In this article, I will explain How To Ensure Bridging Transactions Are Secure between blockchains. Cross-chain bridges are growing in popularity.

Which makes it more important than ever to use proper security measures such as using trusted services, checking the smart contract, and protecting your wallet.

When following these procedures, you are able to safeguard your assets and minimize the chances of getting exploited when bridging funds.

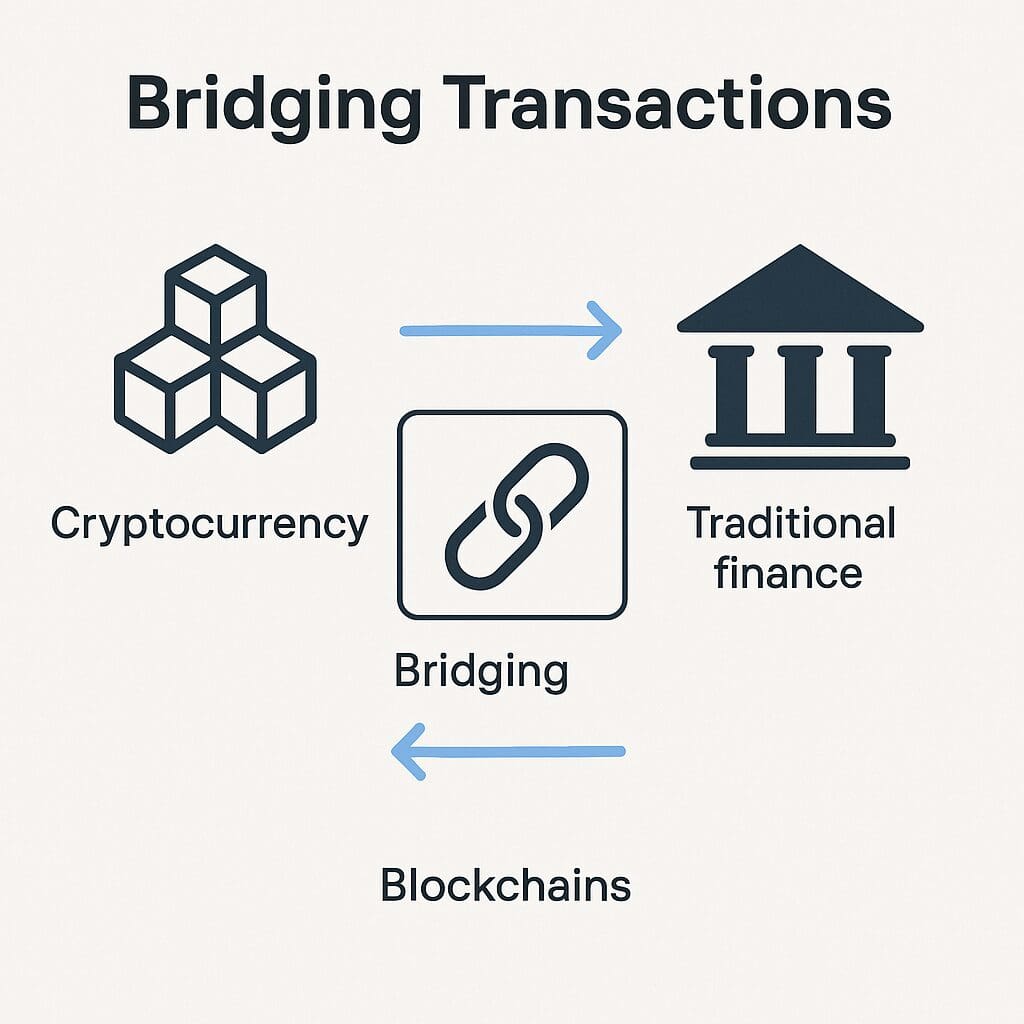

What is Bridging Transactions?

A type of bridging transaction is transferring both financial assets or data between different networks or systems. In the cryptocurrency space, it relates to the transportation of tokens across block chains via a bridge protocol.

It allows the interaction of dissimilar networks such as Ethereum or Solana which would normally not be able to communicate.

In traditional finance, it can even mean the allowance of money or a payment made in anticipation of real money coming during the execution of two financial transactions like receiving money from a sale and using it to pay for an earlier agreed upon item.

Bridging transactions improves liquidity along with flexibility and integration of different financial systems.

How To Ensure Bridging Transactions Are Secure

We look with example with polygon network & Ethereum .

To guarantee secure bridging transactions between the Polygon network and the Ethereum mainnet, it requires following best practices along with using trustable platforms.

Use Official Platforms

To guard against phishing, always open the Polygon Bridge from the actual site Polygon Wallet Suite. Make sure to check the URL along with confirming the smart contract addresses from official documents of Polygon.

Validate Smart Contract Security

On the Polygon Bridge the audited smart contracts are used to transfer assets on Ethereum to the Polygon network by locking them and minting their equivalent tokens on Polygon (or the other way is also possible).

This approach in the Ethereum blockchain of “lock and mint” maintains that on the source chain tokens are safely stored and their wrapped versions are created on the destination. Make sure that these contracts are backed by third security audits of respected companies like Quantstamp.

Check Transaction Finality

Make sure that on the source chain there are enough block confirmations before processing the transaction on the destination chain.

For instance, Ethereum almost always needs 12 to 20 confirmations to complete a transaction, therefore minimizing the possibility of reorganizations of the chain.

Other tools like Etherscan or Polygonscan can be efficiently used to track the state of a certain transaction.

Limit Approvals and Monitor Permissions

When granting permission to the bridge to interact with your tokens, restrict the authorization to only the exact amount of tokens that you want to exchange.

To minimize risks crafted by malicious contraptions, tools like revoke.cash should be used to discard pointless permissions at a later date.

Use Secure Wallets and Environments

Keeping private keys offline is as easy as connecting a hardware wallet (Ledger, Trezor) to the bridge. By doing so, your devices are protected against malware and phishing attacks. Furthermore, do not connect to public Wi-Fi and verify that your device is clear from keyloggers.

Monitor Bridge Liquidity and Activity

A bridge that is well funded is less prone to problems such as lack of activity and inadequate liquidity. Use DefiLlama to monitor bridge activity, and check the Total Value Locked (TVL) to ensure it is liquid and well maintained.

Test and Plan for Withdrawals

Before moving large sums, start with a small amount to test the process. Speculate possible delays such as hours-long wait with Polygon’s PoS Bridge that uses a checkpoint system for withdraws.

By following these steps outlined above, the risks pertaining to transferring assets across the Polygon and Ethereum networks is low.

Supplementary Techniques For Improved Security

Smart Contract Audits: Opt for platforms which utilize certifiable smart contracts by renowned auditors such as Certik. Regular audits eliminate system weaknesses in a reasonable time frame and ensure that quick fixes can be incorporated.

Decentralized Validators and Mult-Sig Approvals: Utilize multi-sig as a single point of control instead of a sole validator as this diversifies risk by ensuring that no single validator or entity can put the transaction at risk.

User Education: Pay attention to the new security updates and standard procedures brought forth by the bridge developers. Education is a primary barrier toward being victimized by social manipulation and phishing schemes.

Security-Control Table

| Transaction Phase | Security Control | Description |

|---|---|---|

| Pre-Transaction | Reputable platform, wallet security, and environment | Choose an audited bridge like Polygon; secure your wallet with MFA and a safe network |

| Initiation | Lock & Mint mechanism, encrypted wallet connection | Tokens are securely locked via audited smart contracts; encrypted channels protect data |

| Verification | Decentralized consensus, multi-party validation | Validators confirm the lock event before minting tokens, reducing risks of fraud or double-spending |

| Post-Transaction | On-chain monitoring, emergency stop mechanisms | Real-time tracking and emergency protocols ensure immediate detection and response to issues |

Pros & Cons of Ensure Bridging Transactions Are Secure

Pros

Better Protection and Assurance: Users view secure bridging transactions with assurance because their assets are perceived to be secure. Users trust the cross-chain process due to the use of audited smart contracts and decentralized validation.

Stronge Restriction of Fraud: Multi-layered security measures like smart contract auditing, validator consensus, and audit trails lower the odds of double spending, hacking, and other forms of fraud.

Security and Monitoring: Each step in the bridging process can be verified due to on-chain records and real-time tracking. This added security enables quicker detection and response to any irregularities.

Decentralized Control: Trust is spread out by relying on multiple validators and other consensus methods, thus improving the chance of avoiding a single point of failure and controlling the centralized risk.

Examination Prevention: Additional integrated measures like pause/rollback capabilities provide a safety net. These safety nets offer the preventative measures that prevent systems failure during suspicious activity.

Cons

Greater Efforts: The strict security measure can certainly change the design structure of the protocol for the bridging due to the added complexity. These structures can be difficult to develop, maintain, and user-friendly.

Slower Processing Speeds: Secure bridging often takes more time to accomplish than less secure methods. Steps like multi-party validation and consensus slow the overall transaction throughput.

Justifiable Expense: Improved audit processes, more computation power for validator consensus, and upgraded infrastructure can all add advanced security measures, which can lead to elevated costs per transaction or increase operational expenses.

Possible Centralization Control: While decentralization is a target, some heuristics (like depending on a few highly trusted validators) have the potential to centralize control. This centralization poses a risk, as those validators may be attacked which puts them at risk of control.

Operational Complexity: In order to secure a network against evolving threats, a sustained level of maintenance, monitoring and updating needs to take place. Such level of sophistication in maintenance can lead to increased resource consumption while compromising system stability during updates or revisions.

Conclusion

For safe bridging through different blockchains, it is best to implement a multi-layered approach integrating security on every level of the transaction.

Use only the designated interfaces, check the safety of the smart contracts, and make sure the transaction has been fully completed before taking any action.

Tightening allowances on tokens, utilizing cold wallets, and watching the liquidity on the bridge decreases the chances of being compromised.

Moreover, knowing how to withdraw and testing with smaller amounts eases the chances for unforeseen complications. With these security measures in place, cross-chain asset transfers can be accomplished with reduced risks.