In this post I will talk about getting free tokens by yield farming in DeFi, a strategy within decentralized finance.

Users can earn rewards for providing liquidity or staking tokens on DeFi platforms, earning without buying anything. It’s a savvy way to passively increase your crypto assets—though it’s crucial to know the risks that come with it.

Understanding DeFi Yield Farming

DeFi yield farming is a strategy for earning rewards by lending or staking crypto assets in DeFi protocols. Users also earn interest, fees, and sometimes the platform’s native token by providing liquidity to decentralized exchanges or lending platforms .

This process does not require any intermediary as smart contracts are used. New or incentivized protocols especially promote yield farming since they have high returns, however there are still risks such as impermanent loss, smart contract bugs, and market volatility.

These risks don’t seem to matter too much, since people continue to use it as a source of passive income while exploring new DeFi projects.

How To Earn Free Crypto Tokens Through DeFi Yield Farming

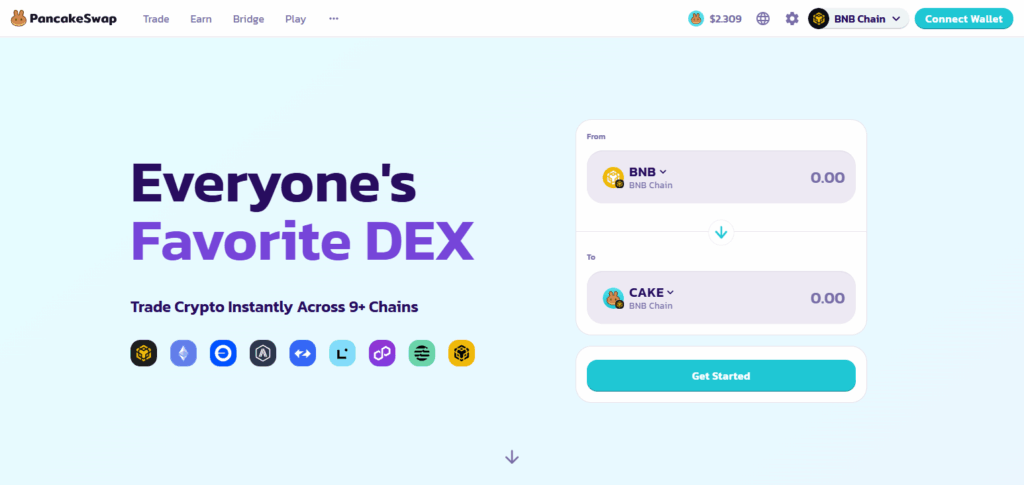

Example: Earning Free Crypto Tokens using Pancakeswap

Step 1: Create MetaMask Account and Connect to PancakeSwap

MetaMask wallet setup can be done over the web as well as on mobile. First add BNB smart chain (BSC). Visit pancakeswap.finance and connect your Wallet.

Step 2: Selecting Liquidity Pair Options

Select trading pairs like CAKE/BNB. You have to contribute both equal values to liquidity pools. You will obtain LP tokens representing that portion of share.

Step 3: Work with Your LP Tokens in ‘Farms‘ Sections Visit [‘Farms’]: stake your LP tokens at the appropriate farm for example, ‘BNB-CAKE farm”. You will subsequently be rewarded with CAKE tokens.

Step 4: Claim Earnings

CAKE tokens can be claimed anytime once earned. The liquidity provided in this case rewards more returns than spent tokens.

Bonus Tip!: Compounding your earnings attained from staking SUM recognized earned CAKE via Syrup Pools wherein you earn other project’s tokens originally further increasing profits.

Ways to Earn Free Crypto Tokens via Yield Farming

1. Providing Liquidity to DEXs

You can earn part of the trading fees by depositing token pairs into liquidity pools within decentralized exchanges. You also get LP tokens which can be staked for extra rewards, enabling passive earnings over time.

2. Incentivized Farming Programs

Bonus tokens are given by many DeFi platforms to incentivize participation. During early phases of these incentives, you can earn governance and native tokens besides regular fees which boosts total yield without incurring additional spending.

3. Staking LP Tokens

You can earn extra rewards on trading fees by staking LP tokens in yield farms after providing liquidity. This often includes the platform’s native coin, thus doubling the reward streams; one from trading fees and another from farming incentives.

4. Using Aggregators

Yearn Finance and Beefy Finance are examples of yield aggregators that automate optimization of strategies to provide high returns at a lower level of work effort on your side, allowing you to passively earn free tokens.

5. Airdrop Participation for Farmers

Certain DeFi projects give early liquidity providers or yield farmers free tokens in the form of airdrops during some project launches. Remaining engaged with certain protocols increases your chances of getting rewarding tokens, just because you participated in advance.

Best Platforms for DeFi Yield Farming

1. Ethereum-based Platforms

Some of the protocols on Ethereum are Uniswap, Curve and Aave, which are popular DeFi platforms.

While these have abundant liquidity and stable smart contracts, they are more suited for bigger players due to high gas fees unless using Layer 2 options.

2. Options on the Binance Smart Chain (BSC)

PancakeSwap and Venus are examples of platforms on BSC. With low fees and fast transactions

users also enjoy simple interfaces friendly for beginners with multiple farming pools to earn free tokens. After all, security is paramount in crypto.

3. Polygon Network

Users can use DeFi apps such as QuickSwap and Aave that operate under Polygon which offers low-cost transactions too.

New criptos launch here so early investors are often incentivised through ariable token distributions along side liquidity mining bonuses

4. Solana Ecosystem

Platforms like Raydium and Orca that operate on Solana offer fast and cheap yield farming. Its design favors growth which makes it easy to onboard new developers as well as farmers.

While the network gets overloaded sometimes, its still a go-to option for users who look for best APYs with frequent tokens.

Tips for Maximizing Yield

Use of farming calculators and dashboards

For efficient farming decisions, estimate returns and risks using tools.

Diversifying across protocols

Investments made motivated reduced risk capture multiple reward sources gained.

Timing and strategy (e.g., farming early)

Participate early to achieve soaking up higher rewards initially given.

Keeping up with DeFi trends

Mark market flows to emerging, effortlessly profitable farming opportunities diminishing.

Conclusion

In conclusion, yield farming in DeFi grants users precious opportunities to earn digital currencies through providing liquidity, staking assets, and participating in various loyalty programs.

Alongside the high earning potential, risks such as impermanent loss or exposure to smart contract failure can significantly impact earnings.

Appropriately selected algorithms, along with the right tools and platforms will help achieve passive income optimization alongside active engagement in the dynamic world of decentralized finance.

FAQ

Are the tokens really “free”?

Yes, but with conditions. Rewards are earned passively without purchasing them, but you must lock up crypto assets, and risks like impermanent loss or market volatility can affect your total gains.

What platforms are best for beginners?

PancakeSwap (BSC), Uniswap (Ethereum), and QuickSwap (Polygon) are user-friendly platforms. They offer simple interfaces, farming guides, and active communities.

Is yield farming safe?

It can be risky. Smart contract bugs, rug pulls, and volatile token prices can lead to losses. Use audited protocols and never invest more than you can afford to lose.