I will discuss Orbiter Finance, an advanced DeFi protocol in this article. Orbiter Finance is changing the DeFi space dramatically due to its capabilities to facilitate easy cross-chain asset movement through ZK-proofs.

I will also examine its features and security measures and why it is necessary in this fast-changing, rapidly growing blockchain environment.

What IS Orbiter Finance?

Orbiter Finance is one such decentralized finance protocol that underlines the importance of cross-chain interoperability.

Advances in blockchain technology allow Orbiter Finance to provide services such as the transferring and trading assets among various goods that complement its ecosystem.

The platform interface contains options like Orbit Bridge and Orbit Dex, focusing on the different aspects of seamless trading: convenience, safety, and profit.

Adopting such a strategy also allows users to lend, borrow, stake, and farm without interference while being completely transparent about the risks involved.

How Orbiter Finance Works

Orbiter Finance uses advanced intelligent contracts, precisely zero-knowledge proofs (ZK-proofs), to process data uniquely without compromising security. The process comes in the following steps:

Step 1. Initiate the transfer.

Customers acquire and lock up their assets in Orbiter Finance’s smart contract on the Creator Rollup.

Step 2. Lock the assets.

The assets are kept intact and are locked in the smart contract within the transfer stages.

Step 3. Verify Transfers.

Orbiter Finance uses the ZK-proof to authenticate transaction details while keeping all the crucial information under secure scrutiny.

Step 4. Transferring Value.

The appropriate value equivalent to different assets is shifted to the intended rollup chain after completing and authenticating the packs.

Step 5.Taking back your assets.

At the targeted roll-up, users retrieve the assets in their ownership by verifying ownership using the respective Orbiter Finance contract.

Using ZK-proofs also dramatically enhances the security and privacy of asset swap processes between rollups, making Orbiter Finance an essential instrument for people who attempt to interact efficiently within the Ethereum rollup ecosystem.

Orbiter Finance Major Features

Secure

Orbiter Finance benefits from the security of rollups, resulting in a minimal risk associated with data synchronization between networks. This is because rollups synchronize their data with the leading network, thus ensuring the security of the transfer process.

Compatible

Supporting non-EVM L2 and L3, as well as EVM rollups, valium, and Dapp-specific rollups, this versatility enables a wide range of use cases, making Orbiter Finance an attractive choice for users seeking flexibility in transactions.

Fast

Orbiter Finance’s timeliness is exceptional, making it the quickest solution available. Transactions between two EOAs can be completed within 10 to 20 seconds.

Cost efficient

Orbiter Finance also offers the lowest basic network costs, the sum of the gas costs for transactions between two EOAs on both source and destination networks. Rarely can any other solution be found cheaper than ours.

Openness

They support the decentralized addition of various ERC20 token liquidity. It enables developers to access the environment by deploying SPV and customizing cross-rollup transactions and message events. This openness provides users with greater flexibility and control over their transactions.

Trustless

Orbiter Finance has developed a decentralized incentive front-end that enables third-party DApps to establish frontend interfaces compatible with the cross-rollup bridge protocol.

This marks a significant achievement in Orbiter Finance’s pursuit of ultimate decentralization and trustlessness.

The strategy for the token creation of Orbiter Finance.

Orbiter Finance doesn’t issue tokens yet as they intend to focus on developing the protocol and improving the user experience.

Nevertheless, a recent Twitter post suggested that they were preparing to release tokens and attributed the likelihood of an airdrop to their future activities in the crypto space.

Besides, Orbiter Finance has successfully raised the first tranche of funding led by Tiger Global, A&T Capital, StarkWare, and Vitalik Buterin.

Thus, DeFi projects supported by institutional initiatives will probably issue these tokens once the product is ready for deployment.

How to Claim the Possible Airdrop Orbiter Finance Tokens, If Any

Referring to the boxmining.com page, the optimal way to get the Orbiter Finance tokens as airdrops is to bridge the ETH or the stablecoin assets among the 11 supported networks.

Here are the steps to take to get a possible Orbiter Finance airdrop, more specifically:

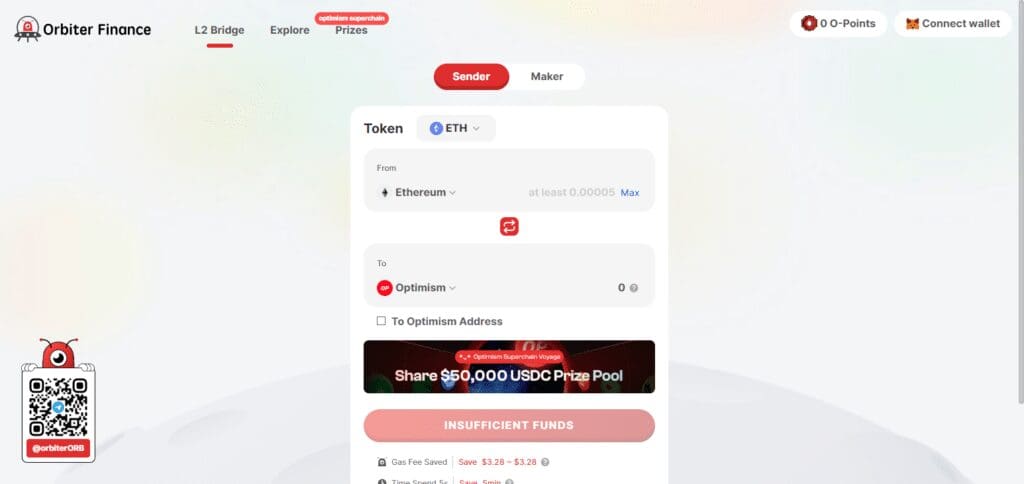

Link the MetaMask or other compatible Polygon/Ethereum/ZkSync/Arbitrum wallets.

Choose the chain in which you would like to transfer the assets.

Proceed to execute the transfer.

Although airdrop optimization recommends bridging assets many times to maximize the chances of airdrops, there will be fees for every transaction.

Nevertheless, the modifier of the Orbiter fee structure will be the Gwei of the destination network so that T1 fees will be kept below average.

On the other hand, this will be infrequent, mainly due to the volatility of gas fees. Senders can watch the current fees charged on Orbiter’s website.

Orbiter Finance Pros & Cons

Pros:

Speed: Orbiter Finance facilitates the rapid movement of assets across Ethereum Layer 1 and Layer 2 patchworks1.

Security: Leverages using ZK-proofs, which facilitate private and safe interactions.

Cost Efficiency: Using its platform is cheap as it incurs low charges during transactions3.

Interoperability: Compatible with many chains such as Ethereum, zkSync, Arbitrum, Optimism, etc.

User-Friendliness: The system is built so anyone from novice to expert can use it.

Cons:

Low-Margin Asset Portfolio: Users will likely be limited in the number of assets they can trade.

Fluctuating Fees: Certain fees may fluctuate, which can hinder predictability.

Previous Transactions Problems: The platform has had some security issues, including loss of transactions.

No Liquidity Provider Yield: No liquidity provider yield program is currently available.

Orbiter Finance Alternative

Synapse Protocol

Features efficient cross-chain transfers with fast bridging across several Layer 1 and 2 blockchains.

Hop Protocol

We enabled transfers between multiple layers using low-cost and rapid clearances within the Ethereum scaling system.

Multichain (Anyswap)

A multi-chain interoperability platform that allows the utmost security in cross-chain swap and transfer operations.

Conclusion

In conclusion, Orbiter Finance leads cross-chain finance, applying the most advanced zero-knowledge proofs, ZK-proofs, which provide reliable, speedy, and private means of asset exchange across networks.

Orbiter Finance’s leveraging of asset-bridging features within the Ethereum ecosystem simplifies the process and enhances user experience while enhancing security.

The DeFi market is developing, and Orbiter Finance is uniquely poised to grow and provide solutions that other players will continue to search for.