In this post, I will discuss the How to Auto-Compound Bridging Yields bridging yields to earn more with minimal effort in crypto.

With auto-compounding, rewards earned while moving between blockchains are automatically reinvested, saving you the hassle of doing it manually. Learning how this works allows you to enhance your investments in the fast-paced world of DeFi.

What is Auto-Compounding?

The auto-compounding feature in Crypto investments is a process in which earned yields or rewards are automatically reinvested to generate additional returns.

Rather than claiming earnings manually and reinvesting them, auto-compounding tools or smart contracts take care of this process automatically at scheduled times.

This way, users do not have to constantly intervene to reap the benefits of compound interest. In terms of bridging yields, auto-compounding continuously reinvesting profits across blockchains to maximize return on investment, thus optimizing growth while minimizing the effort required in traditional yield farming tactics.

How to Auto-Compound Bridging Yields

Example: Auto-Compounding Bridging Yields with Stargate Finance

Bridge Assets Via Stargate

Go to Stargate Finance to bridge stablecoins like USDC or USDT from Ethereum, BNB Chain, or Arbitrum networks.

Deposit Bridged Tokens into Liquidity Pools

Bridge transactions enable you to earn yield from native protocol rewards and trading fees after depositing bridged tokens into liquidity pools.

Stake LP Tokens for STG Rewards

With the received Liquidity Provider (LP) tokens, stake them in Stargate’s farming vault to earn STG tokens on auto-pilot.

Enable Auto-Compounding

STG rewards can be auto-compounded by using Rebasing Vaults or other yield optimizers such as Beefy Finance that reinvest rewards into LP positions.

Monitor & Rebalance

For best results, regularly check APY and other network parameters to adjust positions for better compounding efficiency.

Other Place Where to Auto-Compound Bridging Yields

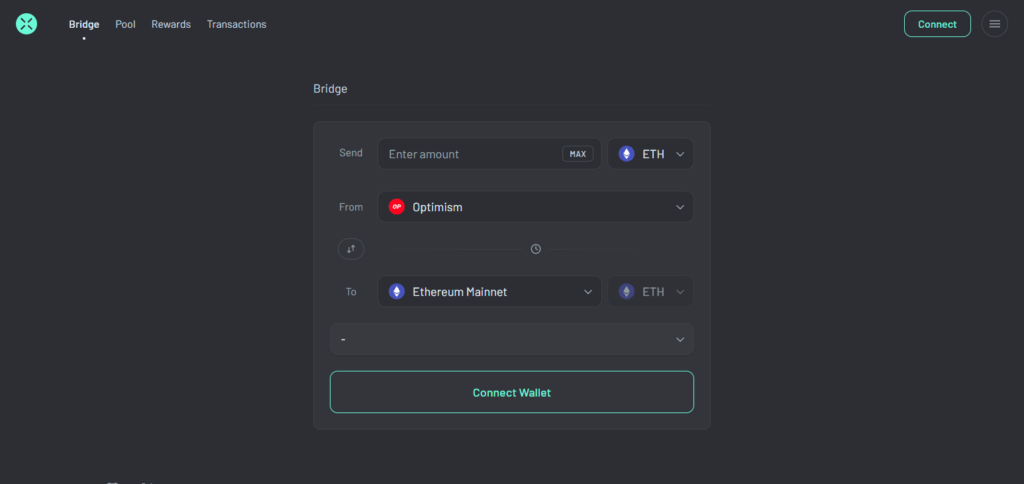

Across Protocol

Across protocol aims to auto-compound bridging yields through rapid, cost-effective cross-chain transfers while applying yield optimization strategies.

Across’s distinct design utilizes a single liquidity pool and automated relayer subsidy systems to accrue yield during bridging to automate yield accrual. Unlike traditional bridges, Across’s unique design mitigates slippage and provides faster settlement.

This enables efficient return compounding. Within the context of the protocol, smart contract design is done in such a way that rewards are reinvested automatically when possible.

This allows users to grow their assets passively while carrying out multi-chain transfers which makes the bridging process very easy and profit maximizing.

Yearn Finance

Yearn Finance facilitates the auto-compounding of bridging yields by cross-chain yield optimization. Through various strategies, its vaults reinvest rewards from different protocols, earning users compounded returns without active intervention.

Notable is Yearn’s automation of strategy implementation which integrates with bridging protocols to maximize returns across several networks.

This empowers passive income generation through yield farming while assets are bridged, providing smart contract automation-driven scalability and efficiency through self-sustaining reinvestment and minimal user engagement.

Beefy Finance

Beefy Finance simplifies the process of auto-compounding bridging yields with vaults that cross-chain liquidity reward reinvestment.

What Beefy is known for is supporting multi-chain strategies natively. Assets can bridge while compounding without any user intervention. With Beefy’s smart contracts, rewards are claimed and reinvested automatically at preset optimal intervals.

This guarantees users capture maximum yield without doing anything. This approach removes manual timing efforts and transaction costs, making it easy to increase the value of bridged assets across multiple chains with better efficiency and higher returns.

Benefits Of Auto-Compound Bridging Yields

Profits That Keep Compounding

Compounding rewards not only improves the rewards you get but also heightens the benefits over a period of time.

Saves Time

Saves effort while also saving time through eliminating the need for repetitive reinvestment activities.

Reduced Gas Payments

Manual interactions done frequently can increase costs that bundled auto-compounding transactions do not have.

Cross-Chain Earnings

Allows multiple blockchains to be simultaneously optimized for profit while compounding at the same time.

Easy Passive Income Activities

Earning and growing returns is made easy since the only thing users need to do is sit back and relax without active involvement.

Reduced Bridging Mistakes

Automated processes cuts down work-related errors during yield farming or bridging.

Why Auto-Compound Bridging Yields?

Grow Benefits Faster: Compounding rewards increases momentum of earning over time without manual work.

Work Across Blockchains: Yield generating gap is closed as assets transition across different blockchains.

Free up Your Time: The time spent claiming and reinvesting rewards is zero, making the process more efficient.

Less Transaction Fees: Through bundled automated transactions, less gas fees are used.

Minimize Losing Out on Gains: Ensures instant reward reinvestment, maximized compounding benefits.

Tips to Maximize Your Auto-Compounded Bridging Yields

Select The Best Yield Pools: Look for pools or protocols with the best APY rates and consistent cross-chain performance.

Keep Gas Fees In Check: Use networks with lower gas fees or reinvest during off-peak hours to save on gas fees.

Spread Your Assets Across Chains: Utilize multiple bridges and chains to increase total yield and mitigate risk.

Use Reliable Platforms: Avoid security issues by sticking to auto-compounding protocols that are audited and well-known in the industry.

Track and Adjust Often: Maintain adjusted strategies on platforms that track performance and recalibrate for optimal yield.

Risks and Considerations

Smart Contract Risks

Automated systems depend on smart contracts which could have bugs or exploitable security holes.

Bridge Security Threats

Cross-chain bridges often serve as a target in hacks and can result in the loss of a great deal of assets.

Elevated Gas Expenses

On some networks, consistent auto-comppounding can lead to extremely high gas expenses, cutting net income.

Volatility in the Market

Rapid price changes of bridged assets can affect the performance of yields and the total value of the portfolio.

Changes in Strategies

Modifications in auto-compounding systems will change the outcomes whether positively or negatively.

Pros & Cons

| Pros | Cons |

|---|---|

| Maximizes returns through continuous compounding | Potential smart contract vulnerabilities |

| Saves time by automating reinvestment | Gas fees can accumulate and reduce profits |

| Enables seamless yield growth across multiple blockchains | Risk of bridge hacks or security breaches |

| Reduces manual errors and missed opportunities | Market volatility can impact yields |

| Optimizes cost-efficiency with bundled transactions | Changes in protocols may disrupt compounding |

Conclusion

To summarize, auto-compounding bridging yields an advanced technique for maximizing yield farming automated across various blockchains with little to no manual effort.

Users benefit from constant growth with minimal work as earned rewards are automatically reinvested, along with optimized gas expenditure.

Still, trusted platforms need to be selected, fees monitored, and other concerns like smart-contract risks or volatile markets be kept in mind. With proper planning and strategy, auto-compounding bridging yield strategies will drastically improve passive income earned and overall experience using DeFi platforms.