Peter Schiff Claims Bitcoin Needs $148K to Keep Up With Gold.

Peter Schiff, economist and outspoken advocate for gold, puts Bitcoin’s latest surge to an all time high of 126,198 and US Bitcoin market capitalization exceeding 2.5 trillion as not reason for celebration, “just a bear market rally.” Schiff believes Bitcoin still pales in price value to gold, which has reached an all time high of 4,000 an ounce.

Schiff moved on to explain the reasoning behind such price to gold rally. “Considering where gold is, to match gold’s price records, Bitcoin needs to hit 148,000.” He advised “lack of excitement by Bitcoin holders is proper, this is not the beginning of a bullish market.”

Concerns regarding a possible U.S. government shutdown do not seem to affect Bitcoin’s positive momentum. This is likely due to the Fed anticipated interest rate cuts later this month. Bitcoin has performed poorly compared to gold this year, as gold continues to show strong momentum in the market. Gold’s market capital yet again surpassed $27 trillion this month and is still over 10x Bitcoin’s market cap.

Investors still seem to be interested in Bitcoin and gold for their economic uncertainty as gold and Bitcoin continue to outperform the rest of the market with gold showing the best returns for the least amount of risk. This has been the trend for over 2 year and indicates a clear market preference for hard assets.

Paul Tudor Jones continues to be bullish on Bitcoin, predicting an “explosive Uptober rally” this year, as is the rest of the market. Analysts continue to predict a $150,000 BTC target and believe this is reasonable to expect over the holidays if risk assets are favor in the market.

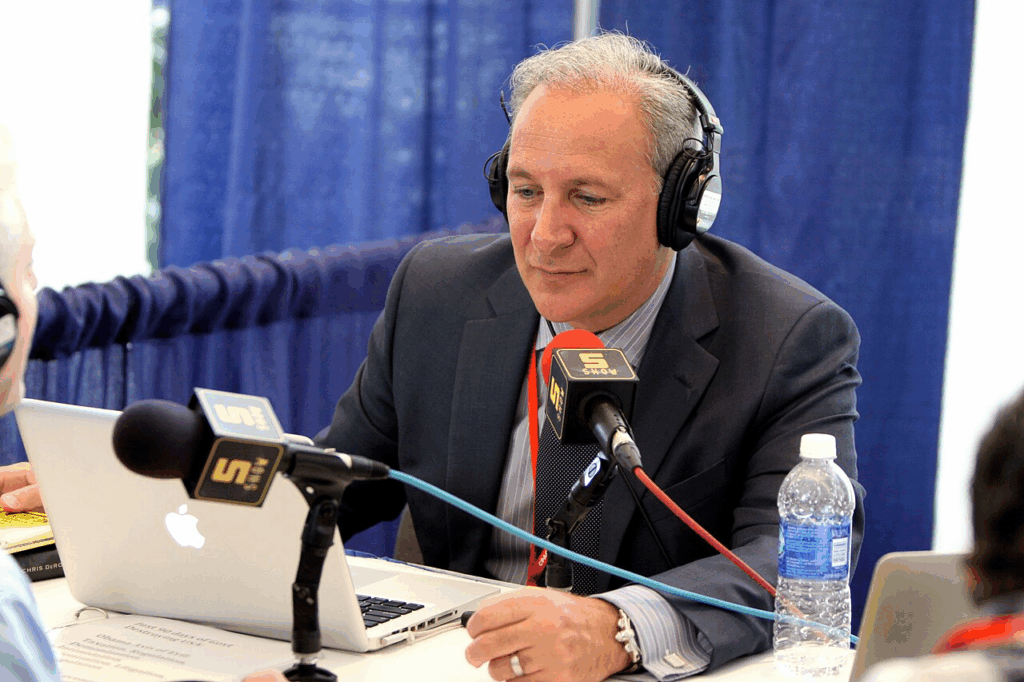

While commenting on the current gold rally, Schiff maintained his critique toward the Federal Reserve, saying, “This is a clear warning that current Fed policy is wrong. The Fed should turn in the opposite direction, raise interest rates between meetings, and communicate that they will continue to raise rates.”

For all the optimism that Bitcoin’s new all-time high brings to crypto investors, Schiff’s perspective is a reminder that traditional economists will always see gold as the benchmark to real value. Whether Bitcoin will close the gap and reach the predicted $148k is yet to be seen, but the competition between Bitcoin and gold is far from settled.

Final Thought

The Bitcoin price rally surge has reignited interest from investors. In contrast, Peter Schiff’s comments remind people of gold’s still primary value as a record. The performances of these assets reflect a wider narrative shaped by inflation, monetary policy changes, and demand for hard assets.

Bitcoin seems to be trying to reach a price of $150,000 and needs to catch up with gold in this rally. In the coming months, we will see if the momentum with these cryptocurrencies is a real breakout or just a bounce back. In a financial world that is constantly evolving, gold and Bitcoin still remain important assets, each for a different aspect of value and stability.