In this article, I will discuss the Best Ways to Handle Foreign Currency Exchange, providing specific examples on how to save money and organize your finances before traveling.

Ranging from avoiding airport kiosks to using multi-currency travel cards, these tips will secure favorable rates, reduced fees, and an effortless experience abroad – all tailored to convenience and cost effectiveness.

10 Best Ways to Handle Foreign Currency Exchange

1. Use a Multi-Currency Travel Card

A multi-currency travel card is classified as a prepaid card and assists in handling foreign exchange in one of the simplest ways by allowing you to load several currencies onto one card before traveling.

Such cards are provided by companies like Wise and Revolut, where you are able to load currencies at a fixed rate, hence shielding you from market volatility.

In addition, they usually have low or no transaction fees unlike traditional bank cards or cash exchange, which makes them a smart economic choice.

Furthermore, their acceptance in merchants and ATMs worldwide makes them secure and convenient.

For those managing several destinations with differing currencies, this method makes budgeting easier and mitigates the hassle of carrying large amounts of cash.

Use a Multi-Currency Travel Card

Pros:

- When converting funds to cash into the card’s balance, exchange rate is guaranteed.

- Great for multi-country travel as several currencies can be stored on one card.

- Transaction fees are low or non-existent compared to regular cards.

- Cards and ATMs are convenient and accepted all over which makes it easy to access funds.

- Less cash needs to be carried which improves safety.

Cons:

- Must have a plan in advance and load funds which is not always the most convenient.

- Inactive cards may incur setup or dormancy fees.

- Not everyone accepts these cards, especially in smaller places.

- Remote fund loading may depend on app or internet availability.

- Access to funds may be restricted should the card be lost or stolen.

2. Exchange at Local Banks

Exchanging money at local banks is also one of the most straightforward approaches to dealing with foreign currency exchange because they offer better rates than travel-centered services such as airports or hotels.

After reaching the travel destination, reputable local banks or even one’s own bank’s international affiliates tend to have better deals and lower fees.

This method requires a bit more effort in locating a bank, possibly tackling the language barrier, but the benefits can be rewarding, especially with larger amounts.

This is a reliable approach for travelers who wish to avoid the rage of being abused with charges and don’t mind taking a slight detour to a bank as opposed to more expensive and convenient options.

Exchange at Local Banks

Pros:

- Compared to places where tourists frequent, local banks offer very competitive rates.

- Service charges are also lower than airports or hotels.

- Established businesses are less likely to scam making them trustworthy.

- Bank branches may have additional cash available for longer trips.

- In some instances, banks may also offer traveler’s checks.

Cons:

- Searching and traveling to a bank takes time and effort.

- Language barriers or local bank operating hours can create problems.

- Not as convenient as ATM-type immediacy.

- Some institutions might still impose a fee or necessitate an account.

- Research is required to find the most cost-effective option due to differing rates among banks.

3. Avoid Airport Currency Counters

One of the best ways to maximize the value of your foreign currency is to avoid airport currency counters, which are infamous for their exorbitant service fees and unfavorable exchange rates.

These kiosks capitalize on accessibility and convenience by preying on travelers who require cash immediately upon departing or arriving at a location, however, the price is high–often with hidden markups beyond the translucent fees advertised.

Unless you’re backed into a corner with no alternatives, it’s far easier to plan ahead and use ATMs or local banks.

Ensuring these kiosks are avoided will have you saving money to spend elsewhere, ensuring you’re not wasting your finances on termed ‘convenience’.

Avoid Airport Currency Counters

Pros:

- Saves resources by not paying the high fees and poor exchange rates.

- Fosters seeking cheaper alternatives to advance planning.

- Curbing shady exchanges that lead to financial loss.

- Widely applicable advice across airports around the world.

- Encourages people to explore other useful resources such as ATMs or banks.

Cons:

- Ready cash on landing can be an issue, especially when not planned.

- Increased reliance on expedient but less desirable options in times of need.

- Some airports are less terrible with the rates than others.

- May pose problems for stressed travelers with tight schedules.

- Exceptionality can (e.g. emergencies) can justify the use regardless of costs.

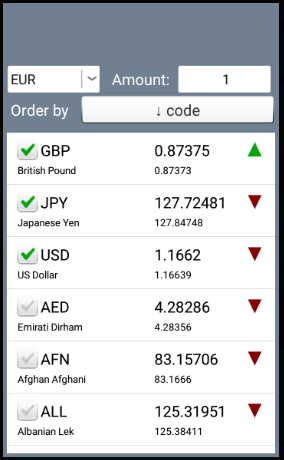

4. Compare Exchange Rates Online

Looking up exchange rates on the internet guarantees you better deals for exchanging foreign currency as it allows you to shop around before making a commitment.

Websites and applications such as XE, OANDA, and Google provide up to the minute updates on exchange rates enabling you to check how much your currency is worth with different dealers.

This is particularly important when weighing options on whether to exchange currency with the bank, use travel cards, or withdraw cash when abroad.

Spending a couple of minutes researching this precious information will allow you to avoid overspending and make smarter choices that will improve your travel budget significantly.

Compare Exchange Rates Online

Pros:

- Aiding actively allows for better decision making through live information.

- Use available resources to obtain better rates from different providers.

- Online with no extra charges, through XE or OANDA for example.

- Able to perform quickly and easily everyhwere there is internet access.

- Applicable whether dealing in small or large value trades.

Cons:

- Online rate comparison comes at the opportunity cost of time spent researching.

- Rates listed online may differ from what is offered in person.

- Can cause overthinking even for small transactions that yield minimal cost savings.

- Dependent on internet availability, which is not always guaranteed.

- Does not include other fees which may not be included in base rates.

5. Withdraw from ATMs Abroad

Rather than exchanging money at a currency exchange center, withdrawing cash from an ATM is a better option. It works to foreign currency and is processed as a direct withdrawal from your account.

To avoid bank fees, it is advisable to use ATMs that work in collaboration with your bank or international ATM networks. ATMs operated by banks like Charles Schwab are ideal since they charge low or no foreign withdrawal fees.

Nonetheless, make sure to check foreign ATM charges and—and make certain that your bank does not impose additional currency conversion fees.

This approach is suitable for travelers and makes it simple for people to access cash in regions where cards aren’t commonly accepted.

Withdrawing from ATMs when Traveling

Pros:

- Increasingly common and available at most traveling destinations.

- Usually offer better exchange rates than to that of currency services provided by your bank.

- Advantageous to those who wish to take out specific amounts.

- Beneficial in the case of banks that have low or no international fees.

- Funds are available immediatelly without pre-planned currency exchanges.

Cons:

- There may be extra costs incurred by local ATMs which curtail savings.

- Your bank will most likely charge a service fee for currency exchange.

- Possible risk of skimming and theft at unsecure ATMs.

- The amount retrievable each day is limited to the banks regulations.

- Not suitable for use in places with scarce ATMs.

6. Notify Your Bank Before Travel

Informing your bank prior to journeys is quite easy. However, it is just as important when it comes to dealing with foreign exchange currency. This manages ensuring your debit or credit cards will work seamlessly when you need them the most.

In the absence of this step, foreign transactions that occur spontaneously may lead to a fraud case which will, in turn, leave your card frozen at the worst possible time, say when you’re attempting to pay for a meal or hotel.

Calling or posting online about your travel dates and travel destinations is the sorest reliever which means you do not have to undergo these hassles.

Such changes relieve the burden of bank transactions abroad. It is a reasonable precaution that facilitates ATM withdrawals and card payments.

Notify your bank before setting out to travel

Pros:

- Stops the card from being blocked or tagged as fraud while traveling.

- Access to funds while abroad is guaranteed.

- Easily done over the phone, through apps or online banking.

- Protects the customer and ensures that the bank knows of their whereabouts.

- No expense or effort is required.

Cons:

- Even forgetting to notify someone can still create problems.

- There’s no direct savings on fees or currency conversions.

- Follow ups may be needed if there are changes to the travel itinerary.

- Some cards don’t require notification while some banks may not.

- Minor hassle if multiple cards are involved.

7. Use Credit Cards with No Foreign Transaction Fee

Avoid paying foreign exchange fees while using your credit card, is one of the easiest methods of dealing with foreign exchange, particularly for people who travel often or have expensive purchases to make.

With standard cards, there is a foreign transaction fee of 1-3%; however, the Chase Sapphire Preferred and Capital One Venture cards waive all these fees and charge for the exchange rate instead.

Not only does this reduce expenses, but it also increases ease of use, since credit cards are issued by numerous banks, and they offer fraud protection.

For people who prefer using a credit card over cash, with the right card, it is possible to use them without incurring costs.

Use Credit Cards with No Foreign Transaction Fees

Pros:

- Eliminates 1-3% foreign purchase fee.

- Positive exchange rates from the card issuer.

- Widely accepted and convenient for large purchases.

- Fraud and purchase health coverage relaxes expenditures.

- For frequent big spenders or travelers.

Cons:

- Not everyone has access to apply for them.

- Acceptance is limited in remote areas.

- Some cards have annual fees which can outweigh benefits.

- Not paying off balances results in accruing interest charges.

- More restrictive to those in need of premium options with good credit.

8. Avoid Dynamic Currency Conversion (DCC)

One of the best ways to manage foreign exchange, and keep your wallet intact, is Avoiding Dynamic Currency Conversion(DCC).

Each time you go to make a payment or withdraw cash, the merchant or ATM allows you the convenience of converting the amount to your home currency. However, this so-called convenience comes with costly exchange rates.

If you, instead, choose to always pay in the local currency, a far less expensive option, your bank or card issuer will, more often than not, perform the conversion at a significantly better rate.

This single decision can go a long way to ensure that the traveler is financially better-off by the end of the trip.

Avoid Dynamic Currency Conversion (DCC)

Pros:

- Helps avoid paying higher then necessary exchange rates or added on fees.

- Guarantees that your bank will give better rates.

- Incredibly easy all you need to do it pick the local currency.

- Usable anywhere at merchants and ATMs.

- Clearer beforehand understanding of costs associated with transactions.

Cons:

- Spotting and declining DCC options require active awareness.

- Some merchants may use DCC to intentionally confuse the consumer.

- Minimal for savings, especially for smaller transactions.

- Does not remove all costs (for example, bank-side fees).

- Still depends on your card issuer maintaining reasonable rates.

9. Keep Some Cash for Emergencies

Cash is often kept for emergencies. This stands true for foreign currency exchange too, and it is of utmost importance when considering the advances in digital payment systems today.

While many places utilize cards and apps, smaller vendors like taxi drivers and rural people prefer cash. Additionally, power outages or technical failures can make one stranded without cash.

Having a small amount of local currency is helpful especially when it comes to meals, rides or tips. This allows you to act as a safety net who doesn’t require the hassle of managing large sums.

Lastly, these small amounts act as a level of assurance that one won’t be caught off guard no matter where they want to travel to.

Maintain Emergency Cash

Pros:

- Steps in handy where cards are not accepted.

- Valuable during an emergency, such as power outages, misplaced credit cards, etc.

- Small spends like tips, taxi rides, and many more can be dealt without complications.

- Entirely does not depend on technology and internet.

- Works with calm mindset without any requirements.

Cons:

- Cash can easily be lost or stolen.

- Exchanging cash for smaller amounts can come with high fees added.

- Larger emergency staches can be deemed bulky and inconvenient.

- Funds that are not spent may have to be reconverted for a price.

- Significantly less common in digitally driven payment places.

10. Monitor Currency Trends Before Exchange

It’s an approach that is beneficial, particularly to those who are looking to make big transactions. By keeping track of changes using news, apps or online financial sites, one can exchange their money during preferable shifts, such as when their currency is stronger.

This method is useful during longer trips or when bulk exchanges are made, however when it comes to smaller sums, the effort may outweigh the rewards.

Although the strategy may not be the most consistent due to fluctuations in the currency markets, being well informed allows skilled planners to save money that has been set aside for travel.

Change Currency With Monitoring Trends Beneath Them

Pros

- Assuming spending money at the right time to make exchanges with measurement can save money.

- Good partner for long-distance travel or large transactions.

- Increases the level of financial planning by the individual.

- Accessible for free from mobile applications, news portals, or finance websites.

- Have the power to shift the market in their favor during extremely unpredictable fluctuations.

Cons

- Definite mentally draining use for non frequent flyers.

- Uncertainty if the timing will turn out beneficial or not when dealing with the market.

- Does not leave a deflation on direct spenders coming and going for short stays.

- Needs regular checking, which could be difficult to implement.

- Too much focus can slow down important interactions.

Conclusion

To sum up, effective management of foreign currency exchange requires a mix of planning and strategies tailored to suit an individual’s travel requirements. Travel multi-currency cards and credit cards with no foreign transaction fees provide ease and savings for the tech-oriented, while exchange at local banks or ATM withdrawals abroad offer competitive rates at slightly higher effort.

Steering clear of busy currency counters at airports and dynamic currency conversion helps avoid standard overpayment, making cash a useful backup in case of emergencies.

For those willing to dedicate some time, online comparisons of exchange rates and even monitoring currency trends add value, although the payoff depends on the extent of your transactions.

The ideal solution blends all approaches—foremost having travel cards on standby while cash along with ATMs provides greater flexibility—minimizing expenditure while maximizing rates and offering peace of mind throughout the trip.

Analyzing the advantages and disadvantages of each piece of information allows formulation of an optimal plan to span distance and increase cost efficiency tailored to personal needs.