The Best PayRequest Crypto Alternatives that assist companies and independent contractors in accepting bitcoin payments, generating invoices, and safely handling transactions will be covered in this post.

These alternatives are perfect for merchants seeking effective and scalable crypto payment solutions since they provide greater flexibility, broader crypto support, reduced fees, and seamless integrations.

What is PayRequest?

PayRequest helps customers and clients of all types create and manage payment requests, invoices, subscriptions, and payment pages with zero coding and technical skills. This payment automation tool for billing streamlines and enhances cash flow management for businesses of all types, be it freelancers, SaaS, or payment service providers.

It cooperates, and fully integrates, with global and local payment service providers (PSPs) such as PayPal, Stripe and Mollie. As such, it enables businesses to manage one-time and installment payments in multiple currencies and to be sent and/or received in various payment channels (email, SMS, QR, APIs, etc.).

It also has features for automated and scheduled payments, customer billing pages, analytics and reporting, and more.

Key Features to Consider in Crypto Payment Platforms

Global Reach

The platform should allow merchants to accept payments from all over the world and should also consider the relevant global regulations and provide payment solutions in all the required languages.

Supported Currencies

Merchants in diverse markets may need to use and accept different cryptocurrencies and fiat currencies, so it is important to select a payments gateway adopting numerous cryptocurrencies and stablecoins.

Regulatory Compliance

Select platforms that are authorized and regulated of a financial authority (MAS, EU, US) so for due to the AML and KYC regulations for transactions to be safe and also for the business.

Fees

Look for a payment processor with a clear and simple fee structure that charges 0-1% of the transaction amount; if there are zero-fee transactions, it will be even more beneficial.

Settlement Methods

Select platforms that allow merchants to choose to mitigate the effects of volatility by providing instant crypto-to-fiat conversion, stablecoin, or direct transfers to wallets and predictable funds.

Ease of Integration

Providers should allow simple plug-and-play crypto payment integration so users of all technical skills are able to add payment processing to their websites and applications without a hassle.

Speed & Scalability

Thanks to the Lightning Network or Layer-2 capabilities, instant, fast, and inexpensive transactions are guaranteed, and scalable infrastructure manages efficient high-volume payment processing for large enterprises, SaaS, and global e-commerce.

Security Features

Gateways should have encryption, fraud detection, multi-signature wallets and non-custodial features so merchants can retain control of their funds while protecting customers against hacks or chargeback fraud.

Customer Experience

Customer Experience is improved through user-focused features during checkout, such as QR code payments, mobile wallet integration, and support for multiple languages to further streamline the payment process so that the customer experience is similar to that of traditional card or PayPal transactions.

Support & Reliability

With 24/7 customer support, uptime guarantees, and easy dispute resolution, merchants can depend on the system to conduct mission-critical transactions without delays or exposure to compliance liability.

Best PayRequest Crypto Alternatives (2026)

| Platform | Key Features |

|---|---|

| Coinbase Commerce | Easy merchant integration, non-custodial |

| BitPay | Long-standing crypto processor, debit card |

| NOWPayments | Auto-conversion to fiat, recurring billing |

| CoinGate | Lightning Network support, gift cards |

| Binance Pay | Zero-fee transfers, global reach |

| OpenNode | Bitcoin-only, Lightning fast |

| TripleA | MAS-regulated, global compliance |

| Alchemy Pay | Hybrid fiat-crypto gateway |

| PayPal Crypto | Mainstream adoption, fiat conversion |

| Stripe Crypto | API-first, Web3 integration |

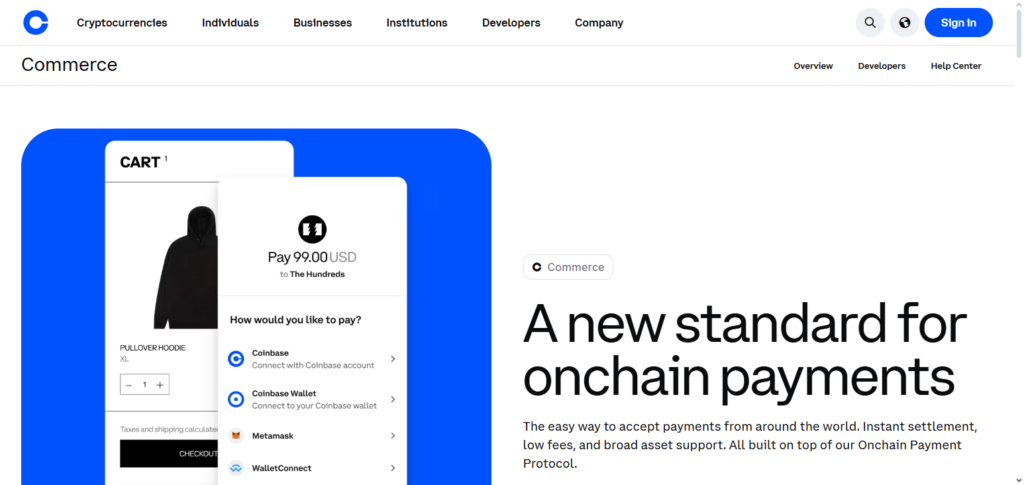

1. Coinbase Commerce

Coinbase Commerce began operating in 2018. This company is a non-custodial crypto payment processor that supports BTC, ETH, LTC, USDC, and over 100 other altcoins. Merchants keep full payment custody.

Transaction dollars are charged a 1% fee, while instant USDC conversion is used to minimize volatility. As a payment processor that is usable everywhere in the world and integrates with popular ecommerce solutions like Shopify and WooCommerce, it’s clear that Coinbase Commerce is the most compliant and the most user-friendly.

They’re the best regulated, scalable, and secure crypto payment processor in the world and thus is the top company for those looking to secure PayRequest crypto alternatives.

Coinbase Commerce Features

- No third party: merchants are in full control of their funds.

- Instant conversion: Yes, USDC. Mitigates exposure to volatility.

- 100+ digital currencies supported: including but not limited to BTC, ETH, USDC, DOGE, MATIC

- Pre-configured Connectors: to Shopify, WooCommerce, Primer, Jumpseller.

- Very reasonable fees (1%): No chargebacks, fraud-proof payment is zero risk.

Coinbase Commerce Pros & Cons

| Pros | Cons |

|---|---|

| Non-custodial: merchants control funds | Limited fiat settlement options |

| Supports 100+ cryptocurrencies | 1% transaction fee (higher than some rivals) |

| Easy integration with Shopify, WooCommerce | No direct customer support in some regions |

| Instant USDC conversion reduces volatility | Focused mainly on crypto-native merchants |

2. BitPay

Starting in 2011 in Atlanta, USA, BitPay was one of the first crypto payment processors in the industry. It supports payment in BTC, BCH, ETH, LTC, DOGE, and stablecoins, and even allows merchants to settle in fiat.

Each transaction fee totals 1%, and BitPay offers prepaid debit cards to consumers. BitPay is operational in the rest of the world except in OFAC sanctioned countries. BitPay is fully compliant with U.S and EU, and the UK is why many businesses consider BitPay to be a reputable choice.

Given the impressive merchant features and conversion to fiat, BitPay remains one of the top alternatives to PayRequest for the crypto industry and is perfect for e-commerce and retail merchants all over the globe.

BitPay Features

- 2011: This crypto payment processor is one of the pioneers.

- Cryptos supported: BTC, BCH, ETH, LTC, DOGE, and various stablecoins.

- Composable Payments: Merchants can receive in any fiat, including USD, EUR, GBP.

- Instant Crypto spending: Available by the BitPay Card

- Unlimited Accessibility: Accessible to everyone, barring sanctioned regions.

BitPay Pros & Cons

| Pros | Cons |

|---|---|

| Established since 2011, highly trusted | Limited crypto support compared to newer gateways |

| Supports BTC, BCH, ETH, LTC, DOGE, stablecoins | 1% fee per transaction |

| Offers BitPay Card for spending crypto | Restricted in OFAC-sanctioned countries |

| Strong compliance in US/EU | Less flexible for SaaS recurring billing |

3. NOWPayments

Founded in 2019, NOWPayments is also a non-custodial gateway, and it supports 75+ cryptocurrencies, including BTC, ETH, stablecoins, etc, and has a fee of 0.5% to 1% depending on whether the payment is of a single or multiple currencies.

Merchants have the option of turning off volatility by converting to fiat money or stablecoins. The platform is mostly used in developing countries as it is automotable. The system has a perfect backwards compatibility in automating bills for SaaS.

When it comes to the best alternatives to PayRequest crypto, NOWPayments is one of the best because it is flexible, has a very low fee, and has a very wide range of currencies for the merchants.

NOWPayments Features

- 2019: Launch of the non-custodial payment gateway.

- Cryptos supported: more than 75 cryptocurrencies, BTC, ETH, stablecoins.

- Customized pricing: 0.5-1% based on the currency.

- Ideal for subscription: Recurring billing and auto-conversion for SaaS are ideal.

- Immediate crypto payment: Merchants can settle in any fiat or stablecoins.

NOWPayments Pros & Cons

| Pros | Cons |

|---|---|

| Supports 75+ cryptocurrencies | Fees range 0.5–1%, variable |

| Non-custodial, merchants retain control | Less brand recognition than Coinbase/BitPay |

| Auto-conversion to fiat/stablecoins | Customer support less robust |

| Recurring billing for SaaS | Smaller enterprise adoption compared to PayPal/Stripe |

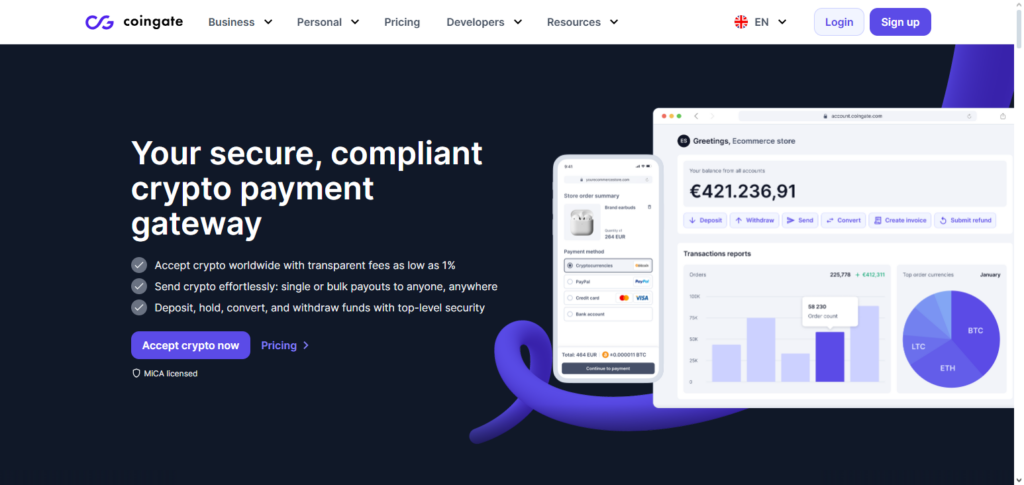

4. CoinGate

CoinGate started in 2014 in Lithuania and currently has 70+ different cryptocurrencies under them: BTC, ETH, LTC, XRP, DOGE, and many different stablecoins. They integrate Lightning Network in order to process instant Bitcoin payments.

Their fees are at 1% for every transaction, while providing fiat settlement options in both EUR and USD. They serve over 150+ countries and have great adoption in Europe. Merchants are able to integrate gift cards and e-commerce plugins.

Their Lightning Network and compliance in Europe makes them one of the top PayRequest crypto alternatives for businesses looking for inexpensive and fast Bitcoin and altcoin payments.

CoinGate Features

- Lithuania 2014.

- Cryptos supported: more than 70 coins including BTC, ETH, LTC, XRP, DOGE, and stablecoins.

- For Lightning Network Users: Instant Bitcoin payments.

- For merchants: EUR, USD.

- Coverage in 150+: Strong presence in Europe.

CoinGate Pros & Cons

| Pros | Cons |

|---|---|

| Supports 70+ cryptos | Primarily strong in Europe, less global reach |

| Lightning Network for instant BTC payments | 1% transaction fee |

| Fiat settlement in EUR/USD | Limited fiat currency options |

| Gift card integrations | Less enterprise-grade compliance than TripleA |

5. Binance Pay

Binance Pay, which began operations in 2021, is Binance’s zero-fee crypto payment solution. It covers 350+ digital currencies as well as BTC, ETH, BNB, and stablecoins.

Binance has operations in more than 100 countries, but the USA, UK, Canada, and Netherlands have restrictions. Merchants get instant transfers and global access that Binace’s ecosystem offers.

With 258 million users around the world, Binance Pay is the PayRequest crypto alternative of choice for businesses who want to serve crypto-savvy customers.

Binance Pay Features

- Founded in 2021.

- No transaction fees.

- Over 350 cryptocurrencies supported, including BTC, ETH, and BNB.

- Available in 100+ countries, geographical restrictions in US/UK/Canada.

- Binance ecosystem integration (wallets, trading, and merchant tools).

Binance Pay Pros & Cons

| Pros | Cons |

|---|---|

| Zero transaction fees | Restricted in US, UK, Canada, Netherlands |

| Supports 350+ cryptocurrencies | Custodial, merchants rely on Binance ecosystem |

| Integrated with Binance wallets & trading | Regulatory uncertainty in some regions |

| 258M+ Binance users worldwide | Not ideal for compliance-heavy businesses |

6. OpenNode

OpenNode started out in 2018 and is a BTC only payment processor. They handle BTC and the Lightning Network with USD fiat conversion. OpenNode charges 1% fee for on-chain transactions while Lightning is free.

OpenNode competes on a global scale with Lightning being one of the most used in the US. Being a Bitcoin only payment processor is what helps OpenNode compete with other payment processors that handle multiple fiat.

As a PayRequest crypto alternative, OpenNode is best fit for Bitcoin focused businesses that want Lightning payment settlement.

OpenNode

- Operational since 2018.

- The only accepted cryptocurrency is bitcoin and it is accepted through both the On-chain and Lightning Network.

- Payment Fees are at 1% for on-chain transactions, meanwhile, Lightning transactions are free.

- Available for instant USD conversions.

- Integrated, and adapted to API allowing it to serve multiple platforms.

OpenNode Pros & Cons

| Pros | Cons |

|---|---|

| Bitcoin-only, Lightning fast payments | No support for altcoins or stablecoins |

| Free Lightning transactions | 1% fee for on-chain BTC |

| Strong developer APIs | Limited fiat settlement (USD only) |

| Trusted by Bitcoin-focused merchants | Narrow use case compared to multi-crypto gateways |

7. TripleA

Established in 2017 in Singapore, TripleA, with its MAS (Monetary Authority of Singapore)-licensed crypto payment gateways. As for the supported digital assets, the company deals in Bitcoin (BTC), Ethereum (ETH), Tether (USDT), USDT pegged stablecoins, with instant crypto-to-fiat conversion to mitigate the impact of volatility.

Fees are usually 1% of the transaction amount with the company having marketed the service in the US, Europe, Middle East, APAC, Africa, LATAM, and India except for the sanctioned countries.

With the regulatory compliance and enterprise-grade solutions, TripleA becomes the best PayRequest crypto alternative for companies who operate globally and need a strong compliance assurance.

TripleA

- Operational since 2017 in Singapore.

- Holds a MAS License – notable for their high purchase compliance.

- Holds Accounts in: BTC, ETH, USDT, and stable coins.

- No volatility risk because of the instant conversions.

-**Inclusive of the Entire Globe: ** United States, European Union, Asia Pacific, Africa, Latin America, and India.

TripleA Pros & Cons

| Pros | Cons |

|---|---|

| MAS-licensed, strong compliance | 1% transaction fee |

| Supports BTC, ETH, USDT, stablecoins | Smaller crypto selection than NOWPayments |

| Instant crypto-to-fiat conversion | Less consumer-facing brand recognition |

| Global coverage (US, EU, APAC, Africa, LATAM, India) | Custodial model may deter crypto purists |

8. Alchemy Pay

Established in 2017, Alchemy Pay includes fiat and crypto payment options. Alchemy Pay allows customers from 173 countries to transact in over 50, and over 7 fiat currencies, including USD, EUR, and INR.

As with any service, the average fee varies from region to region, with an estimate of 1%. Alchemy Pay bridges off-ramps, crypto debit cards and offers Web3 crypto payment solutions.

Thanks to its hybrid business model, Alchemy Falls under the top PayRequest crypto options and is undoubtedly the best for companies who need seamless crypto and fiat to be interchangeable.

Alchemy Pay

- Founded 2017.

- Hybrid fiat-crypto gateway: Accepts both seamlessly.

- Supports 50+ cryptos + fiat currencies.

- Global compliance: 70+ countries, 300+ payment channels.

- On/off ramps + crypto cards: Web3 integrations.

Alchemy Pay Pros & Cons

| Pros | Cons |

|---|---|

| Hybrid fiat-crypto gateway | Fees vary by region, average 1% |

| Supports 50+ cryptos + fiat | Regulatory compliance varies by country |

| Operates in 173 countries | Less mainstream adoption than PayPal/Stripe |

| On/off ramps + crypto cards | Complex integration for small merchants |

9. PayPal Crypto

PayPal started allowing crypto payments in 2020 and plans on expanding internationally by 2025. Currently, PayPal supports Bitcoin, Ethereum, Litecoin, Bitcoin Cash, Solana, Chainlink, and the PayPal USD stablecoin.

While fees do apply, they are noticeably less than traditional cross-border payments and save merchants 90% on average.

Accessible in over 200 countries and with PayPal’s extensive merchant network, its public adoption earn PayPal’s crypto conversion the title to being the best PayRequest crypto alternative for countless freelance workers and small businesses.

PayPal Crypto

- Crypto support since 2020.

- Supports 100+ cryptos: BTC, ETH, SOL, USDC, PYUSD stablecoin.

- Automatic fiat conversion: Merchants receive USD or PayPal USD.

- Global reach: 200+ countries, 650M users.

- Mainstream adoption: Seamless integration with PayPal’s merchant network.

PayPal Crypto Pros & Cons

| Pros | Cons |

|---|---|

| Global reach: 200+ countries, 650M users | Custodial, merchants don’t control funds directly |

| Supports BTC, ETH, LTC, BCH, SOL, USDC, PYUSD | Fees higher than Binance Pay |

| Automatic fiat conversion | Limited crypto selection compared to NOWPayments |

| Seamless integration with PayPal merchant tools | Regulatory restrictions in some regions |

10. Stripe Crypto

Stripe was founded in 2010 and added cryptocurrency support in 2024. 2024-2025 is when Stripe added support for stablecoins. Stripe supports USDC and USDB along with processing payments in over 135 fiat currencies.

Stripe is fully available in 46 countries and has extended access in Africa and preview markets such as India. Stripe charges around 1% fee on processing payments and offers simple APIs for developers.

This makes Stripe Crypto one of the best alternatives to PayRequest crypto for SaaS and Web3 developers looking to integrate stablecoins.

Stripe Crypto

- Crypto support expected 2024-2025.

- Stablecoin-first: USDC, USDB.

- Recurring stablecoin subscriptions.

- Global reach: 46 fully supported countries, expanding in Africa/India.

- Developer-friendly APIs: Ideal for SaaS and Web3 platforms.

Stripe Crypto Pros & Cons

| Pros | Cons |

|---|---|

| Developer-friendly APIs | Limited crypto support (mainly stablecoins) |

| Supports USDC, USDB stablecoins | Fees ~1% per transaction |

| Recurring stablecoin subscriptions | Still expanding global coverage |

| Operates in 46+ countries | Preview markets (India, Africa) not fully supported yet |

Conclusion

There are good alternatives to PayRequest that meet various business demands, from basic invoicing to full-featured crypto payment processing, particularly when it comes to organizing invoices and taking cryptocurrency payments.

Alternatives like Coinbase Commerce, NOWPayments, Blockonomics, Aurpay, and other crypto invoice platforms offer expanded cryptocurrency support, customizable invoicing, and seamless integration with e-commerce systems, making them perfect for businesses prioritizing digital asset acceptance and flexibility.

PayRequest excels with flexible payment links and worldwide payment support. Your preferences will determine which option is best for you, whether they be low costs, easy setup for processing cryptocurrency payments, or support for many coins.

FAQ

What are PayRequest crypto alternatives?

PayRequest crypto alternatives are payment platforms and gateways that let you accept cryptocurrency payments, create invoices, and manage transactions similarly or better than PayRequest, often with broader coin support or specialized crypto features.

Which platforms let you accept crypto payments?

opular alternatives include BitPay, Coinbase Commerce, NOWPayments, CoinGate, and Blockonomics, each offering varying levels of coin support, invoicing tools, and integration capabilities.

Can I create crypto invoices like PayRequest?

Yes — platforms like Blockonomics and Aurpay allow merchants to generate crypto invoices and direct payment links, making it simple to bill clients in digital assets.

Do these alternatives support multiple cryptocurrencies?

Many alternatives support a wide range of assets — for example, NOWPayments accepts 250+ coins and even offers optional fiat conversion to reduce volatility risk.

Are features like payment buttons and API available?

Yes — gateways such as CoinGate and Coinbase Commerce provide APIs, payment buttons, and plugins for easy integration with websites and e-commerce platforms.