This article will focus on CoinLedger, a crypto tax software for calculating taxes based on crypto transactions.

CoinLedger has quite a few features, including automated tax reports, tracking of crypto portfolios, and even taxing NFTs, which help users manage their tax obligations in the crypto environment.

What Is CoinLedger?

CoinLedger is crypto tax software that helps users record and report their transactions to the tax authorities incorporated into the system.

It allows users to analyse their risk exposure, prepare the proper forms and documents required for tax reporting, and assist in tax minimization by accumulating losses.

Also, CoinLedger allows working with a vast number of WalleT and Exchange, thereby enabling appropriate transaction imports and accountability.

It is extremely helpful in reducing the pain points for crypto investors who need to deal with the legal aspects of their projects regionally/ internationally.

CoinLedger Overview

| Feature | Details |

|---|---|

| Price | Hobbyist: $49/year, Day Trader: $99/year, High Volume: $159/year, Unlimited: $299/year |

| Fees | No additional fees for basic plans |

| Support | Detailed tax reports and summaries for easy filling |

| Free Portfolio Tracking | Yes |

| DeFi & NFT Support | Advanced |

| Exchange Integration | Major exchanges and wallets via API or wallet addresses |

| Tax-Saving Opportunities | Yes |

| TurboTax Compatibility | Yes |

| Educational Resources | Extensive library of articles, videos, and eBooks |

| Accurate Tax Calculations | Yes |

| User-Friendly Interface | Yes |

| Security | Advanced encryption and security measures |

| Comprehensive Reports | Detailed tax reports and summaries for easy filing |

Crypto Tax Report Pricing

Reports available from 2010 – 2024. All reports are a one-time purchase per tax season.

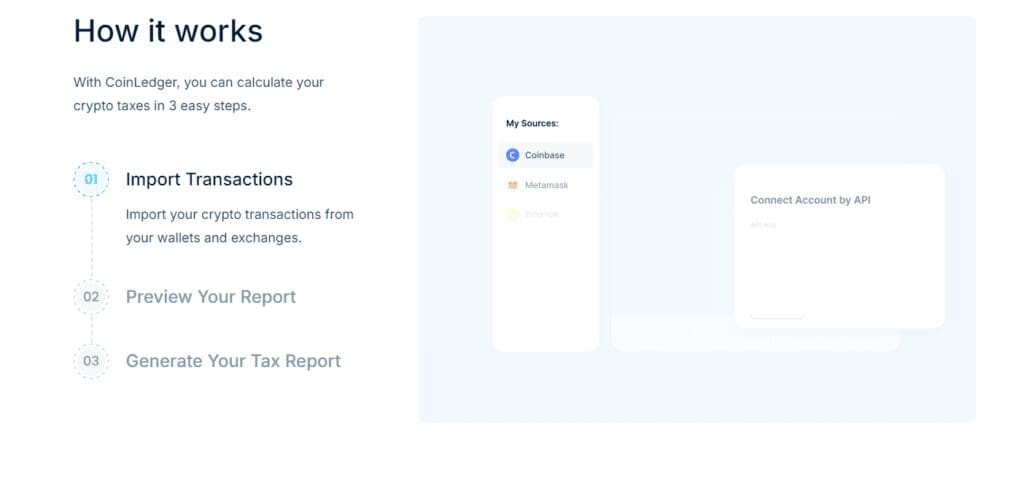

How CoinLedger Works

Import Your Wallets & Exchanges

You can import your transactions with a button, whether you’re using exchanges like Coinbase or wallets like MetaMask.

Classify Your Transactions Automatically

CoinLedger classifies your transaction history into the appropriate tax treatment. This happens automatically, but you can make individual adjustments manually.

Track Cost Basis And Historical Prices

CoinLedger’s historical pricing engine automatically tracks the cost basis of your assets as they move from one wallet to another.

View Your Gains & Losses

Before you pay for a tax report, you can view your capital gains and income for free!

Download Your Tax Report

Once you’ve finished all the steps above, you can download your comprehensive tax report with a button!

CoinLedger Product

| Feature | Description |

|---|---|

| Tax Reports | It generates detailed tax reports, including gains/losses, tax loss harvesting, and IRS Form 8949. Users can export reports for filing or submission. |

| NFT Tax Software | Tracks the tax implications of NFT transactions, syncing with wallets and exchanges to calculate gains and losses. |

| For Tax Professionals | Provides advanced tools for tax professionals to manage crypto portfolios, generate reports, and ensure tax compliance. |

| Portfolio Tracker | Consolidates crypto transactions from multiple exchanges and wallets, allowing users to monitor portfolio performance, value, and income sources. |

Coinledger Unique Features

Thanks to CoinLedger’s valuable features, managing crypto transactions and tax reporting is a breeze.

In this section, we will cover the features of CoinLedger in more detail:

Tax Reports

The most appealing aspect of CoinLedger is the ability to generate tax reports on these transactions.

Transfers from exchanges and wallets can easily be entered into the system, which digitally calculates all the gains, losses, and income.

It provides several tax reports, such as gain/loss reports, tax loss harvesting reports, cryptocurrency income reports, IRS form 8949, and audit trails.

Such reports can be fed into tax programs or filed with the agencies.

Portfolio Tracker

There is also a free portfolio tracking application on the CoiLedger portfolio, which allows users to monitor the level of their cryptocurrency assets and measure their performance.

It aggregates cryptocurrency movements across several and various exchanges and wallets into a single interface, benefiting users.

One can measure trading activities and performance, such as a portfolio’s worth and revenue from trading activities such as staking and liquidity mining. Such features are available to both premium and free users.

NFT Tax Software

Today, as we face the rapid growth of NFTs, CoinLedger’s tax software also includes a mechanism for taxing the NFT marketplace.

Users can connect wallets and NFT marketplaces to evaluate the profit and loss taxation that would be generated on their NFTs.

This is the feature that makes CoinLedger different from other taxation tools.

Crypto Taxes 101

Grasping the principles regarding the taxation of cryptocurrency is often a difficult task.

CoinLedger offers tax-related materials that are referred to as tax guides, offering more information to users.

Such resources outline various countries and aspects, such as activities in margin trading and donations.

CoinLedger Pros & Cons

CoinLedger Pros

Complete tax report generation – Determines the profit, the loss, or the income resulting from cryptocurrency transactions and produces an extensive range of tax reports.

Tools For NFT Tax Tracking – Incorporates tools that allow users to keep track of NFT transactions- one of the few platforms covering this aspect.

Portfolio Tracker Available For No Cost This comprehensive portfolio tracker solution tracks crypto assets across numerous exchanges and wallets on one screen.

Simple Process Of Communication – Enables users to import data from the most popular exchanges, wallets, and tax software to submit returns.

Educational Resources – Contains various countries’ laws and tutorial content for crypto taxation.

CoinLedger Cons:

Cost For Advanced Features—However, valuable features such as tax report generation are kept for users on a paying plan.

Limited Free Features—While the crypto portfolio tracker’s basic features are free, essential features needed for tax compliance are offered on a subscription basis.

No Direct Tax Filing—Reports cannot be filed using CoinLedger; filing taxes directly through the program is impossible. Users are required to import the reports to other tax filing programs.

Difficult For New Users—The platform has provided fair usage guidelines, but first-time users, especially regarding crypto-taxation, require more straightforward simplification.

CoinLedger Compare With Other Tax Software

| Feature | CoinLedger | Koinly | TaxBit | ZenLedger |

|---|---|---|---|---|

| Price | Live chat, email support, extensive help centre | Starts at $99/year | Starts at $119/year | Starts at $49/year |

| Fees | No additional fees for basic plans | No additional fees for basic plans | No additional fees for basic plans | No additional fees for basic plans |

| Support | Live chat, email support, extensive help centre | Live chat, email support, extensive help centre | Live chat, email support, extensive help centre | Live chat, email support, extensive help center |

| Free Portfolio Tracking | Yes | Yes | No | Yes |

| DeFi & NFT Support | Advanced | Yes | Yes | Yes |

| Exchange Integration | Major exchanges and wallets via API or wallet addresses | Over 300 exchanges | Over 400 exchanges | Over 500 exchanges |

| Tax-Saving Opportunities | Yes | Yes | Yes | Yes |

| TurboTax Compatibility | Yes | Yes | Yes | Yes |

| Educational Resources | Extensive library of articles, videos, and eBooks | Articles and guides | Articles and guides | Articles and webinars |

| Accurate Tax Calculations | Yes | Yes | Yes | Yes |

| User-Friendly Interface | Yes | Yes | Yes | Yes |

| Security | Advanced encryption and security measures | High | High | High |

| Comprehensive Reports | Detailed tax reports and summaries for easy filing | Yes | Yes | Yes |

Coinledger Support

First, Coinledger’s Support is decent, especially considering the price factor of many crypto tax platforms. These platforms do not provide this support at all unless you purchase their premium $199+ packages. Coinledger provides it for all its plans—and still, it’s not bad.

Most platforms answer complex queries in about 15-20 minutes(Net time, including wait time until the end), or about 15 minutes, which is what other crypto-tax takes.

That’s great, considering they offer support on all their plans, not just the most expensive ones.

Is CoinLedger Justifiable?

CoinLedger is the best-selling crypto tax software for obvious reasons. It is user-friendly, comprehensive and low-priced.

Filers seeking detailed support for margin trading should consider another platform, but in 2024, CoinLedger will offer crypto traders a simple tax solution.

Coinledger Alternatives

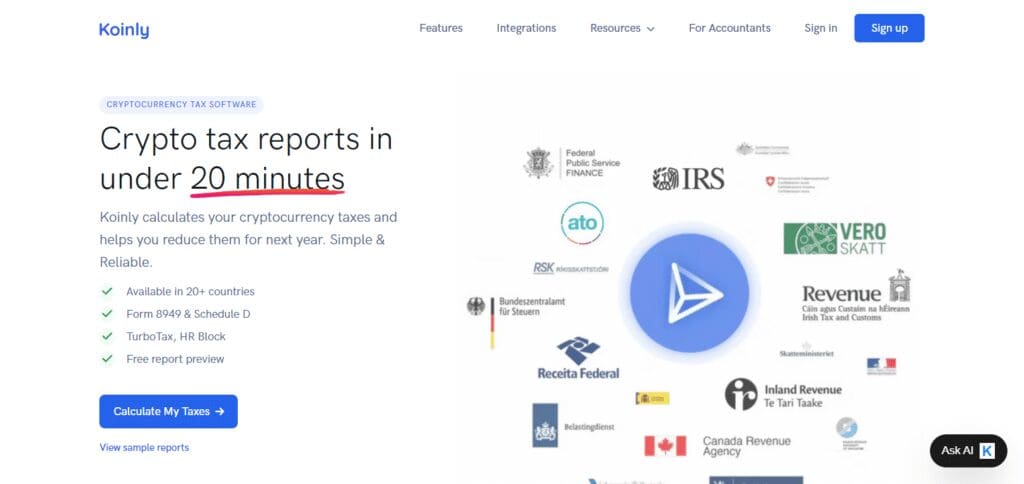

Koinly

Koinly automates tracking cryptocurrency transactions, capital gains and losses, and tax returns.

It has many exchanges, wallets, and blockchains to facilitate free and paid subscriptions. Koinly also has branches to satisfy investors and tax practitioners.

TokenTax

TokenTax is mediation in the realization of people facing many tax issues irregularly through preparing tax reports.

For instance, TokenTax provides an option to deduct lawful absences at the IRS, foresee available deductions up to the end of the year, or implement structural strategies.

As stated, the platform’s aim is targeted especially on the investing users and those professionally engaged in the investment world.

ZenLedger

ZenLedger has emerged from the educational backgrounds of tax accountants and designers, mainly targeting those who have fought the IRS for years.

The application also helps to systematically prepare authorities about crypto assets, as it combines features regarding the taxation of NFTs and salvage within a single framework.

The ZenLedger system has references and works with several exchange services and electronic wallets.

In such services, you can download reports for filing taxes while placing orientation to novices.

CryptoTrader.Tax

The vice president of crypto trader tax is launched as Coinledger. The users can also note the ease of importing the generated tax reports into the necessary taxation software.

It is a simple and fast platform; however, since it is purely about the taxation of crypto assets that they don’t provide,

If the user has more complicated tax situations and wishes to seek assistance, they may need to look for other tools.