The top Xenex exchange substitutes that provide safe, dependable, and feature-rich cryptocurrency trading choices will be covered in this post.

These options provide minimal costs, support for numerous cryptocurrencies, robust security, and attentive customer service. They range from user-friendly platforms like Coinbase and WhiteBIT to sophisticated exchanges like Bybit and Deribit. A secure and effective trading experience is ensured by selecting the appropriate platform.

Why It Is Xenex Exchange Alternatives Matter?

Improved Security Features

- Each exchange has different protective measures, some of which are better. Some substitutes have cold storage, two-factor authentication, and hack insurance.

Reduced Costs

- Some substitutes have lower trading costs, and even lower costs to deposit, withdraw, and do margin trading. These can help frequent traders save a lot of money.

More Variety of Coins

- Many substitutes have cryptocurrency offerings that Xenex does not. This helps traders diversify better.

More Features for Trading

- Some substitutes have more advanced trading features like margin trading, derivatives, staking, etc. Xenex’s offerings may be more limited.

Improved User Experience

- Some substitutes have better, more user-friendly features like better interfaces and more responsive customer service. These improvements help make trading better for everyone.

Regulations Aware

- Some substitutes are more aware of regulations than Xenex. This can help protect your finances.

Performance and Liquidity

- Some substitutes may have better price consistency, less slippage, and quick trade execution. This can be really important for big trades.

Key Point & Best Xenex Exchange Alternatives List

| Exchange | Key Point |

|---|---|

| WhiteBIT | User-friendly interface with strong security features for beginners. |

| Bitget | Focuses on derivatives trading and copy-trading for active traders. |

| Poloniex | Offers a wide range of altcoins with moderate trading fees. |

| Bybit | Known for margin and futures trading with high liquidity. |

| Bitstamp | One of the oldest exchanges, trusted for fiat-to-crypto trading. |

| OKX | Advanced trading tools and staking options for professional traders. |

| Binance | Largest exchange by volume with extensive crypto pairs and features. |

| Coinbase Exchange | Beginner-friendly, highly regulated, ideal for secure crypto purchases. |

| Kraken | Strong security, fiat support, and margin trading options. |

| Deribit | Specializes in crypto derivatives like options and futures trading. |

1. WhiteBIT

WhiteBIT was established in 2018 and is considered one of Xenex Exchange Alternatives. It is one of the first EU-certified crypto exchanges. It employs 2FA and cold storage for crypto assets to enhance security and also offers crypto trading in EUR for BTC, ETH, and other cryptos as well as stablecoins.

Transaction fees are about 0.1% for spot trading, and they offer crypto trading in multiple fiat currencies. Customer support is also considered fast and responsive making the exchange user-friendly and suitable for beginners and pros alike.

WhiteBIT — Key Features

| Feature | Explanation |

|---|---|

| Wide Coin Selection | Supports many cryptocurrencies and trading pairs for diverse trading. |

| User-Friendly Interface | Intuitive dashboard; easy for beginners to navigate. |

| Spot & Margin Trading | Allows regular trading plus leveraged trades for more advanced users. |

| Staking/Earning Options | Users can earn passive income by staking specific assets. |

| Security Tools | Includes 2FA, cold storage, and protection for account security. |

Pros & Cons WhiteBIT

Pros:

- Easy for Beginners – First time users can navigate and even track trades easily with their interface.

- Safe and Secure – Funds are most kept in cold storage which, along with two-factor authentication makes for strong security

- Wide Array of Coin Support – There are numerous cryptocurrencies and varying trading pairs supported by the exchange.

- Costs – For both spot and margin trading, trading fees are cheap.

- Possibility of Earning – Holding certain crypto assets allows for the opportunity of earning through staking.

Cons:

- Not Worldwide – There are countries that are unable to register for WhiteBIT.

- Inequality for Professionals – There are not enough features for pro traders.

- Support Takes Time – Resolving issues can take quite some time with the support system.

- Volume is Limited – Other major exchanges allow for trading to occur at much higher volumes.

- Too Few Options – There are not enough fiat to crypto gateways which causes many to be unhappy.

2. Bitget

Established in 2018 and focused on derivatives and margin trading, Bitget is regulated in Singapore and emphasizes compliance and user security by employing the use of cold wallets and encryption. Bitget is multilingual and accepts trading in multiple cryptocurrencies including Bitcoin, Ethereum, and other altcoins.

Trading fees start at 0.05% for takers and 0.02% for makers. The exchange is also equipped with copy trading and advanced charting tools, making it one of the more complete trading platforms. Bitget has become one of the Best Xenex Exchange Alternatives for traders using advanced trading features.

Bitget — Key Features

| Feature | Explanation |

|---|---|

| Derivatives & Futures | Advanced trading with perpetual contracts and leverage. |

| Copy Trading | Beginners can copy strategies from top traders automatically. |

| Multi-Language Support | Platform available in many languages worldwide. |

| Mobile App | Fully functional app for trading on the go. |

| Security Protocols | Offers cold storage and withdrawal confirmation steps to protect funds. |

Pros & Cons Bitget

Pros:

- Variety of Trade Options – There is a plethora of advanced margin for both contract and persistent trading.

- Strong Security Measures – There are even stronger security measures in place with more cold storage and withdrawal verification.

- Mimicking Possibility – New users have the chance to practice trading by following along with the trades of advanced users.

- Global – There is a presence in nearly all countries so they support a multitude of languages.

- Trading Bonuses – Extra rewards given for trading activities and referrals.

Cons:

- Difficult for New Users – Advanced features could be too much at first.

- Limited Spot Trading Options – Compared to some other top exchanges.

- Withdrawals Can Delay – Transfers may be affected by high network congestion.

- Support Service – A delay in live chat can occur.

- Some Trading Pairs Have Higher Fees – Trading pairs with lower volumes can have higher fees.

3. Poloniex

Poloniex is one of the oldest crypto exchanges, and was founded in 2014. Poloniex is regulated under U.S. and international crypto guidelines, and thus has to follow the same guidelines for the newest coins. The exchange is also multilingual and supports the trading of Bitcoin, Ethereum, and the newest altcoins.

Active traders are able to pay 0.1% to 0.2% in spot trading fees, and they also have cold wallets and security features such as multi-factor authentication and monitoring. Poloniex maintains a reputation for reliability and variety, making it one of the Best Xenex Exchange Alternatives for traders looking for a variety of cryptocurrencies.

Poloniex — Key Features

| Feature | Explanation |

|---|---|

| Large Token List | Hundreds of altcoins and trading pairs available. |

| Margin Trading | Users can trade with borrowed funds (leverage). |

| API for Bots | Programmable API useful for algorithmic/trading bot use. |

| Market Charts | Visual charts to analyze price movements. |

| Mobile Trading | App version provides full access on phones. |

Pros & Cons Poloniex

Pros:

- Reputable – Veterans in the crypto trading space.

- Good Coin Variety – A large number of tokens and cryptocurrencies.

- Leverage/Margin Trading – Available for professional traders.

- Algorithmic Trading – APIs available.

- Mobile Trading App – Convenient for on-the-go trading.

Cons:

- Difficult Interface – A complex layout can be harder for new traders.

- Security Breaches – Presence of potential risks.

- Slow Support for Urgent Issues – Not the best for critical concerns.

- Less Fiat Payment Methods – Not the best option for making direct transfers.

- Regulation Issues – Traders from certain countries cannot access the platform.

4. Bybit

Bybit was launched in 2018 and is one of the top exchanges focusing on derivatives. The major regulators of the exchange are the British Virgin Islands. The platform is available in several local languages and the supports an extensive list of digital currencies, including DeFi tokens, as well as Bitcoin (BTC) and Ethereum (ETH).

The company charges competitive trading fees of 0.075% for takers and has free maker fees for derivatives. Advanced security measures are in place, including cold wallet storage and 2FA (Two Factor Authentication). Bybit is also known for its educational offerings, along with responsive trader support. Bybit is among the Best Xenex Exchange Alternatives for futures and leveraged trading because of its strong security.

Bybit — Key Features

| Feature | Explanation |

|---|---|

| Derivatives Market | Strong support for perpetual contracts and futures. |

| Advanced Chart Tools | Includes technical indicators and drawing tools. |

| High Leverage Options | Traders can increase position size up to high multipliers. |

| User-Friendly Mobile App | Trading optimized for both Android & iOS devices. |

| Security Practices | 2FA and encrypted systems to safeguard accounts. |

Pros & Cons Bybit

Pros:

- Good Derivatives Liquidity – Easy trading for derivatives and perpetual contracts.2. Cutting-edge Trading Features – Available leverage and options for indicators and charting.

- Mobile App is Simple – Smooth trading on mobile.

- Security is Tight – SSL and 2FA.

- You can make referrals for Rewards – Rewards for users who trade often.

Cons:

- Fewer Possibilities For Spot Trading – Primarily recognized for derivative trading.

- More complicated Fees – Fees can be a bit perplexing for newcomers.

- Support is Lacking – Responses can be slow when there is a lot of activity.

- Not Great for Depositing Fiat – There are a few fiat options.

- Risks in Trading on Margin – Increased risks in losses with higher leverage.

5. Bitstamp

Bitstamp has been in the business since 2011 and is one of the oldest and most credible crypto exchanges. The company is also one of the longest-standing crypto exchanges, with regulation in Luxembourg.

The support of the exchange is available in several languages, with cryptocurrency trading available for Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), and other major crypto blocks. The exchange utilizes tiered fees with 0.1% to 0.5% charged based on trading volume.

The exchange includes cold wallet storage, 2FA, and asset insurance to strengthen security measures. Support is available via email and voice chat for assistance. Bitstamp is one of the leading Best Xenex Exchange Alternatives for trading crypto with fiat currencies because of its extensive history in the market.

Bitstamp — Key Features

| Feature | Explanation |

|---|---|

| Regulated Exchange | Official compliance with financial authorities for legal operations. |

| Fiat Support | Deposit/withdraw in USD, EUR, GBP, etc. |

| Simple Interface | Clean design suitable for new traders. |

| Reliable Order Execution | Consistent and stable trading with good uptime. |

| Cold Storage Security | Majority of funds held offline for protection. |

Pros & Cons Bitstamp

Pros:

- It’s a Licensed Exchange – Licenses in the EU and high adherence to regulations.

- Support for Fiat – Withdrawal and deposit support for USD, EUR, GBP is available.

- High Security – Primary assets are in cold storage and insurance for digital assets.

- Suitable for Beginners – Both pros and beginners enjoy the interface.

- Old and Trustworthy – They offer great performance and have been around a long time.

Cons:

- Not Enough Coins – Competitors have more altcoins available.

- More Expensive – Fees for spot trading are higher for traders with low volume.

- Support Takes Time – Time to ticket resolution is too long.

- Trade Limitations – Tools are not optimized for high-volume traders.

- Withdrawing Funds incurs a Fee – Regularly taking funds off the platform can cause high network fees.

6. OKX

Since 2017, OKX has been operating under Malta and Seychelles licenses. It has a variety of language options and allows trading of more than 400 coins (BTC, ETH, stablecoins). Fees for spot trading begin at 0.1%. OKX offers margin trading as well. Security measures for the exchange are cold storage, multi-sig wallets and even 2fa.

OKX has an easy to use platform for new traders, as well as responsive customer support. OKX has earned a spot as one of the Best Xenex Exchange Alternatives for features like advanced trading, and multiple cryptocurrencies for staking, which is ideal for pro crypto traders looking for reliability and a feature rich exchange.

OKX — Key Features

| Feature | Explanation |

|---|---|

| Comprehensive Markets | Spot, futures, options, and more trading options. |

| High Liquidity | Strong volume allows fast trade execution. |

| Staking & Earn | Savings and yield products for passive income. |

| Global Support | Works in many regions with multilingual UI. |

| Advanced Tools | Indicators, charts, and order types for serious traders. |

Pros & Cons OKX

Pros:

- Variety of Ways to Trade – Use spot, futures, options, or perpetual contracts.

- More than Enough Liquidity – Trades can be executed easily for the major pairs.

- Costs of Trading – For significant-volume traders, fees are affordable and competitive.

- Passive Crypto Income – Crypto holdings can be utilized to earn income in Staking and DeFi services.

- Available Globally – Support in addition to a variety of languages.

Cons:

- Not Beginner Friendly – Having a myriad of features can be a bit too much.

- Withdrawals are Delayed – Withdrawals can be slow especially when the network is highly congested.

- Customer Support is Underwhelming – Support via live chat may take a while.

- Lack of Regulation – Accessibility may be limited in some regions.

- Advanced Features are Risky – There is a great risk when trading with leverage.

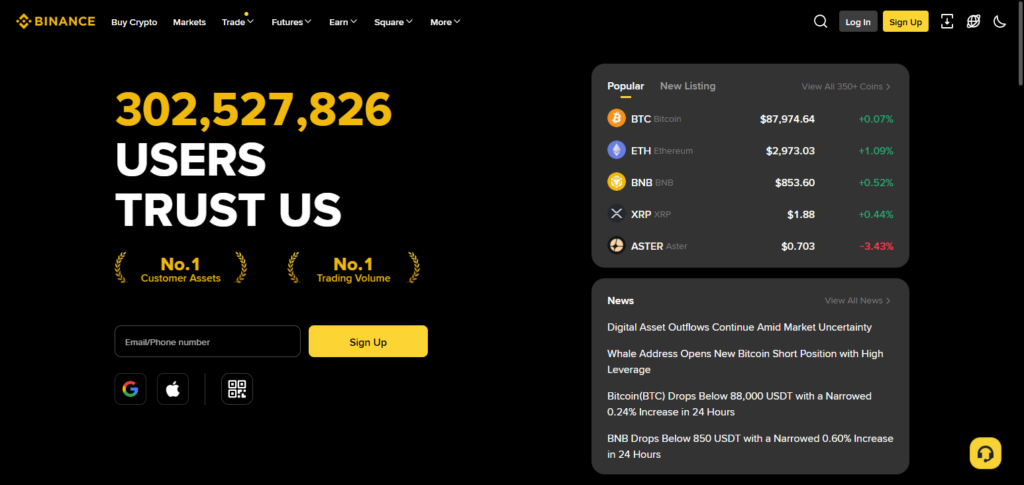

7. Binance

Also founded in 2017, Binance has become the largest crypto exchange in the world, having a license for each of the regions they operate in. Binance offers more than 600 cryptos, as well as support in multiple regional languages. Fees for spot trading begin at 0.1% and if you use the BNB token you can reduce those fees even more.

Binance has cold storage, 2fa, and even SAFU insurance to provide protection for your investment. Their customer support is available 24/7 and they have educational resources for all traders. Their innovative features, low fees and crypto selection all add to why Binance is often listed as one of the Best Xenex Exchange Alternatives for pro traders and customers just starting out.

Binance — Key Features

| Feature | Explanation |

|---|---|

| Largest Liquidity Pool | Deep market depth for most crypto pairs. |

| Wide Asset Coverage | Thousands of coins and tokens available. |

| Multiple Products | Spot, margin, futures, options, savings, NFTs, and more. |

| Binance Earn | Variety of passive earning options including staking. |

| Strong Security Fund (SAFU) | Insurance-like backup for emergency coverage. |

Pros & Cons Binance

Pros:

- Most Volume Exchange – There is good liquidity on almost every trading pair.

- Diversity of Cryptocurrencies to Trade – Support for thousands of coins and tokens.

- More than Enough Trading Features – Tools that are offered include futures, margin, staking, and savings products.

- Safety – There are good protocols and a SAFU fund for emergencies.

- Good Accessibility and Support in Many Languages – High Accessibility in Many Areas.

Cons

- Regulatory Challenges – Restrictions in some international markets.

- Complexity – Features can overwhelm new users.

- Slow Support – Response times can be lengthy.

- Possible Downtime – Trading may be interrupted during high usage periods.

- Complex Pricing – Tiered discounts can create price opacity.

8. Coinbase Exchange

Coinbase began operating in 2012. It is one of the largest U.S.-based exchanges with SEC and FinCEN regulation. It operates in multiple countries and has support in several languages.

Users can trade Bitcoin, Ethereum, and more than 250 other cryptocurrencies with the exchange. Users pay between 0.5% and 4.0% in trading fees which vary based on the method of payment and the trading activity.

The exchange incorporates industry-leading security protocols, including two-factor authentication, cold storage, and insurance. Assistance is available to customers through email, chat, and phone. For customers needing a secure platform to trade easily on, Coinbase is one of the Best Xenex Exchange Options.

Coinbase Exchange — Key Features

| Feature | Explanation |

|---|---|

| Highly Regulated | Meets strict U.S. compliance and reporting standards. |

| Fiat On/Off Ramps | Easy cash deposits and withdrawals in multiple currencies. |

| Simple UI | Beginner-friendly layout and trading steps. |

| Insurance on Custody Assets | Funds held in custody have protection against theft. |

| Educational Tools | Guides and tutorials for learning crypto basics. |

Pros & Cons Coinbase Exchange

Pros

- Regulatory Approval – Operates from the US, following all the laws.

- Easy to Use – The platform has an easy to navigate design.

- Strong Security – Users are protected by their insurance.

- Good Fiat Support – Supports deposits and withdrawals in dollars, euros, and pounds.

- Learning Material – New investors can use many guides and tutorials to help them navigate the platform.

Cons

- High Fees – Their trading fees are higher than the fees of other competitors.

- Few Altcoins – Their competitors, such as Binance and OKX, have more coins to trade.

- Slow Support – They can take several days to respond to users.

- Limited Features – They do not have advanced trading features.

- Regional Restrictions – Users from unsupported countries will have limited functionality.

9. Kraken

Established in 2011, Kraken has become one of the most secure exchanges available and is regulated in the U.S. and through the EU. Kraken is available in many languages. Users can trade Bitcoin, Ethereum, and numerous other cryptocurrencies and fiat currencies.

The exchange has trading fees of 0.16% for makers and 0.26% for takers. Kraken boasts numerous security features, including two-factor authentication, cold storage, and auditing of the proof of reserves.

Also, the exchange has good customer support. With its variety of analytics and tools, Kraken is one of the Best Xenex Exchange Alternatives for traders needing a secure exchange with many features.

Kraken — Key Features

| Feature | Explanation |

|---|---|

| Strong Security | Robust measures including cold storage and audits. |

| Fiat Support | USD, EUR, GBP, CAD, JPY deposits/withdrawals available. |

| Margin & Futures | Advanced trading options for professional traders. |

| Reputation for Stability | Long-standing presence with reliable service. |

| Advanced Charting | Tools for technical analysis built into the platform. |

Pros & Cons Kraken

Pros

- Super Secure – They have cold storage, 2-step verification, and an overall good presence in the industry.

- Fiat and Crypto Support – Supports deposits in dollars, euros, pounds, and Japanese yen.

- Advanced Features – They offer margin trading and futures.

- Regulated Exchange – This trading platform follows US and EU rules.

- High Liquidity – Allows users to execute trades quickly for popular crypto trading pairs.

Cons:

- Complex Interface – Novice traders may find it hard to use.

- Slower Verification Process – May take a while to verify accounts.

- Limited Token Variety – Not as many altcoins as you would find on Binance or OKX.

- System Downtime – This may occur during times of extreme market volatility.

- Customer Support Delays – Problems may take a while to be fixed.

10. Deribit

Deribit started operations in 2016 and has since grown to become one of the leading exchanges for derivatives and options in the cryptocurrency space.

It is regulated in Panama and provides support for multiple languages. Its trading pairs are focused primarily on BTC and ETH futures and options. Its trading fees on the futures and options markets start at 0.05% as a maker. Its security features include cold storage, 2FA, and a withdrawal whitelist. Deribit is responsive in support and has exceptional trading tools.

With their tailored offering for professional traders and strong focus on high liquidity, derivatives and security, Deribit is one of the exchanges on the list from Best Xenex Exchange Alternatives that is most suited for professional traders to trade in the futures and options markets.

Deribit — Key Features

| Feature | Explanation |

|---|---|

| Focus on Derivatives | Specializes in BTC & ETH futures and options markets. |

| High Volume Options Market | Large liquidity for options trading. |

| Competitive Fees | Low trading costs, especially for derivatives. |

| Professional Analytics | Includes tools and risk calculators for serious traders. |

| API for Developers | Strong integration support for trading bots or custom platforms. |

Pros & Cons Deribit

Pros:

- Focused on Derivatives – Best platform for crypto options and futures.

- High Liquidity for BTC/ETH – Large-volume trading supported.

- Advanced Trading Tools – Futures, options, and high leverage are available.

- Low Fees – Fees for trading derivatives are very low.

- Robust API – Highly regarded for algorithmic trading and professional traders.

Cons:

- Limited Spot Trading – Primarily focuses on derivatives.

- Complex Platform – Not very accessible to beginners.

- Limited Coin Variety – Supports only a few major cryptocurrencies.

- No Fiat Deposit Options – Only works if you can fund it with crypto.

- High Risk – If leverage is abused, it can lead to serious losses.

Conclusion

Selecting the appropriate cryptocurrency exchange is essential for safe, effective, and lucrative trading.

The aforementioned exchanges—WhiteBIT, Bitget, Poloniex, Bybit, Bitstamp, OKX, Binance, Coinbase Exchange, Kraken, and Deribit—stand out as the Best Xenex Exchange Alternatives because of their robust security protocols, regulatory compliance, extensive cryptocurrency selection, affordable fees, and dependable customer service.

These substitutes offer reliable choices whether you are a novice looking for an easy-to-use platform or a seasoned trader wanting sophisticated tools and derivatives. Investigating these exchanges guarantees a flexible and secure cryptocurrency trading experience catered to your need.

FAQ

What are the best alternatives to Xenex Exchange?

The best alternatives include WhiteBIT, Bitget, Poloniex, Bybit, Bitstamp, OKX, Binance, Coinbase Exchange, Kraken, and Deribit. These exchanges offer strong security, a wide range of cryptocurrencies, competitive fees, and reliable customer support.

Which exchange is safest among the Xenex alternatives?

Exchanges like Coinbase, Kraken, and Bitstamp are highly regulated and offer top-tier security features including cold storage, two-factor authentication, and insurance coverage, making them some of the safest options.

Which Xenex alternatives are best for beginners?

WhiteBIT, Coinbase Exchange, and Binance are ideal for beginners due to their user-friendly interfaces, educational resources, and easy fiat-to-crypto trading.

Which Xenex alternatives offer the lowest trading fees?

Binance, Bitget, and Bybit offer competitive trading fees, starting as low as 0.05–0.1%, making them suitable for frequent traders.