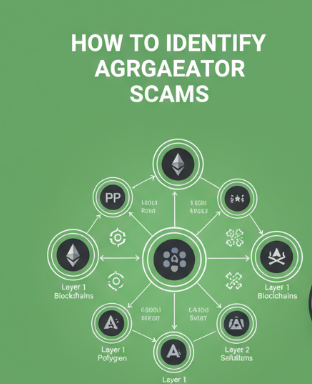

In this article, I will highlight the How to Identify Bridging Aggregator Scams. With the growth of decentralized finance, bridging aggregators are crucial for transferring assets across blockchains.

Unfortunately, scammers take advantage of this trend and deceive users into losing their money. This article will shed light on protective measures, verification techniques, and the most important warning signs so that users will not fall victim to scams.

What Are Bridging Aggregator Scams?

Bridging aggregator scams are unscrupulous schemes set up in the cryptocurrency domain that take advantage of uneducated users attempting to send and receive assets around different blockchain networks.

These scams are set up to look like bridging aggregator platforms and offer users faster and cheaper cross-chain transactions.

But in reality, they can siphon users’ funds, obtain private keys, or manipulatively complete transactions for their selfish gains. Scams are set up to include fake websites in demand of popular aggregators, phishing, and unmonitored smart contracts.

Knowing what these scams are and what they do is vital to anyone using crypto bridges, in order to minimize losses, and foster safer use of decentralized finance (DeFi) ecosystems.

How to Identify Bridging Aggregator Scams

Example: Scamming a Bridging Aggregator

Step 1: Verify the Website URL and Domain

- Confirm the URL of the website very carefully. Scammers almost always create domains that look similar to a legitimate bridge with a few character errors.

- Example: bridgesafe.com – legitimate, vs br1dgesafe.com – scam.

Step 2: Investigate the Team and The Project

- Try to find the team that is working behind the aggregator. Legitimate projects usually have easily verifiable founders, or at least a LinkedIn presence.

- No information available, or the team being completely anonymous is a huge red flag.

Step 3: Analyze the Community and Social Media

- Look at Twitter, Discord, and Telegram. Are users complaining, or is there a lack of interaction?

- Scams usually have quite a few users, but the community is poorly managed.

Step 4: Try a Minimal Transaction

- Make sure to test with a small amount of money to see if the transaction goes through.

- If there’s a problem and the transaction fails, or the money seems to vanish, it’s a scam.

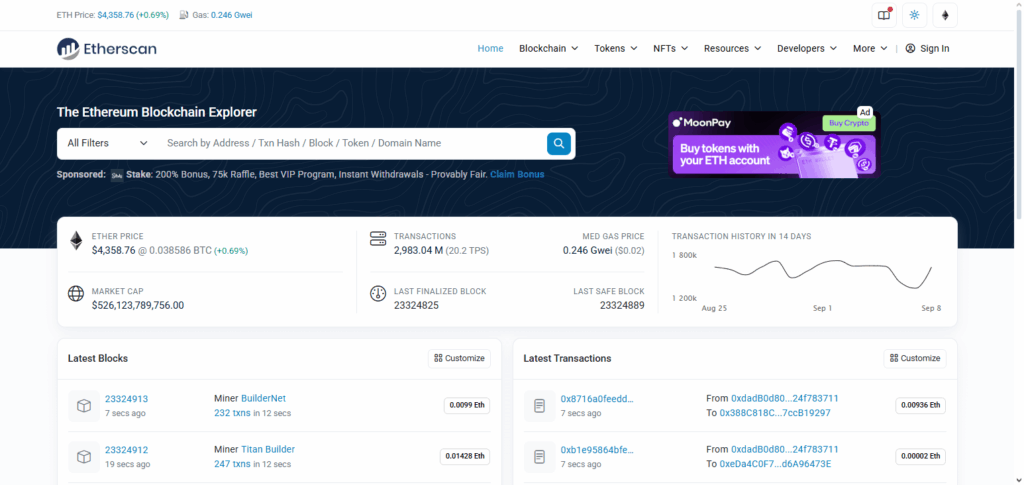

Step 5: Confirm the Smart Contract Safety

- Review the smart contract with tools like Etherscan, BscScan, or DeFi safety audits.

- Not covered contracts that have been tagged are always considered a risk.

Step 6: Before Working, Confirm the Aggregator’s Reputation

- Go check crypto forums like Reddit, CryptoSlate, or Twitter threads for analysis and ratings, and reviews.

- Aggregators, with proven reputation, leave a footprint across several trustworthy sources.

Step 7: Stay Away From Outrageous Offers

- Outrageous claims like super low fees, instant bridging, and instant high yields should raise red flags.

Warning Signs of a Scam

Knowing something is wrong is important in order to avoid bridging aggregator scams. The most obvious examples are false claims with promises of sky-high returns or potential earnings coupled with fees so low you’d think they’re “too good to be true.”

Also, if the platform doesn’t have a ‘team’ page or if there is no guaranteeable track record, they are being opaque, which is another sign. Badly designed or legt typos, as well as other suspicious page elements like an asyc URL, are all signifiers of a likely scam.

Purchased reviews, especially testimonials that are either paid or endorsed by bots, contribute to online deception alongside the other infamous examples of aggregates. Most Aggregates are actively checked by certified third parties to ensure the safety of users’ funds while they avoid public security audits.

Tools and Methods to Verify Legitimacy

Contract Address Verification: Cross-check the smart contract addresses on Etherscan and BscScan or other equivalent sites to confirm that the contract addresses originate from the correct sources.

Review Aggregator Ratings: Verify user ratings and reviews on reputable DeFi aggregator review sites and DeFi lending platforms and evaluate the platform’s review history.

Follow Official Channels: Confirm the project’s updates and announcements from the social media accounts and verified pages on Discord and Telegram.

Audit Reports: Search for the published audits from well-known and certified security firms to confirm that the smart contracts on the neck are safe.

Community Feedback: Participate in the Crypto Twitter and Reddit forums to evaluate the community’s perspective on the platform’s credibility.

Best Practices for Safe Bridging

Start Small

Always test with a small amount before transferring large sums to ensure the platform works properly.

Use Verified Platforms Only

Only use audited bridging aggregators that have established reputations within the industry.

Keep Your Wallets Safe

Always keep your private keys, seed phrases, and wallets and never share them with anyone.

Use Hardware Wallets

For large transfers, use hardware wallets to significantly reduce the risk of easy hacks.

Do a URL Check

Ensure the URL you have clicked on is not a phishing site.

Stay Updated

Follow the official updates of the project and track the security announcements to keep alert for a possible attack.

Pros & Cons

| Pros | Cons |

|---|---|

| Enables fast cross-chain transfers of crypto assets. | Scams and fraudulent platforms can steal funds. |

| Aggregators can find the best rates and lowest fees. | Fake or unaudited platforms pose security risks. |

| Simplifies bridging by combining multiple protocols in one interface. | Phishing websites may mimic legitimate aggregators. |

| Increases accessibility to DeFi and multi-chain opportunities. | Lack of transparency and team information can be red flags. |

| Can save time by automating the bridging process. | Users may lose funds if proper verification is not done. |

Conclusion

To wrap up, telling apart bridging aggregator myadventures scams is complex and concerns strategy and study coupled with careful checks.

Users should remain hyper alert to signs like lack of clarity, unverifiable claims, dishonest websites, and smart contracts that have not been certified. Balancing due diligence and paranoia, if you use blockchain explorers, review report feedback from the community, and the audit, you can figure out if the platform is real.

Attaining best practices, like starting with tiny sums then moving to higher and higher transactions, moving to transactions to trusted providers, and appropriately closing wallets can help crypto users dodge scam traps. Users need to be vigilant so their funds remain protected in the quickly changing world of DeFi.

FAQ

How can I spot a scam platform?

Watch for unrealistic promises, lack of transparency, poor website quality, fake reviews, and unaudited smart contracts.

What tools help verify legitimacy?

Blockchain explorers, audit reports, aggregator reviews, and community feedback can help confirm if a platform is legitimate.

How can I protect my funds while bridging?

Use small test transactions, verified platforms, secure wallets (preferably hardware wallets), and double-check URLs before bridging.

Can I recover funds lost to a scam?

Recovery is difficult and often impossible, which is why prevention through careful verification is crucial.

What is a bridging aggregator scam?

A bridging aggregator scam is a fraudulent platform that pretends to facilitate cross-chain crypto transfers but aims to steal users’ funds or personal information.