In this article i will cover the Best Banks For Digital Checks services and offer mobile deposit features.

I will also highlight those banks that have optimized their mobile apps to ensure easy, efficient, and timely check deposits.

Those banks that offer effective and hassle-free advanced digital check services would be the most ideal.

Key Point & Best Banks For Digital Checks List

| Bank Name | Key Features |

|---|---|

| Ally Bank | Online-only bank, no physical branches, high-yield savings accounts, low fees. |

| Chase Bank | Offers extensive branch network, premium credit cards, business services, and loans. |

| Bank of America | Large physical presence, wide variety of products, rewards programs, and digital tools. |

| Wells Fargo | Broad branch network, personal and business banking, investment services, and mortgages. |

| HSBC | International reach, competitive savings accounts, and credit cards, global banking. |

| Citibank | Global presence, strong credit card offerings, investment and loan options. |

| Barclays | Known for its credit cards and UK banking services, competitive interest rates. |

| Capital One | Low fees, cash-back credit cards, excellent customer service, digital banking options. |

| PNC Bank | Regional presence, strong mobile app, personalized banking services, and loans. |

| TD Bank | Customer-friendly, extended hours, robust mobile banking, and credit products. |

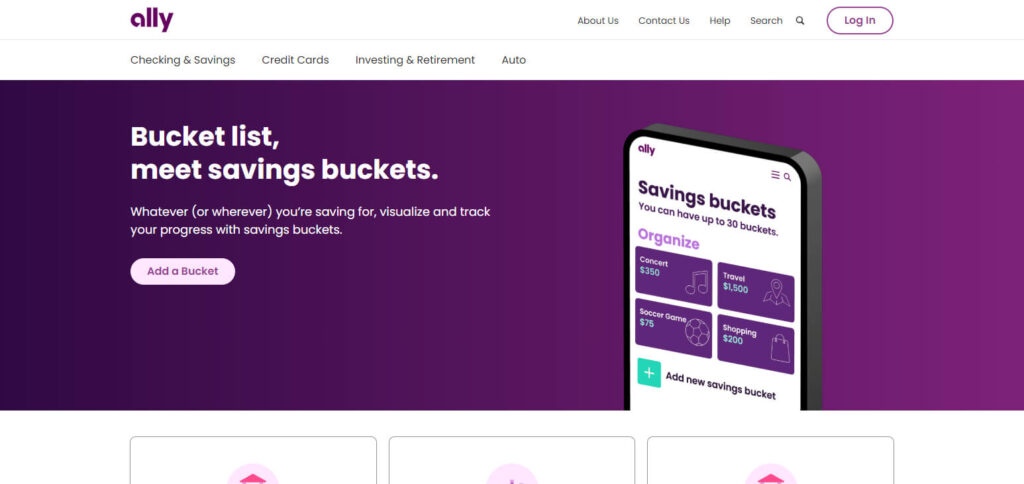

1.Ally Bank

Ally Bank is one of the best banks for mobile check deposits. It scores excellently in both online banking and mobile app usability.

The bank has no branches, which means that all services are offered online. For someone who likes to deposit checks using a phone, Ally Bank is ideal.

Additionally, high-speed check deposit processing alongside stringent security measures and ultra-low fees gives customers the best experience possible, especially for users who wish to keep their banking interactions digital.

| Details | Ally Bank |

|---|---|

| Established Year | 2009 |

| Local Language | English |

| Security | High-level encryption, 2-factor authentication, fraud protection |

| Support | 24/7 customer support via chat, phone, and email |

| Minimal KYC | Digital-only KYC process, no physical branch verification required |

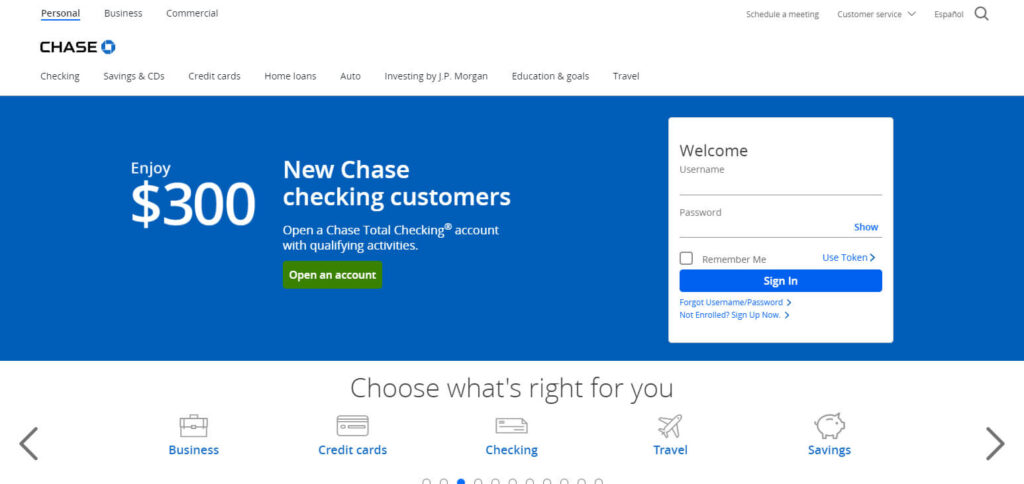

2.Chase Bank

Chase Bank has one of the best digital check services as users can deposit checks promptly by taking a picture with their advanced mobile application.

The main reason why Chase stands out is the bank’s fraud protection and encryption services which makes sure transactions are secure.

The bank also supports quick check deposit processing so Cxustomers can expect many deposits to be processed the same day, making the bank thier best choice for fast, safe and efficient digital services.

| Details | Chase Bank |

|---|

| Established Year | 1799 |

| Local Language | English |

| Security | Advanced encryption, 2-factor authentication, fraud protection |

| Support | 24/7 customer support via phone, chat, and in-branch |

| Minimal KYC | Digital KYC process with identity verification, no in-person requirement for most accounts |

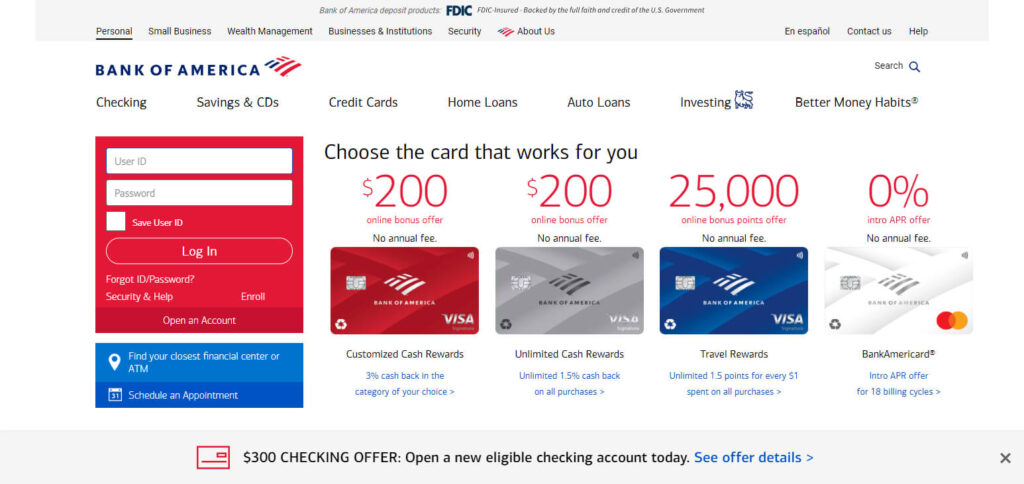

3.Bank of America

Due to its user-friendly mobile app that enables users to deposit checks easily, Bank of America is a front-runner when it comes to using digital checks.

One major benefit is the mobile deposit capture feature which enables users to take pictures of the check’s front and back and deposit them without delay.

There is also rapid posting of credits which means that users can utilize their money instantly.

Moreover, users can feel safe with their funds because the bank’s comprehensive fraud protection is an assurance of security. Because of this, the bank is an ideal choice for mobile check deposits.

| Details | Bank of America |

|---|---|

| Established Year | 1904 |

| Local Language | English |

| Security | Robust encryption, 2-factor authentication, fraud protection |

| Support | 24/7 customer support via phone, chat, and in-branch |

| Minimal KYC | Digital KYC process with identity verification, no in-person visit for most accounts |

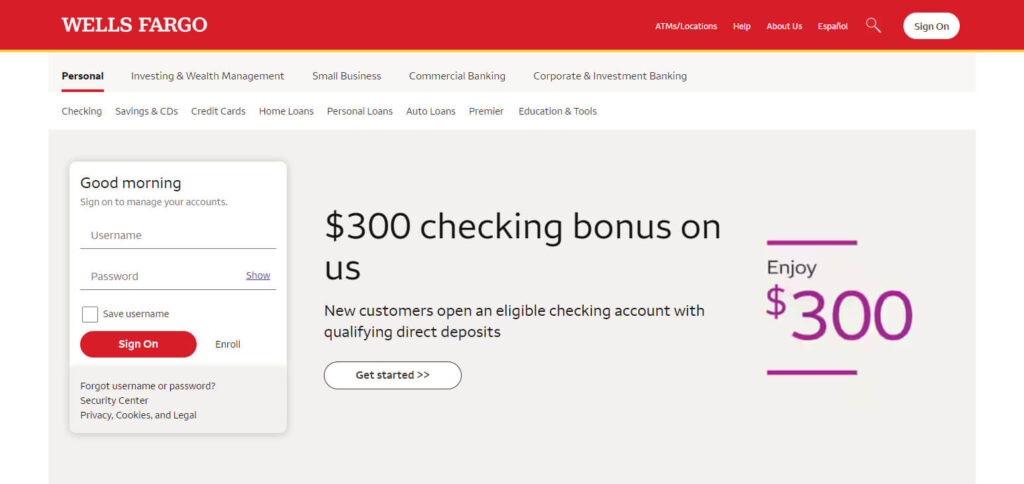

4.Wells Fargo

Wells Fargo has exceptional ease of use because clients can deposit checks through the mobile app.

Wells Fargo’s service is unique because the users receive real time notification of the status of the check and deposit.

The bank also permits high limits for mobile check deposits which is helpful to individual and business clients.

To top it all off, there are advanced security features that make digital check deposits sophisticated and ensure funds are made available quickly.

| Details | Wells Fargo |

|---|---|

| Established Year | 1852 |

| Local Language | English |

| Security | High-level encryption, 2-factor authentication, fraud protection |

| Support | 24/7 customer support via phone, chat, and in-branch |

| Minimal KYC | Digital KYC process with identity verification, no physical visit required for most accounts |

5.HSBC

HSBC is well-placed in respect to deposits with checks because of sheer volume of deposits relative to other banks which has led to a well designed mobile app which is very easy to use.

Another distinguishing characteristic is that clients can deposit checks in several countries with the same ease and safety.

HSBC helps clients by ensuring that they are informed constantly through fast processing and real-time notifications.

Customers who prefer hassle-free digital checks and services prefer HSBC because of a sophisticated and simple to navigate platform that has strong encryption for all digital transactions.

| Details | HSBC |

|---|

| Established Year | 1865 |

| Local Language | English, with regional language support in various countries |

| Security | Advanced encryption, 2-factor authentication, fraud protection |

| Support | 24/7 customer support via phone, chat, and in-branch |

| Minimal KYC | Digital KYC process with identity verification, no in-person visit required for most accounts |

6.Citibank

Citibank takes the lead in digital check deposits thanks to its convenient check submission feature featured in the mobile app.

Its surge in efficiency is due to the advanced integration of intelligent image capture technology which automatically detects and adjusts the image quality of the check to reduce errors.

The next business day deposits withstanding, Citibank is also known for its quick check processing which ensures that every advanced feature is processed with a rush.

Citibank combines its advanced feature with exceptional customer support and fraud protection protocols guarantees its users a seamless experience.

| Details | Citibank |

|---|---|

| Established Year | 1812 |

| Local Language | English, with regional language support in various countries |

| Security | Advanced encryption, 2-factor authentication, fraud protection |

| Support | 24/7 customer support via phone, chat, and in-branch |

| Minimal KYC | Digital KYC process with identity verification, no in-person visit required for most accounts |

7.Barclays

When it comes to digital check deposits, Barclays is one of the strongest candidates due to its effective mobile app which simplifies the process of check submission.

The most serving feature is its sophisticated image recognition which improves the accuracy of check processing and subsequently minimizes the possibility of errors.

Depositing limits are high, making it ideal for personal and business users. Along with fast processing times, there’s a high guarantee of privacy and security.

Because of this, Barclays promises an effective and reliable digital check deposit service.

| Details | Barclays |

|---|

| Established Year | 1690 |

| Local Language | English, with regional language support in various countries |

| Security | Advanced encryption, 2-factor authentication, fraud protection |

| Support | 24/7 customer support via phone, chat, and in-branch |

| Minimal KYC | Digital KYC process with identity verification, no in-person visit required for most accounts |

8.Capital One

Capital One stands out in digital check deposits due to their easy-to-use mobile app which simplifies the entire process.

One of its notable strengths is the incorporation of check deposits into the Capital One app that offers users immediate access to most of their deposited funds.

In addition, sensitive user data is protected through high-level encryption whilst checking-in the deposits.

Capital One guarantees rapid turn-around for processing of checks and a lower error possibility, thereby removing any fuss behind the deposits. Customers know that their digital check deposits are protected and swiftly handled.

| Details | Capital One |

|---|

| Established Year | 1994 |

| Local Language | English |

| Security | High-level encryption, 2-factor authentication, fraud protection |

| Support | 24/7 customer support via phone, chat, and online services |

| Minimal KYC | Digital KYC process with identity verification, no physical visit required for most accounts |

9.PNC Bank

With the help of PNC Banks app, its customers can easily snap and deposit checks remotely.

PNC is unique in that it has great flexibility where users can choose between instant or next-business-day processing for their deposits.

Aside from that, PNC provides alerts for check deposit statuses and quick access to funds, offering transactions smooth control.

Using more advanced security technology offers smoother and faster processing of deposits which allows users a better experience when PNC is chosen for check deposit services.

| Details | PNC Bank |

|---|

| Established Year | 1845 |

| Local Language | English |

| Security | Advanced encryption, 2-factor authentication, fraud protection |

| Support | 24/7 customer support via phone, chat, and online services |

| Minimal KYC | Digital KYC process with identity verification, no physical visit required for most accounts |

10.TD Bank

TD bank is known to be one of the leading companies when it comes to mobile check deposits.

Their mobile app allows users to deposit checks efficiently with extreme flexibility.

The bank’s unique feature is the availability of extended hours for mobile check deposit including weekends which is perfect for busy customers.

Their rapid processing speeds also guarantee that funds are available quickly, often on the same day. TD Bank is another example of a company that offers great opportunities and efficiency while remaining secure.

| Details | TD Bank |

|---|---|

| Established Year | 1855 |

| Local Language | English |

| Security | High-level encryption, 2-factor authentication, fraud protection |

| Support | 24/7 customer support via phone, chat, and online services |

| Minimal KYC | Digital KYC process with identity verification, no in-person visit required for most accounts |

Conclusion

In conclusion, the best digital check deposits in banks are provided with a blend of simplicity, security, and efficiency.

From effective image scanning at Barclays, processing speeds at PNC, or the international network of HSBC, each bank has its own features that assist in mobile check deposit.

Users can select a bank that satisfactorily meets their expectations, knowing that the application will provide them with enhanced, secure transactions, timely access to their funds and intuitive mobile interfaces which make banking more accessible than ever.