In this article, I will explain how to deposit crypto into a fiat bank in a secure and legal manner. Cryptocurrency is increasingly popular among users who wish to exchange their digital assets for traditional currency.

I will walk you through the entire process of exchanging crypto into fiat and withdrawing it to your bank account using reliable services.

Introduction Crypto Into a fiat Bank

Depositing cryptocurrencies like Bitcoin or Ethereum into a fiat bank involves converting them to traditional currencies like USD, EUR, or INR. Since banks do not accept direct crypto deposits, users must sell their crypto on an exchange and then transfer the resulting fiat to their bank accounts.

This method of withdrawing funds from decentralized finance “bridges” the world of DeFi with traditional banking. It’s vital to obtain all necessary licenses, verify your identity (KYC), and comply with any applicable laws or taxes.

With the growing acceptance of cryptocurrencies, more people and businesses are adopting the practice of depositoing cryptocurrency as users are able to go through the conversion process with relative ease.

How To Deposit Crypto Into a fiat Bank

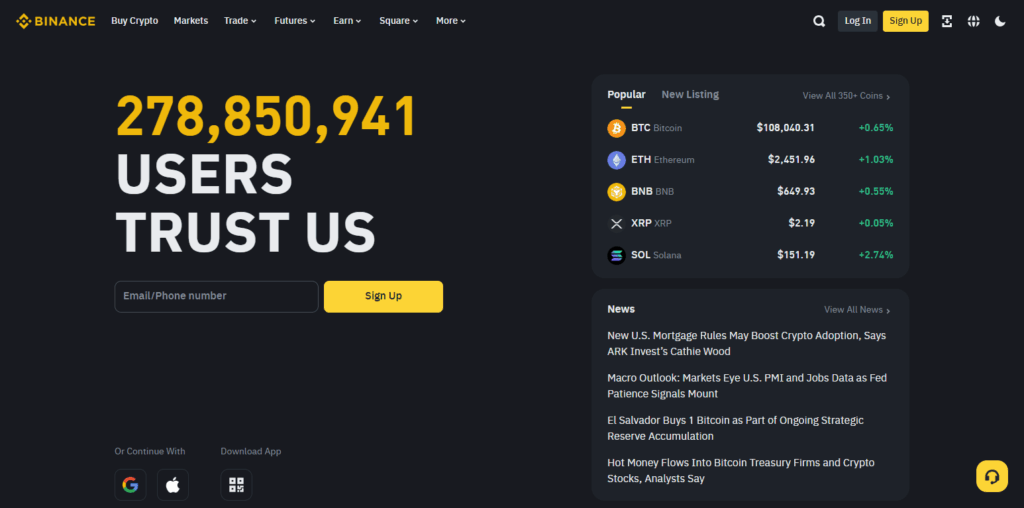

Step 1: Access Your Binance Account

- Open binance.com or launch the app.

- Complete your 2FA and KYC identity verification processes.

Step 2: Transfer Crypto to Binance Wallet

- Click on Wallet > Funding or Spot Wallet > Deposit.

- Select which cryptocurrency you would like to deposit (BTC, ETH).

- Copy your deposit address and transfer crypto from your external wallet.

Step 3: Exchange Cryptocurrency With Fiat-Currency

- Navigate to Trade, then either go to Convert or Spot when receiving funds.

- Choose the crypto you plan on selling for your preferred locale currency (USD, EUR, INR, KES…).

- Use the alternative instant conversion through the Sell Crypto option.

Step 4: Cash Out Fiat Currency To Bank Account

- Go to Wallet > Fiat and Spot > Withdraw

- Select “Withdraw” after choosing currency under fiat

- Fill in banking details including name, account number along with SWIFT/IFSC/etc..

- Choose payment methods like SWIFT, SEPA and UPI alongside others.

- Validate the transaction.

Step 5: Monitoring Transfer Status

- Transaction processing takes between 1–5 business days.

- Your bank account will reflect the processed funds.

What is the safest way to convert crypto to fiat?

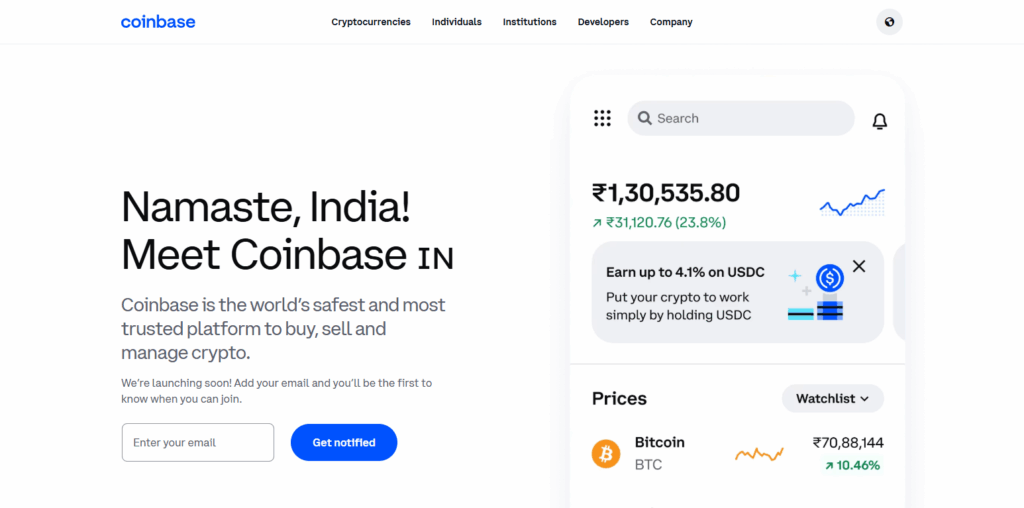

Coinbase

As one of the easiest exchanges to use, Coinbase serves US customers and offers a mobile app along with strict compliance with regulations. Once an account is verified, users may sell their crypto assets like Bitcoin and Ethereum for fiat currencies including USD, EUR, or GBP.

ACH transfers as well as SEPA and wire transfers allow withdrawal of funds to bank accounts. With strong account protection plus transparent fees along with clarity in transaction histories provided boosts user experience satisfaction especially for Americans and Europeans seeking crypto to traditional banking conversions.

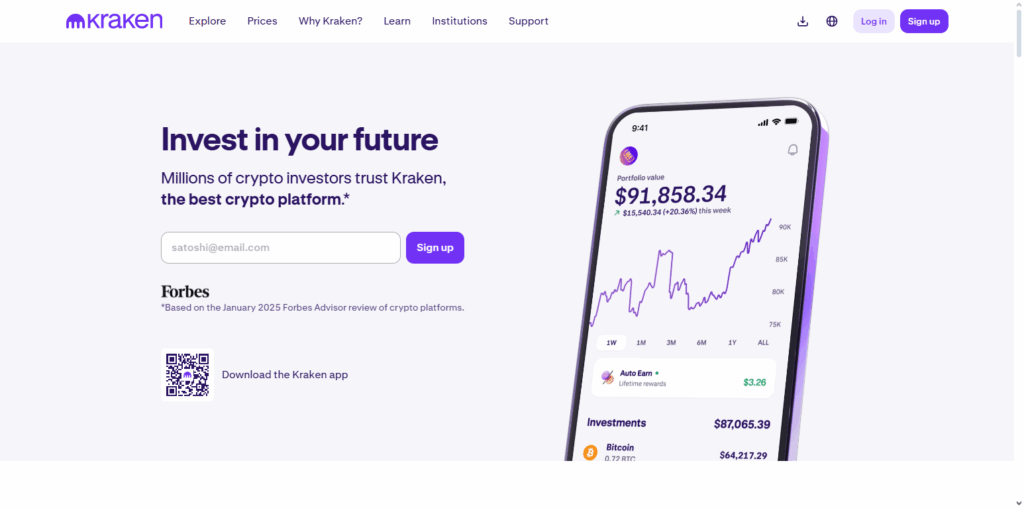

Kraken

Kraken is an exchange based in the U.S. which is renowned for its security, transparency, and compliance with regulations. Users can deposit their cryptos into a Kraken wallet and sell them for fiat currencies such as USD, EUR, GBP, or JPY. Kraken also facilitates withdrawal of funds from crypto wallets via wire transfer, SEPA, and FedWire.

Indicators show that Kraken’s interface caters to novice and advanced traders alike due to informative fee schedules and dedicated support staff. Institutional investors and users who prioritize compliance have made Kraken their exchange of choice because of the trust placed in it during regulatory scrutiny.

Bitstamp

Bitstamp is one of the longest-standing crypto exchanges, located in Luxembourg and operating throughout Europe and beyond. Users can sell cryptocurrencies like BTC or ETH for fiat currencies including EUR, USD, or GBP.

For users in Europe and other parts of the world, Bitstamp allows bank withdrawal transactions through SEPA transfers and international wire transfers respectively. It’s known for its reliability, regulatory compliance, and clean user interface.

After KYC verification, users can link their bank accounts for direct fiat withdrawals. Those who wish to convert their crypto assets to traditional currency will appreciate Bitstamp’s straightforward services.

Fees and Processing Time

| Platform | Conversion Fee |

|---|---|

| Coinbase | ~0.50% + variable spread |

| Binance | 0.10% (spot), 0.50% (convert) |

| Kraken | ~0.16% (maker), 0.26% (taker) |

| Bitstamp | 0.10%–0.50% based on volume |

Conclusion

In summary, To deposit cryptocurrency into a fiat bank, you must first convert your digital assets via a reputable exchange and withdraw the corresponding fiat to your bank account.

Remember to do proper KYC regulations, choose supervised exchanges, and pay attention to costs and waiting periods.

Following thorough procedures accompanied with paper work, this withdrawal method is safe as well as becoming more popular for integrating crypto with conventional banking.

FAQ

How long does it take to receive money in my bank account?

Typically 1–5 business days, depending on the withdrawal method (ACH, SEPA, SWIFT) and the bank’s processing time.

Do I need to verify my identity?

Yes. All major exchanges require full KYC (Know Your Customer) verification before allowing fiat withdrawals to prevent fraud and comply with regulations.

Is the process legal?

Yes—if your country allows crypto trading. Always comply with local laws, report income where required, and retain transaction records for tax reporting.