In this post, I will explain how to open a fiat-to-crypto exchange account which is one of the most important things an individual has to do when they want to purchase cryptocurrency using traditional currency such as USD, EUR or INR.

From selecting an appropriate platform to undergoing identity verification and account protection, this guide ensures that you don’t miss any vital steps in starting your crypto journey securely.

What is a Fiat-To-Crypto Exchange?

A fiat-to-crypto exchange is a crypto currency exchange platform where users can buy cryptocurrency using traditional currencies like the US dollar , Euro, Indian rupee or any other.

These exchanges serve as a link between the conventional finance world and cryptocurrency technologies enabling people to change real money into virtual currencies such as bitcoin, ethereum, or even stablecoins.

Users can use payment methods such as wire transfer, credit card, debit card, or even mobile wallets to add funds in their account.Easily convertible fiat accounts remain fully integrated and Binance , Coinbase , Kraken and Bitstamp are some of the most popular exchanges of this type .

For most users, completing a KYC process is optional. They support identity verification (KYC)and have simple interfaces that make them very easy to use for beginners who want to learn about cryptocurrency.

How To Open A Fiat-To-Crypto Exchange Account

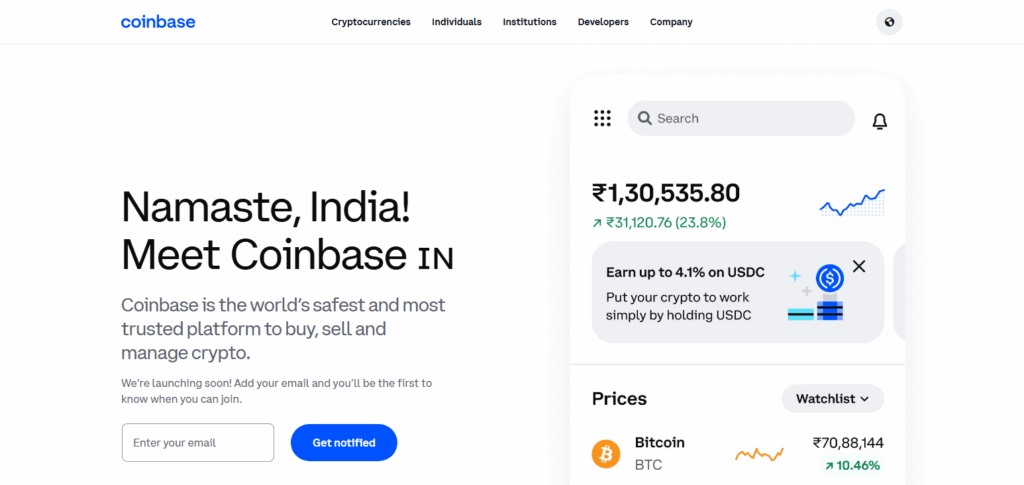

Example: How to Open A Fiat-To-Crypto Exchange Account on Coinbase

Step 1 : Use The Website or Download the Application

To begin, simply navigate to www.coinbase.com or download the Coinbase app from the App Store and Google Play.

Step 2: Go through User Registration

- On the top right click “Get Started”

- Give your name, email, and create a secure password

- Check your inbox for a verification link to confirm your email.

Step 3: Know Your Customer (KYC) Verification.

As Coinbase is a licensed company, KYC verification needs to be done.

- Upload a government-issued ID (passport, driver’s license, or national ID) * Provide a selfie and evidence of residency (like utility bills or bank statements) * Verifications usually take minutes up to 24 hours

Step 4: Add A Payment Method

- Select payment methods such as a bank account, debit/credit card, or UPI (in some regions) * Link your payment method and complete verification as per instructions on-screen

- Bank transfer often has lower fees compared to card payments which are faster.

Step 5: Deposit Fiat Currency

- Go to the “Buy/Sell” or “Assets” sections.

- Choose the appropriate fiat currency along with proposed amount.

- Complete the transfer process through your linked payment method.

Step 6: Buy Cryptocurrency

- Select any cryptocurrency of your choice( BTC, ETH.)

Enter desired amount then confirm order placement. Your purchased crypto will automatically appear in your Coinbase wallet .

Security Tips Open A Fiat-To-Crypto Exchange Account

- Enable 2FA: Add two-factor authentication for extra login security.

- Use Official Apps/Websites: Avoid phishing by using verified sources only.

- Secure Email & Devices: Use strong passwords alongside up-to-date software.

- Avoid Public Wi-Fi: Never access your exchange account on open networks.

- Cold Storage: Exceptionally advised not to store crypto on exchanges, instead utilize cold wallets.

- Backup Wallets Offline: Securely keeping wallet backups ensures safety from online threats and hacking.

- Monitoring Account Activity: Frequent checks for unauthorized logins or suspicious activity can help keep accounts safe.

Common Mistakes to Avoid

- The Dangers of Using Unregulated Exchanges: There is a risk posed by missing licenses—scams or loss of funds.

- Blocked withdrawals and frozen accounts for providing fake information during KYC processes.

- Ignoring the outlined fee structure may result in concealed trading, deposit, or withdrawal fees which could diminish profits.

- Concerning withdrawal limits, not some accounts come with daily limits or lock-in periods—be aware beforehand.

Pros and Cons of Opening a Fiat-to-Crypto Exchange Account

| Pros | Cons |

|---|---|

| Easy entry into crypto — Allows users to buy crypto using fiat currencies like USD, EUR, INR. | KYC required — Identity verification can feel invasive or time-consuming. |

| Beginner-friendly platforms — Many exchanges offer intuitive interfaces and tutorials. | Limited privacy — Personal data is stored by centralized exchanges. |

| Multiple payment options — Supports bank transfers, credit/debit cards, UPI, etc. | Bank restrictions — Some banks block or delay crypto-related transactions. |

| Regulated and secure — Licensed exchanges follow strict compliance and safety protocols. | Not fully decentralized — Users don’t have full control of private keys. |

| Quick access to popular cryptocurrencies — Easy to trade BTC, ETH, USDT, and more. | Fees may apply — Includes trading, deposit, withdrawal, and currency conversion fees. |

| Supports fiat withdrawals — You can cash out crypto back to your bank account. | Regional limitations — Some exchanges may not be available in certain countries. |

| Higher trust factor — Backed by legal frameworks and institutional partnerships. | Withdrawal limits — May restrict daily withdrawal amounts, especially before full verification. |

Conclusion

In conclusion, just like any other simple but important venture starting an account in a crypto exchange that allows fiat currency is as essential step towards cryptocurrency entry.

Register with a trusted exchange provider, do the KYC process, add your payment account, and enable two factor authentication for added protection. Avoid getting scammed or losing money by understanding various fees, prioritizing security and avoiding common blunders.

FAQ

How long does verification take?

KYC verification usually takes from a few minutes to 48 hours, depending on the platform and the accuracy of your documents.

Is there a minimum deposit amount?

Yes, exchanges usually have minimum deposit limits which vary by currency and payment method. Check the specific platform’s terms.

Are fiat-to-crypto exchanges safe?

Leading platforms implement strong security measures like two-factor authentication (2FA), cold wallet storage, and encryption. Always enable 2FA and avoid keeping large balances online.