The Best Prop Firms With the Fastest Evaluation + Highest Scaling Growth will be covered in this article, which will assist traders in locating funding programs that provide both long-term capital expansion and speedy challenge completion.

These companies enable reliable traders in effectively expanding their funded accounts and reaching professional-level trading success by offering quick assessments, adaptable rules, and potent scaling models.

Key Point & Best Prop Firms With the Fastest Evaluation + Highest Scaling Growth

| Funded Trading Program | Key Points |

|---|---|

| FundedNext | Fast evaluation, flexible account sizes, profit split up to 80%. |

| FunderPro | Minimal KYC, low-cost evaluation, multiple account scaling options. |

| Funding Pips | Simple evaluation, consistent payouts, supports Forex and CFDs. |

| Bullwaves Prime | Instant funding after passing challenge, low rules, high leverage options. |

| Blue Guardian | Transparent rules, multiple account types, reliable support. |

| Funded Trading Plus | Easy evaluations, quick funding, risk management friendly. |

| City Traders Imperium (CTI) | Low-cost challenges, high profit potential, flexible account scaling. |

| E8 Markets | Global availability, instant funding, multiple instruments supported. |

| MyFundedFX | Straightforward evaluation, instant payouts, beginner-friendly platform. |

| Goat Funded Trader | Low-risk evaluation, high profit split, flexible account options. |

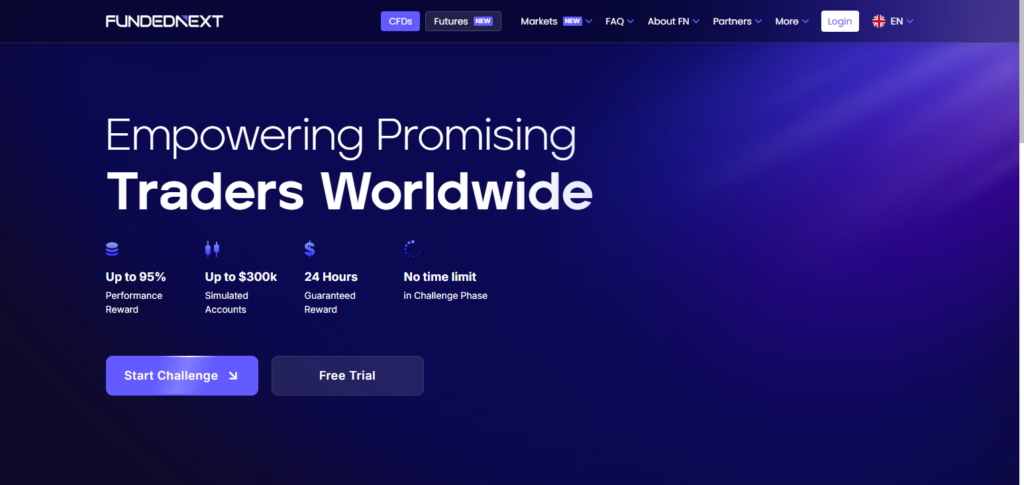

1. FundedNext

One of the most recognized prop firm around the globe is FundedNext. This prop firm is one of the best for its evaluations that are trader friendly, pricing that is competitive, and payouts that are faster than the rest.

This prop firm offers various types of challenges, including Evaluation and Express Challenge, where each trader is able to decide for themselves depending on their risk appetite. Among the mid-program features are Best Prop Firms With the Fastest Evaluation + Highest Scaling Growth. FundedNext has a profit share of above 90%, risk rules.

Pros & Cons FundedNext

Pros

- Quicker funding due to fast evaluation models with low profit targets.

- Account growth with traders on strong scaling plan.

- Flexible trading conditions with a high profit split (90–95%+).

Cons

- Varying spreads in high volatility periods.

- More restrictive drawdown limits for certain account types.

- Attention needed to rules around news trading.

2. FunderPro

FunderPro is reputed for providing **minimal KYC**, simple policies, and quick evaluations for low costs. The company prioritizes traders’ demanding requirements and provides them with high account leverage and unlimited lot sizing. The company classifies itself with the **Best Prop Firms With Fastest Evaluation + Highest Scaling Growth**, enabling traders to scale their accounts to significant sizes.

Thanks to the simple challenge framework, reliable tracking, and instant funding opportunities, FunderPro is trusted by rookie and veteran traders alike. They pay promptly, and their platform supports numerous assets to trade. They have one of the easiest policies to follow, and their trading guide is unmatched.

Pros & Cons FunderPro

Pros

- Very fast evaluation completion with minimal KYC members.

- Transparency with rules that are straightforward for beginners.

- Low challenge fees with high leverage.

Cons

- New traders still will have limited educational tools.

- Smaller firms and less account type variations.

- Scaling plan is good but less aggressive compared to CTI.

3. Funding Pips

Funding Pips has been gaining traction due to its simple two-phase evaluations due to its fairness and unrestrained trading strategies. It has gained attention due to immediate withdrawals, no trading restrictions, and dependable trade executions.

One of the Best Prop Firms With The Fastest Evaluation + Highest Scaling Growth, this firm allows traders to scale their accounts rapidly. With average spreads and trade executions, Trading Pips caters to Forex, commodities and index trading.

There are no unnecessary rules, allowing traders to easily concentrate on perfecting their trading strategies. The firm has relatively better customer support and quick evaluation times, making it better suited for the more disciplined traders.

Pros & Cons Funding Pips

Pros

- Realistic profit targets for quick two-phase evaluation.

- Fast support with instant payouts.

- Great execution with good variety of asset classes.

Cons

- Not the highest profit split in the industry but still competitive.

- Smaller firms offer more additional trader tools.

- More community presence needed.

4. Bullwaves Prime

Unlike their competitors, Bullwaves offers instant funding. When a trader meets performance criteria, they get access to real capital right away. Their evaluation model has been optimized around fastest progress, getting funded traders quicker than the rest.

As one of the Best Prop Firms With the Fastest Evaluation + Highest Scaling Growth, Bullwaves Prime has excellent scaling options and high leverage. The traders have flexible rules, competitive spreads, and trade all the majors. With a modern, user-friendly interface and an excellent supporting team, Bullwaves Prime is one of the best options.

Pros & Cons Bullwaves Prime

Pros

- Extremely fast access to capital with instant funding.

- High leverage, flexible rules, and low friction.

- Good scaling opportunities for traders consistently making a profit.

Cons

- Younger company, so long-term reputation is limited.

- Compared to most big prop firms, some platform features are lacking.

- Payout policies are not as highly reviewed.

5. Blue Guardian

Blue Guardian provides traders with a great combination of transparency, reliability, and trader-friendly policies. They have a two-phase evaluation, with fair drawdown limits and realistic profit targets.

They are among the Best Prop Firms With the Fastest Evaluation + Highest Scaling Growth, and continue to provide traders with the potential for long-term growth. Blue Guardian has strong community engagement, educational resources, and consistent payout participation.

Their rules have a bias towards responsible and risk-managed trading, as opposed to restrictive trading. With multiple account options and competitive pricing, Blue Guardian remains one of the most trusted choices for professional aspiring Forex traders.

Pros & Cons Blue Guardian

Pros

- Rules and risk policies are very trader-friendly and transparent.

- Good model for scaling and account growth over the long term.

- Support team and community are great.

Cons

- Price of their evaluations is a bit higher than some competitors.

- Some programs have restrictions on news trading.

- Compared to E8 Markets, platform tools are basic.

6. Funded Trading Plus

Funded Trading Plus, as the firm with the best rating for ease of access to evaluation with capital, has one of the easiest evaluations given.

For ease of access to evaluation capital, this firm has clear rules, flexible account options, and great customer support. For the best prop firms with the fastest evaluation to the highest scaling of growth, this firm allows traders to scale their accounts progressively.

The trading conditions are very good this firm has low spreads and fast execution. Funded Trading Plus has gained a great reputation for regular payouts and transparent challenges through their user friendly interface routing traders with growth challenges.

Pros & Cons Funded Trading Plus

Pros

- Rules for the evaluation are easy and profit targets are low.

- Other firms have more advanced resources for traders than this one does.

- Comes with very good customer service and a strong reputation.

Cons

- Fast payouts and multiple challenge types come with this one.

- Some accounts come with static drawdown limits.

- Compared to the best firms, scaling plans are a bit more basic.

7. City Traders Imperium (CTI)

Based in the UK, City Traders Imperium (CTI) is a well-established prop firm with a reputation for affordable challenges and offering great long-term scaling. While some firms become very strict, CTI believes in building mindful traders and rewarding them for their trading discipline. They have been recognized as the Best Prop Firms With The Fastest Evaluation + Highest Scaling Growth.

At CTI, traders can add substantial size to their trading accounts while having the freedom to trade however they want. Some of the programs allow up to a 100% profit split, and you can even hold trades over the weekend. CTI is a great fit for traders looking for funding as well as development due to their coaching ecosystem and array of advanced tools.

Pros & Cons City Traders Imperium (CTI)

Pros

- Industry leading scaling growth programs.

- Long term trader development with high profit splits and great incentives.

- Requirements allow some actions on weekends plus some swing actions.

Cons

- Usually not as quick as other firm alternatives.

- Competitors offer lower rates based on firm structure.

- Less suited for traders who want funding right away.

8. E8 Markets

E8 Markets is among the most sought-after companies due to their innovations in technology, fast funding, and worldwide reach. They feature large scales in accounts, easy and clear procedures, and modern trading dashboards.

E8 is listed among the Best Prop Firms With the Fastest Evaluation + Highest Scaling Growth due to their provision of rapidly increasing accounts to traders, depending on their consistent efforts.

Their trading conditions are also excellent, having low and competitive spreads and very fast execution. It is very easy to appreciate the customer base of E8 Markets as the rules they have in place are seamless, the payouts are very fast, and the entire process is seamless. E8 is also known for their excellent customer support and proven reliability.

Pros & Cons E8 Markets

Pros

- Evaluation periods and payout processing can be surprisingly quick.

- Best features and real-time analysis on the top dashboards available.

- Sizeable positions available and a good reputation globally.

Cons

- Features are good, but pricing goes beyond the lower end.

- Programs can have more restrictive rules on drawdowns.

- Feature doesn’t exist for an instant funding with step one model.

9. MyFundedFX

MyFundedFX is also a very popular and decreasingly advanced prop firm due to their seamless evaluations, rapid payouts, and overall low-cost transactions.

They operate with an adaptable trading system, with styles varying from news trading to weekend holding. MyFundedFX is listed under the Best Prop Firms With the Fastest Evaluation + Highest Scaling Growth due to the multiple account growth schemes that they have in place.

They also feature very quick support and execution, making them a reliable source for conducting rapid movements through various trading challenges. It is clear that many traders would like to get funded without any complex rules and MyFundedFX is a choice that has attracted a number of traders.

Pros & Cons MyFundedFX

Pros

- Easy to pass challenges with only a few rules.

- Fast or instant funding possible with some accounts.

- Doesn’t restrict holding positions overnight and allows news trading.

Cons

- Good but just capped in size relative to other firms like CTI or FundedNext.

- Wider spreads can be caused by the liquidity providers.

- Heavily customer serviced times in a trading pattern can reduce in response times.

10. Goat Funded Trader

With evaluation models, profit-spots, and other trading conditions supporting minimal risk, Goat Funded Trader prioritizes trader autonomy. The firm caters to numerous asset classes and provides clients with performance-tracking dashboards.

Due to consistent results, Goat Funded Trader Frequents the List of Best Prop Firms With The Fastest Evaluation + Highest Scaling Growth The firm is well-liked by traders with a need for a simple and reliable funding partner due to its clear regulations, dependable spreads, timely payouts, and all-around transparency. In the prop industry, Goat Funded Trader is a trustworthy choice due to their balanced evaluation systems and opportunities for sustained growth.

Pros & Cons Goat Funded Trader

Pros

- Evaluation system lower risk, but can have high profit splits.

- More risk allowed with stronger predictive models and other systems.

- Can trade on more assets with good but not great spreads.

Cons

- Not always large, but the system does have a smaller amount of older reviews.

- Abovementioned firms charge evaluation costs are somewhat higher on the spectrum of budget-friendly firms.

- Analytics and dashboard possiblities are more advanced.

Conclusion

The best prop firms with the fastest evaluations and highest scaling growth should offer a nice mix of speed, flexibility, and long-term potential. These firms allow traders to move quickly through evaluations and offer generous scaling.

Consistency and discipline is the name of the game. Be it rapid funding by FundedNext and FunderPro, blue guardian and My Funded FX having the clearest and most transparent rules, or CTI and E8 Markets with the most potential for large scale growth, all of these firms offer serious traders unique potential.

Overall, the most active and best performing prop firms allow traders to make the most money, accelerate the growth of their capital, and avoid the corporate 9 to 5 by building a stable long term trading career with maximum freedom.

FAQ

What makes a prop firm “fast evaluation”?

A fast-evaluation prop firm offers quick challenge phases, low profit targets, simple rules, and faster verification processing. This allows traders to become funded in days instead of weeks or months.

Which prop firms offer the fastest evaluation process?

FundedNext, FunderPro, MyFundedFX, and E8 Markets are known for extremely fast evaluations, simple rule structures, and quick account activation.

What is scaling growth in prop firms?

Scaling growth refers to a firm’s program that increases a trader’s funded capital based on consistent performance. Traders can grow accounts from small sizes to six-figure and even seven-figure allocations.