This article will present a comparison between FP Markets and OANDA, focusing on their differences with respect to trading conditions, regulation, platforms, and commissions.

Although both brokers are popular in the forex market, they serve different trader preferences. This will assist you in determining which broker you will have the optimal trading experience with in 2025.

What is FP Markets?

Established in 2005 in Australia, FP Markets has become one of the world’s most prominent online forex and CFD brokers. It is highly regulated, including by ASIC (Australia) and CySEC (Cyprus), so brokers and investors can have peace of mind. FP Markets has a diversified offers, including forex, indices, commodities, shares, and cryptocurrencies.

They provide excellent customer service and quick account opening. Customer support is responsive and there is an educational suite and account flexibility tailored for beginner and professional traders. Advanced trading platforms (MetaTrader 4, MetaTrader 5, cTrader) and trading speed with narrow spreads have also become distinguishing marks of FP Markets.

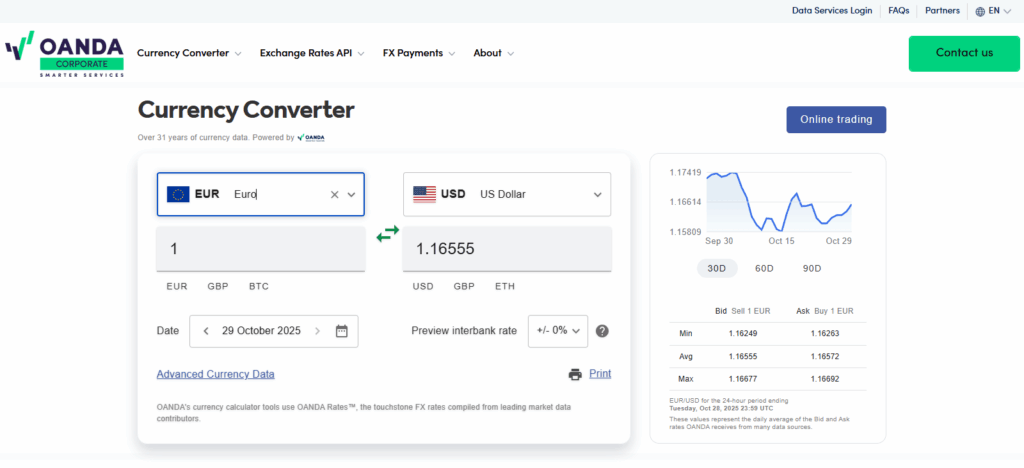

What is OANDA?

OANDA was established in 1996, and since then, it has evolved into a global leader in the forex and CFD trading brokerage industry, distinguished for its transparency and reliability. OANDA has earned the trust of the trading community, thanks in part to its innovative trading technology.

Moreover, its multiple tier-one global licenses from the FCA in the UK, ASIC in Australia, the CFTC, and Australia, make its trading environment secure. OANDA is versatile and features various trading options, such as forex, bonds, and commodities, as well as cryptocurrencies.

Its advanced analytical tools and fast execution make trading easy on its OANDA Trade and MetaTrader 4 platforms. Offering comprehensive educational tools alongside sponsored competitions, OANDA undoubtedly is remarkable for its trading value.

key differences between FP Markets vs OANDA

| Feature | FP Markets | OANDA |

|---|---|---|

| Minimum Deposit | Around US $100 required. | Very low or US $0-1 in some jurisdictions. |

| Maximum Leverage (Retail Clients) | Up to 1 :500 in some regions. | Typically lower (around 1 :200 or less). |

| Trading Instruments (Breadth) | Very large range including many CFD stock options, many commodities & crypto. | Good range especially in forex, but fewer stock/CFD options in some regions. |

| Platform Options | Supports MT4, MT5, cTrader, TradingView and sometimes DMA (eg. IRESS) for stocks. | Supports MT4, MT5, proprietary platforms; fewer niche platform options comparatively. |

| Spreads & Trading Costs | Often very competitive spreads (especially on ECN/raw-type accounts) but depends on account type. | Also competitive; often better for beginners or smaller accounts; though some fees/inactivity costs apply. |

| Regulation & Trust | Regulated in multiple jurisdictions (eg. ASIC Australia, CySEC etc) but fewer Tier-1 licences than OANDA in some metrics. | Strong regulation across multiple top-tier regulators (FCA UK, ASIC AU, CFTC/NFA US etc) giving higher trust score. |

| Best Suited For | Traders seeking high leverage, broad instrument range, advanced platforms and active/scalping strategies. | Traders looking for simpler entry, strong regulation, beginner-friendly features, and straightforward accounts. |

Regulation and Security

FP Markets

- Regulated under different authorities including Australian Securities and Investments Commission (ASIC) and Cyprus Securities and Exchange Commission (CySEC).

- Client funds are held with leading banks and are separated from the company’s capital.

- Member of the Financial Commission (approved June 17 2025), and thus has access to a complaint reimbursement compensation scheme of up to €20,000.

- Some operations are under less-strict jurisdictions (e.g., Seychelles register) for certain clients/regions — less protection compared to top tier regulators.

- Does not have a U.S. regulatory licence and does not serve U.S. clients.

OANDA

- Holds licences with several top-tier regulators: e.g., Financial Conduct Authority (FCA, UK), Commodity Futures Trading Commission (CFTC, U.S.), Australian Securities and Investments Commission (ASIC).

- Uses segregated client funds (separate from company funds), and in applicable jurisdictions offers negative-balance protection (so you cannot lose more than your deposit).

- Strong data security practices: encryption (SSL/TLS), two-factor authentication (2FA) encouraged or mandated regionally.

- There have been regulatory concerns: for example, the U.S. NFA settled charges against OANDA regarding some compliance issues.

Fees, Spreads, and Commissions

FP Markets

- Standard (no commission) and Raw/ECN (tight spreads + commission) are the two main account types.

- On major pairs, the Standard account: spreads from about 1.0 pips and no extra commission.

- Raw account: Spreads can get as low as 0.0-0.1 pips + commission of US $3 per standard lot per side (≈ US $6 round turn) for forex.

- No inactive account fees and no deposit fees most of the time.

- For leveraged positions, swap/overnight financing charges will apply normally.

OANDA

- For FX & metals, OANDA has two pricing models: Spread-Only (all cost baked into the spread) and Core Pricing + Commission (lower spread + separate commission).

- On the Spread-Only model, typical spreads: EUR/USD is around 1.0 pip in many cases.

- On the Core Pricing model, spreads can go down to 0.1 pips or so, however, you will incur a commission per trade (e.g., ~US $5 per standard lot for some jurisdictions).

- Currency conversion mark-ups (about 0.5%) are applied in some regions when the account base and the trading currency differs. .

- Inactivity fees, fees for withdrawals, and account funding are region-specific (e.g., withdrawal bank transfer fees). .

Deposit and Withdrawal Options

FP Markets

- Receives a wide range of payment methods: credit/debit cards, Bank Wires (Domestic & International), e-wallets (Neteller, Skrill), and Local Transfers in some regions including India.

- In India: UPI, NEFT/RTGS, and Local Bank methods, Credit cards, and major banks (SBI, HDFC, ICICI, Axis) are supported.

- Deposit processing: cards and e-wallets are typically instant or fast for most cases. Bank wires are 1-5 business days. No deposit fees from FP Markets in most cases.

- Bank-wire, e-wallets, and cards are some available methods for withdrawals. FP Markets generally does not charge withdrawal fees for many methods, some methods incur small fees e.g. (e-wallets or certain local transfers) depending on region.

- Withdrawal times: e-wallets online methods/all e-wallets often 1 business day; Bank wires domestic wires may take longer (2-10 business days depending on method and country).

OANDA

- For each region, payment methods are credit/debit cards, Bank Wires, local Bank Transfers, and e-wallets.

- Withdrawal rules: All withdrawals should be done using the same method that was used for deposits. For example, deposits made via a card must be withdrawn back to that card first.

- Withdrawal fees: OANDA often doesn’t charge for withdrawals made via cards, but there might be charges for bank wire withdrawals, depending on the currency and country. There can also be charges from your bank.

- Withdrawal processing times: When approved, card and e-wallet withdrawals take 1-3 business days. Bank wire transfers can take 1-5 business days and even longer for international transfers.

Pros and Cons: FP Markets vs OANDA

Pros & Cons FP Markets

Pros:

- Active traders enjoy low all-in cost and ultra-competitive spreads on Raw/ECN accounts (e.g., near 0.0 pips on majors).

- Offers a variety of well-known platforms (MT4, MT5, cTrader, TradingView) which provides traders with various options.

- Has a very broad range of instruments and 10,000+ tradable assets including forex, CFDs, commodities, and shares.

- With regulation by ASIC and CySEC trust is solid, and gives FP Markets a boost.

- Great execution speeds, with range of deposit and payment options.

Cons:

- When it comes to education and research, some traders feel they are not on par with industry leading brokers.

- Compared to newer brokers, some of the mobile apps and the mobile interface may feel outdated.

- More expensive and/or more challenging entry restrictions may put some account types and platforms (like IRESS) out of reach for small traders.

- In some cases, dormant accounts may incur inactivity fees.

Pros & Cons OANDA

Pros:

- The licenses of Tier-1 authorities (e.g., FCA in UK, ASIC in Australia, CFTC/NFA in US) provide a strong regulatory footprint.

- In a number of areas, low (or non-existent) minimum deposit requirements allows the company to be more accessible for beginner traders.

- When it comes to tools and integrations, such as Trading View, they offer strong tools along with competitive fees and spreads.

- Good educational resources, reliable mobile & web platforms, user-friendly interface.

Cons:

- Spreads may be higher unless you qualify for “Elite/Core” pricing tiers — so cost-structure may disadvantage smaller/less frequent traders.

- Some traders report withdrawal/complaint procedures can be lengthy or less smooth in certain regions.

- In certain jurisdictions (e.g., US) product range is more limited (e.g., fewer CFDs, lower leverage) compared with global standard.

- Some broker features (like negative-balance protection) may vary by region/regulator.

Conclusion

To sum up, FP Markets and OANDA are both credible brokers and are really good in different respects. FP Markets has a greater number of trading platforms, larger leverage, and more closely priced trading spreads. All of which favors pro and high volume traders.

Yet, OANDA has better supervision, easy to use feature tools with lower trading entry levels which suits newbies and more cautious traders. The differentiation comes down to trading style: FP Markets if you need more sophisticated features and versatility, OANDA if you need security, clarity, and ease.

FAQ

Which broker is safer?

FP Markets is regulated by Australian Securities & Investments Commission (ASIC) and also holds a Cyprus licence among others.

OANDA boasts licences across multiple major regulators (FCA, CFTC, ASIC, MAS, JFSA etc) and is rated with a high Trust Score (93/99).

A: Both brokers have strong regulation, but OANDA may edge ahead in terms of global regulatory breadth.

What trading platforms do they support?

FP Markets: Offers MT4, MT5, cTrader and other platforms depending on region.

OANDA: Supports proprietary platforms (web, mobile), MT4/MT5 in some regions, and integration with tools like TradingView.

A: Both offer strong platform options; FP Markets may offer more variety in specialised platforms, while OANDA emphasises ease-of-use and integration.

How long do withdrawals take?

FP Markets: Timing depends on method and country; card/e-wallet tends to be faster, wire slower.

OANDA: Generally 1-5 business days for bank transfers; card withdrawals may be faster; weekends may delay.

A: Factor withdrawal time into your choice—especially if you value fast access to funds.