroad to various fiat currencies (USD, EUR, GBP).

OpenNode processes conversions in real-time, and charges instant settlement fees. OpenNode can be integrated to a point-of-sale in Shopify, WooCommerce, and APIs. OpenNode has no restrictions on country of integration, with most users being merchants from the US or Europe.

OpenNode is a better option than PayPal Crypto Checkout for merchants who value a hybrid bitcoin solution in the form of Lightning transactions and direct fiat currency settlement, which greatly reduces volatility.

OpenNode Features

- Fees: 1% fee for on-chain transactions, Lightning is free

- Supported Assets: Bitcoin only

- Integrations: WooCommerce, Shopify, and APIs.

- Global Reach: Strong Presence within US and Europe.

- Unique Strength: RTC and hybrid bitcoin solutions with fiat settlement.

OpenNode Pros & Cons

| Pros | Cons |

|---|---|

| Free Lightning transactions | Bitcoin-only support |

| 1% on-chain fee | Limited fiat settlement currencies |

| Hybrid BTC + fiat solutions | Requires technical integration |

| Shopify, WooCommerce, API support | Smaller ecosystem compared to Binance or Coinbase |

10. TripleA

In Singapore, licensed cryptocurrency payments consider Ethereum, Bitcoin, and stablecoins. They compete on transaction volume and cost ~1%, and settlements are T+1. Over 50 currencies offered.

Merchants implement APIs, plugins, and white-label solutions with encased exchange rates. Dominance across Asia, Europe, and compliance makes them a leader.

Alternative for PayPal crypto checkout. Excellent for regulated businesses due to instant settlement and compliance with strong licensing. Global customer base and user-friendly interface.

TripleA Features

- Fees: A fee of about 1% per transaction.

- Supported Assets: Stablecoins, Bitcoin, and Ether.

- Integrations: white-label solutions, plugins, and APIs.

- Global Reach: Licenced in Singapore and supports more than 50 fiat currencies.

- Unique Strength: A focus on compliance with an instant fiat settlement, and a regulated gateway.

TripleA Pros & Cons

| Pros | Cons |

|---|---|

| Licensed in Singapore, compliance-focused | ~1% transaction fee |

| Supports BTC, ETH, stablecoins | Smaller coin selection than NOWPayments |

| Instant fiat settlement in 50+ currencies | Less brand recognition globally |

| Easy API, plugins, white-label solutions | Stronger in Asia, less presence in US/EU |

Why Seek Alternatives to PayPal?

Numerous fees and hidden charges

With PayPal, there are transaction fees and hidden charges that can cut into profits.

Alternatives such as Binance Pay, Crypto.com Pay, and BTCPay Server are far more cost-effective as they offer 0% or minimal fees.

Minimal cryptocurrency support

Currently, PayPal has only a limited selection of coins (BTC, ETH, LTC, BCH) and has withdrawal restrictions in many areas.

NOWPayments and CoinGate have extensive support for numerous cryptocurrencies, providing more options for both merchants and customers.

Potential for account freezes and fund hold

In the past, PayPal has been known for freezing accounts or holding funds, especially when it comes to large volume crypto transactions.

BTCPay Server and Strike are good alternatives that are non-custodial or Lightning-based so that merchants have total control of their funds.

Operational restrictions

Due to PayPal’s strict regulations, their service is unavailable in some regions.

For more regulated businesses, TripleA and BitPay have licensed and compliant services, which offer more flexible fiat settlement options.

Stagnancy

Compared to other payment gateways with more advanced offerings, PayPal has a more basic crypto checkout experience, with features such as cashback, instant settlement and payment options through the Lightning Network.

With ecosystem benefits, Loyalty programs, and extensive reach, Crypto.com Pay and Binance Pay are ones to watch.

Key Features to Consider in a PayPal Alternative

Transaction Cost

In the processing fees of cryptocurrencies, consider the low and zero fees offered by other platforms to ensure profitable crypto processing transactions without losing money in hidden fees.

Supported Cryptocurrency

Choose gateways for crypto payments that offer more coins, especially stablecoins, to increase customer and merchant flexibility and to help reduce the adverse effects of volatility.

Instant Fiat Settlements

To reduce the adverse effects of crypto volatility, merchants need to receive payouts in USD, EUR, or GBP. Choose a platform that automates instant crypto conversions to fiat currencies.

Ubiquity

Ensure the platform offers universally accepted payment inclusions for the super regions that PayPal restricts, giving the merchant and merchant clientele new compliance to commerce in diverse crypto markets.

Integration and Plugins

Choose gateways that are integrated easily and without friction into monetized crypto transactions to promote merchant minimal technical effort and ensure smooth checkout for customer transactions.

Custodial vs Non-Custodial

Choose custodial which offers compliance and fiat settlements, or non-custodial options such as BTCPay Server which requires that merchants forfeit a degree of control and confidentiality over their funds.

Compliance & Licensing

Legally Safe Alternatives like TripleA and BitPay would give Strong Positive Reputation and Seamless Process for legally and Operationally Complex Jurisdictions.

Speed & Scalability

Lightning Network like Strike and OpenNode guarantee Marginal Cost and Near Real-time Transactions, and hence Scalability, for Globally Operating Merchants.

Rewards & Incentives

Unlike the benefits offered by PayPal, crypto cashback, loyalty and other ecosystem rewards offered by Crypto.com Pay, and Binance Pay are cost-effective perks for Merchants and added values for customers.

Security & Fraud Protection

For Merchants to have Secure Crypto Payment Processing and avoid PayPal’s Account Freezes, Fund Withholdings, and overall retention, the Preferred Gateways Should Have Robust Fraud Protection.

Conclusion

More than just elevated costs and limited support of coins, Paypal’s crypto checkout also has limited global reach, making alternatives more attractive. Coinbase Commerce, BitPay, NOWPayments, CoinGate, Crypto.com Pay, Binance Pay, BTCPay Server, Strike, OpenNode and TripleA focus on greater crypto acceptance, lower costs and faster settlement times and far greater compliance.

Each has its strengths, for instance BitPay and TripleA operate best in tightly regulated environments, BTCPay Server is ideal for privacy focused merchants, Strike and OpenNode are speedy because of their use of Lightning, and there are additional ecosystem benefits in Crypto.com Pay and Binance Pay.

All together, these gateways are more than scalable, secure and global, confirming they are the ideal substitutes for PayPal’s crypto checkout for today’s merchants.

FAQ

Why should I consider PayPal crypto checkout alternatives?

Because PayPal has high fees, limited coin support, and account restrictions, while alternatives offer lower costs, global reach, and more flexibility.

Which platforms are the best alternatives?

Top options include Coinbase Commerce, BitPay, NOWPayments, CoinGate, Crypto.com Pay, Binance Pay, BTCPay Server, Strike, OpenNode, and TripleA.

Do these platforms support global payments?

Yes, most operate worldwide, with fiat settlement options in USD, EUR, GBP, and more.

Are fees lower than PayPal?

Absolutely—many charge 0–1%, compared to PayPal’s higher crypto transaction costs.

Which is best for compliance?

BitPay and TripleA excel in regulated environments, while BTCPay Server suits privacy-first merchants.