In this article i will discuss the How to Integrate Crypto Holdings with Your Bank Account and transferring them to your digital assets requires that you withdraw the money from the bank account first, then, deposit it onto a reputable exchange for the currency to fiat conversion.

This process deepens the connection between conventional banking and the fast-paced world of digital assets, provided more liquidity and easy access to the assets.

What is Integrate Crypto Holdings?

Integrating crypto holdings implies linking your cryptocurrency assets with a bank account, yielding interaction of the pair. The user is now able to easily transfer currency from their bank account to the crypto wallet and vice-versa.

The user with integrated holdings may convert crypto assets to fiat currencies like USD or EUR and deposit them in the bank account or take money from the bank account to buy cryptocurrencies.

Usually, this integration is done through cryptocurrency exchange or some other financial services that provide safe connection between the digital assets world and standard banking. This procedure aids individuals in managing, spending, or converting crypto into accessible funds effortlessly.

How to Integrate Crypto Holdings with Your Bank Account

Consolidating your cryptocurrency assets with your bank entails selling your digital currency and transferring the money to your financial institution. Here is a detailed guide of example with Coinbase, one of the leading cryptocurrency exchanges: Soft-Hyperlink-Submitted-Cross-Sourcing.

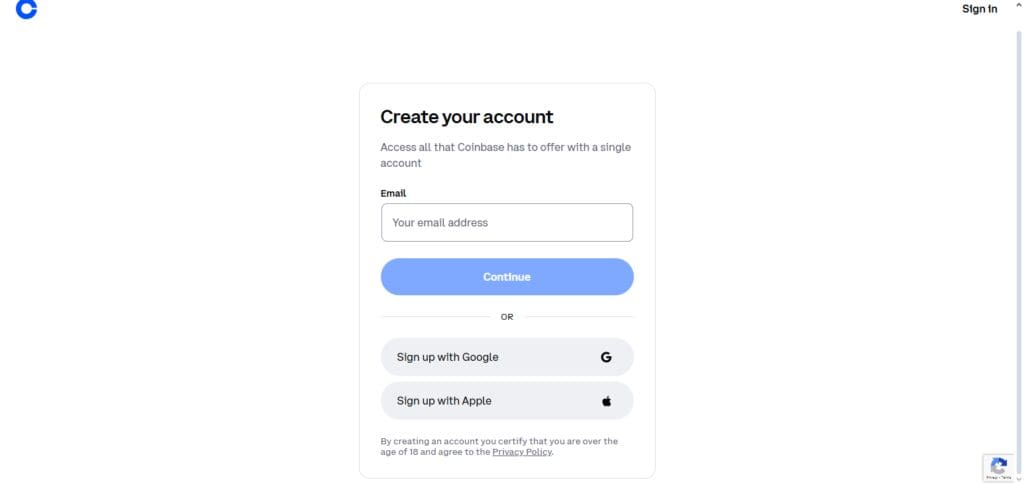

Create and Verify Your Coinbase Account

Visit the Coinbase website and sign up for an account. Then, identity verification will be conducted, in accordance with the law.

Link Your Bank Account

Go to the ‘Settings’ section, choose ‘Payment Methods,’ and input your bank account information. Linking bank accounts is supported on Coinbase, for faster transactions.

Transfer Crypto Assets to Fiat

Sign in to your account with Coinbase On the top part of the screen, click on the “Buy/Sell” tab. Identify the cryptocurrency you want to sell and the amount you want to earn in return.

Select your bank account

Select your bank account from the pre-linked accounts to receive the funds. Detail the Sale and Cash Out Confirm the sale details and finalize the transaction.

The transaction must be allowed time to load.

Depending on the exchange as well as transaction volume, the waiting could take anywhere from a couple minutes to a couple of days.

Add Funds to Your Bank Account

After the funds are made available in the Coinbase account, head to and select Portfolio or Assets, then choose Withdraw or Send.

Withdrawal Amount

Select the desired withdrawal amount and verify the bank account provided. Proceed with the withdrawal request and monitor your bank account for incoming funds.

Methods of Integration

Merger of higher cryptocurrency holdings with your bank account can be achieved in numerous ways which differ in terms of efficiency, speed, and ease of access. Here are some well-known methods:

Crypto Exchanges

Process: Your cryptocurrency holdings can be sold via a wallet on cryptocurrency exchanges; Coinbase and Binance exchanges are examples. Transferring crypto assets turn them into fiat currencies such as euros or US dollars, which after selling the crypto assets can be converted into fiat funds which can be withdrawn to linked bank accounts.

Considerations: Transaction fees, time delays, and the exchange limits on withdrawal needs to be considered.

Crypto Friendly Banks:

Process: Some banks have merged with crypto services or built their own platform to allow direct merger such as Anchorage Digital which do banking for non-fiat assets.

Considerations: Ensure the bank allows for the cryptocurrencies you are holding and the associated fees or requirements.

Crypto Debit Cards

Process: Binance and Coinbase are known for their withdrawal services, however, they also provide debit cards which give you the ability to convert cryptocurrencies into fiat currency when shopping.

Considerations: The card fees, cryptocurrencies which are supported and the area where the card can be used needs to be analyzed.

Peer to Peer platforms:

Procedures: You can sell your cryptocurrency on P2P platforms such as Binance, Paxful, or Localbitcoins for fiat currency. You can later transfer these funds to your bank account.

Steps to take: Be careful in validating buyer reputation and be familiar with how conflicts are settled on the platform- have a solid understanding of the sellers reputation.

Conversion of Stable Coins:

Procedures: Switch your cryptocurrency to stable coins such as USDT and USDC, then use these on platforms that support direct transfer to bank accounts.

Steps to take: Ensure that the platform supports the stable coin you wish to use and check whether there are fees involved.

Solution: There are a few Fintech companies and banks which can offer direct link paiement solutions which enable the merging of crypto assets with traditional bank accounts.

Steps to take: These services are new and emerging, thus will be less available or need more regulation.

Considerations and Risks

The amalgamation of cryptocurrency investments with regular banking systems has its advantages, yet it is still plagued with issues and risks:

Possible Legal Actions and Law Enforcement

Rampant Regulation Changes: The legal boundaries regarding crypto constantly change. Banks need to keep abreast with new policies to avoid breaking the law. The changing environment of regulations is evident in policy changes like the FDIC’s new policy that allows banks to participate in cryptocurrency transactions without prior approval.

Anti-Money Laundering (AML) and Know Your Customer (KYC) Requirements: Fraudulent activities are prone to the use of suspending denial cryptocurrencies. To eliminate the risk of fraud and money laundering that the pseudonymous feature of digital are enables, banks need to focus on impenetrable AML and KYC systems, which are hard to do.

Bank Stability and Corporate Hazard

Unpredictability: One of the prominent features of cryptocurrencies is their price unpredictability. Dramatic changes might destabilize the banks’ balance sheets and be a difficulty for the management of assets and liabilities.

Sweating and Losing Capital: Problems with currency liquidity may present a difficulty for banks that possess digital crypto tokens. It can force a bank to trade its cryptocurrency for fiat currency at a low price, resulting in losses.

Integration Issues: The provision of cryptocurrency services necessiates additional tools, customized software, and supplementary skills, causing operational difficulties.

Security Risks

Cybersecurity Threats: Cyber attacks and hacking are alarming threat to bank as they rely heavily on technology. Digital butest must have strong safeguards to prevent cyberattacks and unauthorized theft of bank assets.

Fraudulent Activities: It is scarcely possible to recover funds back due to the adoption of irreversible transactions working behind cryptocurrency. All institutions and their customers need robust protective means to prevent them from being scammed.

Reputational Risks

Public Perception: The image of a bank can be improved or ruined depending on the way they use crypto assets. While profits and good reputation is not guaranteed, getting well known by tech-savvy population is a plus masking possible negative impacts.

Lack of Trust: Banks have to maintain a certain level of trust and reputational safeguards, meaning that their cryptocurrency policies should be communicated in a way that does not harm their image.

Other Industries and Legal Issues

Defunct Banks: The risk of heavily exposed crypto banks like Signature Bank is clear. Signature Bank had to deal with liquidity problems and a failing bank because of its heavy crypto dependencies.

Action from Authorities: The failure of some banks to manage the oversight over the cryptocurrency transactions due the transactions was sufficient proof of compliance documents framework.

Strategies to Limit Damage

Develop Internal Policies: Policies elaborating on customer engagement, transaction limits, and reporting requirements in relation to cryptocurrency should be developed. ∆

Increase Compliance Training: Advanced anti-money laundering procedures and Know Your Customer policies designed for the currency are required to ensure compliance for these entirely new difficulties.

Put Money Into More Actions: Take appropriate steps to apply more powerful measures to deal with cyber threats and internal transactions using imaginary money.

Conduct Education and Ongoing Training: Continuously educate staff on the dangers that accompany cryptocurrency, its regulations, and security measures.

Participate in Regulatory Engagement: Foster two-way conversations with relevant authorities so that changes to the requirements can be well understood, while also proving concern for compliance.

Conclusion

Linking your bank account with cryptocurrency requires exchanging the digital assets for fiat currency before transferring the funds into the bank account.

Choose credible platforms, comprehend their fees, and comprehend how long the process takes. Banks and cryptocurrency can function together efficiently if these directives are receded by.