In this article, I will cover the How to Convert Bitcoin to Stablecoins.

If you want to keep your funds from volatility, secure profits, or use stablecoins for trading, I will provide exchanges, DeFi platforms, and P2P options that will help you achieve your goal while maintaining security and low fees.

What is Bitcoin ?

Bitcoin is a form of digital currency that is not regulated or supervised by any central authority and facilitates global person-to-person payments.

Someone or a group of people under a mysterious name “Satoshi Nakamoto” launched bitcoin in 2009. Bitcoin operates on blockchain, a reliable and open record system.

It is frequently used as an asset that protects value, as a means of transacting, and a deflationary guard against inflation. In contrast to traditional currencies, Bitcoin’s nature is deflationary and owing to having diminutive supply cap set at 21 million coins, its value is driven over time.

How to Convert Bitcoin to Stablecoins

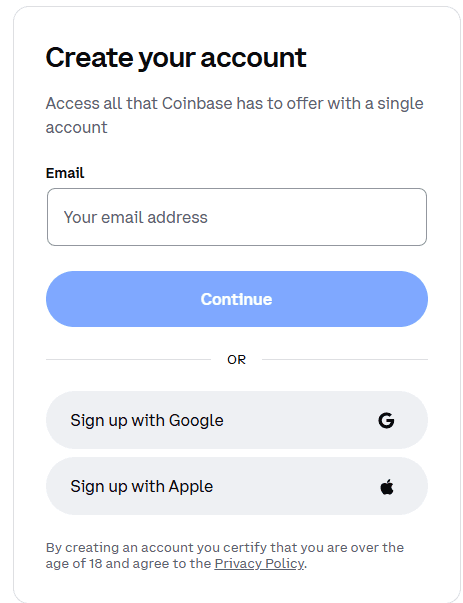

It is easy to convert Bitcoin (BTC) to stablecoins. There is a guide on how to do it on the site Coinbase:

Create and Fund Your Coinbase Account

Create a new Coinbase account if you haven’t done it already.

Transfer Bitcoin into your Coinbase wallet from an external wallet or exchange.

Go to Trade Page

Access your Coinbase account and navigate to the “Trade” ot “Buy/Sell” tab.

Select Bitcoin (BTC) as the asset you would like to sell.

Select a Stablecoin

Choose a stablecoin supported on Coinbase like Tether (USDT), USD Coin (USDC), or DAI.

Input a Conversion Value

Type in how much Bitcoin you would like to convert into coins.

Check the conversion rate and any fees.

Approve the Change

Make sure all the information related to the transaction is correct.

If everything seems alright, click on “Convert” or “Sell” to finish the transaction. The coins will be sent to your wallet in Coinbase.

Withdraw or Utilize Your Stablecoins

Stablecoins are available for withdrawal to an external wallet. You can also trade them or keep them for protection against market fluctuations.

Security & Best Practices

Use Only Trustworthy Exchange Platforms – To keep your funds secure and scam-free, stick to traditional platforms like Binance, Coinbase, or Kraken.

Enable 2-Factor Authentication (2FA) – Protect account access using 2FA as a blocker against unwanted access to a user’s account.

Use Complex Passwords and Refrain From Shared Devices – Users are encouraged to shift logins from public devices for security reasons.

Withdraw to Secure Wallets – Instead of maintaining funds on exchange platforms themselves, it is encouraged to use a non-custodial wallet (Ledger, Trust Wallet) for stablecoin storage.

Cross Check All Details Pertaining A Trade – Wallet addresses alongside fees charged for transactions should be checked alongside, confirming every considered move is done prior to trading.

Avoid Phishing Scams – Any link that appears suspicious should not be clicked. Furthermore, site validation is advised prior to account credential submission.

Adapt To Ongoing Security Changes – Rolling news on crypto technology should be followed in order to stay free from newer challenges paired alongside vulnerabilities and risks.

Tax Implications & Legal Considerations

Taxable event

In many nations, swapping Bitcoin for stablecoins is seen as a taxable event since it may result in capital gain or loss.

Tax on Capital Gains

In case Bitcoin was sold profitably, you are likely to pay capital gains tax depending on the holding period which could be short term or long term.

Stablecoins & Tax Liabilities

The mere possession of stablecoins is generally non-taxable, however, transactions related to them (i.e. staking, earning interest) could be taxable.

KYC Compliance

Certain jurisdictions have KYC requisites for verification plus reporting of high transactions for Anti Money Laundering (AML) purposes.

Document Keeping

Keep comprehensive records of transactions like dates, amounts, exchange rates, platforms, etc, as this makes filing taxes easier.

Seek Tax Advisors

As experts familiar with cryptocurrency tax laws understand different nations have different regulations, it’s best to approach a crypto tax consultant.

Alternative Methods to Convert BTC to Stablecoins

Decentralized Exchanges (DEXs

offer trading services like Uniswap and PancakeSwap witout the use of intermediaries, enabling users to convert BTC to stablecoins directly. DEXs on the Ethereum blockchain may also require Wrapped Bitcoin (WBTC) as a prerequisite.

DeFi Lending Protocols

Aave and MakerDAO allow users to deposit Bitcoin as collateral against a stablecoin loan, preventing other conversion methods and potential tax implications.

Crypto ATMs

Certain Bitcoin ATMs, which support stablecoin withdrawals, grant users the ability to convert BTC into USDT or other stablecoins.

Over-the-Counter (OTC) Trading

High-volume traders are able to utilize OTC desks to perform direct BTC to stablecoin exchanges with minimal price slippage.

P2P (Peer-to-Peer) Platforms

Users looking to exchange BTC for stablecoins may do so via Binance P2P or LocalCoinSwap, which allows customers to deal directly, eliminating the need for intermediaries and boasting more flexible payment methods.

Pros & Cons

Pros:

Protection from Bitcoin Volatility – Unlike Bitcoin, stablecoins remain constant, making them a reliable repository of value.

Fast and Effortless Transfers of Funds – The majority of platforms and exchanges provide convenient conversion options that require little effort on the user’s end.

High Status Coins/ Tokens – Stablecoins such as DAI, USDC and USDT have high accessibility and can be traded with or used in a wide range of payment systems and DeFi applications.

Holding During Market Declines – Converting to stablecoins during market declines ensures that profits are hedged.

Minimal Charges in Transactions – Transfers of stablecoins on some blockchains are more affordable compared to bank transfers.

Cons:

Shifting of Funds May Attract Capital Gains Tax – Converting the Bitcoin holdings can lead to capital gain taxable events.

High Conversion Fees – A number of platforms charge high fees for conversions and withdrawals.

Custodial wallets and centralized exchanges pose a high risk of hacks, mismanagement or lost funds. – Centralized exchanges increase Counterparty risk, leading to security issues.

Limited options of using pseudonymous digital currencies leads to high level of regulation instability by some governments. – These implementations usually hinder the freedom of using stablecoins.

Existence of freezing or blacklisting imposes high risk – Most stablecoins are linked to an issuer which is centralized so, there is low degree of decentralization.

Conclusion

To wrap up, changing Bitcoin into stablecoins is a good way to minimize losing value, access profits, and easily get cash. With the right exchange, security protocols, and considering the fee structure, the conversion can be done efficiently and securely.

Furthermore, paying attention to tax laws active and other approaches such as DeFi, P2P trading, or even peer-to-peer trading can enhance the user experience There is no doubt that stablecoins provide a balance between cryptocurrency and traditional financial systems, be it for trading, investment, or day-to-day use.

Security, compliance, and seamless connection should always be prioritized during the conversion process.