In this article i will focus on How to Earn Bridging Transaction Fees which is one of the profitable areas of blockchain interoperability.

Users can earn remuneration by providing liquidity, staking, or running nodes, and serving as an intermediary in cross-chain transactions.

I will identify the strategies, potential outcomes, and important factors that can assist you begin and increase your profits.

What Are Bridging Transaction ?

Bridging transactions are those transfers that move from one blockchain network to another using a decentralized bridge.

This permitting of different blockchains to link to one another, leads to the movement of tokens or data across different blockchains.

An example lays in moving tokens from Ethereum to Binance Smart Chain. Apart from the tokens, transferring ‘bridging transaction’ tokens incurs a transaction fee for the operator or liquidity service provider.

These serve as motivation for the maintenance of the How to Earn Bridging Transaction Feesinfrastructure, which focuses on secure methods of cross-chain transfers.

How to Earn Bridging Transaction Fees

As an example, let’s look how you can profit from relaying bridging transactions with a decentralized cross-chain bridge:

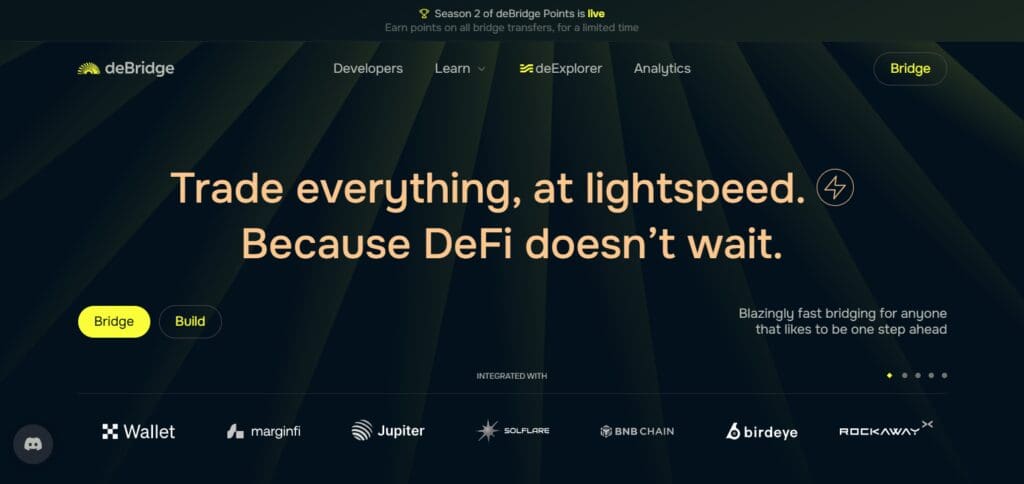

Select a Bridge Platform

Either deBridge or ChainBridge can be used as a relayer-friendly decentralized bridge of chose.

Create the Required Infrastructure

For this particular step, please note the following instructions:

Wallets: Create deposit and withdrawal wallets on the source and destination chains and transfer funds into them.

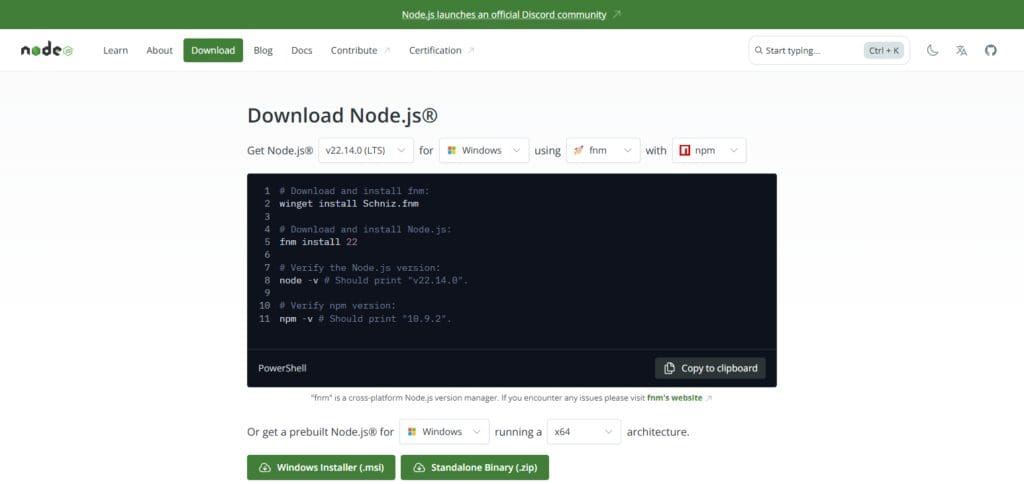

Node Setup: Download and install the relayer node software. Set up your relayer node to communicate with both blockchains.

Get Relayer Account Approved

Follow the platform’s onboarding steps which may involve depositing or locking up some tokens as collateral and sending a registration call through your wallet.

Watch Out for Bridging Requests

Run your node non-stop so that you can listen to cross-chain transfer requests. Once a user wants to do a bridge transaction, the node will capture it.

Execute the Transaction

Grant the node cross-chain bridging permission, transfer the respective tokens to the required destination chain, and execute the transfer on the blockchain.

Receive Processing Fees

For sustaining the bridging processes, the protocol paid your account with a percentage of the transaction fee. After successful completion of the process, the fees are directly deposited into your wallet.

Other Place Where Earn Bridging Transaction Fees

ChainBridge

ChainBridge stands out with its unique approach by catering to both Ethereum and non-Ethereum blockchains, allowing liquidity providers and validators to profit from an extensive variety of inter-chain transactions.

The constant innovation in blockchain technology allows users to retrieve bridging transaction fees by assisting in the infrastructural transfer of assets throughout different blockchain networks. This ability facilitates increased earning potential in different blockchain ecosystems.

Choosing the Right Bridge for Earning Fees

Fee Structure

Each bridge has a set of fees that include flat rates or some might charge a percentage. Find a bridge that charges nominal rates corresponding to your transaction volume.

Transaction Volume

Generally speaking, increasing transaction volumes create more opportunities to earn fees. Select the most well-known and liquid bridges available to increase your revenue.

Security

As a priority, select securities with strong security defenses. Because bridges fall under the most hacked services, always make sure the bridge in question gets props for having well established asset guards.

Liquidity Provider Incentives

A select number of bridges offer extra rewards to incentive liquidity providers in the form of, granted governance tokens, or bonus payouts. Make your selection based on the most attractive staking or liquidity programs.

Interoperability

These bridges are cross-chained and permit a number of blockchains. They help in creating a wider scope for earning fees, thus should be accounted for.

Reputation and Reliability

It is highly encouraged to investigate the reputation of the bridge in question. Use established, credible platforms with positive user feedback and open business policies.

Best Practices for Maximizing Earnings

Reputation and Security: It’s best to always choose bridges with good brand reputation. A bridge with hacks and weak security should be avoided to not lose money.

Cost Monitoring: Bridges sometimes change their fee policies or instantly create promotional offers. Pay attention to the announcements to increase revenue due to the changes.

Cross-Bridge Diversification: Relying on a single bridge comes with risk. Spreading assets over multiple bridges increases chances of earning while minimizing losses.

Yield Optimization: Active users should look for bridges with better liquidity provider rewards and staking incentives. They usually actively participate and effortlessly receive more money.

Gas Fee Monitoring: Gas fees can greatly affect returns. Choose services that allow adjustable gas fees where a middle ground can be found between speed and cost.

Reinvest Earnings: Use your earnings from staking or providing liquidity to reinvest them again in order to earn more. This increases your earning potential without having to invest more money.

Understand Risk and Reward: Always check the risks that each bridge comes with before diving straight into it. Usually, higher returns try to lure you in, but they are attached to great risks. Strategize carefully in accordance to risk appetite.

Risk & Considerations

Security Risks

As a result of their importance in enabling cross-chain transfers, bridges are often targeted by hackers. Significantly harmful funds loss can occur to exploits or weaknesses in the bridge protocols. Make sure to always use bridges that possess ample security attention like audits, insurance and market reputation.

Smart Contract Bugs

A sturdy audit along with open-sourced development processes is crucial for the bridge to possess. Most bridges work through smart contracts which can also be attacked if crafted or willed badly.

Network Congestion

Congested networks will cause transaction fees to rise which diminishes your earnings overall. Some Blockchains gaining too much popularity can lead to slow transaction time and heighten the expenses.

Liquidity Risks

Do not forget the possibility of losing value due to price volatility across blockchains. Bridges have a liquidity providing risk called impermanent loss. Before investing assets, consider the possibility of volatility.

Regulatory Risks

The boundary defining blockchain bridges is still in the process of being constructed as regulations change. New compliance rules could raise or alter how bridges operate. Always pay attention to changes in laws within the blockchain industry.

Bridge Interruption or Breakdown

Bridges have designated downtimes or may technically fail, which would result in a delay of transactions or even losses. Always pick bridges with a good reputation for uptime and operational continuity.

Other Charges Not Specified or Trick Fees

Some bridges will always have other bridges with sharp, hidden tactics, like withdrawal fees and tricked exchange rates. Check every detail and analyze the bridge’s underlying costs before investing any assets.

Operators of Liquidity Pools

In the case of more sought after bridges, the competition from other liquidity providers whillremarkably diminish profits. Determine how attractive the bridge has designed its fee divide and liquidity pool.

Pros & Cons

Pros

High Earning Potential: There are chances to earn considerable fees from transaction.

Incentives for Liquidity Providers: Some bridges offer payments for liquidity supplying.

Access to Multiple Blockchains: Enables cross-chain transfers and access to other blockchain ecosystems.

Staking for Passive Income: Earnings from staking or provision of liquidity without active engagement.

Diversification of Investments: Exposure to other blockchains and assets is provided.

Lower Cross-Chain Fees: There is an opportunity to save on fees when bridging across chains.

Cons

Security Risks: Bridges can lead to loss from hackers which poses security risks.

Smart Contract Vulnerabilities: Code defects can result in some problems or even gain an exploitation.

Network Congestion: Increased demand can lead to slow transfers along with expensive transaction fees.

Liquidity Risks: Susceptibility to impermanent loss while providing liquidity to pools.

Regulatory Uncertainty: Bridges might stop functioning or become restricted because of new regulations.

Bridge Downtime: Service interruptions or delays from technical failures can be caused by downtime.

Hidden Fees: Earnings may be affected by less visible or adjusted fees.

Conclusion

To summarize, transactions for blockchain bridging offer a good revenue-generating opportunity for users via liquidity provision, staking, and cross-chain transfers.

Like any investment opportunity, there are risks included such as security issues, network traffic, and even regulatory changes. By selecting credible bridges, being attentive to market conditions, and implementing different strategies, one can control risks while maximizing profits.

With the transformation of the blockchain ecosystem, navigating the understanding of bridging transactions will aid in making informed choices in relation to the earning opportunities.