In this post, I want to explain the differences between Flash Stake and Time-Locked Staking so that you can understand how both of these staking methods function and which one fits your investment strategy best.

Understanding the primary differences between flash staking and time-locked staking can help you make better decisions in crypto whether you prefer immediate returns or deferred rewards.

Overview

As the world of decentralized finance (DeFi) develops, crypto investors are always looking for new ways to generate passive income from their assets. Staking has become one of the most favored methods to accomplish that and is now being done through time-locked staking.

This process locks tokens for a set period in exchange for rewards. There is a new concept called flash staking which is becoming popular due to its unique approach.

What is Time-Locked Staking?

Time-locked staking is the most common type of staking. Users deposit their cryptocurrency into a staking protocol or smart contract for a fixed period of time—30, 60, or even 90 days. During these periods, users do not have access to their staked tokens.

In return, users enjoy the benefits of staking rewards which -depending on the system- can be daily, weekly or monthly. The rewards are calculated based on an annual percentage yield (APY), amount staked and lock-up duration.

What is Flash Staking?

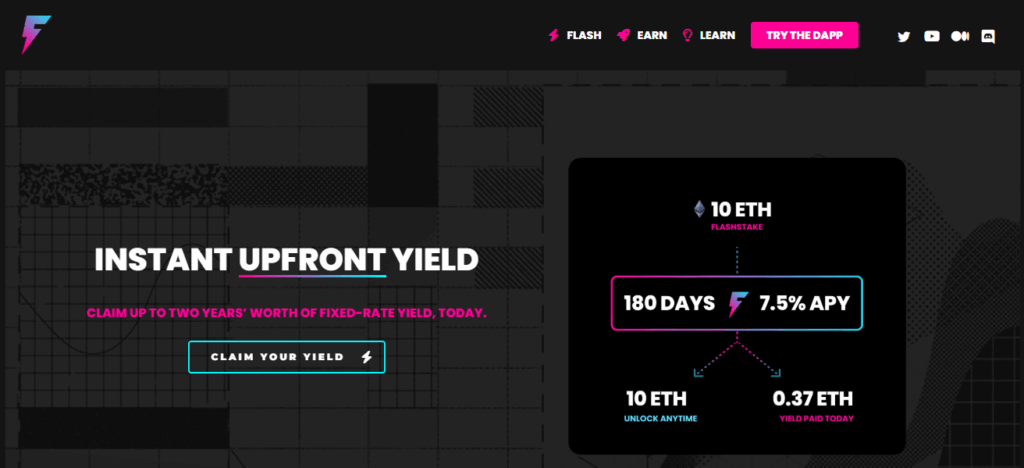

Unlike traditional models where users are forced to wait through a lock-up time for payout, Flash stake instant reward protocols have introduced flash staking that pays rewards up-front.

In detail, the user agrees to ‘stake’ tokens for a specific period just as in time-locked staking. The notable difference is that rewards are paid upfront based on the projected annual percentage yield (APY) during the “staking” term.

Although rewards are disbursed entirely at the beginning, staked tokens remain inaccessible throughout the duration of the agreement.

Key Differences Between Flash Stake and Time-Locked Staking

| Feature | Flash Stake | Time-Locked Staking |

|---|---|---|

| Reward Timing | Rewards are received instantly at the time of staking. | Rewards are distributed over time or at the end of the staking period. |

| Capital Lock-in | Yes, tokens are locked for the chosen duration even though rewards are upfront. | Yes, tokens are locked for the entire staking period with no early access. |

| Liquidity of Rewards | High – you can use rewards immediately in other DeFi activities. | Low – rewards are not accessible until they are distributed. |

| Exposure to Price Volatility (Rewards) | Lower – you get rewards based on current market value. | Higher – value of rewards may change by the time they are received. |

| Ideal For | Active DeFi users who want to reinvest rewards or hedge positions quickly. | Long-term investors seeking predictable yield and willing to wait for rewards. |

| Early Exit Option | Not available – principal remains locked; only rewards are upfront. | Often available but comes with penalties or reduced rewards. |

| Availability | Limited – offered by a few DeFi protocols like Flashstake. | Widely available on major platforms and blockchain networks. |

| Reward Predictability | Fixed upfront based on APY and staking duration. | May vary slightly depending on network performance and reward distribution. |

| Innovation Level | High – newer concept designed for flexible DeFi strategies. | Traditional – proven model used in most PoS systems. |

Pros and Cons at a Glance

| Time-Locked Staking | Flash Staking |

|---|---|

| Delayed | Instant |

| Yes | Yes |

| Often high | Not applicable for rewards |

| Low during staking | Higher due to upfront rewards |

| Higher (especially for rewards) | Lower for upfront rewards |

| Widely supported | Limited to a few protocols |

Which method gives better returns – flash staking or time-locked staking?

Your overall investment strategy, as well as the specific market conditions at the time, will largely dictate whether you prefer flash staking or time-locked staking. Flash staking allows users to benefit from instant reward systems that pay out what you are eligible to receive in full yield in real-time based on current APY.

This is great for those who need cash immediately or are planning to use it to reinvest pick up other DeFi opportunities. In contrast, time-locked staking has the potential to give a higher return over time, particularly if held during favorable periods.

Still, time-locked can have a large downside where there is a risk of price volatility which renders the value of rewards useless by the time they would be released. In summary, flash trading favors those who prefer flexibility; as for time locked staging seeks passive income strategies.

Which is Better?

There’s no universal answer. It all depends on your strategy and how much risk you’re willing to take:

Select time-locked or fixed staking periods if you’re a conservative investor who values long-term rewards and is comfortable putting funds away for the duration of the lock.

Go for flash or instant staking if you actively participate in DeFi and want instantaneous yield that you intend to redeploy immediately.

In volatile markets, flash staking may allow for greater control concerning your yield’s value. However, if the token’s price appreciates significantly during the stake period, you could be left missing out on proportionately larger future returns compared to what time-locked rewards would provide.

Conclusion

In summary, Flash staking gives users freedom without having to commit to long-term token locks. This contrasts with time-locked staking which requires assets to be locked for a predetermined duration in exchange for gradually earned rewards.

While flash staking is ideal for active traders who value immediate access and quick Flash returns, time-locked over time offer steady growth capturing the interest of long-term holders.