The cryptocurrency market enjoyed a standout week that underscored the sector’s strengthening foothold and rising investor appetite. Digital assets drove higher with only brief pullbacks that failed to derail the advance. The upbeat tone was bolstered by key events and structural shifts that pointed to broader market maturation. Below are the week’s standout moments and top performers.

From July 14 to July 20 the highest-impact story was the “Crypto Week” organized by the House of Representatives. The week ended on a high note when the Senate voted through three crypto-related bills. Chief among them, the GENIUS Act, was promptly signed into law by President Trump.

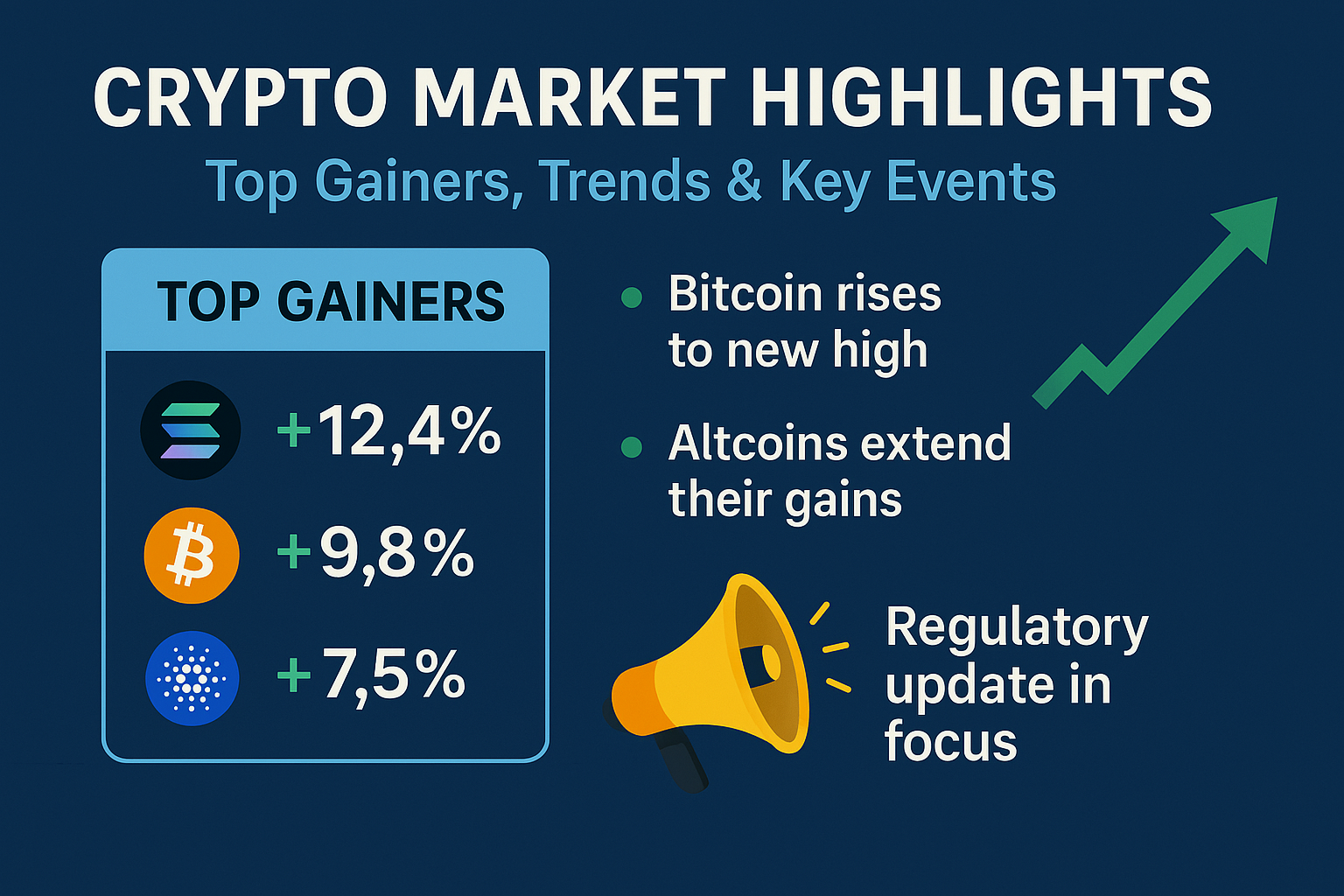

The legislative momentum sent traders into a buying frenzy, propelling Bitcoin to a new all-time high of \$123,000. Meanwhile, a wave of buying lifted altcoins sharply, fueling chatter of an accelerating altcoin season.

The momentary crossing of the \$4 trillion total crypto market cap marked both a mental and monetary watershed for the space. Bitcoin, Ethereum, and Solana each chipped in fresh gains, and the tide of fresh capital lifted the entire shoreline. Crypto ETFs caught the uplift, recording \$2.39 billion into Bitcoin funds and \$1.8 billion for Ethereum products alone.

On July 18, ProShares’ 2x leveraged XRP ETF went live, and both traders and institutions dialed in. That same week, token unveilings added more than \$1.5 billion, highlighted by the 90 million TRUMP tokens now in circulation. A quick pause on July 19 momentarily caught traders’ breath, but the broader trend and sentiment remained firmly in the green.

While Bitcoin’s price kept rewriting the record book, the week’s leaderboard was anchored by nimble altcoins. Bonk, Curve DAO Token (CRV), Pudgy Penguin (PENGU), FLOKI, and Hedera (HBAR) stole the show, with Bonk at the front and sprinting 52.5% to a fresh price of \$0.00003383.

The move drew wind from rising institutional appetite, a swelling trading volume, and a cascade of short squeezes. Grayscale’s decision to add Bonk to its watchlist was the last piece of kindling, igniting further buying.

Curve DAO Token surged 48% to trade at $0.09406 as demand for stablecoin swaps skyrocketed alongside key upgrades to the protocol. The passage of the GENIUS Act gave a green light on the regulatory side, pushing many to withdraw funds from exchanges and scoop up CRV.

Pudgy Penguin (PENGU) shone too, climbing 46% on the week and 16% just on July 19 to a price of $0.03336. Buzz around Igloo Inc.’s upcoming developments and a clean technical breakout drove the renewed interest.

FLOKI kept the momentum rolling for a second week, now at $0.0001393 after a 44% weekly jump and another 8% on July 19. The meme-coin wave and a decisive break from a stubborn long-term downtrend powered the ascent. Hedera (HBAR) added to the winners, up 33.5% to $0.02713 as the spotlight turned to fast, energy-saving blockchains.

Investor sentiment remains strong, backed by favorable legislation and a widening appetite for non-mainstream digital assets, creating a vibrant and optimistic crypto landscape.