In this article, I will quickly discuss How To Get a Crypto Loan Without Collateral.

This will include peer-to-peer lending platforms, decentralised finance (DeFi) options, ns, and credit-based crypto products that do not require physical assets as collateral for loans.

Thus, there are strategies which you can employ to secure a financial interest in digital currency even if you don’t have any security to pledge.

What Is a Crypto Loan?

A crypto loan is a secured type of lending in which borrowers use their crypto exchanges as security to get funding, often in fiat money or other cryptos.

This journey demands giving out virtual properties, such as Bitcoin and Ethereum, to ensure that one gets credit, similar to when someone puts a car or house down as collateral in traditional bank loans.

If the borrower pays back the interest and loan within the agreed-upon repayment terms, they will still own their crypto assets.

Crypto loans can be intermediated through centralized intermediaries, diaries, or decentralized platforms with blockchain technology and smart contracts for transaction management.

How To Get Crypto Loan Without Collateral

However, specific loans and platforms are typically involved in getting a crypto loan without collateral.

One is flash loans, an uncollateralized loan type available on DeFi platforms.

Flash loans have a feature that allows users to borrow money without providing any security, but this must be returned in the same block where it was taken.

Such loans can often be used for almost split-second purposes like arbitrage or refinancing.

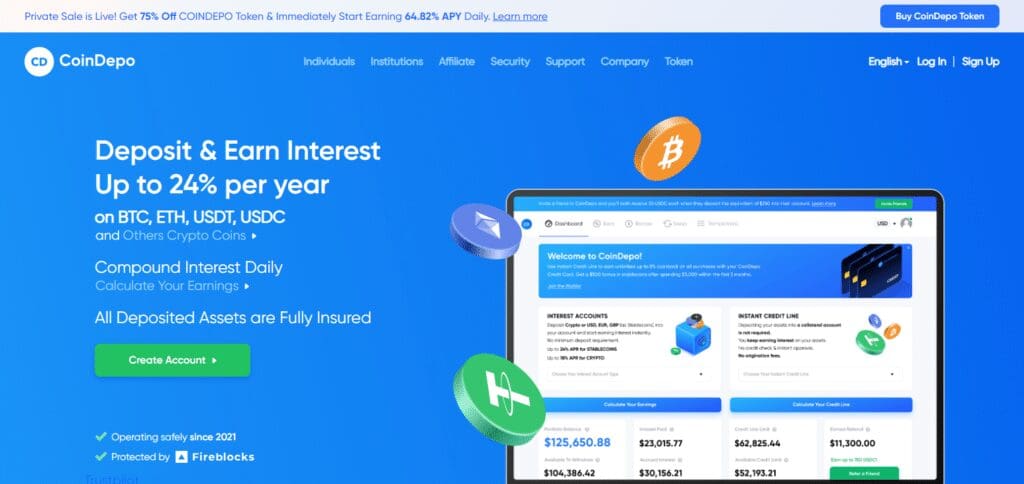

Another option is using platforms like CoinDepo, which provides instant credit lines without collateral accounts.

These include alternative measures to determine the creditworthiness of borrowers, just like the crypto credit score.

Nevertheless, it should be noted that compared to collateralized credits, uncollateralized crypto loans might entail higher interest rates or more stringent eligibility criteria.

Before taking such credits, ensure you have thoroughly researched and understood all conditions and terms.

Why Do Most Crypto Loans Require Collateral?

Conversely, standard crypto loans are much different from flash loans. Unlike flash loans, which can be executed promptly without collateral, typical crypto loans are more traditional and require collateral to secure the loan.

This is because lenders need certainty that they will be able to recover the value of their assets.

Flash loans have found a way around this by using smart contracts to recover value and set limits on how borrowed assets can be used.

On the other hand, average crypto loans hold the equivalent amount of collateral with the lender.

However, to retrieve one’s collateral, a borrower must repay any accrued interest and the loan amount.

Collateral also helps keep interest rates lower since it provides security for the lender.

Selling off such collateral enables borrowers to recover their money in case of default, thus offering customers lower interest payments because there is reduced risk.

Typical forms of collateral for crypto loans include Bitcoin and Ethereum and stablecoins like USDT and USDC.

However, some platforms accept many types of altcoins, and occasionally, even NFTs may be accepted as security by peer-to-peer lenders.

Why Crypto Loans Sometimes Require Over-Collateralization

For various reasons, crypto loans typically need over-collateralization.

Price volatility: cryptocurrencies are well known for their high price fluctuations. By demanding that borrowers offer more collateral than the loan amount, lenders protect themselves from the risk of a significant drop in the value of the collateral.

Mitigation of Risk: Over-collateralizing ensures a cushion in case of borrower default. If the borrower does not repay, the lender can sell off the collateral to repay the loan.

Loan-to-Value Ratios: Most platforms have loan-to-value (LTV) ratios between 50% and 90%. This means that borrowers can only access a small fraction of their assets when borrowing against them, ensuring that financing is secure enough.

Market stability: Over-collateralization helps stabilize these markets by reducing the chances of bad debt and ensuring loans are sufficiently asset-based.

These steps help establish a safer and more dependable credit atmosphere within crypto, which will benefit creditors and borrowers.

The Top Platforms for Crypto Loans Without Collateral

These are some of the best places to get crypto loans without collateral:

CoinDepo

CoinDepo has an instantaneous line of credit without needing a collateral account.

Borrowers can access funds whenever they want and repay them, making it flexible in terms of interest, which is calculated based on the loan balance.

Teller

Teller is a decentralized alternative data-based platform that offers uncollateralized loans based on the borrower’s ability to pay.

CoinRabbit

CoinRabbit permits flash loans without security, allowing users to borrow and return funds within the same block.

Goldfinch

Goldfinch uses blockchain technology to assess and manage risk to facilitate unsecured lending.

Conclusion

People without enough assets but who need money can obtain a loan in cryptocurrency with no collateral.

Although standard crypto loans require collateral to secure them, alternative methods such as P2P lending platforms, DeFi protocols and credit-based crypto loans allow people to borrow without initial collateral.

These options are generally based on creditworthiness, decentralized intelligent contracts or innovative financial products like crypto credit cards.

However, one must also be aware of hazards, such as heightened fees, interest charges, and increased volatility rates.

Thoroughly studying and choosing reliable platforms while understanding their conditions can help to moderate these risks.

Investigating these unsecured loan channels can help you access the liquidity you need when operating in the fluid terrain of crypto finance.