The need for adaptable and crypto-native payment solutions is growing beyond Stripe’s conventional services as companies adopt digital assets more and more.

The Best Stripe Crypto API Alternatives enable Web3 apps, SaaS platforms, and retailers to accept cryptocurrency payments with reduced costs, quicker settlements, and worldwide reach.

These options, which range from developer-friendly non-custodial APIs to compliant enterprise gateways, aid in future-proofing payment infrastructures in a changing financial sector.

What Is Stripe Crypto API?

Stripe’s suite of tools and integrations that allow companies to accept cryptocurrency-related payments and services in addition to conventional fiat transactions is known as the Stripe Crypto API.

Using Stripe’s reliable payment infrastructure, it enables platforms to process payments involving digital assets, enable cryptocurrency on-ramps and off-ramps, and link users to blockchain networks.

The Stripe Crypto API was created primarily for financial apps, markets, and Web3 platforms. It helps companies bridge the gap between traditional payments and the crypto ecosystem by emphasizing compliance, security, and a smooth user experience.

Key Points

| Platform | Key Points |

|---|---|

| Coinbase Commerce API | Enables businesses to accept major cryptocurrencies with a seamless checkout experience. Offers non-custodial payments, strong US/EU compliance, and easy integration for global merchants. |

| BitPay API | A trusted crypto payment processor supporting BTC, ETH, and stablecoins. Provides fast settlements, invoice management, and enterprise-grade security for large organizations. |

| NOWPayments API | Supports 250+ cryptocurrencies with auto-conversion and non-custodial options. Ideal for global e-commerce and SaaS platforms seeking flexible crypto payments. |

| CoinGate API | Offers crypto acceptance with automatic fiat payouts, recurring billing, and EU regulatory compliance, making it suitable for subscription-based businesses. |

| CoinsPaid API | Designed for high-volume merchants with instant settlements, advanced reporting, and secure processing, widely used by exchanges and marketplaces. |

| MoonPay API | Provides fiat-to-crypto on-ramp services with card and bank support, smooth KYC flow, and global coverage for consumer and Web3 applications. |

| Transak API | Compliance-focused on-ramp and off-ramp solution available in 160+ countries, enabling easy fiat-crypto conversions for Web3 apps and wallets. |

| BlockBee | Non-custodial crypto payment gateway offering a simple API, multi-coin support, and privacy-focused transactions for merchants and developers. |

| Coinremitter | Low-fee crypto payment API with invoice generation, auto-payments, and easy integration, ideal for startups and small businesses. |

1. Coinbase Commerce API

Merchants are enabled by Coinbase Commerce API to directly accept multiple cryptocurrencies, self-custody or settle into USDC through a Coinbase account. There are invoicing, checkout integrations, and comprehensive developer API tools.

The most reliable choice for businesses in the United States and the EU because of their strong regulatory compliance and solid reputation in the market.

More than most Stripe Crypto API Alternatives, Coinbase Commerce API is the most suited for e-commerce and SaaS businesses that need a dependable crypto acceptance service and fiat conversion capabilities.

Coinbase Commerce API Features

- Provides support for multiple digital currencies (BTC, ETH, USDC, etc.)

- Options for settling via self-custody or Coinbase accounts

- Simple integration for checkout and invoice processing

- Excellent compliance and brand trust

- Optimal for merchants requiring US/EU regulatory clarity

Coinbase Commerce API Pros & Cons

| Pros | Cons |

|---|---|

| Trusted Coinbase brand | Higher fees than smaller gateways |

| Strong US/EU compliance | Limited coin support compared to NOWPayments |

| Easy checkout & invoicing | Requires Coinbase account for fiat settlement |

| Option for self-custody | Not ideal for small merchants |

| Auto-settlement into USDC | Limited global fiat payout options |

2. BitPay API

Still among the oldest, BitPay API supports Bitcoin, Ethereum, and stable coins. Also, it has diverse functionalities such as invoicing, billing, and, as it allows merchants to mitigate risks related to crypto payment volatilities, it supports fiat settlement across different currencies.

It also has excellent compliance, strong merchant adoption, and seamless accounting tool integrations.

Because of such attributes, BitPay API is an excellent choice among enterprise, NGOs, and tier 1 merchants crypto payment solutions that include the ability to fiat settle and most strive to remain regulated.

BitPay API Features

- Accepts BTC, ETH and stable coins.

- Invoice, billing, and donation tools available

- Option for fiat settlement in various currencies

- Reputation for compliance and focus on the long-term

- Most suitable for large merchants, enterprises, and NGOs

BitPay API

| Pros | Cons |

|---|---|

| Long-standing reputation | Limited crypto support (BTC, ETH, stablecoins) |

| Fiat settlement in multiple currencies | Requires merchant KYC |

| Invoicing & billing tools | Less flexible for startups |

| Strong compliance | Higher integration complexity |

| Widely adopted by enterprises | Focused on large-scale merchants |

3. NOWPayments API

With features such as auto-conversion, NOWPayments API supports more than 250 currencies and is non-custodial. In addition to effortless integration, it also has features such as mass payouts and re-billing that are appealing to merchants across the globe.

Because of such features, global businesses find it to have flexible diversified coins with low transaction fees.

NOWPayments API is also among the best alternatives to the Stripe Crypto API and more suited for e-commerce, SaaS, and marketplace for those wanting diversified crypto, non-custodial payment solutions and losing central custody.

NOWPayments API Features

- Over 250 supported coins on a non-custodial gateway

- Crypto to fiat conversions occur automatically

- Supports mass payouts and recurring billing

- Easy API integration for merchants globally

- Most suitable for SaaS and e-commerce platforms requiring diverse coins

NOWPayments API Pros & Cons

| Pros | Cons |

|---|---|

| Supports 250+ coins | Smaller brand recognition |

| Non-custodial gateway | Limited fiat settlement |

| Auto-conversion features | Advanced features need setup |

| Mass payouts & recurring billing | May lack enterprise-grade compliance |

| Easy API integration | Less suited for regulated industries |

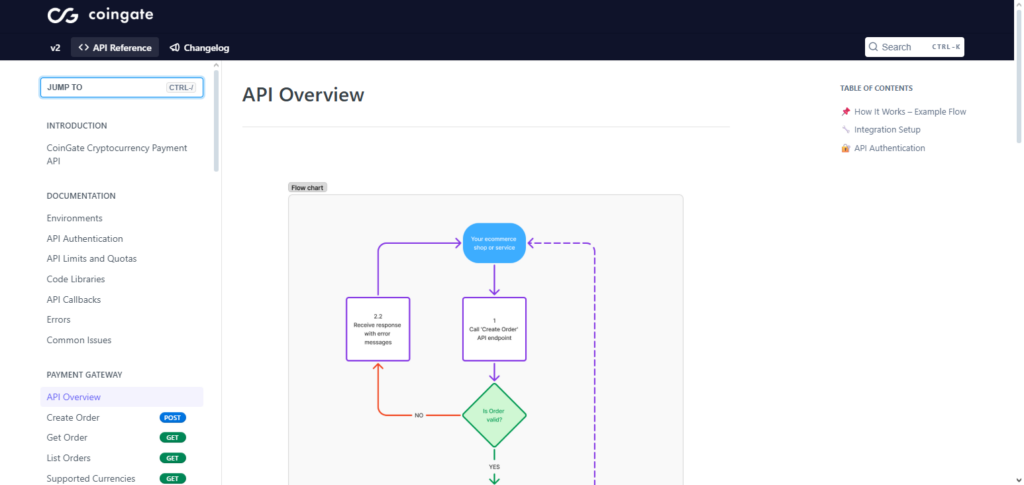

4. CoinGate API

It supports Bitcoin, Ethereum, altcoins, and has the ability to manage subscription billing. CoinGate API has the ability to process crypto payments and, due to the ability to do fiat conversions to major currencies, is especially good for European merchants, as it supports payouts in EUR, USD, and GBP.

Its strengths are in thorough compliance with EU crypto regulations and fast, seamless conversion of crypto to fiat. APIs like CoinGate API are easily the best fit for compliant subscription-based businesses, SaaS, and e-commerce merchants in Europe looking for flexible crypto payment alternatives.

CoinGate API Features

- Altcoins, ETH, and BTC are accepted

- Fiat payouts available in EUR, USD, and GBP

- Available features for managing recurring billing and subscriptions

- Compliant and regulated across the EU

- Most suitable for subscription companies and merchants across Europe

CoinGate API Pros & Cons

| Pros | Cons |

|---|---|

| Fiat payouts in EUR/USD/GBP | Primarily EU-focused |

| Recurring billing support | Limited global fiat coverage |

| EU-regulated | Smaller ecosystem |

| Supports BTC, ETH, altcoins | Not ideal for high-volume enterprises |

| Subscription management tools | Less coin diversity than NOWPayments |

5. CoinsPaid API

This API offers enterprise solutions for high throughput customers, including merchants, exchanges, and marketplaces. CoinsPaid API offers instant crypto to fiat settlement, mass crypto payouts, crypto custody, and vault storage.

With strong infrastructure, good compliance, and advanced tools for merchants, it provides good scalability for major players in the ecosystem.

Best alternatives to the Stripe API for crypto payments is CoinsPaid APIs as it has the ability to support large enterprises, crypto exchanges, and has a good infrastructure for marketplaces that you’re able to support a large volume of transactions with good fiat liquidity for global business engagements.

CoinsPaid API Features

- Payment infrastructure for crypto on an enterprise level

- Settlement for crypto and fiat available instantly

- Mass payouts and custody services

- Large merchants that have high transactional throughput

- Best suited for enterprises, marketplaces, and exchanges

CoinsPaid API Pros & Cons

| Pros | Cons |

|---|---|

| Enterprise-grade infrastructure | Complex setup for small merchants |

| Instant crypto-to-fiat settlement | Focused on large-scale businesses |

| Custody services | Requires deeper compliance integration |

| Mass payouts | Higher onboarding requirements |

| High transaction throughput | Less suited for freelancers/startups |

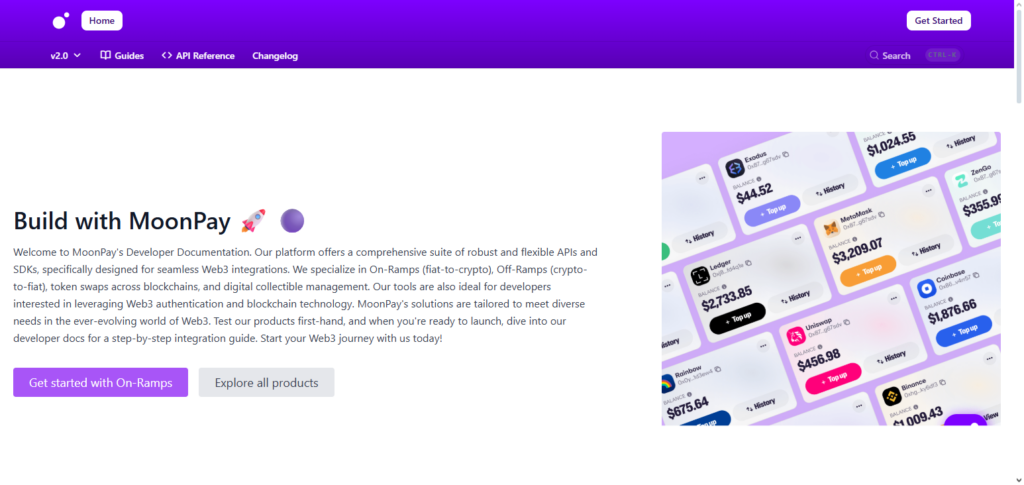

6. MoonPay API

Offering credit card, bank transfer, and Apple Pay integration, MoonPay API is a fiat-to-crypto on-ramp. Due to their extensive reach and KYC/AML compliance, MoonPay is a reliable option for your Web3 application.

Some of their strongest points are their seamless onboarding and regulatory compliance. Apps, wallets, and NFT markets that need a compliance-driven solution for fiat-to-crypto integration will benefit from best-in-class alternatives to Stripe Crypto API like MoonPay API.

MoonPay API Features

- Ability for users to buy crypto and use cards, bank transfers, or Apple Pay for payments

- Good standing for KYC and AML

- Accessible in many parts of the world

- Good onboarding experience for Web3 apps

- Best suited for NFT marketplaces, apps, and wallets

MoonPay API Pros & Cons

| Pros | Cons |

|---|---|

| Smooth fiat-to-crypto on-ramp | Higher fees for end-users |

| Supports cards, bank transfers, Apple Pay | Requires full KYC/AML |

| Strong compliance | More consumer-focused than merchant-focused |

| Global reach | Limited crypto-to-fiat settlement |

| Easy onboarding | Not ideal for enterprise payouts |

7. Transak API

Transak API, as one of the competition’s best alternatives to Stripe’s Crypto API, is best for Web3 applications, DeFi services, and international digital wallets. It allows direct integration of Transak’s on/off-ramp services in over 160 countries.

Transak, like most of its competitors, provides compliance-driven on- and off-ramps as well as a variety of payment solutions for developers to choose from.

Most of its users’ complaints are along the lines of regulatory compliance, but the truth is that their competitors are tough to beat. It is evident that Transak’s strongest points are world-class service coverage and compliance.

Transak API Features

- Ability to open and close fiat in over 160 countries

- Payments through bank transfers, cards, and UPI

- Infrastructure that prioritizes compliance

- Linked directly to Web3 apps and wallets

- Best suited for global Web3 programs and DeFi platforms

Transak API Pros & Cons

| Pros | Cons |

|---|---|

| Operates in 160+ countries | Heavy compliance requirements |

| Fiat on/off-ramp | Fees vary by region |

| Multiple payment methods | Primarily Web3-focused |

| Wallet & Web3 integration | Less traditional merchant tools |

| Strong developer tools | May be complex for small merchants |

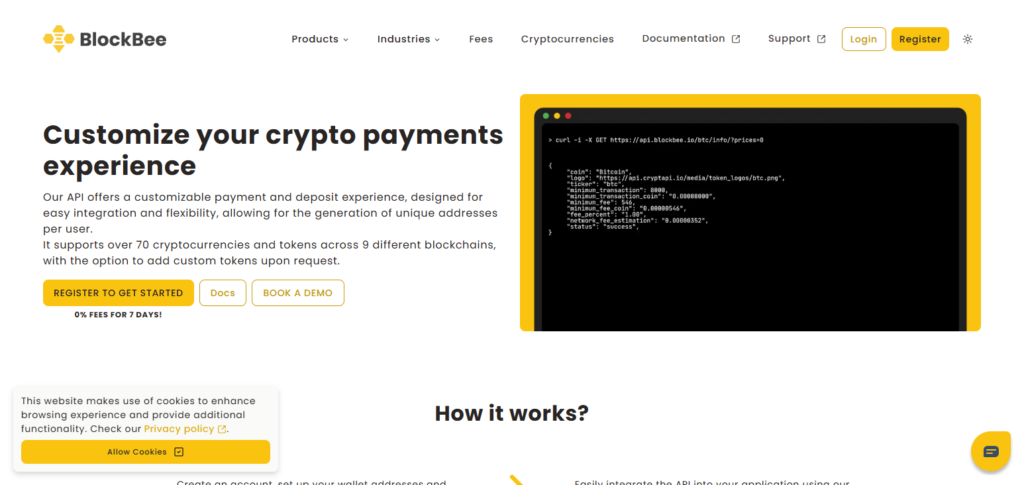

8. BlockBee API

BlockBee API is the first crypto payment gateway that is lightweight, wonderfully simple to integrate, and provides instant notifications while processing multiple coins. It is geared towards small, and medium-sized merchants that want to start accepting crypto while avoiding complex infrastructures.

Its simplicity, low costs, and small setups with very fast integration and response times, set them apart.

These kinds of offerings like the BlockBee API are ideally suited to small businesses, freelancers, and growing businesses that want to minimize the staff technical skills needed to implement a streamlined payment processor with crypto.

BlockBee API Features

- Minimal crypto payment gateway

- Supports a variety of cryptos

- Instant notifications for payments

- Best suited for freelancers, small businesses, and startups

BlockBee API Pros & Cons

| Pros | Cons |

|---|---|

| Lightweight & simple integration | Limited advanced merchant tools |

| Supports multiple coins | Smaller ecosystem |

| Instant notifications | Less compliance infrastructure |

| Low fees | Limited fiat settlement |

| Fast setup | Not enterprise-grade |

9. Coinremitter API

Coinremitter API is a crypto gateway focused on merchants with wallet services, invoices, and ability to withdraw crypto. It has support for multiple coins and has low fees on transactions. Its strengths are low costs, simplicity, and tools for the merchants.

These kinds of offerings like the Coinremitter API are best suited for small merchants, ecommerce, and businesses in emerging economies that want a wallet integrated, simple and low cost solution to accepting crypto payments.

Coinremitter API Features

- Gateway and wallet tailored to merchants

- Crypto invoicing and withdrawals

- Transaction costs are low

- Quick and easy integration and setup for online merchants

- Best suited for small businesses and merchants in emerging economies

Coinremitter API Pros & Cons

| Pros | Cons |

|---|---|

| Merchant-focused | Limited fiat settlement |

| Low fees | Smaller coin support |

| Easy setup | Less regulatory backing |

| Wallet-based gateway | Not ideal for enterprises |

| Invoicing & withdrawals | Limited global adoption |

How to Choose the Right Stripe Crypto API Alternative?

Supported Cryptocurrencies Check if the providers offer the desirable cryptocurrencies including stablecoins. Customers will have a better payment experience and there will be better acceptance across the global markets.

Custodial Vs Non-Custodial Model Decide if you want to have complete control over the funds (non-custodial) or if you want the provider to take over control of the wallets, management of the security and the settlements on your behalf.

Fiat Crypto Settlement Options Check if the API allows you to mitigate the risk of volatile prices of cryptocurrencies and make accounting and taxes easier for you by offering instant or scheduled settlements (aka crypto to fiat).

Regulatory Adherence Identify and go for a provider that will follow laws/regulations in your area. Ensure that they have a KYC, AML, and licensing as this will help mitigate legal risk and even provide you with sustainable business operations in the long run.

API Flexibility And Documentation The provider you opt for should have their API thoroughly documented, and be easy-to-use for developers. Look for SDKs, webhooks and plugins as that will make the whole process of integration easier and faster.

Transaction Fees And Costs Ensure that you compare the transaction fees, conversion fees, and withdrawal fees so that you can be able to breach in high volume or micro transaction businesses.

Local Availability Look for a solution that will cover a variety of countries and have local payment options as this will allow you to offer your services to clients all around the world without any regional lock.

Protection and Dependability Search for excellent protection policies like encryption and cold storage, uptime guarantees and fraud prevention to protect the funds of customers and the company.

Growing and Performing Choose the API that will allow for no lag, downtime, and failure, which can give the business growth the company deserves.

Trust and Acknowledgment of the Buyers Assess the popularity and prestige of the marketplace to evaluate the provider to make the issues of support, response, and to resolve issues outstanding.

Benefits of Using Crypto Payment APIs in 2026

Lower Transaction Fees

Crypto payment APIs help businesses save costs. They lower processing fees compared to traditional gateways which helps businesses save significantly on processing fees on high-volume and cross-border transactions.

Faster Cross-Border Payments

Payments made on a blockchain settle within minutes. This feature of blockchain technology eliminates delays from traditional banking systems which helps cross-border transactions to be processed in a matter of minutes.

Global Customer Reach

Businesses increase their clientele by accepting cryptocurrencies. It helps businesses serve customers and potential customers in geographies with no or limited banking systems and high card (credit and debit card) decline rates.

Reduced Chargeback Risk

Merchants are protected from chargeback fraud with payments processors that allow crypto transactions. The irreversible nature of fraud chargebacks which are common with credit card payments is eliminated.

Multiple Currency Support

Crypto payment APIs enable customers to pay in different stablecoins and crypto. This allows customers to choose how they finalize a transaction which is a big win for businesses in volatile markets.

Seamless Integration

Crypto payment APIs provide extensive documentation and organizational structures (SDKs) that help businesses integrate their payments systems in a seamless manner to other systems.

Enhanced Security

Transactions utilizing blockchain technology are sealed with an advanced and unbroken form of technology called cryptography which reduces data breaches and payment fraud.

Fiat and Crypto Flexibility

Businesses enjoy automatic crypto-to-fiat conversions with many APIs. This feature helps businesses not be encumbered on how they maintain stable cash flow since they can retain benefits of crypto adoption.

Future Proof Payments

With the increased popularity of digital assets, businesses can utilize crypto payment APIs to stay adaptable and competitive within new financial ecosystems.

Web3 Use Cases Support

With the ability to process payments, crypto APIs can facilitate the payments of NFTs, subscriptions, gaming, and decentralized applications, creating new sources of revenue, unlike traditional E-commerce.

Conclusion

Your business model, regulatory requirements, and target market determine what the best Stripe Crypto API alternatives will be. Coinbase Commerce, BitPay, NOWPayments, and CoinGate are strong crypto payment processors with good regulatory compliance and the ability to settle in fiat.

On the other hand, CoinsPaid, MoonPay, Transak, BlockBee, and Coinremitter serve high-volume merchants, Web3 platforms, and developers who need flexibility and/or non-custodial payment solutions.

With the expected rise in the adoption of cryptocurrencies in 2026, picking the best API will be indispensable for businesses that want to cut costs and extend their global reach.

FAQ

What is a Stripe Crypto API alternative?

A Stripe Crypto API alternative is a payment solution that allows businesses to accept and manage cryptocurrency payments using APIs, offering crypto-native features beyond Stripe’s limited crypto support.

Why should businesses look for Stripe crypto API alternatives?

Businesses choose alternatives to access more cryptocurrencies, lower fees, faster settlements, non-custodial options, and better support for Web3, global payments, and blockchain-based use cases.

Which is the best Stripe Crypto API alternative in 2026?

There is no single best option. Coinbase Commerce is ideal for compliance-focused businesses, NOWPayments for multi-coin support, and CoinsPaid for high-volume merchants.

Are crypto payment APIs legal to use?

Yes, most crypto payment APIs operate legally but must comply with regional regulations. Businesses should choose providers that follow KYC, AML, and licensing requirements in their operating regions.

Can I receive fiat payouts using crypto payment APIs?

Yes, many alternatives such as BitPay, CoinGate, and CoinsPaid offer automatic crypto-to-fiat conversion and direct bank settlements.