By combining blockchain technology with certified environmental assets, Best Platforms for Investing in Tokenized Carbon Credits are revolutionizing investor participation in climate action.

These days, the top platforms for investing in tokenized carbon credits provide real-time trading, transparent ownership, and worldwide access to top-notch climate projects.

These ecosystems, which range from decentralized protocols to regulated exchanges, assist investors in matching financial objectives with quantifiable environmental effect, increasing the accessibility, liquidity, and accountability of climate-focused portfolios.

What Are Tokenized Carbon Credits?

Tokenized carbon credits are carbon credits expressed as digital tokens on a blockchain system which represent 1 metric ton of CO2 reduced or removed. Instead of having to be based on a registry, carbon credits can be blockchain based, allowing them to be traded, transferred, or retired in a transparent, real time manner.

Tokenization enhances market accessibility, enables fractional ownership, and streamlines administrative processes through smart contracts.

Users and organizations can monitor on the blockchain the origin of the credits, transfer history, and retirement status of the credits, which strengthens trust, supports ESG reporting, and bridges climate finance with decentralized finance.

Key Point

| Platform | Key Point (Value for Investors) |

|---|---|

| Verra | Provides widely recognized verified carbon credits that can be tokenized for transparent trading. |

| Toucan Protocol | Enables blockchain tokenization of carbon credits and DeFi integration for liquidity and trading. |

| ClimateTrade | Connects buyers directly to verified projects, offering transparent tokenized offsets. |

| AirCarbon Exchange (ACX) | Offers regulated, blockchain-based trading of tokenized carbon credits with real-time settlement. |

| Moss.Earth | Tokenizes reforestation-based carbon credits (MCO2) tradable on public channels for investors. |

| Nori | Focuses on carbon removal credits with traceable tokenized assets for offset investments. |

| CarbonX | Integrates tokenized carbon credits into digital ecosystems, enabling everyday offset use and trading. |

| Celo | Uses a mobile-friendly blockchain to broaden access to tokenized carbon credits globally. |

| Xpansiv | Provides data-rich tokenized environmental commodities, enhancing price discovery and trading. |

| Flowcarbon | Connects high-quality carbon projects with buyers through tokenization and efficient market access. |

1. Verra

Verra manages the world’s largest voluntary carbon credit certification system, the Verified Carbon Standards (VCS), which issues and certifies the majority of carbon credits used for tokenization.

VCS credits represent real emissions reductions or removals using rigorous, science-based methods, and are used by companies to offset emissions that cannot be avoided.

For years, VCS credits have used retirement as a means of protecting the environment, but Verra is now considering tokenization of immobilized credits linked to block chain tokens.

Investing in credits aligned with Verra’s standards helps ensure quality and widespread acceptance. Verra.

Verra Features Features

• Issues a Verified Carbon Standard (VCS) certification.

• Manages a global project registry and credit tracking.

• Utilizes high-integrity carbon methodologies.

• Offers a transparent claim issuance and credit retirement system.

• Widely populates voluntary carbon markets.

Verra Pros & Cons

Pros:

• Universal gold standard for carbon credits.

• High acceptance among both corporations and institutions.

• Strong registry and documented tracking systems.

Cons:

• No retail access.

• No trading or token platform.

2. Toucan protocol

Toucan protocol offers tokenized carbon credits by minting their on-chain equivalents (TCO2) and pooled tokens (Base Carbon Tonnes, BCT).

This tokenization and minting process integrates traditional carbon registries with blockchain markets and allows for fractional ownership, 24/7 trading, and seamless incorporation into decentralized finance (DeFi).

Toucan helps improve liquidity and price discovery by enabling carbon credits to be traded, retired, or bundled across multiple platforms.

Although earlier implementations have been criticized for poor credit quality, Toucan remains a leader in the carbon tokenization ecosystem, and continues to develop with market guidance and developing standards.

Toucan Protocol Features

• Changes carbon credit certificates to on-chain tokens.

• Engages in TCO2, BCT, and NCT token standards.

• Integrates DeFi for trading and staking.

• Provides a carbon bridge for credit registries on the blockchain.

• Offers fractional credit ownership.

Toucan Protocol Pros & Cons

Pros:

• Real carbon credits on-chain tokenization.

• Assets of carbon fractionals.

• Traditional trading and DeFi liquidity pools integration.

Cons:

• Beginner complexity.

• Regulated uncertain tokenization of credits.

3. ClimateTrade

ClimateTrade is a carbon offset marketplace powered by blockchain that facilitates the buying and selling of verified carbon credits. The platform records its transactions using distributed ledgers while linking buyers with high-quality projects, such as renewable energy and forestry.

ClimateTrade’s tokenized offsets assist companies and investors in engaging with carbon markets more seamlessly compared to traditional, intermediated processes. This reduces administrative costs and enhances traceability.

The platform’s emphasis on verified carbon credits and its simplicity attracts investors who desire climate impact and ESG compliance along with investment exposure.

ClimateTrade Features

• Operates a carbon brokerage on a blockchain.

• Grants direct access to verified climate projects.

• Provides businesses with API integration.

• Offers transparent impact tracking.

• Manages a multi-project carbon offset portfolio.

Climate Trade Pros & Cons

Pros:

• Easy integration of businesses and APIs.

• Easily verified direct access to climate projects.

• Low-tracking transparency based on blockchain.

Cons:

• Less visibility than larger exchanges.

• Low advanced trading instruments.

4. AirCarbon Exchange (ACX)

AirCarbon Exchange integrates blockchain technology with regulated market infrastructure to sell and buy tokenized carbon credits. ACX is licensed under established financial frameworks, enabling secure custody, immediate transactions, and ownership records.

ACX is based in Singapore and offers digital carbon assets. Its blockchain technology reduces double-counting and increases settlement efficiency, which is beneficial for corporate buyers and institutional investors focused on compliance and ESG.

ACX increases market accessibility and trust by attaching high-integrity systems to tokenized credits.

AirCarbon Exchange (ACX) Features

• Offers a regulated digital carbon exchange.

• Provides real-time blockchain settlement.

• Offers secure custody and compliance tools.

• Trades renewable energy certificates.

• Provides access to an institutional-grade market.

AirCarbon Exchange (ACX) Pros & Cons

Pros:

• Real-time blockchain settlement.

• Compliant trading and regulated platforms.

• Security and custody on an institutional grade.

Cons:

• A complicated onboarding process.

• Limited access for retail users.

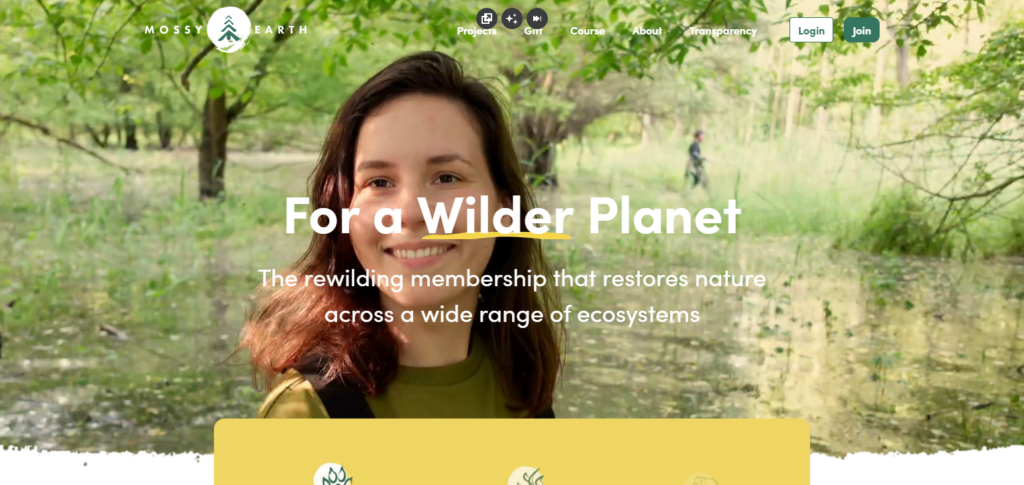

5. Moss.Earth

Moss.Earth focuses on tokenizing carbon credits from nature-based projects, in particular the conservation of rainforests. Individuals and companies can use MCO2 tokens to purchase and retire carbon credits while maintaining transparency to environmental benefits.

These tokens are tradable on the Ethereum and Celo blockchains, and are making the carbon credit market more accessible.

Investors can track the ecological impact of their investments with Moss due to the transparency of the tokens, as data from each individual token indicates the corresponding project and certification Moss has.

Moss democratizes the acquisition of verified nature-based credits and fulfills the demands of environmental finance and climate action.

Moss.Earth Features

• Utilizes an MCO2 carbon token system.

• Focuses on nature-based projects (rainforests).

• Provides public trading on a blockchain.

• Allows token retirement for offsetting.

• Offers transparency on ESG impact.

Moss. Earth Pros & Cons

Pros:

• Focus on projects involving nature and rainforests.

• Public blockchain to token trade.

• Easy process of offset and token retirement.

Cons:

• Project liquidity based on token demand.

• Less diversity of projects.

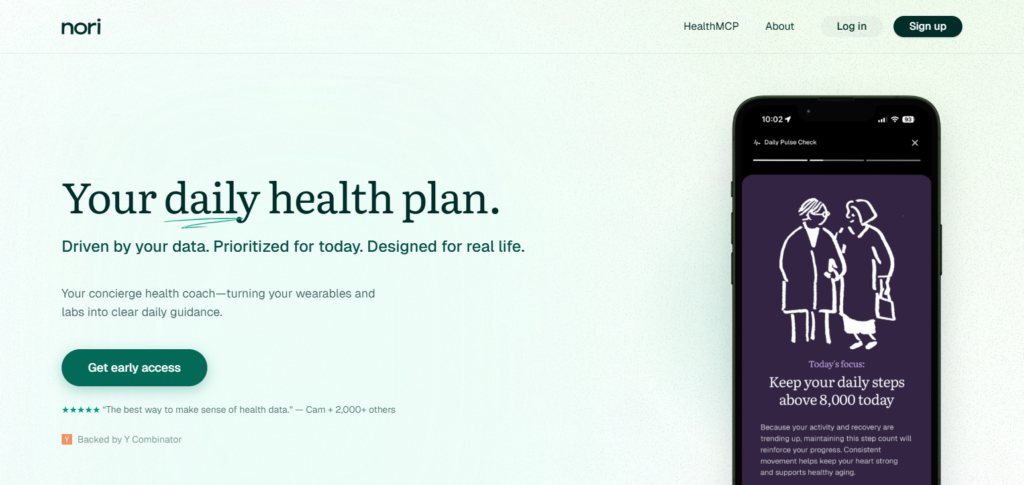

6. Nori

Unlike others, Nori’s marketplace specializes in carbon removal rather than avoidance credits. Thus, the Regenerative farmers sell credits that are for CO₂ that has been permanently removed from the atmosphere and sequestered in soil or biomass.

Nori also uses blockchain to provide transparency and reduce the number of middlemen. Nori has had to tackle market and operational challenges, but the goal has always been to provide investors the ability to monetize verified carbon removal.

Nori Features

• Operates a marketplace for carbon removal credits.

• Records transactions on a blockchain.

• Focuses on regenerative agriculture.

• Utilizes a Nori Removal Tonne (NRT) system.

• Employs a direct supply-to-buy model.

Nori Pros & Cons

Pros:

• Provides services for removal carbon credits

• P2P marketplace

• Real-time credit monitoring

Cons:

• Smaller market scope

• Greater credit cost

7. CarbonX

For ESG objectives and consumer engagement, CarbonX allows real-time use of procurable tokenized carbon credits from integrated digital economies. The Carbon X platform offers businesses, developers, and lots of customers, digital assets that represent carbon reductions.

With CarbonX tokenization, apps and loyalty programs can embed carbon credits, facilitating greater market engagement and support for sustainable consumption.

For investors, the ecosystem (the combination of carbon finance, utilities, and incentives) is the integrated carbon market and climate innovation diversified investment, within the climate finance innovation market.

CarbonX Features

• Integrates tokenized carbon assets.

• Offers Consumer and enterprise ESG tools.

• Provides loyalty and rewards programs.

• Solutions for digital offset

• Carbon trading based on marketplace

CarbonX Pros & Cons

Pros:

• Merges carbon credits with digital technologies

• ESG tools for customers

• Accommodates rewards and loyalty use cases

Cons:

• Reduced market liquidity

• Restricted features for institutions

8. Celo

Celo is a blockchain ecosystem that includes tokenized carbon credit markets and offers financial inclusion applications. Celo facilitates climate asset trading on the world’s most used devices, increasing accessibility in low and medium-income economies.

Celo’s platform supports Flowcarbon’s carbon tokens and other decentralized finance climate solutions.

By utilizing a carbon-negative blockchain for tokenized carbon credits, Celo is improving the internationally recognized environmental standards for carbon credits while providing climate investors with an inclusive solution for Africa, Asia, and Latin America.

Celo Features

• Design of blockchain mobile-first

• Network that is carbon-negative

• Supports DeFi and ReFi ecosystems

• Transactions with fees that are low

• Accessibility in emerging markets

Celo Pros & Cons

Pros:

• Carbon-negative blockchain technology

• Mobile-first and low-cost access

• Potential use with climate finance applications

Cons:

• Not a carbon marketplace

• Third party reliance

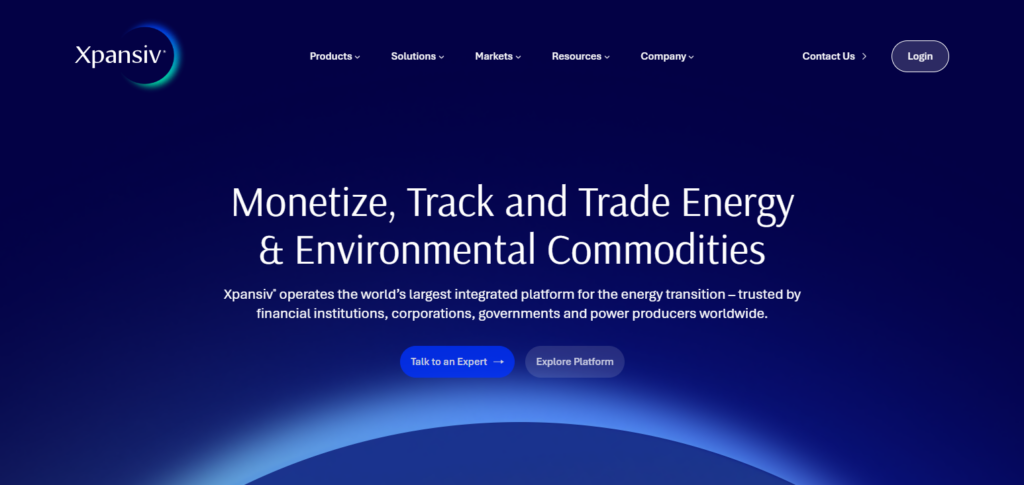

9. Xpansiv

Xpansiv is a leader in environmental commodities exchange that offers tokenized carbon credits and other assets within the sustainability spectrum. Xpansiv’s platform offers a unique solution to liquidity, transparency, and efficiency challenges within the carbon credit market.

The platform’s carbon credit futures contracts, complimented by proprietary data, provide greater market efficiency.Using advanced trading systems and supportive pricing signals, investors can buy various ecological goods, including credits that have been tokenized.

For institutional investors, Xpansiv’s hybridization of blockchain and traditional finance aids in risk mitigation, carbon accounting, and identifies potential arbitrage or hedging strategies in voluntary carbon markets.

Xpansiv Features

• Exchange for environmental commodities

• Trading of Carbon and REC

• Analytics and market data

• Contracts for spot and futures

• Tools for institutional ESG

Xpansiv Pros & Cons

Pros:

• Highly liquid markets for environmental trading

• Analytics and price discovery

• Institutional-grade offering

Cons:

• Overwhelming for newcomers

• High entry costs

10. Flowcarbon

Building decentralized markets for carbon involves Flowcarbon tokenizing live carbon credits on blockchains including Celo and offering fungible tokens such as GNT, which are backed one-for-one by verified and unretired carbon credits.

With this model, token holders have the option of redeeming their tokens for the accompanying carbon credits, which increases their financial flexibility and potential utility. Focused on liquidity and accessibility, this model is particularly useful for developers, businesses, and retail investors and creates a decentralized carbon market that is transparent

The company aims to provide standardized carbon pricing and efficient marketplaces for trading through collaborations with blockchain networks and other participants in the ecosystem.

Flowcarbon Features

• Live carbon credits that are tokenized

• Credits backed 1:1 by GNT token

• Credit redemption bridge for two-way

• On-chain tools for carbon liquidity

• Partnerships with blockchain ecosystem

Flowcarbon Pros & Cons

Pros:

• Tokenized credits with real asset backing 1:1

• Bi-directional bridging for redemptions

• Robust partnerships with blockchain ecosystem

Cons:

• Uncertainty in regulations

• Slow growth in market adoption

Key Benefits of Investing in Tokenized Carbon Credits

Below are specified benefits of investing in tokenized carbon credits, with each point containing.

Transparency: With every transaction recorded, investors can understand project histories, claim ownership of credits, and ascertain retirement, thus improving trust and reducing fraud in the world’s voluntary carbon market.

Liquidity: Because of the possibility of fractional ownership and 24/7 trading, liquid carbon credits can now be purchased, sold, and reallocated to various crypto and ESG diversified portfolios.

Accessibility: The digitization of tokens enables universal participation in retail climate finance with wallets, exchanges, and P2P platforms, while eliminating the need for traditional brokerage firms.

Diversification: The economic and environmental benefits of carbon credits offer investors the opportunity to hedge on environmental climate change, and help reduce portfolio risk.

Efficiency: Using smart contracts in carbon market sales/ purchases allows for gaps in data, delays in transactions, and inordinate administrative costs to be eliminated.

Impact Tracking: Modifiable data allows each token to be associated with a project, thus providing verifiable data about the impact, ESG goals, and sustainability of the corporate consumers.

Global Reach: Using blockchain technology, platforms can link buyers and sellers seamlessly, improving access to cross-border carbon projects and markets with no restrictions on currency conversion and trade zones.

Innovation: The combination of blockchain technology and DeFi allows for new ways to stake, earn yields, and create carbon-backed financial products within the investment ecosystems of regenerative finance.

Price Discovery: Investors get insight on supply and demand through liquid markets, and transparent, decentralized carbon markets are far less opaque than their over-the-counter counterparts.

Regulatory Alignment: The immutable and transparent nature of blockchain technology can help financial institutions meet their environmental accountability and climate-related disclosure obligations.

Risk Factors and Challenges in Tokenized Carbon Investing

Unpredictable Regulations: Regulations around different jurisdictions are unpredicatable and could result in restrictions to token trading, necessitate regulations, and add legal costs to investors for filing.

Quality of Credit: Credit quality of the projects is not the same for all. Low quality borderline projects pose big risks, reducing the confidence of the token.

Risk of Illiquidity: Some platforms are likely to have restrictions put in place. This can lead to the token not being traded for some time.

Risk of Technology: There are many potential risks in the technology world including contract risks and wallet security risks and others that could be disruptive.

Risk of Transparency: High risks of being blindsided by the multiple paper records project that many investors can be subjected to in green projects.

Risk of Market Fragmentation: There are multiple markets for the same product, and each brings its own risks. With such a high volume of risks”}}.

Counterparty Risk: When the platforms, custodians, or project developers face operational or financial failures, it is called counterparty risk. Such failures could result in the delay in settlement systems, loss of access to credit, or cause loss to the investors.

Permanence Risk: Nature-based projects have unproven environmental permanence, where fires, policy shifts, or changes in land use can offset the carbon advantages and detract from the credibility of the term tokens.

Price Volatility: When it comes to long-term investing, it can become difficult to plan because of the unstable valuations as a result of the price discovery distortion fueled by low trading volumes, speculation, or the news of regulation.

Institutional Barriers: The deadlines, added complexity on operations, increase in costs, and extended onboarding can all stem from the custodial and compliance needs for the institutional investors. This can keep contemporary institutional players from traditional financial markets from participating.

Conclusion

The finest tokenized carbon credit investment systems combine transparent, effective digital infrastructure with environmental integrity. Credit quality is ensured by solutions like Verra-backed standards and blockchain-driven platforms like Flowcarbon, Moss, and Toucan Protocol.Earth enhances worldwide access, traceability, and liquidity.

Price discovery and institutional confidence are enhanced by data-rich markets like Xpansiv and regulated exchanges like AirCarbon Exchange.

By connecting traditional carbon markets with decentralized financing, these ecosystems enable investors to support verified climate projects while diversifying their holdings. Tokenized carbon platforms are positioned to play a key role in scalable, reliable climate funding as standards align and legislation develop.

FAQ

What are tokenized carbon credits?

Tokenized carbon credits are digital tokens on a blockchain that represent verified carbon credits, usually equal to one metric ton of CO₂ reduced or removed, enabling transparent trading and retirement.

Which platforms are best for investing in tokenized carbon credits?

Popular platforms include Toucan Protocol, Flowcarbon, Moss.Earth, AirCarbon Exchange (ACX), Xpansiv, ClimateTrade, Nori, CarbonX, and blockchain ecosystems like Celo.

Are tokenized carbon credits safe to invest in?

They offer transparency through blockchain records, but risks include regulatory uncertainty, platform security, liquidity limitations, and varying quality of underlying carbon projects.

How do I verify the quality of a tokenized carbon credit?

Check if credits are backed by recognized standards such as Verra or Gold Standard, review project documentation, and confirm on-chain retirement and traceability data.

Can retail investors buy tokenized carbon credits?

Yes, many platforms allow retail participation using crypto wallets, though some regulated exchanges may require additional verification or limit access by region.