In this article, I will cover the GeckoTerminal, an interesting and effective monitoring service focusing on decentralized exchanges (DEXs).

In the crypto sphere, it offers low-latency data with wide geographical reach and is less than average.

It provides users in the ever-changing market with new opportunities and pertinent knowledge.

Please do not go anywhere because we will discuss what makes it special.

GeckoTerminal Introduction

GeckoTerminal is an advanced DEX tracking application that provides automatic quotes, trades, and ongoing volume for over 600 DEXes across over 100 networks.

Regarding common pools, the tool updates liquidity data for 1.7 million pools and 1.5 million tokens in real time. It, therefore, helps in tracking, and mers are never late to trade.

What stands out when it comes to GeckoTerminal is its network coverage, as its advantages in terms of market-extended coverage are higher than those of its competitors.

Understanding the DEX activity in detail, this platform is focused on the maximum convenience of its navigation.

The bountiful culture extending support for various languages is more than its competitors, most of which target the English market: low demand for a global audience.

Getting Started with GeckoTerminal

To get started with GeckoTerminal, follow these simple steps:

Visit the GeckoTerminal website: Access the official website and download the application from Google Play or App Store if you havenít done so yet.

Create an account

Using the email address, sign up and choose a strong password.

Verify your email

Look for a message to verify your account and click on the link in the email.

Navigate through the platform.

The first task is to get acquainted with the environment: look at the data in real time, assess liquidity, and explore different tools.

Begin monitoring

Start keeping track of DEXs, their trading activity and volumes, and liquidity spread on several blockchains.

How to Use GeckoTerminal Effectively?

To use GeckoTerminal successfully, it is recommended that the user:

Understand the Dashboard

You begin by looking at the user-friendly dashboard to monitor currencies’ latest price, cap, and volume. You can arrange the layout to show the most preferred coins and tokens.

Make Good Use of Advanced Charting Tools

GeckoTerminal also has refined charting tools with several indicators. Employing technical aids like the candlestick chart, moving averages, and RSI in Geckoterminal enables the determination of the trend.

Set Alerts and Notifications

Create alerts directed towards specific coins to keep you updated. Gecko terminal will notify you of triggered price points, helping you make the necessary decisions.

Assess the Liquidity and trading volumes.

Grasping the liquidity and the trading volumes also comes in handy when seeking trading decisions. Use the gecko terminal to check the liquefy pools of token pairs and the trading volume, observing whole trades carried out on DEXs.

Look for Historical Data

Looking back at historical data will be beneficial in evaluating patterns in the long run. Historical charts in Gecko Terminal can examine previous price levels and assist in foreseeing the market.

Create the View that Suits You

Adapt the interface to correspond with your trading plans, including only the data you need the most. Portfolios, watchlists, and preferred exchanges can be integrated through GeckoTerminal.

Key Features of GeckoTerminal

RealTime Stats

Presents current information regarding cryptocurrencies’ prices, trade volumes, and liquidity on several blockchains.

DEX Aggregation

Gathers information on more than 600 decentralized exchanges (DEXes) across over 100 different networks.

Liquidity Tracking

Keeps track of liquidity across 1.7 million pools and 1.5 million tokens.

Advanced Charting Tools

It provides interactive and analytical charts based on the TradingView platform, including more advanced features and tools for Technika.

User-Friendly Interface

Features a well-done, clear, and easy-to-use navigation system.

Multilingual Support

Covering several languages helps make the content more available to numerous readers.

Public API

Enables data accessibility to developers and other integrations.

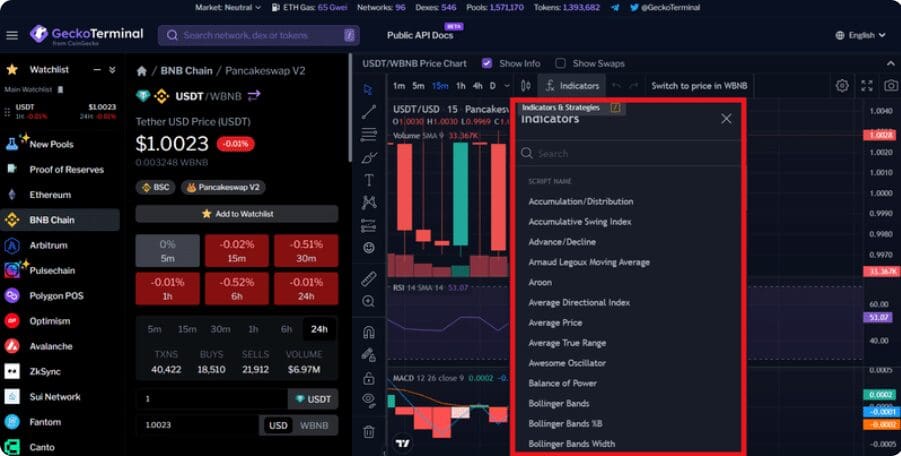

Exploring Interactive Charting Tools in Technical Analysis

GeckoTerminal includes various interactive charting tools in its feature set that upholds technical analysis regarding selected specific assets.

They can draw charts of individual assets and employ numerous indicators to predict a particular asset’s future price trends.

The charting tools can be conveniently found on the right-hand side of the asset page.

Select ‘FX Indicators’ to use indicators and scroll through to the desired indicator.

Some popular indicators include the RSI, MACD, and numerous ways of moving averages.

These are momentum indicators, such as the RSI and MACD, which investors utilize to determine the strength of the market and the expected direction of price changes while the market is in turmoil.

Furthermore, the left-hand side of the chart section has simple and easy-to-use tools like trendlines and Fib Retracements, which will aid your analysis.

These aspects improve the technical aspects and rendering of the information and assist traders in a better picture of their market prediction plans.

GeckoTerminal vs. Other Market Tracking Tools

| Feature | GeckoTerminal | CoinGecko | CoinMarketCap |

|---|---|---|---|

| Real-Time Price Tracking | Yes, with live updates from DEXs and CEXs | Yes, but not all exchanges update instantly | Yes, but updates may lag during high market activity |

| Advanced Charting Tools | Yes, with customizable technical analysis indicators | Basic charts with limited technical tools | Basic charts, third-party tools for deeper analysis |

| Liquidity and Trading Volumes | Extensive data on liquidity pools and trading volumes | Limited liquidity data, mostly for major exchanges | Focus on large exchange volumes, minimal liquidity data |

| DeFi and DEX Support | Strong focus on decentralized exchanges (DEXs) | Limited DEX integration, focuses on centralized exchanges | Minimal DEX data, mostly CEXs |

| Historical Data Access | Comprehensive historical charts and analysis tools | Basic historical data available | Offers historical data but less depth in analysis tools |

| User Interface | User-friendly, customizable dashboard for traders | Simple, easy-to-use interface | Beginner-friendly, but lacks customization options |

| Alerts and Notifications | Yes, custom alerts for price movements and market changes | No built-in alerts, relies on third-party integrations | Basic alerts for price and portfolio updates |

| Premium Features | Premium analytics and deeper data access (if available) | Mostly free, some features require an API plan | Free and paid tiers for advanced data access |

Devising a GeckoTerminal

Employ the Watchlist feature to set up your version of GeckoTerminal. Click the star sign on a liquidity pool to add it to your list of pools.

You can even create more than one watchlist to focus on different pools you wish to and thus make it easier to watch specific assets.

Another convenience is the possibility of changing the display language. The number of different languages currently available is 17, including English, simplified and traditional Chinese, Indonesian, Turkish, Dutch, and so on.

As many DEX tracking tools are limited to only English and other tools are often non-competitive, the tool is a little easier for those who do not speak English.

Cross-Chain Functionality

GeckoTerminal also continues monitoring additional blockchains, providing broader insight into more DEXes.

Let us look at certain interesting ones that are being tracked by the platform.

Ethereum

As the number one blockchain hosting smart contracts, it views the largest number of DEXes.

Many famous DEXes have developed on the Ethereum platform and later migrated to other networks.

Although there are high gas prices, Ethereum is still the leading DeFi network, with about $1 billion in 24-hour volume in trading.

Gaining interest is a layer two solution, Arbitrum and Optimism. However, the impact of Ethereum over DeFi is still considerable.

Solana

Solana Up to now, Solana has also been known as one of the central DeFi ecosystems.

Following the rapid rise in DeFi, the brand Solana, an ‘Ethereum Killer,’ also wants to tag DeFi as an alternative on its legal paper.

Although the FTX scandal broke its growth, Solana is bouncing back from the previous network slumping with 24-hour volumes of 16.77 million USD.

How the DEX ecosystem pans out on its network will determine its future.

Fantom

Even though Fantom is, & engagement networks confounded low in Phizeo r considering the DC future validity than obtainable solos.

This means that even if it has more DEXes than Solana, its 24-hour volume stands at a dismal 2.58 million dollars.

Presence of Curve Finance a leading DeFi App and Spookyswap the leading DEX on fantom reinforces its prospects.

Smaller Networks Tracked by GeckoTerminal Oasis Emerald: These can only comfortably achieve, on average, about five dEXes with a dominant trade volume of 26.2k Over 24 hours at the top of Yuzi ranked at 200th position.

Tomochain: This chain has only one DEX, Luauswap, and has a volume of 12.87k dollars in 374 transactions in 24 hours.

Milkomeda Cardano: Even with its roots in Cardano, Milkomeda Cardano has a volume of only about 3.7k dollars in 24 hours over three dEXes.

Wemix: More DLT friendly DLT than the subsystem-level where this blockchain can be put as fazla MH, arte alan temalığı $ 128.4k through on its One DEX is WE Mix.FI and This performance is healthy in an over-saturated market.

GeckoTerminal Security

GeckoTerminal places a premium on security for its users. The application incorporates strong encryption to secure all data and its communication.

Besides, the platform performs regular security reviews and adheres to the best practices in the industry regarding user security.

Also, because of this technology, the company guarantees the security and reliability of data handling to the users while they try to track decentralized exchanges.

Conclusion

In summary, there is no doubt that GeckoTerminal is one of the best DEX trackers available, providing exceptional real-time information on decentralized exchanges across multiple networks.

Its functionalities, user-friendly interface, and comprehensive coverage make it one of the best tools for traders at every level.

Placing added emphasis on the security and protection of data, GeckoTerminal does not only assist users in improving their trading strategies,

But also safeguards them in a volatile environment such as decentralized finance.