In this post, I will discuss the How to Short Altcoins Using DeFi. Shorting is a trading technique used to profit from an anticipated decline in the price of a cryptocurrency, while DeFi offers a more convenient option than Traditional exchanges.

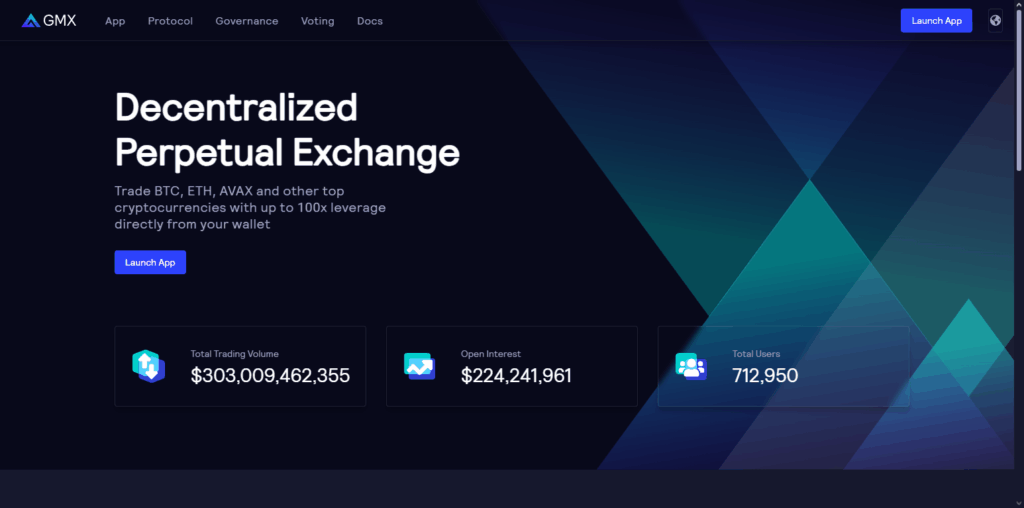

This dYdX and GMX powered guide will provide you all the tips and advice needed to safely carry out risk free shorting of altcoins on DeFi platforms.

What is Short Altcoins?

Shorting altcoins is a form of trading in which investors wager on the decline in value of an altcoin. Unlike traditional methods of buying low and selling high, here, traders first borrow an altcoin, sell it at the current price, and then aim to buy it back later when it’s cheaper to return the loaned altcoin and pocket the difference.

This strategy works best during bearish markets. While there are profits to be made from shorting trades, they come with substantial risk due to potential losses resulting from rising prices instead of the expected fall.

How to Short Altcoins Using DeFi

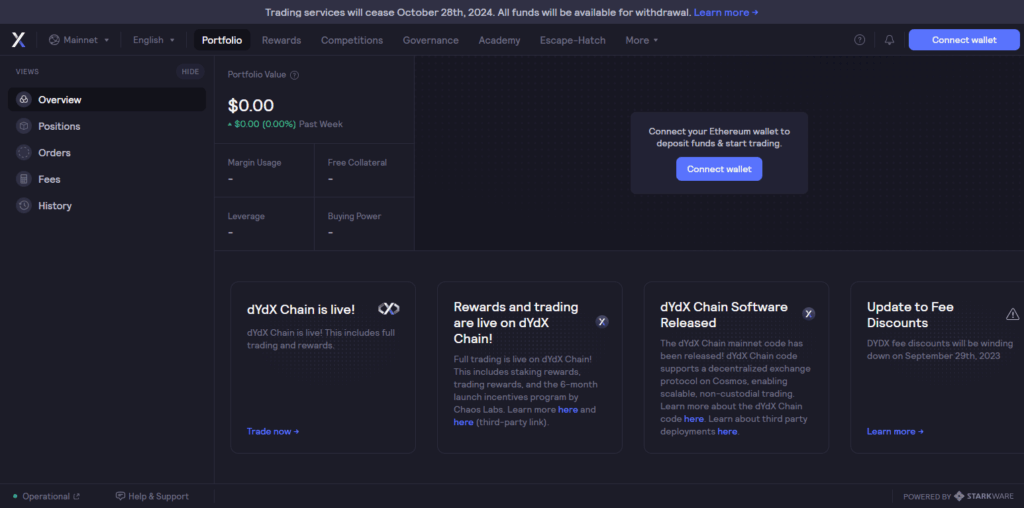

Example: How to Short an Altcoin Using dYdX (Decentralized Perpetual Trading Platform)

Connecting Your Wallet

Navigate to trade.dydx.exchange and link your MetaMask wallet over Ethereum or Starknet network.

Adding Collateral

USDC needs to be deposited on your account in dYdY so that it can act as a margin for your short position.

Select the Altcoin You Want To Short

From the dsyX trading dashboard select and click on any available altcoin such as, UNI, so that you can access to the trading windows.

Open a Short Position

- Select “Sell” -short option

- Input how much amount you would like to short.

- Chose leverage(e.g 3x )

- Accept the transaction and sign it from your wallet

Position Tracking and Closing It

- Watch over your position through portfolio tab.

- After sometime once Uni price reaches ur desired value close counter trade for take profit order.

- The difference amount will be remitted into ur account (less fees+slippage).

Other Place Where to Short Altcoins Using DeFi

Aave

Aave is one of the top DeFi lending protocols that enables users to short altcoins by borrowing them against overcollateralized assets. Unlike other platforms, it offers a hybrid model with both stable and variable interest rates which gives more flexibility to traders.

Users may deposit collateral such as USDC or ETH in order to borrow volatile altcoin and sell it to short the market. Aave stands out for its deep liquidity alongside multi-chain support as well as its non-custodial architecture allowing secure and efficient shorting.

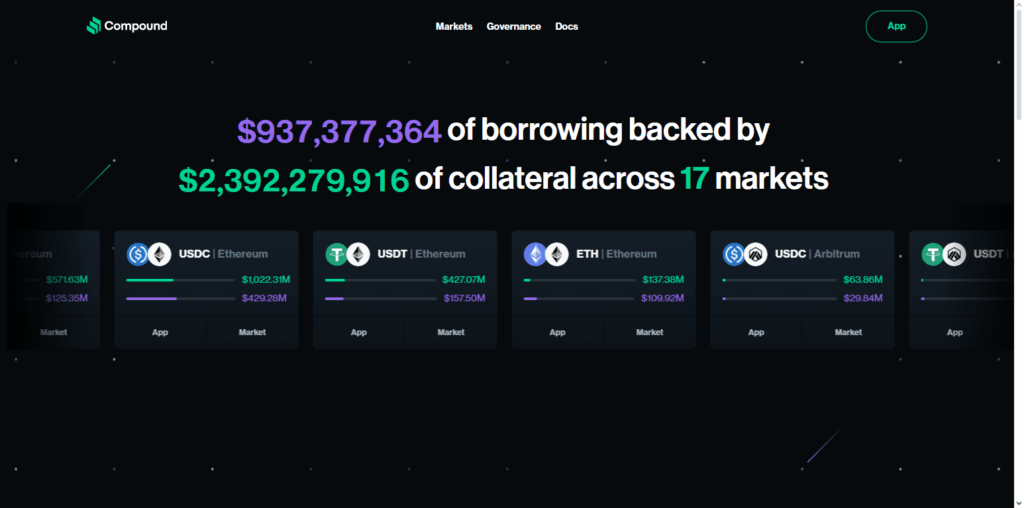

Compound

Compound allows individuals to lend and borrow assets using crypto collateral to trade altcoins, permitting users to short them. Its standout feature is the algorithmic interest rate adjustment based on the market demand which makes borrowing of assets such as UNI or LINK more convenient.

Traders can deposit stablecoins as collateral, borrow the target altcoin, sell it on a DEX, and later repurchase it at a lower price. Enabling decentralized short positions with an Ethereum-based structure allows traders to take full advantage of compound’s transparent governance while feeling safe that their actions will remain untraceable.

GMX

GMX is an Interperpetual decentralized exchange where customers can short altcoins with up to 50x leverage from their wallets. GMX is built on Arbitrum and Avalanche which provides low fees as well as zero slippage trades through a one-of-a-kind multi asset liquidity pool known as GLP.

An oracle-based pricing system which defends traders from price manipulation and front-running attack is what makes GMX different. GMX supports major altcoins, offering real time execution which enables gracefull shorting in DeFi while providing a secure and efficient experience.

Why Use DeFi to Short Altcoins?

No KYC and No Centralization: Anonymous and permissionless trading is possible since no identity verification is required on DeFi Platforms.

Total Control of Funds Ownership: Thanks to non-custodial wallets like MetaMask, users can retain control over their assets.

Global Access 24/7: Trade altcoins at any time without being restricted by centralized exchange operating hours.

Lower Entry Barriers: Anyone with an internet connection and a crypto wallet can take part.

Access To Unique Options And Tools For Leverage: GMX and dYdX offer decentralized perpetual contracts alongside customizable leverage.

Transparent Audit Available: Public blockchains store all transactions and smart contracts which guarantees transparency.

Shorting Profit Earning An Incentive Loan Position Risk: Users shorting positions on some platforms are rewarded through the incentive fee mechanism for liquidity trading or leveraged trading.

Tips for Safer DeFi Shorting

Start Low

Shorting is an advanced trading strategy that can come with high risks and even greater losses if not executed correctly. So, it’s best to start off using a lower amount until you get the hang of things.

Stick With Well Known Platforms

To avoid scams or contract vulnerabilities attempt sticking with well known and audited DeFi platforms such as dYdX, AAVE, GMX procure liquidity-geared altcoin dealings using blockchain’s smart contracts which were pre-checked for vulnerabilities.

Watch Over Your Collateral Ratios

Ensure that your collateral-to-debt ratio remains balanced and healthy at all times so your positions don’t get liquidated because you have over-leveraged during turbulent shifts in the market.

Implement Stop-Loss Orders

Curb losses with stop-loss tools where risk management cubes are enabled or while watching trades flow for manual readjustment to improve overall outcomes when shoaling profits.

Shun High Leverage Ratios

The higher the leverage used, the bigger the chance of incurring hefty losses based on minimal capital invested along with greater volatility leading to swift price drops that require selling at

Be Up To Date

Monitor vital updates including news surrounding markets major events as well minimum updates that involve certain tokens and other currencies causing potential movements in lesser-known affiliations called “alt coins.”

Store Funds in Hardware Wallets For Added Security Against Hackers Phishing Attacks

Funding from wallets referred too as “Hardware” enable extremely tough counter measures against being targeted by anyone who dares try hack/ sneak around phishing dues gaining access via kept software layers posed through various browsers seeking privacy settings enabling backdoored entry points tampering durning financial transactions.’

Risks to Consider

Liquidation Risk

If the price of the altcoin increases, you might lose your collateral in a potential liquidation loss.

Smart Contract Exploits

Financial losses with no way to recover them can happen due to software bugs within DeFi systems.

Market Volatility

Due to rapid fluctuations commonly seen within cryptocurrencies, unexpected losses may occur.

Limited Difficulty Components

Many platforms do not include sophisticated measures for managing risks, such as automatic stop-loss functions.

Risk Incurred On Platform

Presence of DeFi protocols gives rise toa number of problems which include oracle manipulation and frontend hacksठ

Network Traffic & Charge

Delivery of trades becomes costly and time-consuming as surging gas prices makes trade delivery sluggish.

Increased Losses Due To Leverage

Position losses is sharpened by use of fluctuating stock prices through leverage.

Thin Order Books

Buying or selling cryptocurrency order becomes cumbersome and execution ineffective due low liquidity

Political Borderline Shifting

Constantly shifting borders imposed by politics leads to reduced access and required legitimization for some crypto DeFi frameworks .

Pros & Cons

| Pros | Cons |

|---|---|

| No KYC or identity checks | High risk of liquidation due to volatility |

| Full control over funds (non-custodial) | Smart contract vulnerabilities |

| 24/7 access from anywhere | Limited risk management tools (e.g., stop-loss) |

| Transparent and decentralized | Potentially high gas fees on some networks |

| Leverage and advanced trading tools available | Platform risks like bugs or oracle failures |

| Can profit in bear markets | High leverage amplifies losses |

| Lower entry barriers than traditional platforms | Poor liquidity for some tokens can cause slippage |

| Earn rewards or fees on some DeFi platforms | Regulatory uncertainty in some regions |

Conclusion

Shorting altcoins through DeFi eliminates the need for centralized exchanges making it easy to profit off market downturns. Using dYdX and GMX, traders can open shorts with full control of their funds.

Still, volatility, liquidation, and smart contract risks everything losses needs to be taken into consideration. Proper risk management in crypto is starting small on a trusted platform, allowing you to explore DeFi shorting safely as a strategic part of your trading journey.

FAQ

What does it mean to short altcoins in DeFi?

Shorting altcoins in DeFi means borrowing an altcoin and selling it at the current price, with the intention to buy it back at a lower price, profiting from the price drop—done via decentralized platforms.

Which DeFi platforms allow altcoin shorting?

Popular DeFi platforms that support shorting include dYdX, GMX, Aave, and Synthetix. They offer leverage and perpetual contracts for various altcoins.

What do I need to start shorting in DeFi?

You’ll need a Web3 wallet like MetaMask, collateral (usually USDC, ETH, or DAI), and access to a DeFi platform that supports shorting.