In this article, I will cover How to Automate Yield Farming within Decentralized Finance (DeFi) that helps maximize earnings on cryptocurrency.

Rate of return optimization through automation is achieved via reinvestment of rewards, which earns yield farming tools. Automated yield farming enhances ease of earning passive income by reducing time spent, eliminating mistakes, and increasing accessibility.

What is Yield Farming?

Yield farming is a strategy within decentralized finance (DeFi) that enables users to earn rewards by lending or staking their crypto assets in liquidity pools.

These pools facilitate decentralized exchanges and lending platforms, allowing seamless token swaps and loans. Users also receive interest, governance tokens, or a share of the transaction fees.

Yield farming helps investors increase their holdings over time, but it comes with risks such as impermanent loss and smart contract vulnerabilities. This makes yield farming require caution and extensive research beforehand.

How to Automate Yield Farming

Here’s how you can automate yield farming with a DeFi yield aggregator:

Example: Automating Yield Farming with Yearn Finance

Choose a Yield Farming Strategy

Go to Yearn Finance to check out their automated yield farming strategies. These vaults help to maximize yield across different DeFi platforms.

Connect Your Wallet

You may connect to Yearn Finance using a Web3 wallet like MetaMask or Trust Wallet. Make sure your wallet has the assets you wish to farm, for example, USDC, ETH, or DAI.

Select a Vault

Yearn has many vaults that cater to different assets. Based on your preferred cryptocurrency and risk appetite, pick a corresponding vault.

Deposit Funds

With the chosen vault, deposit your tokens. Yearn Finance will automatically deploy your funds over protocols like Aave, Curve, and Compound to fetch optimal returns.

Monitor and Withdraw

Since compounding and reinvestments are automated with Yearn Finance, feel free to check periodically and withdraw at your convenience.

Other Place Where to Automate Yield Farming

Harvest Finance

Harvest Finance is a decentralized yield aggregator that automates yield farming by deploying users’ assets to the most profitable available DeFi strategies.

Its core strength is auto-compounding returns—reinvesting profits which boosts the overall returns. This saves users time while maximizing rewards.

Unlike manual farming, which is tedious and requires constant monitoring and adjustment, everything at Harvest Finance runs on smart contracts, thus ensuring efficiency and optimization.

This level of automation helps users benefit from advanced strategies without needing to possess technical knowledge or manage them daily.

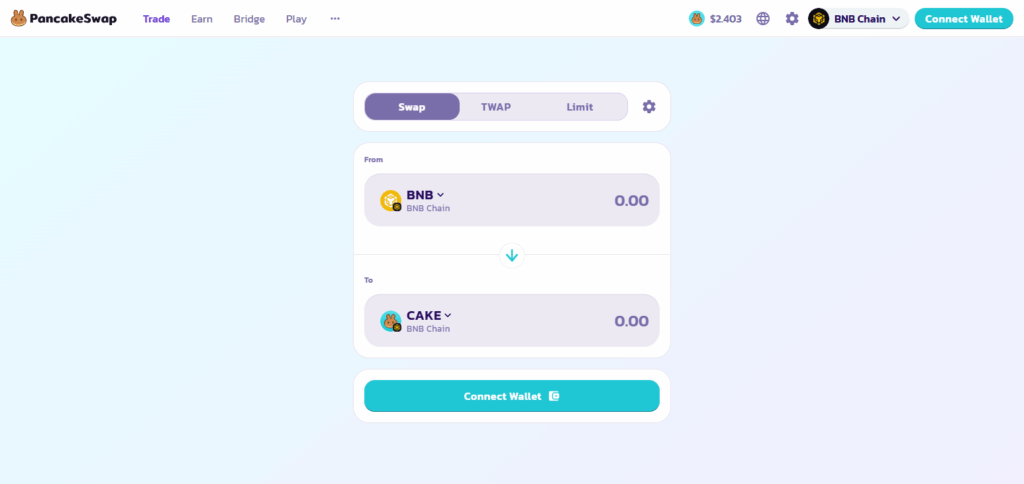

PancakeSwap

PancakeSwap is one of the most popular decentralized exchanges on Binance Smart Chain. It automates yield farming using its simple liquidity pools and staking features. “

Auto CAKE Pool” is specially designed to enhance user earnings by automatically compounding CAKE rewards. PancakeSwap users do not have to manually streamline different farming steps as the platform provides an easy-to-use interface.

While Auto CAKE Pools enhance user convenience, they also save time on traditional yield farming methods. As a result, DeFi yield farming becomes easy for all users regardless of their expertise level.

Why Automate Yield Farming?

Saves Time: Automation allows you to focus on other things as manual monitoring and reinvesting is no longer needed.

Maximizes Returns: Your investments grow faster with auto-compounding as rewards are reinvested instantly.

Reduces Human Error: Complex tasks are performed automagically with smart contracts, significantly reducing errors from manual work.

Increases Efficiency: Automation captures optimal yields without any time lags, making farming strategy execution more efficient.

Simplifies Process: Removes deep knowledge requirements in DeFi for beginners, widening accessibility for new yield farmers.

Tips for Safe and Effective Automation

Select Proven Platforms

Well-paid audit and trusted yield farming tools can lessen the chances of risk.

Spread Focus Across Multiple Investments

Use various protocols to lessen the possible losses.

Be Aware of the Risks Involved with Monitoring Smart Contracts

Automation permits streamlining tasks, but it is reliant on smart contracts that carry certain level of risks.

Stay Informed

Make sure to regularly check for any changes made to the platform for added security measures and fixes to avoid problems.

Test with Gradual Scaling

Limit exposure while learning how to automate by starting with a smaller amount then scale up.

Risk & Management

Risk

Smart Contract Risks: Automated farming relies on smart contracts that can be vulnerable to exploitation or contain errors.

Impermanent Loss: Automation does not eliminate the price volatility associated with liquidity pools, resulting in potential losses.

Platform Risks: Sudden changes in protocols or shutdowns can affect your investments.

Market Risks: Swings in the price of crypto assets can lead to reduced profits or loss when farming.

Management

Use only audited and reputable platforms

Spread investments across multiple farms and assets

Stick to a well-defined plan; periodically review and adjust

Use small amounts to test strategies before scaling up

Keep track of changes to protocols and the market

Pros and Cons of Automated Yield Farming

Pros:

Time-saving automation of compounding and strategy changes.

Better returns from constant reward reinvestment.

Less human error and oversight damage.

No technical knowledge makes yield farming初心者-friendly.

Improved real-time strategy optimization increases effectiveness.

Cons:

Smart contract vulnerabilities and exploit exposure.

Fees from the platform can reduce profits.

Control reduction over manual adjustments.

Risk of shutdown or changes.

Automation does not eliminate volatility impacts.

Conclusion

To sum up, automating yield farming is a great way to increase your crypto earnings while cutting down on the time and energy spent managing investments. With automation systems that reward compounding and strategy optimization, your returns can be further enhanced with efficiency and minimal risk of human blunders.

Staying informed, diversifying assets, and managing risks are other important steps that should be taken. With the right methods, automated yield farming can help you cultivate a DeFi portfolio without much hassle.