In this article, we will talk about How to Sell Crypto in India in 3 Steps by leading you through each stage.

Whether a rookie or an experienced dealer, it is easy to sell your digital assets for INR safely.

We are going to examine the main stages involved so that you can quickly and conveniently turn your crypto into hard cash.

How to Sell Crypto in India in 3 Steps

If you follow these three steps, then Selling cryptocurrency in India can be uncomplicated.

Choose a Trusted Crypto Exchange

Select a reliable exchange like CoinDCX. Ensure the platform has strong security measures, a user-friendly interface, high liquidity, and compliance with Indian regulations.

Transfer Your Crypto to the Exchange

Move your cryptocurrency from your wallet to your exchange account.

This usually involves logging into your exchange account, selecting the cryptocurrency you wish to sell, and transferring it to the provided deposit address.

Sell Your Crypto

Once your crypto is in your exchange account, you can sell it for INR. Place a sell order on the exchange specifying the amount and price.

After this transaction is completed, you are free to withdraw INR into your bank account.

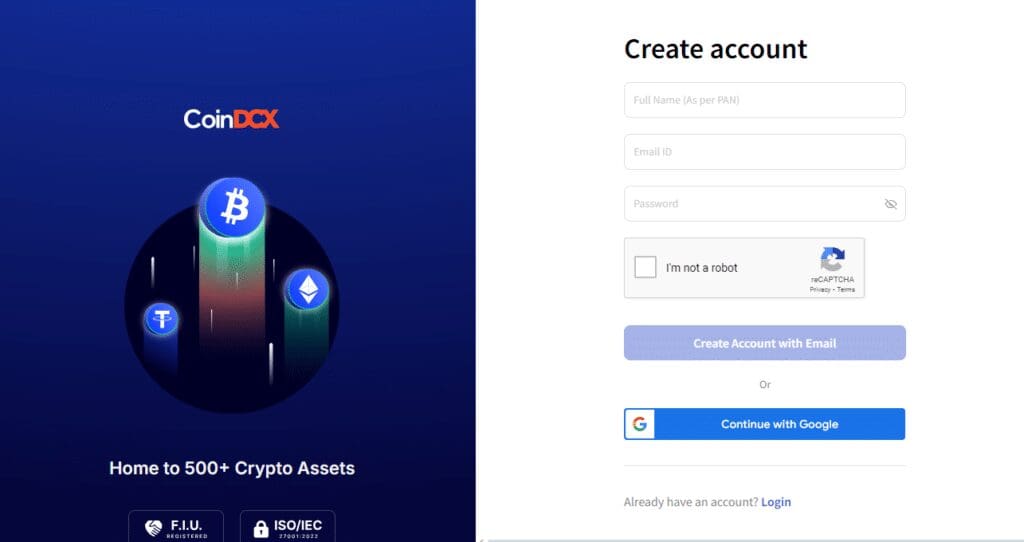

How to sell crypto on CoinDCX

- Sign in to your CoinDCX account.

- Recurrent to the Menu, select “Funds”.

- Pick a cryptocurrency to exchange.

- Hit the “Sell” option.

- Indicate whether it’s a “Market Order” or “Limit Order” type.

- State the total quantity to be sold.

- You shall check these details again before proceeding.

- Press Sell to complete the transaction.

- Make sure to check the newly credited balance.

- (Optional) Move the money out to the bank account.

How to Find a Safe Crypto Exchange

It is very important to choose the right cryptocurrency exchange in order to ensure safe and hassle-free selling.

In India, there are a growing number of exchanges; therefore, you must conduct thorough research and look at the following factors:

Security

Exchanges with strong security measures like two-factor authentication (2FA) and cold storage of funds should be sought.

By having a solid security history, your holdings will be shielded from potential online threats.

User-friendly Interface

Go for an exchange that has an easy-to-use interface. This makes the process of selling easier, especially if you are new to trading digital currencies.

Liquidity

When an exchange has high liquidity, it means that one can quickly sell their crypto coins into Indian Rupees (INR) at reasonable market prices without experiencing any significant price volatility.

Regulation and Compliance

Choose an Indian-compliant exchange with transparent policies. This helps protect your rights as a user while ensuring the legality of your transactions.

Customer Support

At times, you may require platforms with customer support services that respond quickly during the sale process.

You can find more about the best crypto exchanges in India, but for now, let’s look at how to sell crypto on the three most popular ones – starting with transferring your wallet holdings down to your chosen platform.

Is it Legal to Buy & Sell Crypto in India?

Crypto trading is allowed in India, and 15 million people are investing in digital currencies in the country.

The United States has 23 million investors. But on the other hand, Indian authorities have expressed a clear-cut anti-crypto attitude.

In the meantime, a new bill suggests making the possession of cryptocurrency illegal.

Bill has not yet been passed, but this uncertainty worries Indian traders a lot.

The government plans to establish control over the cryptocurrency market while introducing the CBDC (Central Bank Digital Currency) model, which should be completed within this year’s end – Phase One.

Conclusion

To conclude, it is not that difficult in India to sell your cryptocurrency in 3 simple steps.

Initially, make sure you have chosen a trustworthy cryptocurrency exchange which supports INR withdrawals.

The next step involves depositing the digital currency into the exchange and converting it into Indian rupees.

Finally, you can withdraw your funds from the bank using this method.

By doing so, you can quickly convert your crypto-assets into local currencies with simplicity.