In this article, I will discuss the How to Earn Passive Income with DeFi with one of the emerging financial opportunities in crypto, which is DeFi. Users are able to earn an income by staking, yield farming, lending, or liquidity mining without the use of conventional banks.

While it is clear that blockchain has enormous profits, businesses must first comprehend the hazards and tactics to guarantee success.

What is DeFi?

Decentralized finance, or DeFi, describes a financial system that functions on blockchain technology without intermediary institutions like banks or brokers. It uses smart contracts for secure, transparent, interfacer free transactions.

Offering an array of services from lending, trading and borrowing, with crypto assets earning interest, it lets users take advantage of available opportunities.

Empowered by the exclusion of central powers, individuals are able to manage their finances more effectively and to gain greater rewards in return while minimizing dependence on traditional financial systems.

How to Earn Passive Income with DeFi

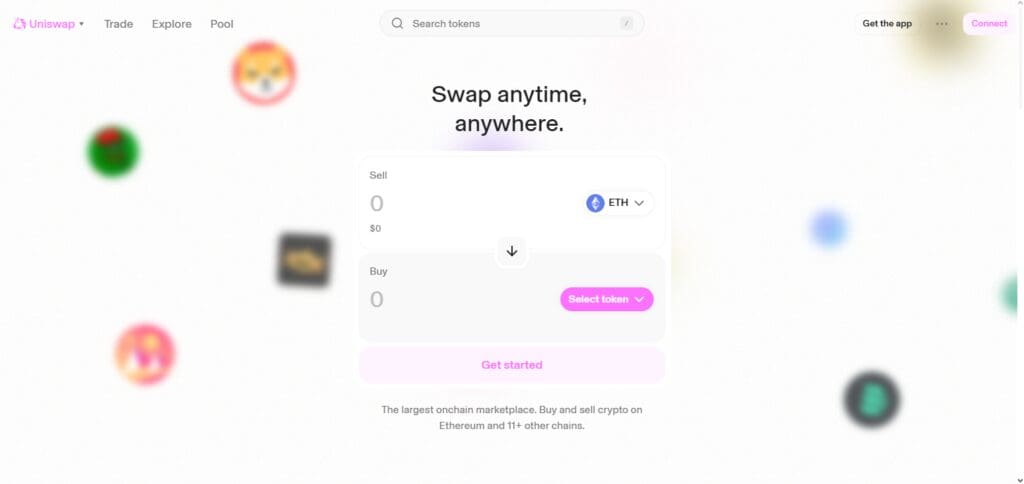

Investing in a cryptocurrency can the if done appropriately. One approach to earning passive income with Cryptocurrency would be by providing liquidity on a decentralized exchange such Uniswap. Here is a step by step example:

Create and Fund Your Wallet

You must create a digital wallet, e.g MetaMask, and buy required cryptocurrencies such as ETH and a stablecoin like USDC. Make sure you have adequate funds for both coin types for transactions.

Download the app for Uniswap or navigate to the website

Launch Uniswap app and make sure to link your wallet first. That enables the platform to set up a secure link between your wallet and the service.

Select a liquidity pool

Head over to “Pool” and click on ETH/ USDC trading pair. After selecting, you can deposit equal quantities of both tokens to the pool.

Providing Liquidity

Specify the amount you want to deposit in both tokens within the pool. In exchange for providing liquidity, you are given LP (liquidity provider) tokens.

Accumulating Passive income

Each time a user swaps either ETH or USDC in the pool, cashing out a certain liquidity fee, implies while you have a share within the pool for passive income, you will be receiving that bonus along with you share fees. Pay over time to see these collected fees as a source of passive income.

Keep an Eye on and Manage Risks

Routinely review your LP position so you can keep track of the possible dangers, such as impermanent loss, and adjust your approach accordingly.

Best Earn Passive Income with DeFi

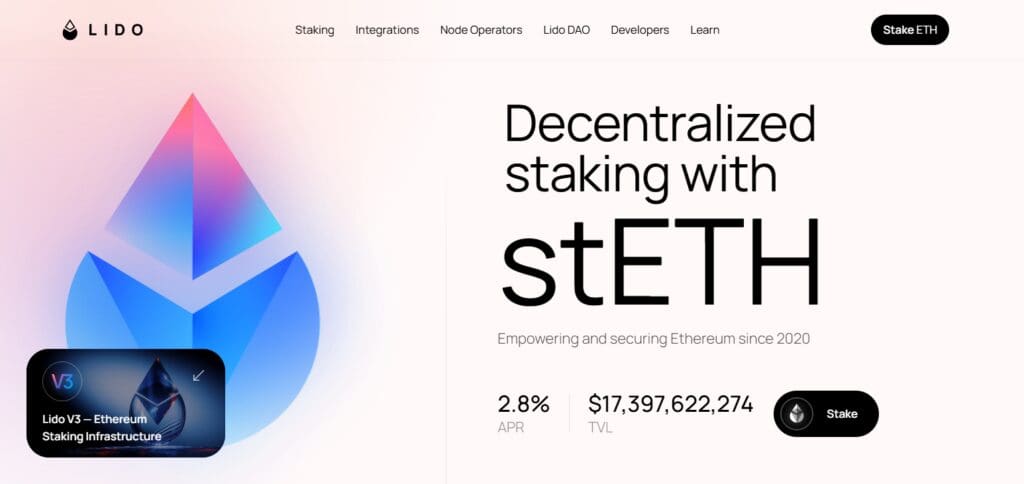

Lido Finance

Lido Finance, one of the leading DeFi platforms, allows users to earn passive income through liquid staking. Unlike the traditional method of staking, Lido lets users stake their assets like Ethereum and remain liquid through stTokens ( for example, stETH).

This allows users to participate in DeFi while passively earning staking rewards. In addition, Lido’s innovative approach makes it easier to earn passive income through DeFi by eliminating the minimum stake amount as well as bypassing any complex technical configurations.

PancakeSwap

PancakeSwap is an emerging Decentralized Finance (DeFi) platform on the Binance Smart Chain (BSC) where users can earn passive income through yield farming and liquidity provision.

Its specialization is in allowing CAKE token holders to stake the tokens in Syrup Pools and earn additional rewards. PancakeSwap has more competitive fees than traditional exchanges and much quicker transactions, which is a great way to passively earn money without straining one’s time in the DeFi sector.

Risk & Management

Risk

Smart Contract Vulnerabilities: The underlying code can be vulnerable or susceptible to bugs and exploits which may cause a loss of funds. In order to mitigate this risk, make sure that the paltforms posses an audited smart contracts and have reputable standing in the market.

Impermanent Loss: When providing liquidity in decentralized exchanges, there are times when the price of the paired assets may fluctuate. This may result in losses. A good way to manage the risk is by diversifying assets and using stable coins.

Platform Risks: Some platforms may be Defi compromised or hacked. Always look for stronger and well known platforms with good security protocols and insurance coverage.

Regulatory Uncertainty: The changes and modifications to DeFi regulation can have an impact on your investments for the worse. Make sure to know about the regulatory changes in your country.

Management Tips

Diversification: Split your investments with multiple platforms not just one.

Risk Assessment: Every so often review and change strategies so that they resonate with the dynamic market.

Start Small: Take a gradual and cautious approach. Make one small investment at first and build up slowly as time goes on and your experience grows.

Best Practices for Maximizing Passive Income

Invest in Different Areas

Allocate your assets on different DeFi strategies (such as staking on multiple platforms, yield farming, lending, etc.) in order to maximize profit and minimize risks.

Pick Credible Platforms

Always make use of reputable platforms with good security. Always check if the smart contracts are audited. Do not use platforms that have not been tested or are high risk, no matter how attractive their offers may be.

Track Your Investment Performance

Most DeFi markets are successfully unpredictable. Check if your investments are progressing, and if the strategies you are employing are fitting to the current market context.

Deposit Your Income to Make More Money

Passive income can be multiplied by depositing back into other staking or liquidity pools, subsequently increasing your returns from total income and growing your deposits.

Maintain Your Portfolio With Stablecoins

Having the ability to minimize risks is important, so in environments with high risk, using stablecoins for staking or lending can reduce the volatility of your assets while still creating passive income.

Educate Yourself and Set Risk Thresholds

Establish a maximum amount for which you are willing to get exposed to any asset or portal. Try staying up to date concerning the changes in DeFi, and accordingly prepare your plans.

Utilize Features That Automatically Reinvest Earnings

Without putting in tedious effort, you can guarantee strong returns when you take advantage of platforms that automatically reinvest your smart contracts earnings without requiring any aid.

Begin With Small Steps and Increase in Continuity

Make smaller investments at the begining to lessen risk while you are learning. With experience and confidence, increase your investment over time.

Pros & Cons

| Pros | Cons |

|---|---|

| High Earning Potential: DeFi offers the possibility of higher returns compared to traditional finance. | High Risk: DeFi investments are volatile, and there are risks like smart contract bugs and platform vulnerabilities. |

| Decentralized: Removes intermediaries, giving users more control over their assets. | Regulatory Uncertainty: The evolving regulatory environment for DeFi can introduce unexpected risks. |

| Access to Global Markets: DeFi platforms are accessible to anyone with an internet connection. | Complexity: The DeFi ecosystem can be overwhelming for beginners, requiring a learning curve. |

| Transparency: Transactions are recorded on the blockchain, offering transparency and security. | Impermanent Loss: Liquidity providers may face losses if the price of assets in a pool fluctuates. |

| 24/7 Availability: DeFi platforms are always accessible, allowing users to earn passive income anytime. | Smart Contract Risks: Bugs or exploits in code can lead to loss of funds. |

| Diversification Options: Numerous platforms and strategies (staking, yield farming, lending) provide ample opportunities for diversification. | Liquidity Risks: Some DeFi platforms may lack sufficient liquidity, affecting withdrawal times and rates. |

Conclusion

In conclusion, Decentralized Finance (DeFi) has an amazing chance for passive income through staking, yield farming, lending, and liquidity mining.

While rewards can be abundant, understanding the risks such as smart contract weaknesses, impermanent loss, and platform security issues is critical.

One can maximize profits while minimizing risks by diversifying investments, using reputable platforms, and staying informed. With a solid strategy, DeFi has the potential to foster financial growth and wealth development over time.