In this article, I will discuss the Benefits Of A High-yield Money Market Account.

For example, these accounts have higher interest rates when compared to regular savings accounts, which aids in growing the savings balance.

Account holders will appreciate these features: low minimum balance requirements and no monthly fees.

Overall, high-yield money market accounts are designed to be ideal for savers while allowing easy access to funds.

Key Point & Best High-yield Money Market Account List

| Account | Key Points |

|---|---|

| Sallie Mae Online Money Market Account | High interest rates, no monthly fees, and easy access to funds via online tools. |

| Discover Money Market Account | Competitive rates, no monthly fees, and FDIC insurance up to $250,000. |

| Ally Money Market Account | No minimum deposit, mobile banking, and competitive rates. |

| Zynlo Money Market Account | High interest rates, no monthly fees, and access to funds through a mobile app. |

| VIO Cornerstone Money Market Savings | Competitive APY with easy online access and no monthly maintenance fees. |

| Synchrony Bank Money Market Account | Offers high interest rates, ATM access, and no monthly maintenance fees. |

| First Foundation Bank Online Money Market | Competitive rates, no monthly fees, and FDIC insurance coverage. |

| UFB Direct Portfolio Money Market Account | High yield rates and no monthly fees, with online access to manage funds. |

| Prime Alliance Bank Personal Money Market | Solid interest rates and FDIC-insured, with no monthly fees. |

| EverBank Yield Pledge Money Market | Competitive rates with a guarantee to be in the top 5% for the first year. |

1.Sallie Mae Online Money Market Account

The Sallie Mae Online Money Market Account is unique for its high-yield interest rate which offers a competitive return on your savings.

No monthly fees applied and there is no limit on the minimum balance, making it easy to access your funds without the limits of traditional accounts and maximizing interest.

Its higher yield enables savings to keep up with rising prices while also being supportive of liquidity and easy access. Withdrawals from the account are instant and unlimited.

| Detail | Information |

|---|---|

| Account Name | Sallie Mae Online Money Market Account |

| Industry | Banking, Financial Services |

| Established Year | 1972 |

| Key Features | High-yield interest rates, no monthly maintenance fees, check-writing capabilities, FDIC-insured |

| Market Position | Leading high-yield money market account with competitive rates and easy access to funds |

2.Discover Money Market Account

The Discover Money Market Account offers high-yield interest rates which make it effective in growing your money.

The account has no monthly fees and does not require a minimum balance allowing more flexibility in managing your money.

Your money also earns competitive returns, which is a plus. Discover also has 24/7 customer service and a comprehensive online banking system which makes managing the account easy.

The combination of high yield and good support makes it a great option for those looking to save more easily.

| Detail | Information |

|---|---|

| Account Name | Discover Money Market Account |

| Industry | Banking, Financial Services |

| Established Year | 1985 |

| Key Features | High-yield interest rates, no monthly maintenance fees, ATM fee reimbursements, FDIC-insured |

| Market Position | Leading high-yield money market account with competitive rates and easy access to funds |

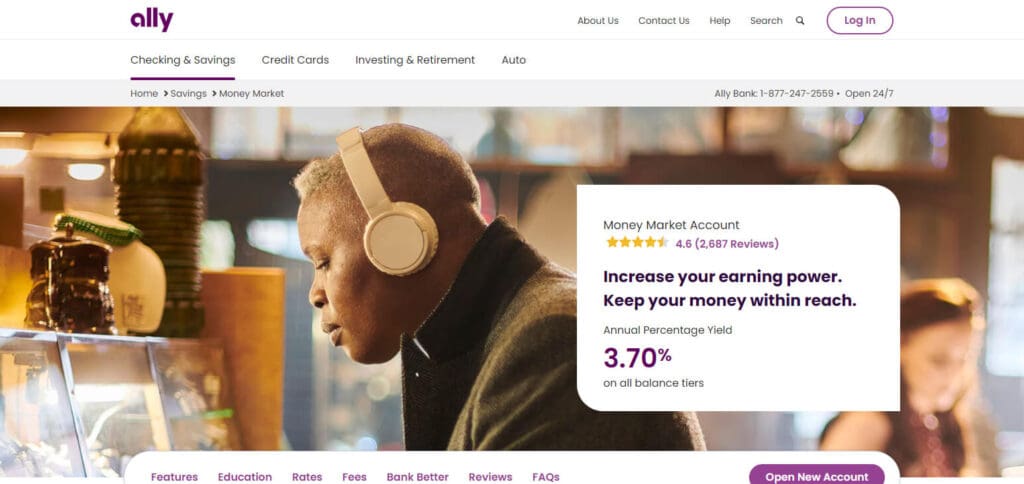

3.Ally Money Market Account

The Ally Money Market Account offers the best of both worlds by providing a high yielding savings account that allows users easy access to funds at the same time.

In addition, your savings will grow faster than with traditional savings accounts thanks to the competitive interest rates. Since there are no monthly fees, the account also helps to keep costs low.

Plus, the account comes with a very helpful mobile app so that users can manage their account while on the move.

What makes it a great account is the lack of restrictions on withdrawals alongside receiving high interest, making it the perfect option for savers.

| Detail | Information |

|---|---|

| Account Name | Ally Money Market Account |

| Industry | Banking, Financial Services |

| Established Year | 2009 |

| Key Features | High-yield interest rates, no monthly maintenance fees, unlimited ATM withdrawals, FDIC-insured |

| Market Position | Leading high-yield money market account with competitive rates and easy access to funds |

4.Zynlo Money Market Account

The Zynlo Money Market Account enables high-yield interest rates which can grow one’s savings more effectively than a traditional account.

The account also has no monthly fees and only a low minimum balance which allows great accessibility.

The account is easy to manage online and comes with competitive returns that allow the account to keep up with inflation.

These factors combined, as well as the no fee access makes the account great for anyone looking to make the most out of their savings.

| Account Name | Zynlo Money Market Account |

| Industry | Banking, Financial Services |

| Established Year | 2020 |

| Key Features | High-yield interest rates, no monthly maintenance fees, unlimited withdrawals, FDIC-insured |

| Market Position | Leading high-yield money market account with competitive rates and easy access to funds |

5.VIO Cornerstone Money Market Savings Account

By paying a lower fee compared to other types of savings accounts, you will have the VIO Cornerstone Money Market Savings Account which still provides additional savings.

This account not only has a low minimum deposit requirement, but will not force you to pay monthly maintenance fees as well making it easier to use. The flexible account allows you to access your money as needed allow you to get liquidity whenever needed.

The high yield alongside low maintenance fees makes the account unique and a preferred choice for optimization.

| Detail | Information |

|---|---|

| Account Name | VIO Cornerstone Money Market Savings Account |

| Industry | Banking, Financial Services |

| Established Year | 1999 |

| Key Features | High-yield interest rates, no monthly maintenance fees, ATM fee reimbursements, FDIC-insured |

| Market Position | Leading high-yield money market account with competitive rates and easy access to funds |

6.Synchrony Bank Money Market Account

The Synchrony Bank Money Market Account has the benefit of high-yield interest rates which can increase your savings balance faster than other savings accounts.

It has no monthly fees and includes an online account management service for added convenience.

This account is great for savers in need of easy access to their funds because it requires a low initial deposit and offers high returns.

Thanks to the balance requirements and functionalities offered, Synchrony is an excellent option for people who want to have their savings grow with little effort sent their way.

| Detail | Information |

|---|---|

| Account Name | Synchrony Bank Money Market Account |

| Industry | Banking, Financial Services |

| Established Year | 1988 |

| Key Features | High-yield interest rates, no monthly maintenance fees, ATM fee reimbursements, FDIC-insured |

| Market Position | Leading high-yield money market account with competitive rates and easy access to funds |

7.First Foundation Bank Online Money Market Account

The First Foundation Bank’s Online Money Market Account is good for earning higher interest as your savings grow at a better pace compared to standard methods.

Additionally, with no monthly fees and a low minimum deposit, there is more flexibility as well as easier access to your funds.

Your savings won’t lose their value due to the competitive interest rates, and managing your account is seamless with online banking.

All these factors such as high yield, low fees, and easy access, makes this account a smart choice for those looking to save.

| Detail | Information |

|---|---|

| Account Name | First Foundation Bank Online Money Market Account |

| Industry | Banking, Financial Services |

| Established Year | 1999 |

| Key Features | High-yield interest rates, no monthly maintenance fees, ATM fee reimbursements, FDIC-insured |

| Market Position | Leading high-yield money market account with competitive rates and easy access to funds |

8.UFB Direct Portfolio Money Market Account

The UFB Direct Portfolio Money Market Account is unique because of its interest rates which are highly valuable.

There is a great return on investments. The account comes with no maintenance monthly fees and has a low minimum balance which allows flexibility for savers.

For people wanting to maximize their savings, the money market account is a perfect fit because it provides easy access to the funds. UFB Direct’s competitive rates and customer service makes it a great choice to grow your savings.

| Detail | Information |

|---|---|

| Account Name | UFB Direct Portfolio Money Market Account |

| Industry | Banking, Financial Services |

| Established Year | 1999 |

| Key Features | High-yield interest rates, no monthly maintenance fees with a $5,000 balance, ATM fee reimbursements, FDIC-insured |

| Market Position | Leading high-yield money market account with competitive rates and easy access to funds |

9.Prime Alliance Bank Personal Money Market Account

The Prime Alliance Bank Personal Money Market Account helps your savings grow with its high-yielding interest rates.

In addition to no monthly maintenance fees, there is also a low minimum deposit requirement.

This way, maximizing returns is much simpler. With the account, funds are easy to access and rates are competitive.

This makes the account suitable for those who want to keep their money liquid while still getting a good return. This account provided by Prime Alliance Bank offers great flexibility and growth.

| Detail | Information |

|---|---|

| Account Name | Prime Alliance Bank Personal Money Market Account |

| Industry | Banking, Financial Services |

| Established Year | 2004 |

| Key Features | High-yield interest rates, no monthly maintenance fees, unlimited deposits, FDIC-insured |

| Market Position | Leading high-yield money market account with competitive rates and easy access to funds |

10.EverBank Yield Pledge Money Market Account

The EverBank Yield Pledge Money Market Account’s high yield interest rate provides a competitive edge when compared with traditional savings accounts.

In addition, this account allows the user to have easy access to their funds and earn competitive returns making it a versatile option.

You are not required to meet any minimum deposit limits which makes this account favorable to a wider base of individuals who prefer greater returns without the burden of steep hook deposit requirements or monthly obligations.

| Detail | Information |

|---|---|

| Account Name | EverBank Yield Pledge Money Market Account |

| Industry | Banking, Financial Services |

| Established Year | 1999 |

| Key Features | High-yield interest rates, no monthly maintenance fees, ATM fee reimbursements, FDIC-insured |

| Market Position | Leading high-yield money market account with competitive rates and easy access to funds |

Conclusion

To conclude, high-yield money market accounts have their distinct advantages, which include greater savings growth compared to regular accounts due to competitive interest rates.

Additionally, these accounts incur low or no monthly fees, have low minimum balance requirements, and provide easy access to money, making them very flexible.

Also, these accounts offer very convenient features such as mobile banking and online banking which maximize returns, making them great for people looking to save money with little effort.