In this article, I will discuss the How to Convert Crypto into Gold Instantly in 2025, discussing some of the fastest and most secure platforms to trade on as of now.

Converting crypto to gold as digital assets and traditional wealth intersect brings both diversification and stability. You will grasp the in-depth guide, leading platforms such as Kinesis and Paxos, and critical pointers to ensure smooth est pratices.

“How to Convert Crypto into Gold Instantly in 2025”

1. Select An Exchange That Allows Crypto To Gold Transactions.

Consider using Kinesis Money, Tether Gold (XAUT), Paxos Gold (PAXG), Vaultoro, Aurus, or Bitpanda Metals. They enable the conversion of cryptocurrencies to gold, either in gold bars, coins or as tokenized gold. Secure vaults with easy and transparent access provide audited gold reserves for storage.

2. Register with Selected Platform and Undergo KYC.

Use your email and password to sign up with the selected platform. Some platforms conduct KYC verification with a government issued ID and proof of residence which helps the platform comply with regulations, mitigate fraudulent activity, and unlock access to the full platform features.

3. Crypto Deposit

After the account is approved, transfer the BTC, ETH, USDT, or USDC to the platform’s crypto wallet. Most platforms enable quick confirmations and once the transactions are approved, the available balance can be converted to gold. Your funds will be accessible after the transfer.

4. Exchange Cryptocurrency for Gold Immediately

Go to “Buy Gold” or “Swap to Gold” section. Specify the amount of crypto you wish to convert. The platform shows you how much gold you would receive in real time based on the current market price. After confirming, the gold (either tokenized or digital) is immediately credited to your account.

5. Store or Redeem Gold

The converted gold is kept securely in insured vaults which are backed 1:1 with physical gold. It can be kept as a digital balance, traded, or redeemed for physical delivery (depending on the platform). Kinesis and PAXG, for example, allow redemption in grams or full bars.

6. Withdraw or Transfer

You can always convert your gold back to cryptocurrency or fiat. Some platforms permit withdrawals to crypto wallets or bank accounts. Tokenized gold PAXG or XAUT can be freely transferred to other wallets, traded on exchanges, or utilized in DeFi, providing full liquidity and control over assets..

Key Platforms Supporting Instant Crypto-to-Gold Conversion

1. Kinesis Money

With Kinesis Money, users are given instant opportunities to convert their cryptocurrencies, Ether and Bitcoin, into fully allocated gold. Kinesis operates on the blockchain and is therefore a monetary system. Kinesis issues KAU tokens which represents their users gold ownership and is backed 1:1 with gold stores in insured vaults around the world.

Users are given the flexibility of buying, selling and even spending gold through a debit card which provides utility of the system and Kinesis is fully audited, compliant and provides discretionary KAU spending rewards. Kinesis is the best option in 2025 for users willing to convert their gold to crypto due to its fast transaction speeds and concise user interface.

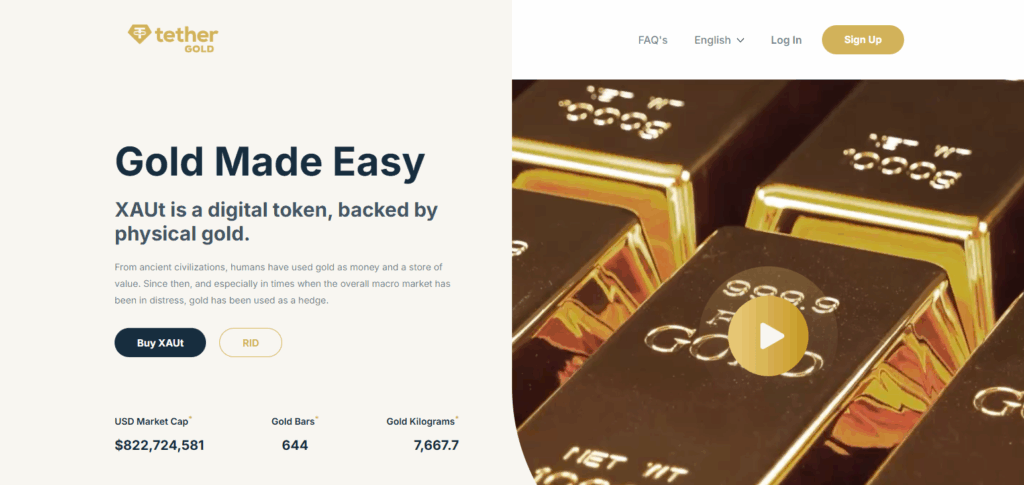

2. Tether Gold (XAUT)

Tether Gold (XAUT) is a gold-backed token created by Tether, the parent company of USDT. Each XAUT token is redeemable for a troy ounce of gold which is stored in Swiss vaults. Tether users can trade BTC and USDT for exchanged XAUT on all major exchanges and DeFi platforms.

XAUT offers the liquidity of crypto and the stability of gold. It can also be moved between the Ethereum and TRON networks. Although Tether is sometimes accused of being opaque, for many in 2025, XAUT is an agile and seamless way to mitigate the volatility of crypto by hedging with tokenized gold.

3. Paxos Gold (PAXG)

Paxos Gold (PAXG) is a digital asset regulated by authorities and is backed by a physical gold stored in a vault managed by a credible company, Brinks. Each PAXG gold token is exchangeable or redeemable and tied to representative one fine troy ounce of gold. It is issued by Paxos Trust.

Gold PAXG is also highly liquid and can be found on crypto exchanges like Binance and Coinbase which allows users to exchange crypto for gold easy. PAXG can also be trusted for fast crypto-to-gold exchange without straining the users, making PAXG one of the most trusted in 2025 after the firm regulated by the New York State Department of Financial Services.

4. Vaultoro

Vaultoro is the first exchange allowing users to Trade Bitcoin for physical gold without the Fiat currency exchange. Compared to other tokenized gold services, Vaultoro is unique because it vests gold in Swiss vaults under the user’s name, thus providing true ownership without counterparty risk.

Users can convert gold instantly, track their holdings in real time, request physical shipment, and crypto gold conversion is possible at any time. They offer public gold bar lists which helps in transparent auditing. In 2025 it remains a favorite for those users who want a lot of privacy, decentralization, and exposure to physical gold.

5.Bitpanda Metals

Bitpanda Metals is a product by Bitpanda, a European fintech company which allows to invest in a digitized metals including gold as a part of their crypto balance. Users can buy and sell gold at any time and swap it for crypto with no hidden fees.

Backed by real gold vests in Swiss vaults, Bitpanda metals is user-friendly and fully licensed in Europe which enables recurring investments. It’s unique because it doesn’t issue tokenized gold and acts as an ideal diversify for European users who want a seamless and regulated access to precious metals through crypto.

Factors to Consider Before Converting

Market Timing

Study the trends in both the bitcoin and gold markets. Transacting during a bitcoin dip while gold is at its peak. Use technical analysis or expert predictions to minimize losses.

Platform Reputation and Security

Pick apart industry-leading platforms that have good reviews, gold and crypto storage that is secured by vaulting, and is audited by a bank. Be on the look out for regulatory licenses for the platform, signed contracts for insurance coverage, and proven security measures to protect crypto and gold.

Token vs. Physical Gold

Select between preferred tokenized gold ( PAXG, XAUT) or receiving gold in a physical form. Tokens have more trading and liquidity value while physical gold is subject to space for storage and movement.

Fees and Costs

Go over the charges in the said platforms. These would include: conversion fees, spreads, storage charges, and even gold withdrawal costs. Short-term trading or small-volume transactions will be more negatively impacted by higher fees.

Liquidity Needs

In case you require quick access to funds, it is advisable to use platforms that facilitate seamless selling back of tokenized gold. Physical gold is usually less easily accessible than tokenized gold which is stored on-chain, like on Ethereum.

Regulatory Compliance

Always make sure that the platform is within the compliance of your country’s regulations. Some nations have restrictions when it comes to gold token trading or imports, as well as having tax implications when converting digital assets. Always query the KYC/AML regulations as well as tax obligations before hand.

Storage & Insurance

Check where your gold is stored, for example in Switzerland or Singapore, and if it is fully insured and audited. Geopolitical safety and trust for transparent reporting, and the location choice matter.

Redemption Options

While some platforms permit the redemption of gold into physical gold bars or coins, it is often subjected to minimum limits and restricted delivery zones. In case you want to possess gold physically, ensure that these conditions are met.

Why Convert Crypto into Gold in 2025?

Protect from Volatile Crypto Markets

Cryptocurrencies fluctuate dangerously. In contrast gold is a stable commodity. With the volatility associated in the crypto world converting a portion of your crypto into gold is a good strategic move.

Shield From Inflation

Fiat currencies are losing purchasing power in 2025 due to increased global inflation. Investing in gold always pays off in periods of inflation. Converting crypto to gold allows investors to move away from the weakening currency.

Increased Having Multiple Crypto Assets

Investing with crypto alone is dangerous. Risk is eased with a mix of crypto and gold. While crypto comes with volatility there is great potential with good returns and gold helps in balancing and ensuring portfolio protection. Leveling volatility with strength ensures a smoother journey with lowered risk.

Growing regulatory risk in crypto assets

Possessing crypto currencies are becoming challenging due to strict governance. With virtual currencies becoming more fiatized gold comes as a substitute. Tokenized gold such as PAXG or XAUT comes as a well-regulated substitute.

Liquid Tokenized Gold

With tokenized gold, trading can be done at any time on cryptocurrency exchanges. Compared to physical gold, which takes time to sell, gold tokens can be traded on multiple exchanges. This makes gold tokens ideal for investors looking for both safety and liquidity.

Storage is Secure and Audited

Paxos and Kinesis, for example, store gold in insured vaults, which benefits from third-party audits. This guarantees that the tokenized or digital gold is backed by real assets, which makes it more valuable.

Can be Converted Easily to Fiat or Crypto

When the tokens of gold are gold, they can be easily converted to crypto or fiat as well. This allows investors to access cash or re-enter the crypto market without delays that come from physical gold redemption.

Pros and Cons of Crypto-to-Gold Conversion

Pros

Reduces Risk of Volatility

Gold provides protection against extreme fluctuations. Converting crypto to gold mitigates volatile crypto risks and helps preserve wealth in downturns.

Inflation Shield

Unlike fiat currencies, gold is not impacted by inflation. During inflationary periods and unpredictable fluctuations of fiat and crypto, gold helps maintain purchasing power.

Risk Diversification

Investing in gold increases diversification and mitigates the volatile nature of crypto. It balances the conservative nature of gold and add conservative stability to aggressive growth from high-risk crypto assets.

Better Compliance

Gold, and particularly tokenized versions of gold, like PAXG and XAUT, are regulated assets. Compared to holding some altcoins or DeFi assets, the legal risks are much lower.

Easy and Liquid

Tokenized gold is accessible 24/7, can be traded anytime, and is easily convertible to both crypto and fiat. It provides the security of traditional assets and the liquidity of digital ones.

Backed Storage

Gold is kept in insured, audited vaults by the tokenized gold platforms. They guarantee 1:1 gold backing, allowing for complete peace of mind and mental withdrawal from the need for physical possession.

Cons

Missing Out on Cryptocurrency Earnings

With gold, you can’t take advantage of the exponential growth offered by cryptocurrencies. Converting too early can result in missing out on huge profits.

Reliance on Platforms

For transactions and storage, you need to use specified third-party services. A platform failure or hack could compromise access to assets.

Know Your Customer Rules

Most services necessitate identifying the user. This may dissuade those interested in the less-secretive, decentralized finance.

Service Additional Fees

There might be fees associated with swapping, storing, or withdrawing crypto to gold. This becomes increasingly problematic with small transactions over time.

Delivery of Physical Gold Restrictions

Not all services provide easy delivery of physical gold. Some impose minimums or redemption constraints based on geography and logistics.

Limited Opportunities in DeFi

Although the use of gold in DeFi is on the rise with tokenization, it is not as widely integrated as stablecoins or ETH, therefore, diminishing opportunities for yield farming or lending.

Conclusion

The year 2025 marks instant conversion of crypto into gold as the most safe, convenient, and effective it has ever been. Today, users can hedge digital assets against market volatility with real-time access to gold markets through services offered by Kinesis Money, Tether Gold (XAUT), Paxos Gold (PAXG), Vaultoro, Bitpanda Metals, and Aurus.

he user’s choice of tokenized gold for on-chain versatility or burdensome, physically-held bullion as a store of value makes no difference as it all takes only minutes. By picking a trusted platform and going through KYC and risk/ cost due diligence, users can instantly shield and diversify their digital currencies with gold, the timeless token of wealth, all while navigating through a vividly digital landscape.

FAQ

Can I really convert crypto into gold instantly in 2025?

Yes, many platforms now offer near-instant conversion from crypto to gold using tokenized assets or direct trading with physical gold. Services like Paxos Gold (PAXG), Kinesis Money, and Vaultoro enable fast, secure transactions.

What cryptocurrencies can I use to buy gold?

Most platforms support major cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), and stablecoins like USDT or USDC. Some also support altcoins depending on the exchange.

Do I need to complete KYC to convert crypto to gold?

Yes, most regulated platforms require identity verification (KYC). However, some like Vaultoro offer more privacy-focused options with minimal KYC for smaller transactions.