In this article, I will discuss the how you can liquidity mine on Avalanche step by step. Liquidity mining, also called yield farming, refers to the practice of supplying your crypto assets to liquidity pools on decentralized exchanges to earn passive income.

You can use Avalanche’s super fast and cheap blockchain to enhance your yield while engaging in DeFi opportunities.

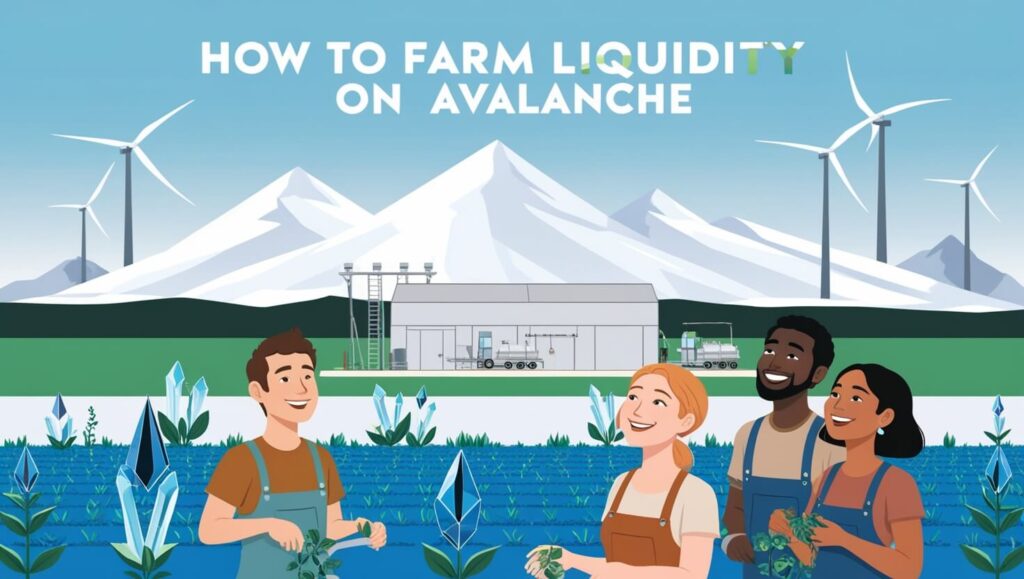

What is Farm Liquidity?

Farm liquidity describes the act of supplying cryptocurrency resources to a liquidity pool on a DEX to earn rewards. It works like this: For trading to occur smoothly via token swaps, there has to be sufficient liquidity in the pools for trading.

Rewards can also include platform generated tokens or fees, which pay for further engaging in the ecosystem and reaping the benefits of more rewards, incentivizing ecosystem participation.

To be considered liquidity providers, users deposit token pairs into these pools and are compensated with LP tokens. More often than not, these LP tokens can be staked in “farms,” allowing users to earn extra farming rewards.

How to Farm Liquidity on Avalanche

Let’s take Trader Joe as the example platform for liquidity farming on Avalanche. You can follow this guide step-by-step:

Setup Your Wallet

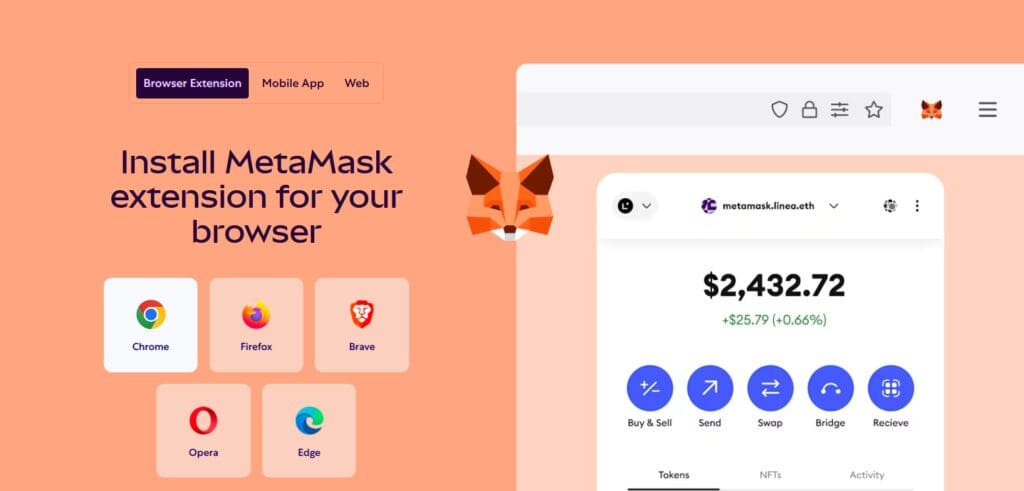

- Download a wallet like MetaMask and set it up.

- Add the Avalanche C-Chain network to your MetaMask wallet.

Fund Your Wallet

- Purchase AVAX tokens and send them to your wallet. You can use the Avalanche Bridge to transfer assets from Ethereum to Avalanche.

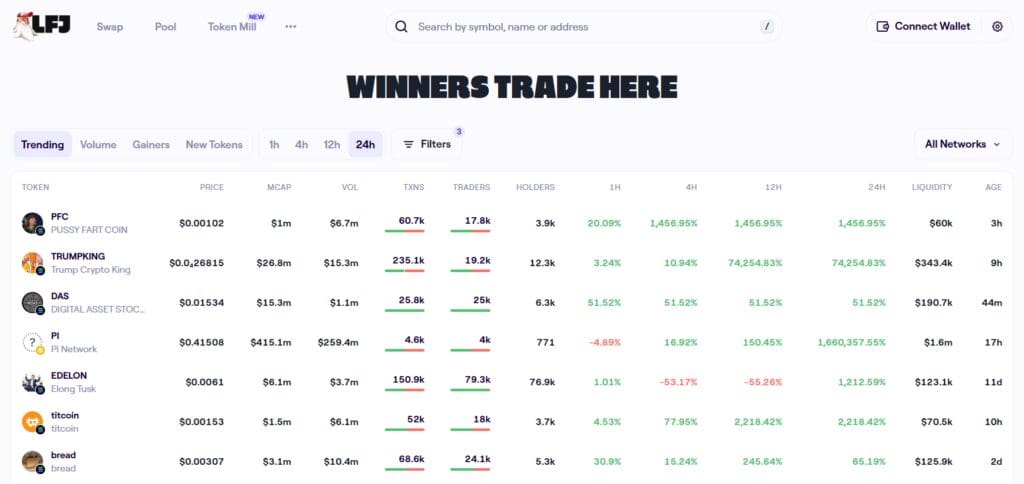

Access Trader Joe

- Go to the Trader Joe platform.

- Connect your MetaMask wallet to the platform so you can start using it.

Choose a Liquidity Pool

- Click on the “Pool” section on Trader Joe to locate it.

- Choose a token pair you want to provide liquidity for (such as AVAX/USDC).

Provide Liquidity

- Make sure you have sufficient balance of both tokens in the pair.

- Add the tokens into the liquidity pool, which will issue you LP (Liquidity Provider) tokens.

Stake LP Tokens

- Navigate to the “Farm” tab on Trader Joe.

- Stake your LP tokens in the farm to start earning rewards.

Monitor and Harvest Rewards

- Check your staked LP tokens regularly. Harvest rewards whenever it is needed.

Withdrawing & Claiming Rewards

Claiming rewards from liquidity farming and withdrawal is as easy as following these steps:

Connect Your Wallet

Head to the site where you are liquidity farming such as Trader Joe or PancakeSwap and connect your wallet.

Locate the Farming Area

Find the specific farm where you had deposited your liquidity pool (LP) tokens.

Rewards Claiming

Select the “Claim” or “Harvest” button to get your earned rewards which are usually given in the form of platform tokens or other rewards.

Withdrawal of LP Tokens

If you wish to completely withdraw your stake then you have to “Unstake” your LP tokens and confirm the transaction in your wallet.

Liquidity Removal

Go to the liquidity pool section, select the “Remove Liquidity” option, choose the token pair, the amount you wish to withdraw, and confirm.

Your Assets

Once the liquidity has been removed, the assets you will receive are the original tokens along with any other fees that are sent to your wallet.

Managing Risks & Maximizing

Investing in liquidity farming while managing risks and maximizing returns requires some attention. Here are a few tips to consider:

Managing Risks

Research Thoroughly: Check out the platform and token pairs to make sure there are no scams or rug pulls.

Start Small: Learn the ropes with a low initial investment.

Monitor Impermanent Loss: Keep in mind the price differences of the tokens can lead to losses when withdrawing liquidity.

Diversify: Don’t concentrate all your funds in a single pool. Spread them across different farms to limit exposure.

Stay Updated: Market conditions and platform information can change. Keep on track so that these do not negatively impact you.

Maximizing Returns

Stake Your Rewards: Put reinvested rewards back into other pools or farms to increase earnings.

Choose High APR Pools: Seek out pools with large annual percentage return. Use caution with the risk though.

Leverage Yield Aggregators: Automatize and optimize your farming strategy using platforms like Beefy Finance or Autofarm.

Time Your Exits: Make sure you are checking the market so you withdraw when value and risk do not outweigh each other.

Stay Informed: Use community forums and analytics for information to catch out on great opportunities.

Pros & Cons

| Pros | Cons |

|---|---|

| High rewards through staking and farming incentives | Impermanent Loss risk due to fluctuating token prices |

| Fast transactions with low fees on Avalanche | Smart contract vulnerabilities (hacks or exploits) |

| Supports a wide range of liquidity pools | Requires initial knowledge of DeFi processes |

| Decentralized and transparent ecosystem | Rewards can be volatile and depend on market conditions |

| Opportunities to reinvest rewards for compounding | Withdrawing funds involves gas fees |

| Access to a thriving DeFi ecosystem | Potential liquidity issues in low-volume pools |

Conclusion

To sum things up, there are many ways passive income can be earned through contributing to the decentralized ecosystem, such as farming liquidity on Avalanche.

Following the instructions provided on how to set a wallet, select a platform like Trader Joe, provide liquidity, and stake LP tokens can increase revenue significantly.

Correspondingly, there are ever-present perils, thus risks need to be managed while remaining continuously informed and monitoring regularly to adapt to changing markets. Through adequate planning, liquidity farming opens avenues of opportunities in the realm of decentralized finance on Avalanche.