In this article I will discuss the best ranked tokenized assets coins by market cap and they will be in the form of tokens backed by gold, silver, real estate, or even debt instruments.

These kinds of coins offer the stability of traditional assets along with blockchain technology, providing a new level of investment security and efficiency. Let’s analyze the best asset-backed tokens that are leading the evolution of finances.

Key Point & Best Tokenized Assets Coins By Market Cap List

| Token | Key Point |

|---|---|

| Tether Gold (XAUT) | Backed by physical gold held in Swiss vaults; redeemable in large quantities. |

| PAX Gold (PAXG) | Regulated by NYDFS; each token backed 1:1 with London Good Delivery gold. |

| Kinesis Gold (KAU) | Yield-bearing digital gold tied to physical metal; spendable via debit card. |

| Kinesis Silver (KAG) | Digital silver token with yield incentives; backed by physical silver. |

| RealT Tokens | Tokenized real estate generating rental income; backed by U.S. properties. |

| Perth Mint Gold (PMGT) | Government-backed token tied to gold stored by Perth Mint; highly trusted. |

| Digix Gold (DGX) | Each token represents 1 gram of gold stored in Singapore; fully auditable. |

| Parcl (PRCL) | Real estate derivative tied to property price indices; no physical backing. |

| VeraOne (VRO) | Backed by physical gold stored in secure vaults in Europe; audited regularly. |

| Novem Gold Token (NNN) | Backed by gold stored in Liechtenstein; combines blockchain with legal trust. |

1.Tether Gold (XAUT)

Tether Gold (XAUT) retains its position as the sole tokenized asset by market cap since it possesses strong liquidity, institutional credibility, and secure backing. Each token represents one troy ounce of gold stored in Swiss vaults, which provides security and trust like no other.

Unlike most of its competitors, XAUT enjoys the global reach and established infrastructure of Tether. Its uniqueness stems from combining gold’s stability with the blockchain’s speed, which renders it a preferred asset for investors looking for easy transferability in a secure asset.

| Feature | Details |

|---|---|

| Platform Type | Tokenized gold-backed cryptocurrency |

| Technology | Built on Ethereum and TRON blockchains |

| Transaction Fees | Variable fees based on network usage |

| KYC Requirements | Minimal KYC required for certain transactions |

| Use Cases | Ownership of physical gold, trading, and hedging against inflation |

| Governance | Centralized issuance by TG Commodities Limited |

| Security | Backed by physical gold stored in secure vaults |

| Supported Assets | 1 XAUT token represents 1 troy ounce of physical gold |

2.PAX Gold (PAXG)

PAX Gold (PAXG) is one of the leading tokenized asset coins by market cap due to its strong regulatory foundation and direct gold ownership model. Its tokens are backed 1:1 with a fine troy ounce of London Good Delivery gold held in Brinks vaults. This makes gold backing them truly verifiable.

It’s most distinguishing feature is that holders do not merely possess a digital representation of the gold, but rather are the legal owners of the physical gold itself. In addition to seamless trade globally, this legal clarity makes PAXG distinctly safe and favorable towards investors in the digital gold realm.

| Feature | Details |

|---|---|

| Platform Type | Tokenized gold-backed cryptocurrency |

| Technology | Built on Ethereum blockchain as an ERC-20 token |

| Transaction Fees | Variable fees based on Ethereum network usage |

| KYC Requirements | Minimal KYC required for certain transactions |

| Use Cases | Ownership of physical gold, trading, and hedging against inflation |

| Governance | Centralized issuance by Paxos Trust Company |

| Security | Backed by physical gold stored in LBMA-accredited vaults |

| Supported Assets | 1 PAXG token represents 1 fine troy ounce of physical gold |

3.Kinesis Gold (KAU)

Kinesis Gold (KAU) is listed among the leading tokenized asset coins by market capitalization because of its unique yield-bearing model associated with physical gold. Each KAU token has backing of 1 gram of gold which is allocated and stored in fully insured vaults.

KAU’s unique feature that adds value is that it can pay users for both holding and spending the asset through a proprietary yield-sharing mechanism. This allows gold to be changed from a latent store of value into a dynamic currency within an expanding international economy.

| Feature | Details |

|---|---|

| Platform Type | Tokenized gold-backed cryptocurrency |

| Technology | Built on Kinesis blockchain |

| Transaction Fees | Low fees for transactions and storage |

| KYC Requirements | Minimal KYC required for certain features |

| Use Cases | Ownership of physical gold, earning passive yield, and global transactions |

| Governance | Centralized issuance by Kinesis Monetary System |

| Security | Backed by physical gold stored in secure vaults |

| Supported Assets | 1 KAU token represents 1 gram of allocated physical gold |

4.Kinesis Silver (KAG)

Kinesis Silver (KAG) is a top tokenized asset by market cap, offering a modern approach to silver ownership with real world utility. Each KAG token is backed by 1 ounce of fully allocated phsycial silver held in secure vaults.

Its standout feature is the ability to earn yields through everyday use and holding, turning traditionally static silver into a dynamic financial tool. KAG uniquely blends intrinsic metal value with a monetary system designed to reward active participation and prolonged commitment.

| Feature | Details |

|---|---|

| Platform Type | Tokenized silver-backed cryptocurrency |

| Technology | Built on Kinesis blockchain |

| Transaction Fees | Low fees for transactions and storage |

| KYC Requirements | Minimal KYC required for certain features |

| Use Cases | Ownership of physical silver, earning passive yield, and global transactions |

| Governance | Centralized issuance by Kinesis Monetary System |

| Security | Backed by physical silver stored in secure, audited vaults |

| Supported Assets | 1 KAG token represents 1 ounce of investment-grade physical silver |

5.RealT Tokens

RealT Tokens rank high among tokenized assets by market cap breached because of their sophisticated blend of blockchain technology and real estate.

Each token signifies a fraction of ownership in U.S. properties that generate income, which allows investors to receive rental payments paid out on a regular basis in stablecoins.

What makes RealT unique is its capacity to democratize property investment, allowing people from all over the world to access real estate markets without barriers. The combination of passive income and easy ownership contributes to its strong market presence and investor demand.

| Feature | Details |

|---|---|

| Platform Type | Tokenized real estate assets |

| Technology | Built on Ethereum blockchain as ERC-20 tokens |

| Transaction Fees | Variable fees based on Ethereum network usage |

| KYC Requirements | Minimal KYC required for fractional ownership |

| Use Cases | Fractional ownership of real estate, passive income, and trading |

| Governance | Centralized issuance by RealT platform |

| Security | Backed by physical real estate properties |

| Supported Assets | Real estate properties tokenized into digital assets |

6.Perth Mint Gold Token (PMGT)

Perth Mint Gold Token (PMGT) is recognized as one of the leading tokenized assets by market capitalization since it is directly backed by government-guaranteed gold. Each token is secured with gold stored at the Perth Mint, one of the most reputable gold refineries in the world.

PMGT’s distinguishing factor is the support from the Government of Western Australia, which provides sovereign backing, guaranteeing trust and security uncomparable to most digital assets. PMGT combines the reliability of gold with the efficiency of blockchain technology.

| Feature | Details |

|---|---|

| Platform Type | Tokenized gold-backed cryptocurrency |

| Technology | Built on Ethereum blockchain as an ERC-20 token |

| Transaction Fees | Variable fees based on Ethereum network usage |

| KYC Requirements | Minimal KYC required for certain transactions |

| Use Cases | Ownership of physical gold, trading, and hedging against inflation |

| Governance | Centralized issuance by the Perth Mint |

| Security | Backed by physical gold stored in secure vaults |

| Supported Assets | 1 PMGT token represents 1 troy ounce of physical gold |

7.Soil (SOIL)

Soil (SOIL) is unique among the most important tokenized assets since it combines traditional finance with the world of cryptocurrency via a regulated DeFi lending protocol.

It operates as a debt marketplace with reputable firms obtaining financing from crypto investors who earn yields by lending their stablecoins, which are backed by real-world assets.

Soil’s investment model captures stable returns for investors from off-chain assets, integrating the advantages of traditional investments with the efficiency of blockchain technology.

| Feature | Details |

|---|---|

| Token Name | Soil (SOIL) |

| Asset Type | Tokenized private credit / real-world lending |

| Backing | Loans to real-world businesses (real-world assets) |

| KYC Requirement | Minimal KYC for crypto investors (non-institutional) |

| Use Case | Investors lend stablecoins to earn yield from off-chain debt instruments |

| Blockchain | Ethereum-based |

| Yield | Variable returns based on loan agreements |

| Security | Real-world legal contracts and underwriting processes |

| Unique Point | Combines DeFi with real-world corporate lending and minimal friction |

8.Parcl (PRCL)

Parcl is one of the top asset tokens because it innovates real estate exposure via blockchain technology. Unlike standard property tokens, PRCL allows users to invest in price movements through real-time indices without having to hold a title deed to tangible estate, which makes investing on Parcl unique.

Its strength lies in the liquidity and freedom it provides in investing compared to markets with high entry barriers and illiquid assets. Parcl revolutionizes real estate investment by making it instantaneous, automated, and analytical which encourages participation from retail and institutional investors alike.

| Feature | Details |

|---|---|

| Platform Type | Tokenized real estate investment platform |

| Technology | Built on Solana blockchain |

| Transaction Fees | Low fees for transactions and trading |

| KYC Requirements | Minimal KYC required for certain features |

| Use Cases | Synthetic real estate trading, hedging, and exposure to real estate indices |

| Governance | Decentralized governance through PRCL token holders |

| Security | Backed by real estate data from Parcl Labs and secure blockchain protocols |

| Supported Assets | Real estate indices tokenized into digital assets |

9.VeraOne (VRO)

VeraOne (VRO) ranks among the best tokenized assets by market cap because it has a strong base in Europe and focuses on transparency.

Each VRO token is backed by certified physical gold stored in high-security vaults which are audited on a regular basis.

What sets VeraOne apart is its connection to a regulated French platform with an auditing system that operates in real time, providing legal clarity and secure asset protection. This level of openness coupled with regulation makes VRO a digital asset trusted by unstable economic market investors.

| Feature | Details |

|---|---|

| Platform Type | Tokenized gold-backed cryptocurrency |

| Technology | Built on Ethereum blockchain as an ERC-20 token |

| Transaction Fees | Variable fees based on Ethereum network usage |

| KYC Requirements | Minimal KYC required for certain transactions |

| Use Cases | Ownership of physical gold, trading, and hedging against inflation |

| Governance | Centralized issuance by VeraOne |

| Security | Backed by physical gold stored in secure, audited vaults |

| Supported Assets | 1 VRO token represents 1 gram of physical gold |

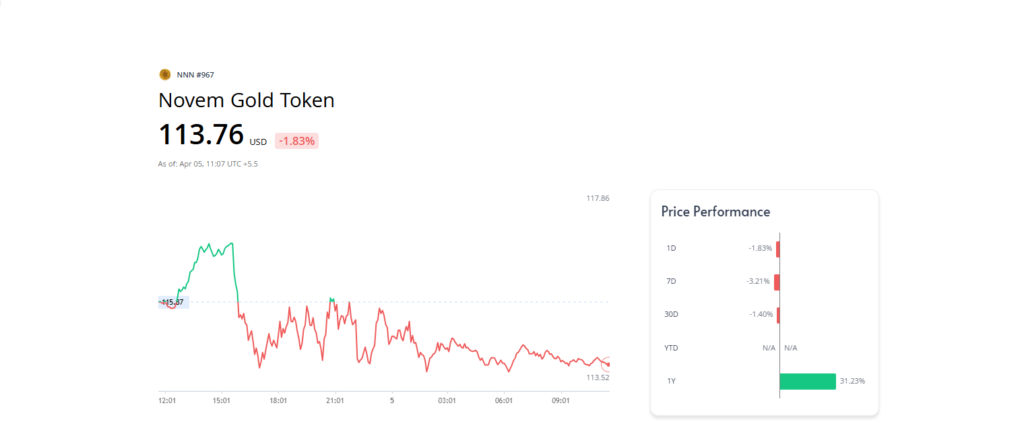

10.Novem Gold Token (NNN)

The Novem Gold Token (NNN) stands out from other tokenized assets due to enabling users to tokenize gold conveniently. Each NNN token signifies one gram of 999.9 fine gold, safely stored in Austria, and comes with free storage and insurance.

NNN’s distinctive characteristic is that it allows token holders to request physical delivery of their gold at any time, thus providing the liquidity of digital assets alongside the value of precious metals.

| Feature | Details |

|---|---|

| Platform Type | Tokenized gold-backed cryptocurrency |

| Technology | Built on Ethereum blockchain as an ERC-20 token |

| Transaction Fees | Low fees for transactions and storage |

| KYC Requirements | Minimal KYC required for certain transactions |

| Use Cases | Ownership of physical gold, trading, and hedging against inflation |

| Governance | Centralized issuance by Novem Gold |

| Security | Backed by physical gold stored in secure, audited vaults |

| Supported Assets | 1 NNN token represents 1 gram of physical gold |

Conclusion

To summarize, the market cap leaders in the tokenized asset coins category like Tether Gold (XAUT), PAX Gold (PAXG), Kinesis Gold (KAU), RealT and the others are literal examples of how blockchain technology is changing the interface with real-world assets.

Each project is distinct with value propositions like yield-bearing gold and silver tokens, fractional ownership in real estate, and regulated physical gold.

Their success is anchored on trust, transparency and utility, empowering investment for those who need stability, diversification, and increased digital operational efficiency in traditional assets.