This article cover the best prop firms in Malaysia. These firms provide traders with access to a lot of capital, advanced trading tools, and profit sharing.

Traders can use these firms to develop their skills, trade in a professional environment while not having to fund their account in a personal capacity, and earn a profit according to their performance. Access to different account types, mentorship, and clear rules are great for prop firms and assist novice traders as well as advanced traders.

What is Prop Firms?

A Prop Firm, short for Proprietary Trading Firm, is an establishment that allows traders to access company funds to trade different financial assets, including equities, forex, and cryptocurrencies, rather than using their funds.

With profits made during a trading session, the traders return a certain percentage to the prop trading company. Props training, tools, and superior risk management make them a go-to for traders wishing to access greater risk without putting their money on the line.

This is one of the few trading options considerably less risky than the vast majority. With access to superior stock, skilled traders can increase their earnings considerably.

Why Use Prop Firms In Malaysia

Access to Larger Capital: Prop firms reduces the risk for traders by providing funds to take bigger posiitions and capture opportunites in the market. This is especially important for skilled traders in Malaysia, as personal risk is minimized allowing for greater profit potential.

Professional Trading Tools and Resources: Traders in Malaysia gain access to the advanced analytics, live data, and sophisticated trading platforms as well as tools prop firms provide. This improves their trading decisions and strategy execution.

Training and Mentorship: Training and structured mentorship is key in prop firms, and helps both novice and seasoned traders. This training support is beneficial to Malaysian traders for professional development inarigi in serisk management and confidence.

Profit-Sharing Opportunities: Profit-sharing is both an incentive and a compensation strategy in Malaysia which improves personal results and income level. This is a counter to the predictable, salary-based trading employments.

Minimized Personal Financial Risk: Trading capital being provided by the company means traders can try different strategies and markets without the threat of losing their money, which enhances learning and growth in the real markets.

Key Point & Best Prop Firms In Malaysia List

| Prop Firm | Key Points / Features |

|---|---|

| Funding Pips | Fast account approval, flexible risk rules, profit-sharing model |

| FunderPro | Low evaluation fees, simple scaling plans, supportive trader community |

| GoatFundedTrader | Instant funding after evaluation, multiple account options, high profit splits |

| SabioTrade | Low-cost evaluation, scalable accounts, training and mentorship programs |

| Instant Funding | Immediate funding after passing challenge, minimal restrictions, fast payout |

| Earn2Trade | Structured educational programs, trading challenges, career path for traders |

| The Funded Trader | Multiple account types, flexible profit split, no personal capital required |

| Topstep | Focus on futures and forex, detailed risk management, community support |

| Blueberry Funded | High profit splits, simple evaluation, instant funding after verification |

| FXIFY | Forex-focused prop firm, low minimum deposits, transparent trading rules |

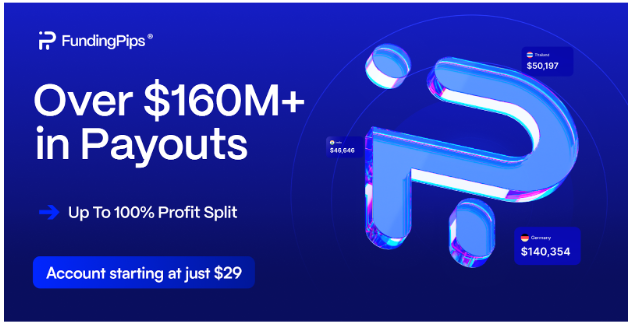

1. Funding Pips

Funding Pips is recognized as one of the top prop firms in Malaysia because it offers low-cost evaluations in addition to easy-to-understand funding methods and accommodating trading conditions for beginner and advanced traders.

Funding Pips’ trading capital scaling plans are also straightforward as Malaysian traders can gradually increase their trading capital as they demonstrate consistency and proficiency.

It also expedited the process of obtaining funded accounts which, combined with flexible risk management rules, allows traders to concentrate on strategy.

Malaysian traders can achieve significant and professional development through Funding Pips, which has responsive profit-sharing, accessible trading instruments, and a strong sense of community.

Payouts: Over $160 Million

Payout cycles: Total 6 Payout Cycles.

- For 1 step and 2 Step (Monthly 100%, Bi-weekly 80%, Tuesday 60%, On-demand 90%)

- 2 Step Pro (Daily 80%, Weekly 80%)

- FundingPips Zero/Instant (Bi-weekly 95%)\

USPs:

- No payout denial (Track record of 0 payout denial)

- 29,900 Reviews on Trustpilot (4.5 stars)

- Up to100% Profit split

- Account starting at just $29

- Over 100K+ traders

- Flexible Payout Cycles

2. GoatFundedTrader

GoatFundedTrader is one of the best prop firms in Malaysia for its funding options. It is one of the best shops for traders who need quick capital as funding is fast and easily accessible.

GoatFundedTrader offers different accounts, enabling Malaysian traders to choose what best suits their needs as well as helping them to earn the most possible while taking advantage of the firm’s capital.

GoatFundedTrader’s focus on flexibility is seen in their straightforward and fewer limiting guidelines, enabling traders to concentrate on their core plans instead of worrying about the rigid rules.

GoatFundedTrader is well suited for prop traders as it enables them to trade to their full potential by offering instant funding upon the successful completion of the evaluation process while offering a transparent and constructive environment.

| Feature | Details |

|---|---|

| Firm Name | GoatFundedTrader |

| Country | Malaysia |

| Account Types | Standard, Advanced, Instant Funding Accounts |

| Minimum KYC Requirement | Basic ID verification only |

| Funding Amount | Up to $100,000 depending on account type |

| Profit Split | Up to 80% for traders |

| Trading Platforms | MT4, MT5, WebTrader |

| Risk Management | Daily loss limit and maximum drawdown rules |

| Evaluation Process | Simple challenge with clear and flexible rules |

| Payout Frequency | Weekly or monthly depending on account |

3. SabioTrade

SabioTrade is one of the best prop firms in Malaysia. Affordable evaluation programs combined with scalable funding options make it ideal for all sorts of traders.

Malaysian traders really appreciate the simple and flexible trading conditions that are designed to let them concentrate on strategy and performance, rather than weaving through a bunch of complicated restrictions.

Apart from offering account funding, SabioTrade helps traders with education and risk management mentorship.

SabioTrade is a no nonsense firm with fast account verification, easy to understand profit-sharing, and many funding options that together really helps traders grow and empowers them to do it with no doubt in their mind. All of this makes SabioTrade one of the best options for proprietary trading in Malaysia.

| Feature | Details |

|---|---|

| Firm Name | SabioTrade |

| Country | Malaysia |

| Account Types | Standard, Scaling, Advanced Accounts |

| Minimum KYC Requirement | Basic ID verification only |

| Funding Amount | Up to $75,000 depending on account type |

| Profit Split | Up to 75% for traders |

| Trading Platforms | MT4, MT5 |

| Risk Management | Daily loss and maximum drawdown limits |

| Evaluation Process | Simple trading challenge with transparent rules |

| Payout Frequency | Weekly or bi-weekly payouts |

4. Instant Funding

The best prop firms in Malaysia are Instant Funding because it provides traders with immediate access to capital, letting them start trading without unnecessary delays.

Malaysian traders appreciate Its prompt and hassle-free account verification process, leaving behind the frustrating waiting period common with other prop firms. Instant Funding’s adjustable trading policies, generous profit-sharing, and various account choices provide traders the ability to select a plan compatible with their expertise and approach.

The clarity of their platform helps the traders concentrate on their trading without worrying about the personal financial. Instant Funding is among the best prop firms in Malaysia because of the speed, flexibility, and profit.

| Feature | Details |

|---|---|

| Firm Name | Instant Funding |

| Country | Malaysia |

| Account Types | Standard, Instant, Scaling Accounts |

| Minimum KYC Requirement | Basic ID verification only |

| Funding Amount | Up to $100,000 depending on account type |

| Profit Split | Up to 80% for traders |

| Trading Platforms | MT4, MT5, WebTrader |

| Risk Management | Daily loss and maximum drawdown limits |

| Evaluation Process | Quick challenge with clear and simple rules |

| Payout Frequency | Weekly or monthly payouts |

5. Earn2Trade

Earn2Trade is recognized as the top prop firm in Malaysia due to its integration of well-organized education and funding. This serves both novice and advanced traders.

Malaysian Earn2Trade users enjoy the full benefits of their trading courses, practice accounts, and evaluation programs, which prepare them for real capital access. Furthermore, Earn2Trade accommodates flexible risk parameters, has multiple account types, and provides generous profit distributions.

With visible processes and trainer assistance, Earn2Trade prioritizes the education of its users. This has become the first professional and funded training the prop firm has provided to ensure its users attain sustainable profitability in the markets.

| Feature | Details |

|---|---|

| Firm Name | Earn2Trade |

| Country | Malaysia |

| Account Types | Standard, Trader Career Path Accounts |

| Minimum KYC Requirement | Basic ID verification only |

| Funding Amount | Up to $50,000 depending on account type |

| Profit Split | Up to 75% for traders |

| Trading Platforms | MT4, MT5 |

| Risk Management | Daily loss and maximum drawdown limits |

| Evaluation Process | Structured trading challenge with transparent rules |

| Payout Frequency | Weekly or bi-weekly payouts |

6. The Funded Trader

The Funded Trader is one of the best prop firms in Malaysia because of its diverse funded accounts and trader-friendly policies. Malaysian traders enjoy various accounts, different risk rules, and clear profit-sharing structures that value traders for their consistency.

Funded Trader prioritizes accessibility by allowing traders to start at low-cost accounts and providing options for scaling accounts.

With quick account approvals, dependable trading software, and straightforward instructions, Malaysian traders of the Funded Trader can concentrate on strategy and account growth. The Funded Trader is top in Malaysia due to its unique combination of flexibility, clarity and the option to scale.

| Feature | Details |

|---|---|

| Firm Name | The Funded Trader |

| Country | Malaysia |

| Account Types | Standard, Advanced, Scaling Accounts |

| Minimum KYC Requirement | Basic ID verification only |

| Funding Amount | Up to $100,000 depending on account type |

| Profit Split | Up to 80% for traders |

| Trading Platforms | MT4, MT5, WebTrader |

| Risk Management | Daily loss and maximum drawdown limits |

| Evaluation Process | Simple challenge with clear rules |

| Payout Frequency | Weekly or monthly payouts |

7. Topstep

Topstep is becoming well-known in Malaysia as one of the best prop firms because of its focus on futures and forex trading while offering a well-structured and professional environment for traders. As for the evaluation programs,

Topstep enables Malaysian traders to focus on evaluation programs that are centered on risk management and consistency, so they grow into more disciplined traders. Topstep makes sure that traders work without distractions by providing real-time assistance, educational tools, and a profit-sharing model that is open and transparent.

Topstep also offers a safe way for Malaysian traders to acquire considerable capital with scalable funding and flexible account options. Topstep’s professional coaching, risk-centered approach, and dependable financing are what makes it so special.

| Feature | Details |

|---|---|

| Firm Name | Topstep |

| Country | Malaysia |

| Account Types | Futures, Forex Accounts |

| Minimum KYC Requirement | Basic ID verification only |

| Funding Amount | Up to $150,000 depending on account type |

| Profit Split | Up to 80% for traders |

| Trading Platforms | TradingView, MT4, MT5 |

| Risk Management | Daily loss and maximum drawdown limits |

| Evaluation Process | Structured trading evaluation with clear rules |

| Payout Frequency | Weekly or bi-weekly payouts |

8. Blueberry Funded

In Malaysia, Blueberry Funded has gained a reputation as one of the best prop firms because of their profit splits, simple evaluation, and quick access to trading capital. Since the firm has no opaque, convoluted, and heavy restrictions, traders can focus on administrative problems that resolve around strategy and performance.

The firm also has several account types and scalable funding, meaning traders can grow their capital as they become consistently skilled.

The firm is quick in verification, has reliable trading platforms, and is supportive which is why Blueberry Funded works as a prop firm very well for advancing traders in Malaysia predominantly because of profit, access, and flexibility. It is no surprise Blueberry Funded is a top choice in Malaysia.

| Feature | Details |

|---|---|

| Firm Name | Blueberry Funded |

| Country | Malaysia |

| Account Types | Standard, Advanced, Scaling Accounts |

| Minimum KYC Requirement | Basic ID verification only |

| Funding Amount | Up to $100,000 depending on account type |

| Profit Split | Up to 80% for traders |

| Trading Platforms | MT4, MT5, WebTrader |

| Risk Management | Daily loss and maximum drawdown limits |

| Evaluation Process | Simple evaluation challenge with clear rules |

| Payout Frequency | Weekly or monthly payouts |

9. FXIFY

In Malaysia, FXIFY is acknowledged as one of the finest prop firms due to its specialization in forex trading and its cost-effective, easily accessible funding for traders. FXIFY provides Malaysian traders with straightforward and flexible trading conditions.

The profit-sharing rules commendably reward clients for their consistent trading activity. The firm promotes uncomplicated trading as a way to achieve efficiency, which allows most traders to prioritize their strategies. FXIFY provides rapid account verification and adjustable funding to accommodate their clients as they scale.

FXIFY equips Malaysian traders with a solid trading platform in a risk-managed environment. Their traders learn to earn, and the firm promotes earning maximization. The firm is so well positioned in the Malaysian market due to its blend of scales in forex trading. Such a combination is difficult to find.

| Feature | Details |

|---|---|

| Firm Name | FXIFY |

| Country | Malaysia |

| Account Types | Standard, Scaling, Advanced Accounts |

| Minimum KYC Requirement | Basic ID verification only |

| Funding Amount | Up to $75,000 depending on account type |

| Profit Split | Up to 75% for traders |

| Trading Platforms | MT4, MT5 |

| Risk Management | Daily loss and maximum drawdown limits |

| Evaluation Process | Simple trading challenge with clear and transparent rules |

| Payout Frequency | Weekly or bi-weekly payouts |

Pros & Cons

Pros

- Getting to Use Bigger Capital– The bigger the capital the bigger the position traders can take without using personal savings.

- Potential Income– Traders can earn higher than a fixed salary.

- Professional Tools & Platforms– Many prop firms provide advanced trading software and real time data and analytics.

- Professional Help– Traders can take guidance and learn things like risk management in training which help them level up.

- Lower Risk to Traders– Traders don’t have to worry. The losing side of the trade is absorbed by the firm.

Cons

- Poor Evaluation Situations– Traders have to jump through many hoops just to get access to capital.

- Uneven Profit Splits– Some firms take a large share of your profits which can be very discouraging.

- Inflexibility to Trade– Traders have to work within very tight restrictions on the risk they can take, the size of the position, and the tradeable instruments.

- Performance Pressure– Capital firms can create stress by encouraging risky trades just to earn more thats especially hard for beginners.

Conclusion

To summarize, investors in Malaysia’s top prop firms have unparalleled access to trading tools, mentorship, and capital, while keeping risk to a minimum. Limited personal risk.

Excellent firms like FunderPro, Funding Pips, GoatFundedTrader, SabioTrade, Instant Funding, Earn2Trade, The Funded Trader, Topstep, Blueberry Funded, and FXIFY have driven profit sharing without fuss, and provided numerous account choices along with trading environment.

Malaysia prop traders selection, improves skill and top margin amount. Firm selection prop trading style and objectives aligned career reliability and professionally expanded. traders enhance trading earnings confidently and professionally.

FAQ

Why should I choose a prop firm in Malaysia?

Prop firms give Malaysian traders access to larger capital, professional trading tools, mentorship, and profit-sharing opportunities, allowing them to grow their trading career without risking personal funds.

What is a prop firm?

A prop firm, or proprietary trading firm, provides traders with company funds to trade financial markets. Traders share a portion of profits with the firm while minimizing personal financial risk.

Why should I choose a prop firm in Malaysia?

Prop firms give Malaysian traders access to larger capital, professional trading tools, mentorship, and profit-sharing opportunities, allowing them to grow their trading career without risking personal funds.

What are the costs involved?

Some prop firms charge evaluation fees or subscriptions, but many offer free or low-cost programs. Traders only risk the evaluation fee, not personal trading capital.