In this article, I will discuss how to route Bridging Aggregator Fees to Treasury. Managing fees properly is vital for transparency, security, and optimized fund allocation in DeFi projects.

I will examine step-wise approaches, best practices, challenges, and the automation of fee routing, all aimed at helping projects securely and cost-efficiently consolidate their revenue and treasury operations.

Understanding Bridging Aggregator

A bridging aggregator is a DeFi protocol that connects multiple different blockchain networks for seamless token transfers across chains. Users interacting with different bridges is time-consuming. A bridging aggregator combines different sources of liquidity to create a more effective bridge for asset transfers from some sources.

This greatly decreases the transaction cost and time as well as the chances of a transfer failing. Multi-chain operations of DeFi projects become more seamless with bridging aggregators as users simplifies cross-chain transactions and automates route selection.

How to Route Bridging Aggregator Fees to Treasury

Example: Routing Fees from a Bridging Aggregator to a DAO Treasury

Step 1: Identify Fee Collection Points

- Identify fee collection points from your bridging aggregator (aka per transaction, gas surcharge, service fee, etc.)

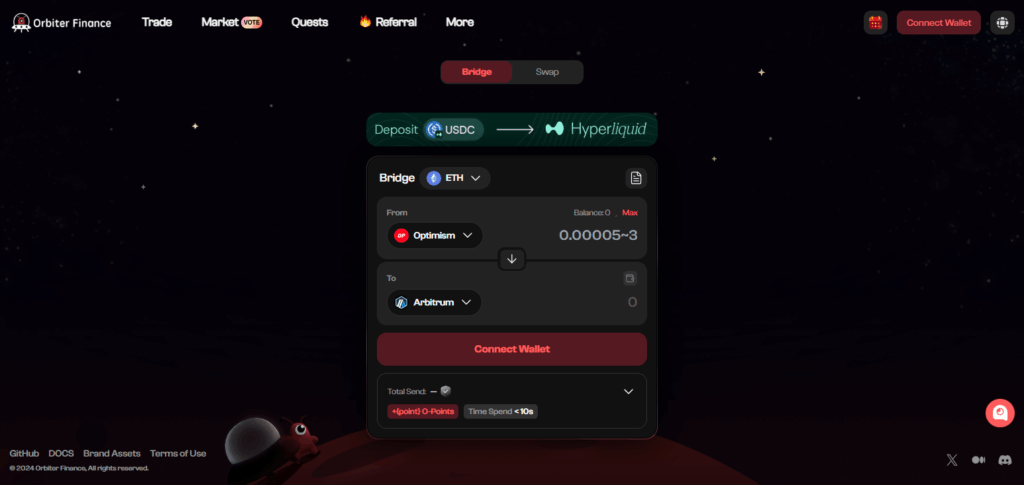

- Example: Users that use Orbiter Finance get charged by Orbiter Finance for every cross-chain transfer.

Step 2: Deploy a Treasury Wallet

- Set up a treasury wallet (preferably a multi-signature wallet) that is secure and will hold all aggregated fees.

- Example: Gnosis Safe wallet on Ethereum.

Step 3: Include a Smart Contract for Automatic Fee Routing to Treasury Wallet

- Rout fees to treasury wallet directly from the treasury contract by modifying the aggregator smart contract.

- Always deploy smart contract on a testnet before mainnet.

Step 4: Set Routing Rules

- Set automated transfer thresholds (example route fees > 0.5 ETH) lowers gas and avoids need for many small payments.

- Will help improve overall gas and transaction fee efficiency.

Step 5: Monitor and Audit Transfers

- Verify that the fees are routed properly and on time to track them use Etherscan, Dune Analytics and custom dashboards.

- Set rules or a chain of steps for easier tracking of payment which will help improve gas and transaction fee efficiency overall.

Step 6: Optimize Gas and Cross-Chain Costs

- When you are able, assemble payments and batch them to improve gas efficiency.

- When crossing several chains simultaneously, make use of low-cost bridges or low-cost optimizers.

Step 7: Look Over and Change Where Necessary

- From time to time, examine and modify the smart contract conditions and the stepping stone threshold depending on the state of the network and recent updates from the aggregator.

Importance of Routing Fees to Treasury

In DeFi operations, the routing of fees from a bridging aggregator to a treasury is vital for effective fund management while ensuring security and transparency. The collection of fees routed to the treasury of a project enables the efficient management of the project’s revenue, enhancing the budgeting while funding the project’s development and governance activities.

This would also eliminate revenue loss and guarantee full collection of monitored fees, thus, satisfying accountability to the stakeholders. Moreover, fee routing management assists in the automized and accurate transfer of the funds, thus minimizing manual computation, which is a major problem in a DeFi ecosystem.

Best Practices for Efficient Fee Routing

Automate Transfers: Manual errors can be reduced by using smart contracts or treasury management tools to automatically route fees.

Set Transfer Thresholds: Specifying minimum amounts for autonomous transfers, to avoid periodic micro transactions frequence and save on gas, is a smart move.

Use Secure Treasury Wallets: Using multi-signature wallets to improve defense and stop unauthorized use is better practice.

Monitor and Audit regularly: To ensure accuracy, fee transfer reconciliations with aggregator reports should be done regularly.

Optimize Gas Costs: Minimal gas fees can be achieved by either batching multiple fee transfers or using gas efficient bridges.

Cross Chain Planning: for multi chain dealing, use optimized routes or aggregators for reduced delays along with better costs.

Maintain Transparency: For governance and stakeholder purposes, complete and clear records should be kept on all fee routing.

Risk & Considerations

Smart Contract Errors: Bugs or exploits in aggregator contracts or treasury contracts can cause loss of funds.

High Network Fees: Repeated transfers can lead to extremely high gas fees and lower net revenue.

Cross-Chain Complexity: Fees that must be paid across different blockchains can incur additional time, failed transactions, or higher fees.

Centralization Risks: A treasury wallet that is not secured can become of interest to cybercriminals.

Threshold Errors: Incorrectly automated transfer thresholds can cause delay in fee collection or tiny transactions to be made.

Regulatory Compliance: Depending on where routing and holding accumulated fees occurs, there may be financial regulations to follow.

Monitoring and Auditing Needs: Without regular examination, fees that are lost or sent in error can be ignored.

Future of Fee Routing in DeFi

Fee management in DeFi is expected to have a greater focus on automation, cross-chain efficiency, and safety. New protocols and smart contracts facilitate real-time automated routing of aggregator fees to treasuries with almost no human involvement.

Multi-chain treasury management systems have improved in their ability to consolidate fees across different networks with lower gas costs. In addition, sophisticated monitoring systems and analytic dashboards will enhance accountability and transparency, making it easier to track all movements of fees.

The innovations that DeFi has to offer, will ease and enhance speed, and lower costs of fee routing within DeFi in a safer way, thus reinforcing financial foundations of decentralized systems.

Pros & Cons

| Pros | Cons |

|---|---|

| Ensures transparent and accurate revenue tracking. | Smart contract vulnerabilities can lead to fund loss. |

| Centralizes funds for easier treasury management and budgeting. | High network/gas fees if transfers are frequent or small. |

| Enables automation and reduces manual errors. | Cross-chain routing can be complex and prone to delays. |

| Supports governance and stakeholder accountability. | Single wallet or mismanaged keys can pose security risks. |

| Reduces revenue leakage and enhances operational efficiency. | Regulatory compliance may require additional record-keeping. |

| Facilitates batching and cost optimization strategies. | Misconfigured thresholds can delay or over-trigger transfers. |

Conclusion

In summary, collecting bridging aggregator fees to a treasury can prevent DeFi ecosystems from losing funds while ensuring the fees are managed with maximum accountability and transparency.

Smart contracts, treasury automation, and multisig smart contract wallets can automate the entire process of smart contract treasury fee collection.

Fee transmutation thresholds, active fee transmutation, active fee transmutation, and cross-chain fee collection are post-gatekeeping best practices. As the DeFi space continues to expand, smart and efficient routing of treasury fees enhances the ecosystem’s accountability while improving the health of other decentralized funds.

FAQ

Why should fees be routed to a treasury?

Routing fees to a treasury ensures transparent fund management, prevents revenue leakage, and allows proper budgeting for development and governance.

How can I secure the treasury wallet?

Use multi-signature wallets, store private keys securely, and regularly monitor transactions to prevent unauthorized access.

How often should fees be transferred?

Transfers should balance efficiency and cost—typically when a minimum threshold is reached to reduce gas fees and transaction costs.