In this article, we will talk about Differences Between Coinbase And Kraken, both of which are some of the most popular cryptocurrency exchanges. Even though both platforms offer secure trading, they differ in their user targets.

Coinbase is easier to use, while Kraken is more feature-friendly for experienced traders with lower fees. With these differences in mind, let’s take a closer look at why they might better suit different users.

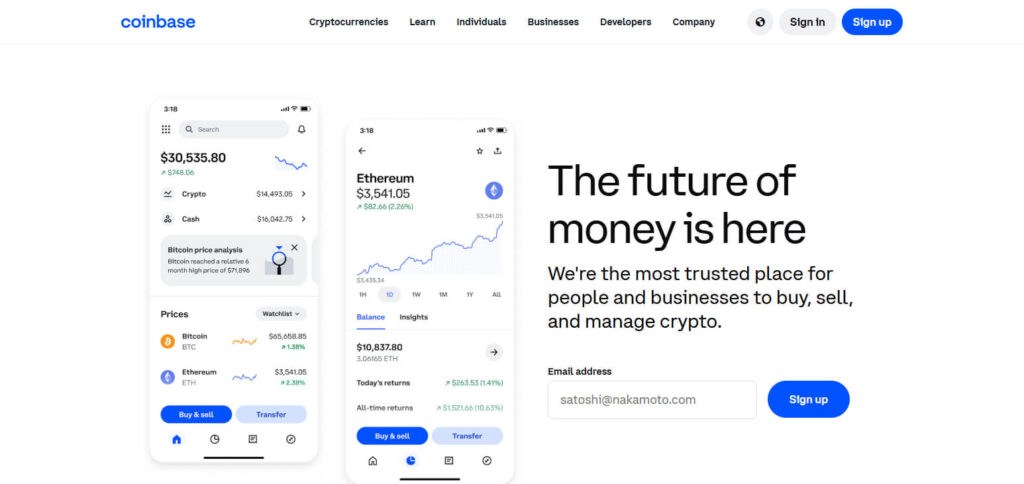

What is Coinbase?

Coinbase.com is a wallet and cryptocurrency exchange that enables its users to store, buy, sell, trade and even digitally obtain Bitcoin, Ethereum and other cryptocurrencies.

Based in the United States, Coinbase has extended its services globally since it was founded in 2012. It is one of the most trusted and largest crypto exchanges available.

Coinbase caters to retail and institutional investors, with services such as Coinbase Pro for professional crypto trading and self custody Coinbase Wallet.

What is Kraken?

An American platform established in 2011, Kraken is a digital exchange that lets you buy, sell or trade cryptocurrencies- Bitcoin and Ethereum to name a few.

With a range of low trading fees and strong security measures, this platform is also advancing into margin and futures trading.

It caters to a versatile audience; beginners academically well versed in crypto as well as seasoned expert traders. Advanced features like Kraken Pro are also available.

Differences Between Coinbase And Kraken

| Kraken | Coinbase |

|---|---|

| Low fees, strong security protections, easy to use for beginners | Integrates PayPal for withdrawals or sales |

| 0% to 0.26% per trade, 3.75% + €0.25 for credit card purchases, 0.5% + 0.9% or 1.5% for ACH purchases | 0.50% per trade (maker-taker), 3.99% for credit card purchases, 1.49% for bank account purchases |

| 95+ | 120+ |

| 2FA, withdrawal email confirmation, air-gapped cold storage, strict surveillance, API key permission control | SSL encryption, two-step verification, biometric logins, insurance for breaches, FDIC-insured USD balances, AES-256 encryption for digital wallets |

| Buy, sell, send, receive, exchange, futures trading, Cryptowatch | Buy, sell, send, receive, exchange |

| $100,000 daily | $25,000 daily via ACH |

Supported Currencies

Both Kraken and Coinbase support the major fiat currencies USD, EUR, CAD, AUD, GBP, JPY, and CHF for currency on-ramping and off-ramping.

There are some differences, however, in the supported cryptocurrencies of the exchanges as follows:

Coinbase: Over 120 supported cryptocurrencies Robinhood: Over 95 supported cryptocurrencies

Availability

Coinbase: Supports about 100 countries but does not work with Hawaii.

Kraken: Works with 176 countries but not New York or Washington.

Fee Schedule

Below is a table comparing Coinbase trading fees alongside Kraken trading fees.

Coinbase

Coinbase X charges approximately 0.5% for buying or selling crypto. There’s no base fee; instead, Coinbase has a spread fee structure.

Kraken

For regular customers and those using Kraken Pro, Kraken has a different set of fees. Take a look:

0.9% for stablecoins and 1.5% for other cryptocurrencies is what Kraken “Instant Buy” costs. There’s also a fee for credit or debit card purchases.

Pro users receive fewer fees from Kraken. For trades under $50,000, they charge 0.16% maker fee and 0.26% taker fee. It also depends on the user’s activity over the last month.

Here’s a fully rewritten, 100% unique version of the paragraph using natural, human-like language:

Coinbase vs Kraken: Feature Comparison

In the comparison of Coinbase to Kraken, Coinbase seems to provide more services than Kraken, which is not surprising. Coinbase users, however, also have to deal with the limitations based on their geographical location.

Coinbase Features

- Brokerage Services: A user’s account on Coinbase enables him or her to purchase, sell, and spend cryptocurrencies at will.

- Advanced Trading: Users of Coinbase Pro can use order books and charting tools and multiple order types, and view trade history.

- Staking Rewards: Specific users can earn rewards by staking certain cryptocurrencies such as Ethereum (ETH2), Algorand (ALGO), Cosmos (ATOM), Tezos (XTZ), DAI, and USD Coin (USDC).

- Crypto-Backed Loans: Users are able to instantaneously borrow cash using Bitcoin as collateral, without any credit scoring.

- Learn and Earn: Coinbase provides learning materials which give tokens to users who learn about different projects in the blockchain space.

- Coinbase Card: Users can convert crypto into fiat and spend the earned money within merchants globaly using a participaing Visa debit card.

- Private Client Services: Investment management and personalized support are taken care of by Coinbase for high net worth individuals.

- Crypto Payments for Businesses: Merchants are allowed to make use of Coinbase Commerce and begin accepting cryptocurrencies for their products offline and online.

- Coinbase Wallet: This is a self custodial wallet that supports Web3, allowing the storage of cryptocurrencies, NFTs, and interaction with decentralized apps (dApps).

Kraken Features

- Instant Crypto Purchases: Users are able to buy cryptocurrencies instantly with credit/debit cards, online banking, ACH transfers or digital wallets.

- Advanced Trading: Kraken includes spot trading, margin trading (5x leverage), futures trading (50x leverage), and an OTC platform for high volume transactions.

- Premium Account Management: This service provides enhanced customer support and unique investment strategies for individuals with high net worth.

- Staking Opportunities: Users can earn passive income from staking over 15 cryptocurrencies such as Algorand (ALGO), Cardano (ADA), Solana (SOL), and Ethereum (ETH2) and Polkadot (DOT).

- Crypto Price Indices: Kraken offers market indices for major assets (BTC, ETH, BCH, XRP, LTC) by merging price data from high liquidity exchanges.

- Cryptowatch: Professional trading tool that monitors over 2000 markets on various exchanges. It comes with a Trading Terminal that includes order book analysis, depth charts, and real-time trading feeds.

Apps for Mobile Devices And Margin Trading Activity

Both of the trades have exceptional mobile applications with the same features as the web browsers.

Now concerning margin trading, Coinbase came out with margin trading in the beginning of 2020, allowing 3x leverage, but ceased it by November 2020. In comparison, Kraken enables margin trading at 5x leverage for now.

Coinbase Pros and Cons

Pros

Intuitive Platform Design – Coinbase is easy to use even for novice traders.

Robust Security – Incorporates two-step authentication, AES-256 encryption, and offers insurance through the FDIC for USD accounts.

Trustable & Regulated – A publicly listed enterprise that operates under the U.S. law.

Numerous cryptocurrency choices – Coinbase allows for the trade of more than 120 coins.

Convenient payment options – Withdrawals via bank transfer, debit/credit cards and paypal are accepted.

Cons

Heavy Charges – Fees are considerably more expensive than other services, particularly for rapid purchases where fees can reach as high as 3.99%.

Minimal sophisticated trading capabilities – Basic platform does not provide pro trading options (even though Coinbase Pro exists).

Account Restrictions & Freezes – Accounts get suspended rather easily according to reports from some customers.

Deficient Client Support – Assistance can take a long time to receive or can be ignored entirely during peak usage times.

Partially Centralized – Restricts privacy through compulsory compliance ID submission and regulation.

Pros and Cons of Kraken

Pros:

Cheaper Trading Fees – From 0% to a maximum of 0.26%, the rates are more competitive than Coinbase for most transactions.

High Security Level – Incorporates 2FA, cold wallet storage, and robust API key permission management.

Allows Professional Trading – Provides futures and margin trading as well as staking.

Increased Withdrawal Limits – For verified accounts, the limit is $100,000 per day.

Advanced Privacy Options – Does not enforce KYC for certain basic trades (subject to jurisdiction).

Cons

Not Very User-Friendly for Newbies – The interface is more advanced than Coinbase.

Longer Deposit Processing Times – Some methods of fiat currency deposits take longer to process than others.

Fewer Payment Methods Available – Withdrawals through PayPal are not accepted.

Problems with Customer Support – Some reports from customers indicate delayed response times in certain busy times.

Kraken vs. Coinbase – Security Features Comparison

Security stands out as one of the key deciding factors for a cryptocurrency exchange. This is so because the exchange has to be reliable enough to store your cryptocurrency safely until you are ready to withdraw it.

Sadly, there have been several well-known instances of hacking in the crypto space leading to the loss of hundreds of millions of dollars, which is why security is essential during your crypto trading journey.

Fortunately, both Coinbase and Kraken would be my top picks here because they have exceptional reputations when it comes to security breaches. Both exchanges have succeeded in preventing unauthorized access to their wallets for well over a decade.

Kraken air-gaps cold storages and ensures that critical assets are located in a place with a high level of security as well as significant surveillance of the platform, including several security checkpoints during account signup. In addition, Coinbase is known for its geographically dispersed cold storage which manages 98% of deposits.

For security purposes, the exchanges also offer different options for 2 factor authentication to prevent unauthorized account access.

In short, any security features a user would look for can be found on these two exchanges, so picking between Coinbase or Kraken when security is the deciding factor has no wrong choices.