This article will explain How to Receive International Payments as a Solopreneur, focusing on the most efficient ways, systems, and methods to collect payments from global customers seamlessly.

You will understand how to select the appropriate systems, control costs, implement invoicing best practices, and facilitate quick, safe, and compliant cross-border payments for your solo venture.

What is International Payments?

International payments are transactions where funds are sent or received to and from different countries and in different currencies. These payments enable freelancers and businesses to interface with their clients around the world and receive payments safely.

International payments usually consist of currency conversion and use of banking systems like SWIFT and digital systems like PayPal, Wise, Payoneer, or Stripe. They often consist of processing times and costs like transfer fees, exchange-rate charges, and other costs which vary depending on the method used.

For most freelancers, the ability to comprehend international payments is critical to ensuring a seamless cash flow, lowering transfer expenses, and offering clients convenient payment options. This helps to improve their income potential and maximizes their reach.

How to Receive International Payments as a Solopreneur

Example: How a Solopreneur Receives International Payments (Step-by-Step)

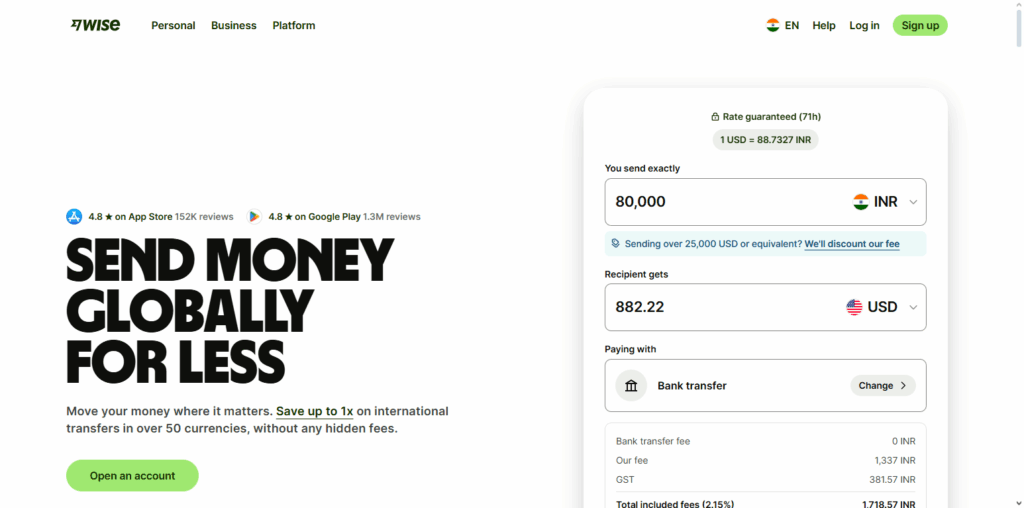

Step 1: Create a Wise Business Account

A solopreneur signs up on Wise and completes the basic KYC verification using ID proof and business details, ensuring the account is ready to receive the global payments.

Step 2: Generate a Multi-Currency Receiving Account

Within Wise, they open receiving accounts in various currencies (USD, EUR, GBP) and Wise provides local bank details (account number, routing number, IBAN etc) for those currencies.

Step 3: Send Your Payment Details to the Client

The solopreneur provides the US client their Wise USD account number and payment instructions which makes the client payment as a local transfer with no international payment issues for them.

Step 4: Client Sends the Payment

The US client completes the transaction, for example $800, and Wise processes the payment to the solopreneur’s Wise USD account. The payment is completed instantly or within a few hours.

Step 5: Verify the Balance in Wise

The solopreneur looks at the balance in Wise USD accounts to see if payments reflect. At this stage, there are no additional bank charges or hidden FX costs.

Step 6: Convert the Currency at Competitive Rates

The solopreneur uses Wise to convert the USD to INR (or relevant currency) at competitive market equilibrium rates and minimal costs.

Step 7: Transfer to Local Bank Account

The balance is sent to their Indian bank account, arriving in a few minutes to a few hours.

Step 8: Send & Mark Invoice as Paid

The solopreneur adjusts their invoice (created with Zoho Books, QuickBooks, or some other software) and indicates the payment has been received.

Step 9: Record for Accounting & Taxes

Wise transaction details are kept for bookkeeping, tax purposes, and income reporting.

Best Methods to Receive International Payments

PayPal

PayPal stands out as one of the premier options for receiving international payments because it is secure, quick, and universally accepted by customers in over 200 countries. One of the best features for solopreneurs is the ability to send professional invoices and receive payments in seconds without the hassle of sharing bank account information.

PayPal’s automatic fund conversion and strong buyer and seller protection features encourage clients to do business. PayPal’s integration with several online tools, security, and easy withdrawal options further enhance their value for global payments. PayPal’s universal acceptance guarantees there are few restrictions for clients when it is time to pay, enabling fast deals.

Stripe

Stripe stands out as an ideal option for international payments as it enables solopreneurs to manage global credit cards, digital wallets, and recurring payments. The option to integrate with ease with websites, landing pages, and invoicing tools to provide clients with an automated and streamlined payment interface is a big plus.

With over 135 supported currencies, automated conversions, and global clients, Stripe makes international business payments a breeze. When it comes to payment management, solopreneurs can appreciate Stripe for its advanced payment management tools, custom solutions, and transparent pricing. Features such as automated payouts and subscription billing enhance Stripe’s capability for expanding income on a global scale, making it a complete tool for payments.

Payoneer

Payoneer provides exceptional service for receiving payments and offers prospective users virtual receiving accounts for different currencies USD, EUR, GBP and more, allowing users to get paid as if they had a local bank account in multiple countries.

Receiving payments in different currencies helps customers in different countries pay without hassle, and cross-border payments are cheaper and quicker. Solopreneurs also gain direct access to customers across the world, as Payoneer is a common method of payment for global agencies, freelancing platforms and marketplaces.

Payoneer is also secure, offers reliable and ready to assist customer support, and provides effortless Payoneer is also secure, offers reliable and ready to assist customer support, and provides effortless global connectivity.

Compare Fees, Exchange Rates & Transfer Speed

| Provider | Fees | Exchange Rate / FX Markup | Transfer / Payout Speed |

|---|---|---|---|

| PayPal | ~4.40% + fixed fee for receiving cross-border payments (for India) ( | ~3–4% above the base (mid-market) rate when converting currencies | Instant to a few hours for PayPal balance; withdrawal to bank takes ~1–2 days (varies) |

| Wise (formerly TransferWise) | Very low fees; for some routes as low as ~0.1% + small fixed part | Uses the real mid-market (“real”) exchange rate | Usually lightning fast — many transfers arrive within seconds or a few hours. |

| Payoneer | – Free when receiving from another Payoneer user Up to ~3.99% + $0.49 for credit-card payments | Exchange rates are typically a markup (varies). Some users report ~2% below mid-market (depends on currency). | Withdrawals to local bank: for India, Payoneer says payments reach local bank within 48 hours. |

| Stripe | – 2.9% + $0.30 for domestic card payments (standard) – +1.5% for international cards + 1% for currency conversion | Currency conversion (FX) fee typically +0.5% or more depending on the currency and cross-border flow. | Payout to bank: cross-border payouts depends on country; Stripe supports global payouts but timing depends on local banking rails. |

Invoicing for International Clients

Client & Business Details: Include your client’s details and contact information for clarity and professionalism when preparing an invoice.

Currency Specification: Always indicate whether the invoice is in USD, EUR, GBP, etc., to prevent confusion and short payment issues.

Payment Terms: Specify the payment method, the due date, and rules for late payment penalties.

Tax & Compliance Information: Cross-border invoicing includes taxes like GST or VAT; ensure to inform the client of any tax regulations applicable.

Itemized Services: Provide a detailed breakdown of services for clarity and to justify the amount invoiced.

Payment Links: Include direct payment buttons to streamline the payment process and minimize delays.

Professional Invoicing Tools: Use invoicing applications like Zoho Books, FreshBooks, QuickBooks, or Wave for automation of reminders and record keeping.

Conversion or Transfer Fees: Indicate if transaction fees will be covered by the client or by you.

Signature & Notes: Notes are important for transparency; ensure all contracts are referenced and other special instructions are included.

Set Up Reminder Notifications: Automate overdue invoice follow-ups for cash flow management without needing manual reminders.

Tax & Compliance Considerations

Maintain Accurate Income Records: For tax filing purposes, document every international payment, including invoices, transaction IDs lists, and bank statements.

Understand Foreign Income Tax Rules: Foreign income is taxed differently. Determine whether income is fully taxable, partially exempt, or needs special reporting.

Know the Applicability of GST/ VAT: For service-based solopreneurs, cross-border services can be subject to GST or zero-rated tax based on local legislations (e.g., India’s IGST on export services).

Report Foreign Remittances Properly: Avoid issues regarding FIRA/FIRS and bank declarations or income reporting to ensure proper reporting on remittances received.

Review Double Taxation Avoidance Agreements (DTAA): If clients based in other countries deduct tax, there are DTAAs that can relieve or zero tax you.

Retain Contracts & Agreements: Legal contracts are necessary for proof of work, payment terms, and compliance during audits.

Fulfill KYC/AML Obligations: Payment systems (e.g. PayPal, Wise, Payoneer, Stripe, and Stripe) need ID to meet anti-money laundering legislation.

Convert Currencies Legally: Ensure your foreign currency exchanges are done through authorized banks and legal.

Timely Filing of Taxes: Avoid penalties by keeping track of deadlines for filing income tax, GST, annual returns, and other business compliance.

Security Tips for Receiving International Payments

Use Trusted Payment Platforms

Choose safe established services like PayPal, Wise, Payoneer and Stripe to avoid fraud as much as possible.

Turn on Two-Factor Authentication (2FA)

Activate 2FA on all your payment and email accounts to prevent others from accessing your accounts.

Don’t Share Sensitive Information

With clients, never share your bank logins, card numbers, or passwords. Just give them the payment information they need.

Verify Your Clients

For new clients, especially if you are going to receive a large payment, confirm their email and check their business profile or website.

Secure Payment Links

Instead of accepting random payment links or screenshots, always make payment requests or invoices from your platform.

Overpayment Scams

Scammers might send you over the required funds and ask for some to be refunded. Always check the source of funds before returning overpayments.

Regularly Check your Statements

Checking your statements often will allow you to see and report any suspicious activity.

Use Current Software & Devices

our phone, laptop, browser and your security software (antivirus and firewall) should all be up to date.

No Public Wi-Fi for Transactions

Financial activity should only be done on secure, private networks.

Maintain Secure Financial Records

Financial documents such as invoices, agreements, and transaction details should be stored encrypted or in secured facilities and

Best Practices to Get Paid Faster

Set Defined Payment Terms Beforehand

Both payment methods and due dates should be agreed to before starting on any work and before the project payment late-fees start accumulating.

Ask For Upfront Deposits

Request 30–50% of the total payment as a deposit to guarantee commitment and improve cash flow.

Invoice Sooner Rather than Later

Once you finish a project, don’t wait to send the invoice; do it immediately, as it helps with cash flow.

Set Automatic Reminders

Decrease the number of times you have to do a check-in yourself by automating reminders on Zoho Books, FreshBooks, and QuickBooks.

Provide Fast Payment Methods

Global payment systems such as PayPal, Wise, Payoneer, and Stripe, as well as standard wire transfers.

Encourage Early Payments

Provide a small discount (2% for example) for payments done before the due date.

Invoicing By Milestones Is A Great Idea

Smaller invoices are much easier to process, and as a result, are approved quicker.

Be Professional

Be polite and firm when overdue payment reminders are due.

Provide Invoice Payment Instructions

Payment currency, links, and payment fee ownership should all be stated together. Empty payment instructions are a great way to delay payments.

Conclusion

As a solopreneur, receiving international payments can be easy as long as the best practices are put in place, there are well defined procedures, and the basic rules of international payments are followed.

PayPal, Wise, Payoneer and Stripe are safe and dependable for getting paid within a reasonable timeframe and from any place in the globe. Professional invoicing, record keeping, and compliance with regulations and taxation will promote a global payment system in a workflow.

In the end, it is best to be well organized and systematic with payment flexibility, and to implement comprehensive and effective payment system security. This will enable receiving payment from international clients, avoiding needless complication and anxiety.

FAQ

Which method has the lowest fees for international payments?

Wise typically offers the lowest fees and the most transparent exchange rates, making it cost-effective for solopreneurs.

What is the easiest way to receive international payments as a solopreneur?

Using platforms like Wise, PayPal, Payoneer, and Stripe is easiest because they offer fast transfers, simple setup, and global client acceptance.

Do I need a business account to receive international payments?

Not always. Platforms like PayPal and Wise allow personal or freelancer accounts, but business accounts often provide better features and higher limits.