I’ll go over the top risk management software for companies of all kinds in this post. Organizations may effectively detect, evaluate, and reduce operational, financial, and regulatory risks with the use of risk management software.

We will examine the best platforms, their features, benefits, and drawbacks, as well as how they might improve decision-making, expedite processes, and bolster organizational resilience in general.

What is Risk Management Software?

Operational, financial, regulatory, and strategic risks are just a few of the risks that may be identified, evaluated, monitored, and mitigated with the use of risk management software. In order to facilitate well-informed decision-making, it centralizes risk data, automates processes, and offers real-time dashboards and analytics.

This software helps companies to proactively manage risks, improve operational resilience, and safeguard assets by speeding risk assessments, monitoring occurrences, and guaranteeing regulatory compliance. Risk management software is used by businesses of all sizes to increase visibility, lower manual error rates, and uphold a systematic approach to risk mitigation across divisions.

Why Use Risk Management Software

Foresee Operational Threats: Operational, financial, and compliance threats can be stopped in their tracks with effective risk management software.

Better Business Choices: Reports, analytics, and real-time dashboards empower leaders to make better choices supported by complete risk information.

Staying Within the Law: Regulatory compliance is built into some software platforms to avoid penalties by following some regulation frameworks (ISO, NIST, SOX, HIPAA).

Eliminate Tedious TasksRisk audits, assessments, and reports can be automated by software to eliminate errors and to save time.

Operational Stability: Organizations can record their risk data and tracking mitigation processes to improve their losses and operational stability.

Store Risk Data: The software stores risk data for every user to improve visibility across departments and improve collaboration.

Manage Key Risk Indicators (KRIs): Organizations can track and manage the metrics relating to the even of a risk to help act timely.

Assist with Strategic Planning: Organizations can avoid the risk of over/under planning and can utilize the resources best with planned objectives.

Key Point & Best Risk Management Software List

| Platform | Key Points |

|---|---|

| Resolver | Integrated risk, incident, and audit management; strong reporting features. |

| Mitratech | Compliance and legal risk focus; automates workflows and policy management. |

| StandardFusion | Cloud-based GRC solution; simplifies risk assessments and compliance tracking. |

| Corporater | Enterprise-wide risk and performance management; flexible dashboards. |

| LogicManager | User-friendly interface; strong risk, policy, and audit management tools. |

| RiskWatch | Automated risk assessment platform; focuses on security and vendor risks. |

| AuditBoard | Cloud-native audit, risk, and compliance platform; excellent for SOX. |

| Riskonnect | Enterprise risk management; highly configurable and scalable. |

| SAP Risk Management | Integrates with SAP ERP; supports operational and financial risk analysis. |

| IBM OpenPages | Enterprise GRC platform; strong AI-driven analytics and reporting. |

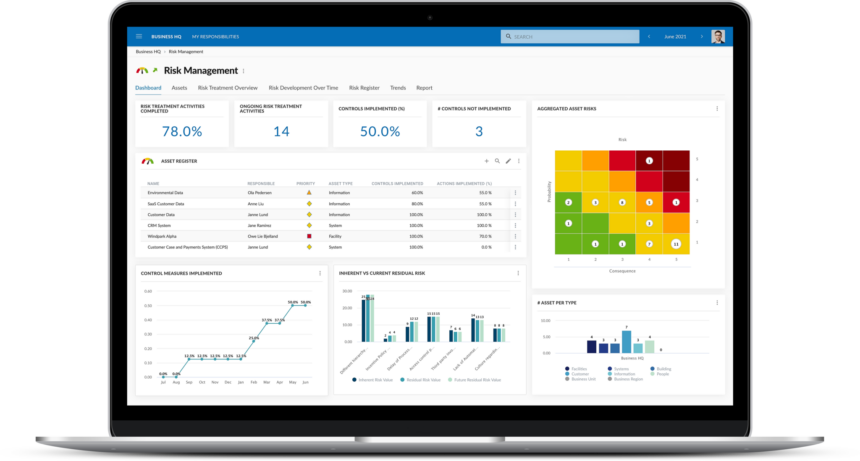

1. Resolver

Resolver is a cloud-based Integrated Risk Management (IRM) solution. It consolidates the disparate data sets of risk, incident, audit, compliance, and third-party risk into a single source of truth.

This helps organizations unify and connect different risk signals to identify systemic problems within the enterprise. With the help of customizable dashboards, real-time reporting, and automated workflows, teams are able to optimize and visualize the impact and trends of risk.

The analytics features serve to enhance and support strategic decision-making. Resolver’s strength is in operationalizing and incident data, converting it into actionable risk intelligence for large organizations.

Resolver Features, Pros & Cons

Key Features

- Risk, incident, audit, and compliance modules – all fully integrated

- Instant dashboards & automated reporting

- Automation of workflows

- Analytics for root causes & patterns

- Risk register, centralized

Pros

- Superb integration of risk and incident data

- Great dashboard and data visualization features

- Exceptional enterprise risk management

- Workflows can be customized to suit teams

- Executive dashboards with actionable insights

Cons

- Onboard training for casual end users can be extensive

- For smaller organizations, pricing can be prohibitive

- Set up and configuration can take quite a while

- Some users may require formal training to use fully

- Less comprehensive than competitors regarding third-party risk

2. Mitratech

Mitratech is a GRC (Governance, Risk, and Compliance) platform that lays emphasis on the use of automation, AI, and analytics to lessen the complexity of enterprise-wide risk and control visibility. It integrates silos by centralizing risk registers, control testing, and regulatory mapping and is able to support complex workflows and real-time dashboards.

AI and machine learning features within the platform help in the automation of evidence collection, risk scoring, and the detection of emerging trends, resulting in a decrease of manual work needed while increasing predictive analytics and insight.

Mitratech’s platform adapts to multiple compliance needs and works with current IT and business systems, making it a good fit for companies needing scalable and automated risk and compliance solutions .

Mitratech Features, Pros & Cons

Key Features

- GRC workflows, automated, plus

- Analytics, AI-assisted

- Mapping of regulations and tracking of compliance

- Management of policies and controls

- Reporting and risk scoring

Pros

- Automation of processes done manually

- AI insights assist in trend detection

- Exemplary support of compliance frameworks

- For mid to large corporations, ideal

- Risks and controls consolidated

Cons

- For new users, it can be complicated

- Costs escalate in order to access the complete suite3. Customization might involve outside consultants.

- User interface can feel overly complicated at times.

- It’s possible that the entire implementation process can take a considerable amount of time.

3. StandardFusion

As a unified Governance, Risk and Compliance (GRC) solution, StandardFusion aims to bring state of the art tools to help risk and compliance work. StandardFusion integrates risk and compliance work into a single framework, allowing all stakeholders to see the entire landscape of risk, compliance and audit.

From one platform, teams can track and mitigate risk through tools such as real�time scoring, and provide a broad set of insights through automated pivots and heat mapping. StandardFusion’s adaptable risk matrices and framework support (ISO, NIST, SOC 2) facilitates quick and easy deployments. This simplifies the process for mid-market to growing companies requiring scalable, audit-ready risk management.

StandardFusion Features, Pros & Cons

Key Features

- GRC platform that is entirely cloud-based

- Mapping of frameworks & standards (ISO, NIST)

- Templates for risk assessments

- Tools for audit planning

- Scorecards and heat maps

Pros

- Deployment is a breeze, especially being cloud-native.

- Solid tracking of standards & compliance.

- Risk and audit workflows are flexible.

- Middle-sized teams will find this user friendly.

- Providing features of this magnitude is a reasonable cost.

Cons

- Less enterprise-level depth is fairly typical for advanced analytics.

- Lacking AI and ML capabilities.

- Of the reporting options, some of them are very basic.

- Very large global enterprises may find this subpar.

- Developer support is necessary for custom extensions.

4. Corporater

Corporater facilitates enterprise performance management integrated with risk and compliance management. This unique proposition empowers businesses to set and manage risks in the frame of strategic goals. Risk management support in Corporater platform spans identification, analysis, mitigation, and reporting across operational, financial, IT, and third-party risks.

With Corporater, stakeholders get a valuable understanding of risk exposure with the help of flexible dashboards and visualizations. Automated workflows strengthen consistency and accountability.

Corporater, with modular risk taxonomy and support for multiple compliance frameworks, aligns with the needs of medium to large organizations who desire a complete risk solution, seamlessly linking performance outcomes to risk insights.

Corporater Features, Pros & Cons

Key Features

- Combined risk management and performance management.

- Dashboards that can be configured.

- Scorecards for enterprises

- Risk taxonomy

- Integration of business intelligence

Pros

- Excellent integration of the performance and risk strategy.

- Solid visuals and dashboards.

- Excellent alignment for enterprise KPIs.

- Modular; over time, additional capabilities can be added.

- Excellent reporting for executives.

Cons

- Planning and time are needed for setup.

- This is a hybrid tool – it is not exclusively a risk tool.

- For smaller teams, this may be an overkill.

- Expertise is required for custom metrics.

- For effective use, some training is required.

5. LogicManager

With the integration of risk libraries, control mapping, and customizable workflows, LogicManager as an enterprise risk management platform assists organizations in enhancing their GRC programs. It promotes organized planning via taxonomy-based risk delineation and real-time analytics, making it possible for organizations to connect risks across functions and map out dependencies.

Executives are supported by built-in reporting, dashboards, and heat maps in monitoring the performance of key risk indicators and the impact of mitigation strategies. For large and mid-size companies aiming to unify risk methodologies and strengthen transparency across business units, LogicManager’s emphasis on process automation and operational resilience is particularly valuable.

LogicManager Features, Pros & Cons

Key Features

- Taxonomy & risk libraries

- Risk scoring & Heat maps

- Compliance & policy tools

- Workflows & automated reminders

Pros

- Intuitive interface & taxonomy model

- Excellent linking of risk & controls

- Great support for compliance

- Onboarding & support are good

- Cost effective for mid-size companies

Cons

- Analytics are not advanced

- Some users think UI is outdated

- Reporting could improve

- Cost can be impacted by number of users

- Some other features are add-ons

6. RiskWatch

With an emphasis on strong template-driven workflows that are regulatory and security framework compliant (NIST, ISO, HIPAA, etc.), RiskWatch is a risk assessment and management tool. Teams are able to assess thoroughly and with consistency, as it automates assessment scoring, prioritization, and evidence collection.

Detailed reports, audit tracking and real-time dashboards show the risk posture and gaps in compliance. For organizations in fields that face strict regulations, the standardization of risk assessments and compliance reporting in RiskWatch contributes greatly to operational integrity and adherence to regulations.

RiskWatch Features, Pros & Cons

Key Features

- Risk assessments driven by templates

- Frameworks for security & regulations

- Prioritization & scoring automation

- Audit trails & evidence collection

- Reports that can be exported

Pros

- Great for industries with heavy compliance

- Assessments that are repeatable & fast

- Library of templates is comprehensive

- Prioritization & scoring is clear

- Documentation for audits is solid

Cons

- Less effective for managing risks strategically

- Focus is narrower for analytics

- Not the best for enterprise risk intelligence

- Expertise is needed for custom templates

- Steep learning curve for the UI

7. AuditBoard

Centralizing risk data, automating workflows, and providing a clear view of the control and compliance landscapes, AuditBoard is a suite of risk and audit management that is cloud-native. It combines risk assessments, auditing, and reporting to minimize efforts and manual tasks, while improving the workflow between audit and risk functions.

With dynamic dashboards and real monitoring capabilities, AuditBoard empowers teams to evaluate and prioritize remediation activities, while providing a level to zero gaps in compliance. With seamless integration with ESG and ERM processes, AuditBoard is getting the highest score from audit and risk practitioners for its process automation.

AuditBoard Features, Pros & Cons

Key Features

- Planning & tracking audits

- Integrated controls & risk

- SOX compliance tools

- Dashboards with real-time updates

- Tracking of issues & remediation

Pros

- The best for audit teams

- Tight control & linkage of issues

- Auditors get good reporting

- Excellent automation of workflows

- Manual Excel work is less.

Cons

- More auditing focus than ERM breadth

- Pure risk teams find it pricey

- Value is max when trained

- Slower in customization

- Third party risk modules are add-ons

8. Riskonnect

Offering an enterprise level of scalability, Riskonnect manages to provide a suite of integrated tools for Enterprise Risk Management that allow the consolidation of risk data including operational, strategic, and compliance.

It provides present and continuous access to risk dashboards, information from risk registers, risk key indicators, and actions from risk mitigation overall providing stakeholders visibility to changing risk in real time.

The sophisticated analytics and reporting capabilities of the platform help organizations proactively identify and respond quickly to risks, and the integrated workflows improve cross-department collaboration.

For large multinational companies needing global connectivity and comprehensive, integrated risk intelligence to assist in executive-level decision-making and resilience planning, Riskonnect’s global customer support and multilingual services are ideal.

Riskonnect Features, Pros & Cons

Key Features

- Consolidation of enterprise risk.

- Management of KPIs/ KRIs.

- Dashboards of real time risk.

- Risk of incidents, vendors and compliance.

- Analytics, predictive.

Pros

- Fast growing enterprises can scale up.

- Good insight of cross domain risk.

- Good predictive analytics.

- Dashboards can be configured.

- Good range of risk coverage.

Cons

- Complexity of implementation.

- More modules lead to increased costs.

- Need for executive sponsorship.

- Advanced analytics have a steep learning curve.

- Reporting requires setup work.

9. SAP Risk Management

SAP Risk Management is an enterprise risk management solution that is part of the SAP ecosystem, allowing organizations to incorporate risk management into their business processes. It monitors threats, and provides assessments of opportunities via heat maps and guided workflows.

It is integrated with SAP ERP, S/4HANA, analytics, and other enterprise systems to better manage financial, operational, and compliance risks. For large, regulated enterprises that rely on SAP for their core business processes, and need integrated risk management across processes, SAP’s solution is quite effective.

SAP Risk Management Features, Pros & Cons

Key Features

- Full integration of SAP (ERP, S/4HANA)

- Ongoing (continuous) monitoring.

- Scoring of operational and financial risks.

- Automated alerts.

- Risk workflows and registries.

Pros

- Good integration with SAP systems.

- Financial risk tracking is excellent.

- Usage of real-time data of enterprise.

- Good compliance.

- Good for organizations that are SAP-centric.

Cons

- Best value only if already on SAP

- Difficult to implement

- Not cost-effective standalone

- Needs SAP expertise

- The interface is functional, but looks outdated

10. IBM OpenPages

IBM OpenPages provides the best AI-enhanced enterprise risk management solution. GRC (governance, risk and compliance) comprises enterprise risk management, audit, policy, and controls all in one place.

Using IBM’s analytics and AI, the platform recognizes trends in both structured and unstructured data, enabling predictive risk assessments and proactive mitigation strategies.

OpenPages combines operational risk, regulatory compliance, IT governance, and third-party risk into one system, allowing for streamlined reporting and scenario analysis across business units. Due to its scalability and robust integration with enterprise data systems, it is particularly beneficial for large multinational companies facing intricate regulatory challenges.

IBM OpenPages Features, Pros & Cons

Key Features

- EGRM platform

- ML + AI

- policy, vendor and IT risk

- Integrated risk

- bespoke dashboards & analytics

Pros

- Analytics and Intelligent Insights are very strong.

- Governance is centralized across domains.

- Global enterprises means horizontal scalability.

- Reporting is very deep.

- IT & vendor risk module is good.

Cons

- Lack of affordability for smaller companies.

- Technical complexity in configuration.

- Lengthy time for implementation.

- Data integration expertise is required.

- Complex but powerful interface.

Conclusion

In conclusion, an organization’s size, industry, regulatory needs, and level of risk management maturity all play a role in choosing the best risk management software. While Mitratech and RiskWatch concentrate on compliance automation and regulatory adherence, platforms like Resolver and AuditBoard excel in integrated risk and audit management, offering real-time visibility and actionable information.

While enterprise-focused tools like Riskonnect, SAP Risk Management, and IBM OpenPages offer scalable, AI-driven analytics and smooth integration with current systems, StandardFusion, Corporater, and LogicManager offer flexible GRC frameworks and robust reporting capabilities. All things considered, the appropriate software enables businesses to proactively recognize, evaluate, and reduce risks, improving operational resilience and strategic decision-making.

FAQ

What is risk management software?

Risk management software helps organizations identify, assess, monitor, and mitigate risks across operations, compliance, finance, IT, and strategic functions. It centralizes risk data, automates workflows, and provides dashboards for better decision-making.

Why do businesses need risk management software?

Businesses use this software to reduce uncertainty, comply with regulations, manage incidents, improve operational resilience, and make data‑driven decisions that protect reputation and assets.

What features should I look for in risk management software?

Key features include risk assessment tools, real‑time dashboards, automated workflows, incident tracking, compliance mapping, reporting, analytics, and integration with existing systems.

Which software is best for small to mid‑sized organizations?

Platforms like StandardFusion, LogicManager, and RiskWatch are known for affordability, ease of use, and scalable features suitable for growing organizations.